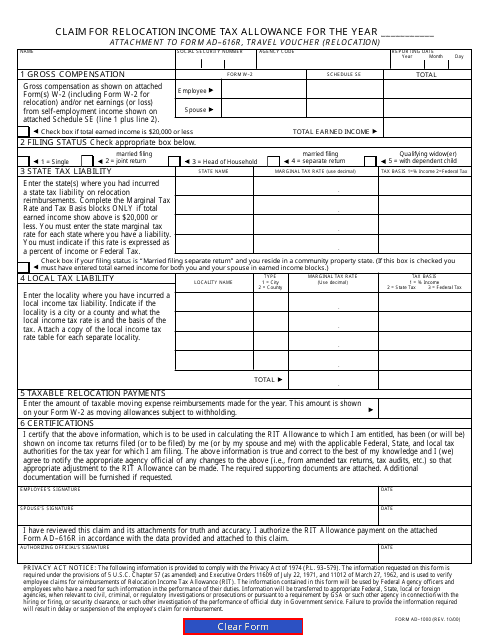

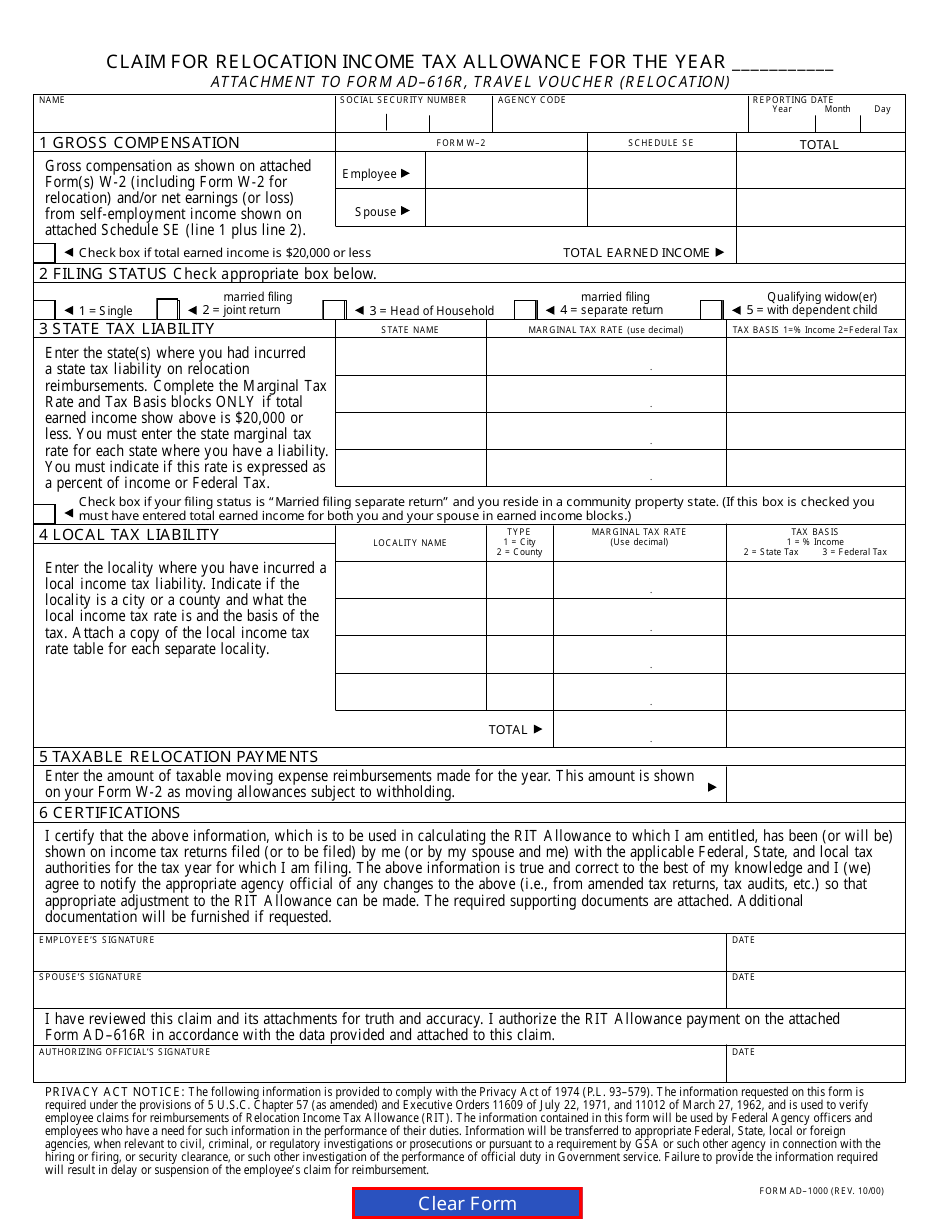

Form AD-1000 Claim for Relocation Income Tax Allowance

What Is Form AD-1000?

This is a legal form that was released by the U.S. Department of Agriculture - Animal and Plant HealthInspection Service on October 1, 2000 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AD-1000?

A: Form AD-1000 is a claim for relocation income tax allowance.

Q: Who can use Form AD-1000?

A: Any individual who qualifies for a relocation income tax allowance can use Form AD-1000.

Q: What is a relocation income tax allowance?

A: A relocation income tax allowance is a benefit provided to individuals who are required to relocate for work.

Q: Why would I need to file Form AD-1000?

A: You would need to file Form AD-1000 to claim a relocation income tax allowance.

Q: Are there any eligibility requirements to claim a relocation income tax allowance?

A: Yes, there are eligibility requirements that must be met to claim a relocation income tax allowance. Consult the instructions for Form AD-1000 for more information.

Q: Are there any deadlines for filing Form AD-1000?

A: Yes, there are deadlines for filing Form AD-1000. Consult the instructions for Form AD-1000 for the specific deadlines.

Q: How long does it take to process Form AD-1000?

A: The processing time for Form AD-1000 may vary. It is advisable to file the form as early as possible to ensure timely processing.

Q: Is Form AD-1000 specific to the United States or Canada?

A: Form AD-1000 is specific to the United States.

Q: Can I claim a relocation income tax allowance if I am relocating within the same city?

A: No, a relocation income tax allowance is generally not available for relocations within the same city. Consult the instructions for Form AD-1000 for more information.

Form Details:

- Released on October 1, 2000;

- The latest available edition released by the U.S. Department of Agriculture - Animal and Plant Health Inspection Service;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AD-1000 by clicking the link below or browse more documents and templates provided by the U.S. Department of Agriculture - Animal and Plant Health Inspection Service.