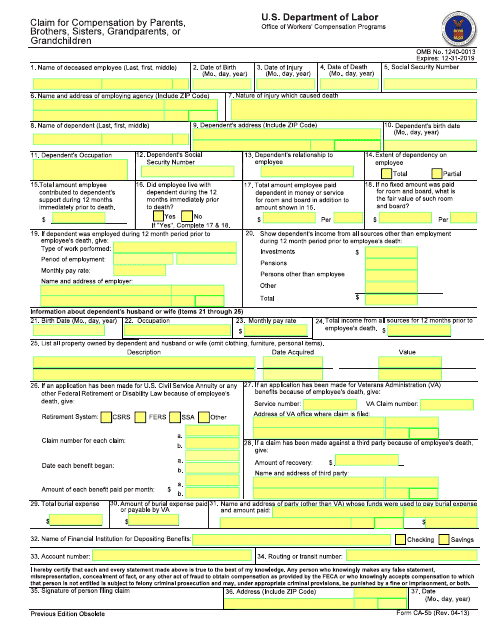

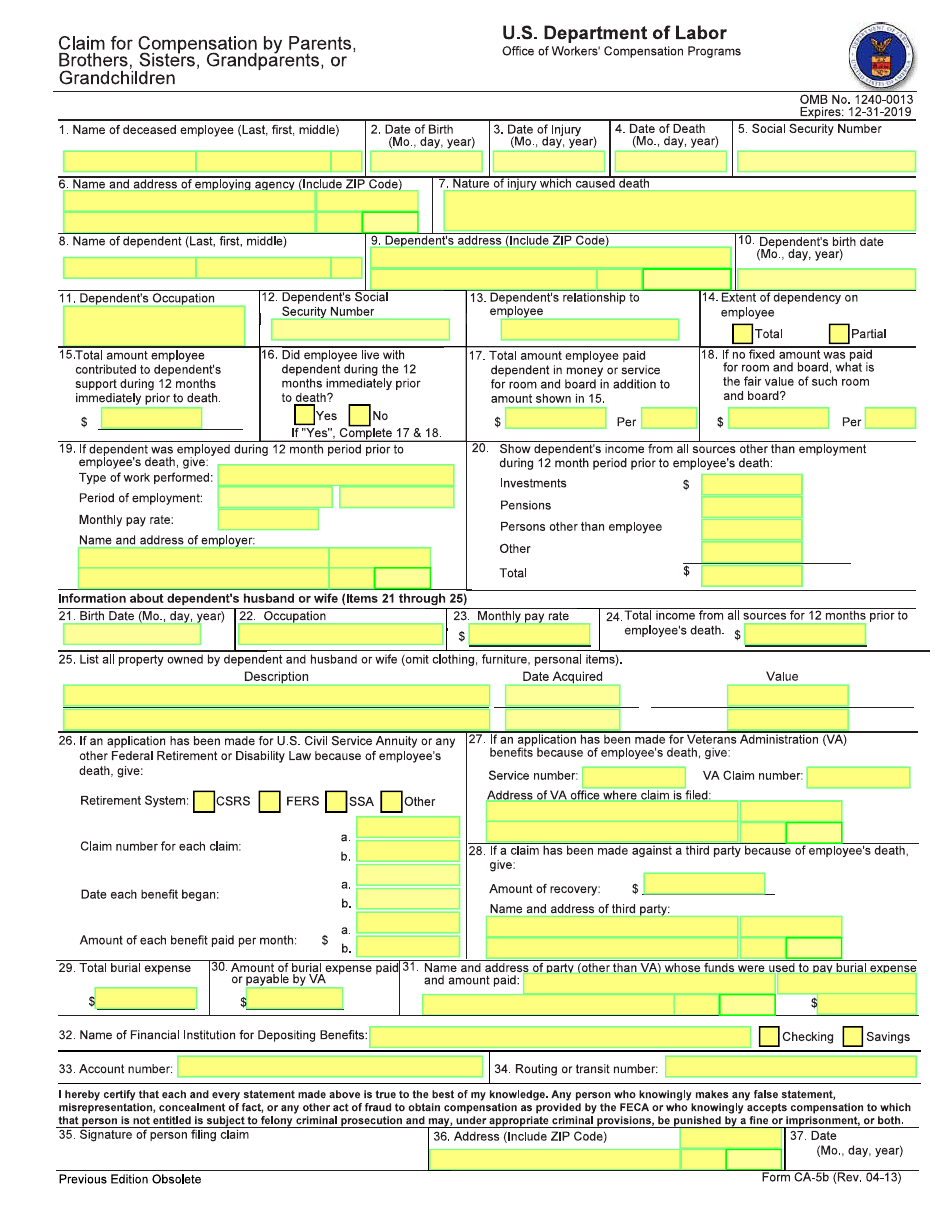

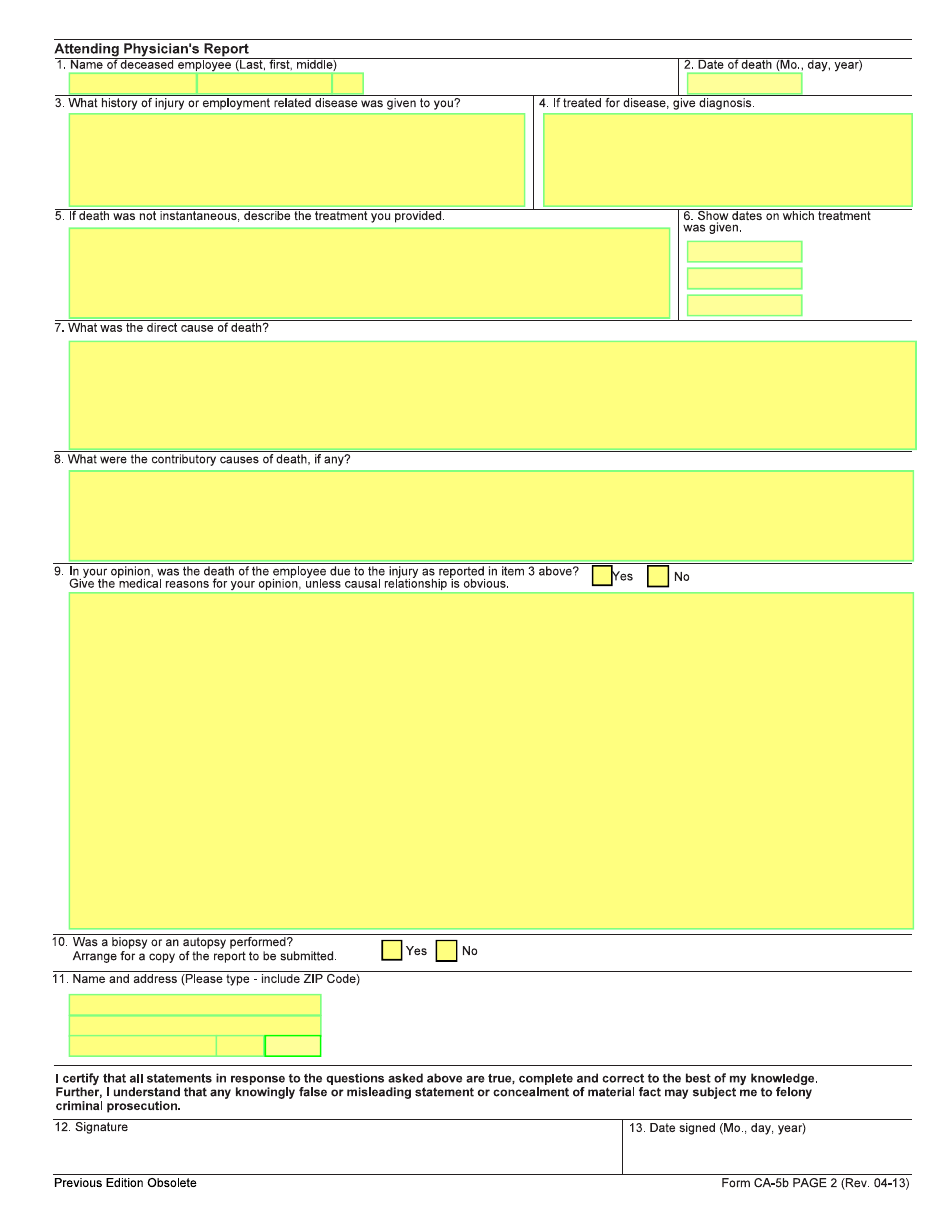

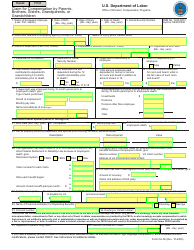

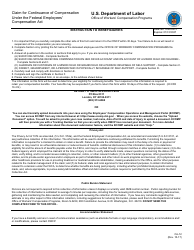

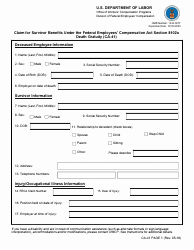

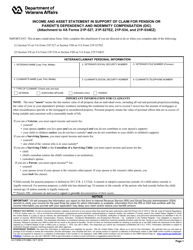

Form CA-5B Claim for Compensation by Parents, Brothers, Sisiters, Grandparents, or Grandchildren

What Is Form CA-5B?

