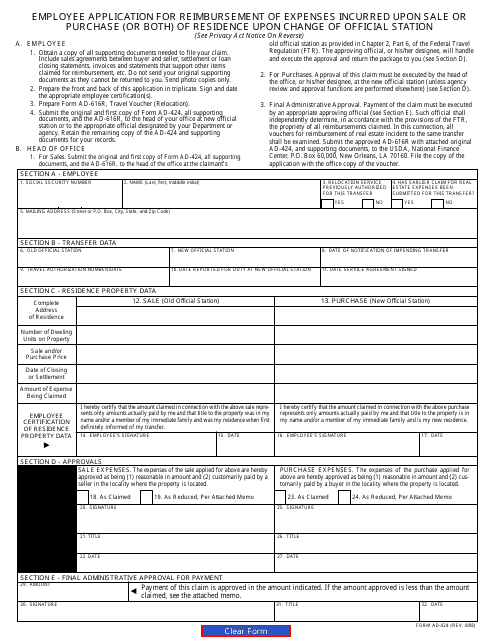

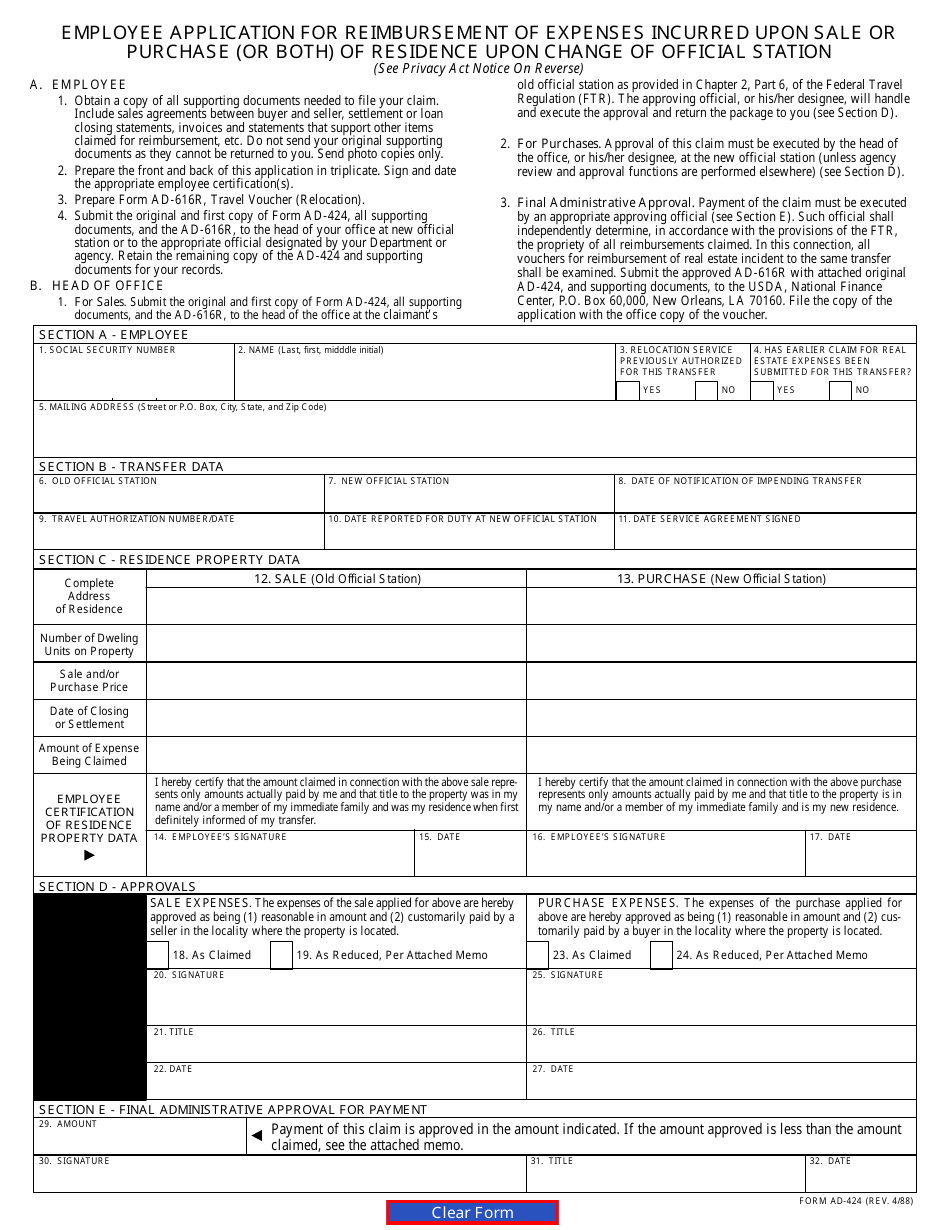

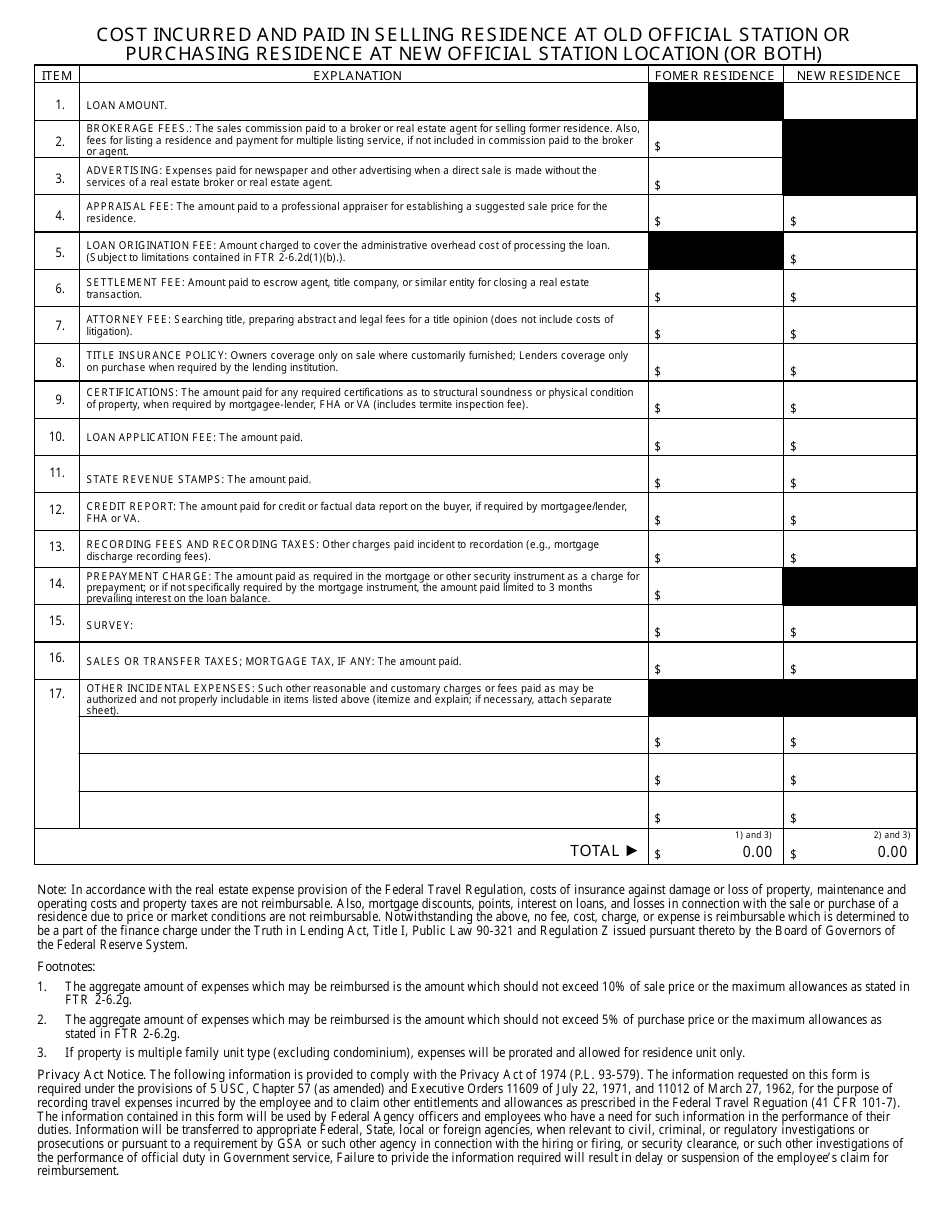

Form AD-424 Employee Application for Reimbursement of Expenses Incurred Upon Sale or Purchase (Or Both) of Residence Upon Change of Official Station

What Is Form AD-424?

This is a legal form that was released by the U.S. Department of Agriculture on April 1, 1988 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AD-424?

A: Form AD-424 is an Employee Application for Reimbursement of Expenses Incurred Upon Sale or Purchase (Or Both) of Residence Upon Change of Official Station.

Q: What is the purpose of form AD-424?

A: The purpose of form AD-424 is to apply for reimbursement of expenses incurred when an employee sells or purchases a residence upon changing their official station.

Q: Who uses form AD-424?

A: Employees who need to be reimbursed for expenses related to the sale or purchase of a residence upon changing their official station use form AD-424.

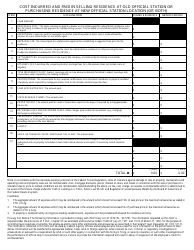

Q: What expenses can be reimbursed using form AD-424?

A: Expenses related to the sale or purchase of a residence, such as real estate agent fees, closing costs, and mortgage fees, can be reimbursed using form AD-424.

Form Details:

- Released on April 1, 1988;

- The latest available edition released by the U.S. Department of Agriculture;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AD-424 by clicking the link below or browse more documents and templates provided by the U.S. Department of Agriculture.