This is a legal form that was released by the U.S. Department of Labor on April 1, 2013 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CA-5B?

A: Form CA-5B is a claim for compensation by parents, brothers, sisters, grandparents, or grandchildren.

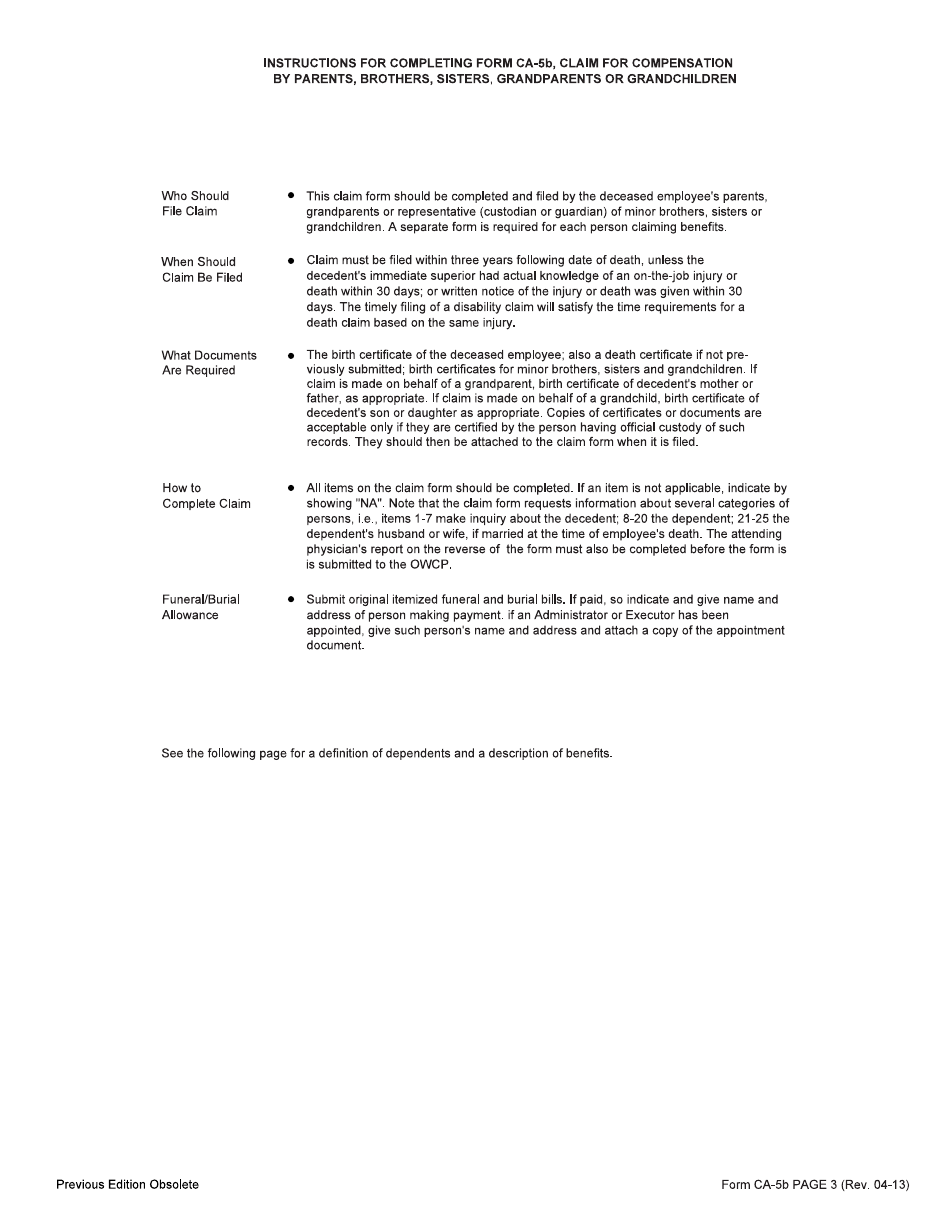

Q: Who can file Form CA-5B?

A: Parents, brothers, sisters, grandparents, or grandchildren of an employee who has died due to a work-related injury or illness can file Form CA-5B.

Q: What is the purpose of filing Form CA-5B?

A: The purpose of filing Form CA-5B is to request compensation for the death of an employee due to a work-related injury or illness.

Q: How do I obtain Form CA-5B?

A: You can obtain Form CA-5B from the Office of Workers' Compensation Programs (OWCP) or from your employer.

Q: What documentation is required to file Form CA-5B?

A: You will need to provide documentation such as a death certificate, proof of relationship to the deceased employee, and any other supporting evidence of the work-related injury or illness.

Q: Are there any time limits for filing Form CA-5B?

A: Yes, there are time limits for filing Form CA-5B. It is recommended to file the claim within one year from the date of the employee's death.

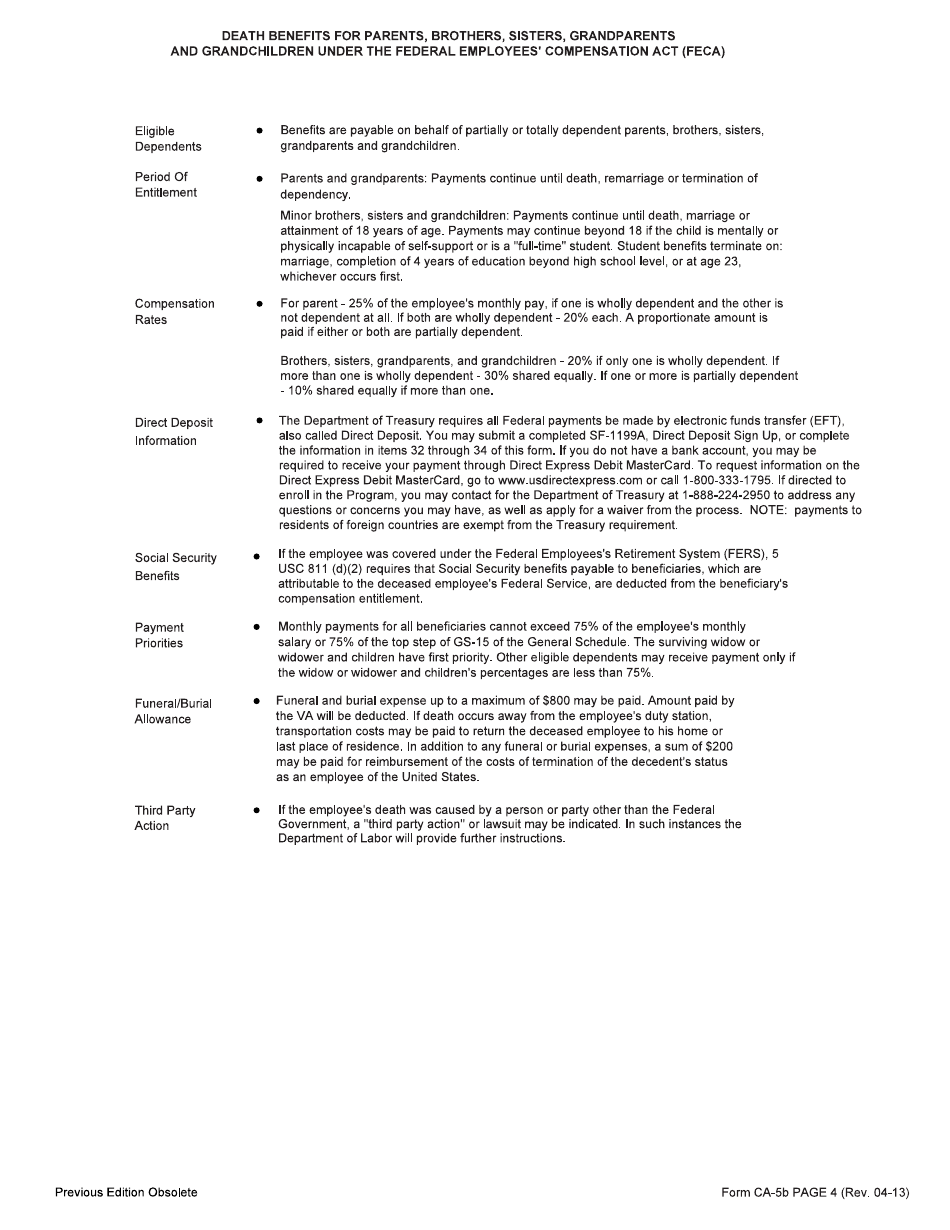

Q: What benefits can I receive by filing Form CA-5B?

A: By filing Form CA-5B, you may be eligible to receive death benefits, including a monetary payment and reimbursement for funeral expenses.

Q: Can I appeal a decision on my Form CA-5B claim?

A: Yes, if your claim is denied or you disagree with the decision, you have the right to appeal the decision through the OWCP's appeals process.

Q: Who can I contact for assistance with Form CA-5B?

A: You can contact the OWCP or your employer's human resources department for assistance with Form CA-5B.

Form Details:

- Released on April 1, 2013;

- The latest available edition released by the U.S. Department of Labor;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CA-5B by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor.