This version of the form is not currently in use and is provided for reference only. Download this version of

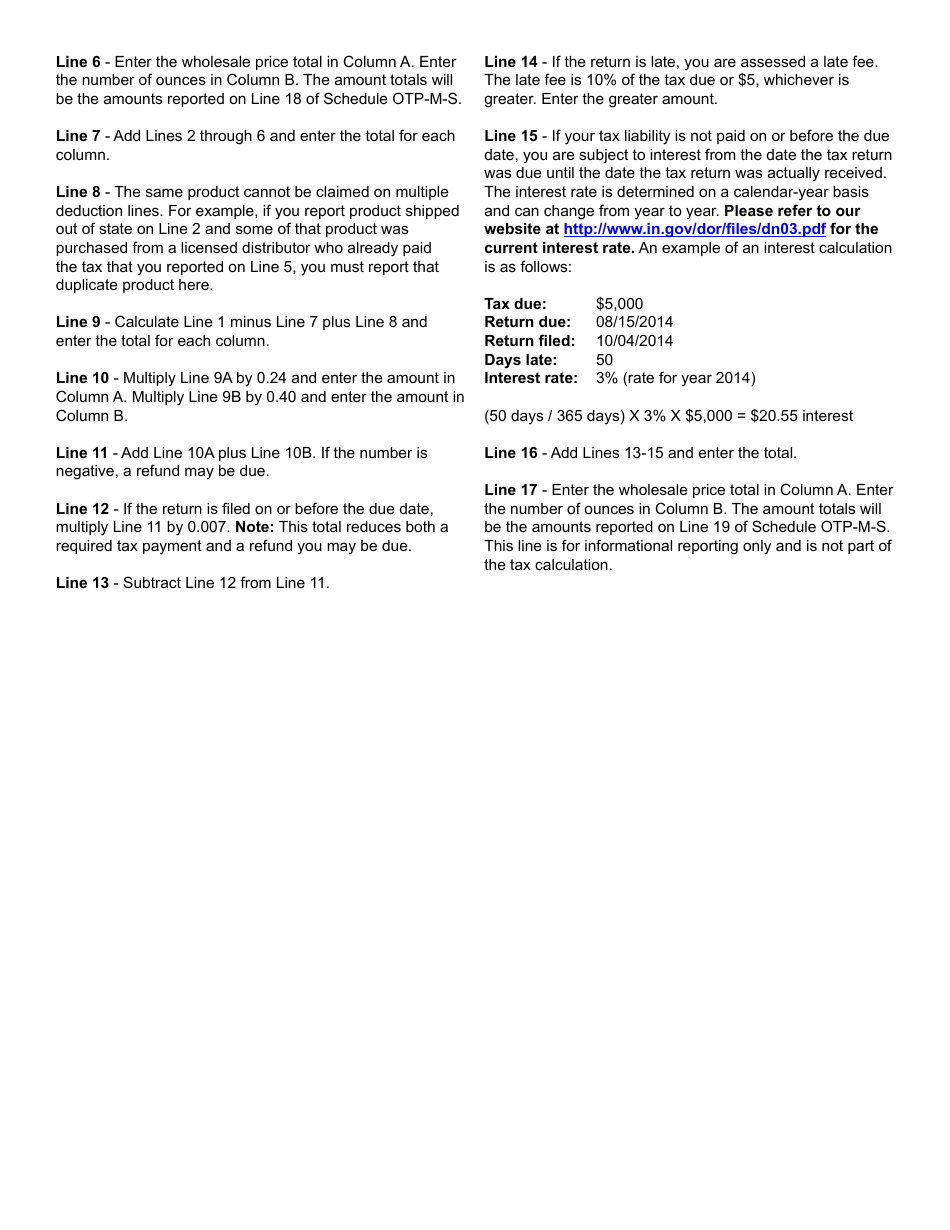

Form OTP-M (State Form 46853)

for the current year.

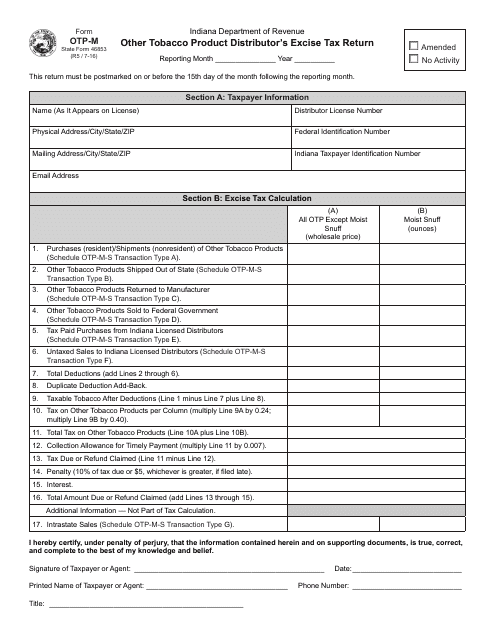

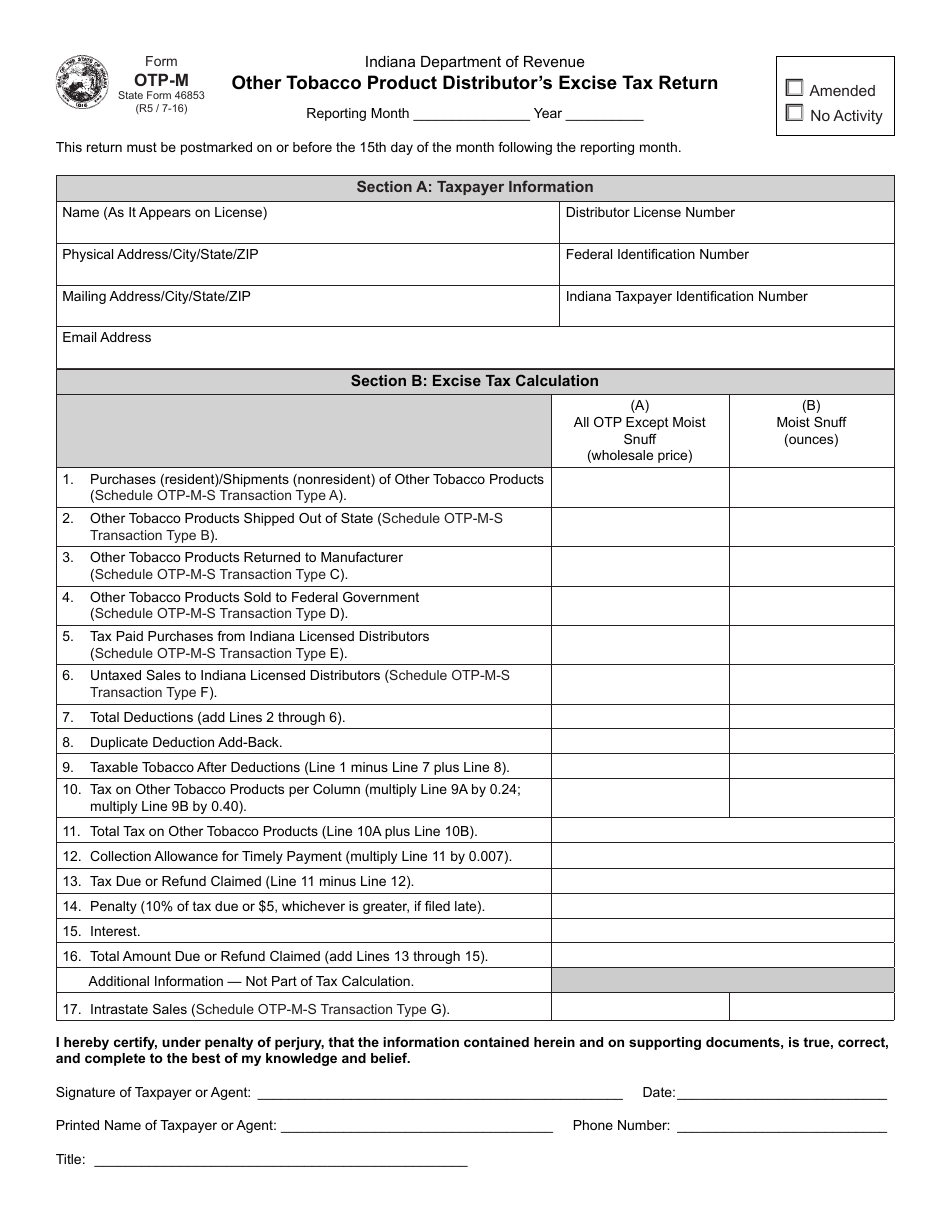

Form OTP-M (State Form 46853) Other Tobacco Product Distributor's Excise Tax Return - Indiana

What Is Form OTP-M (State Form 46853)?

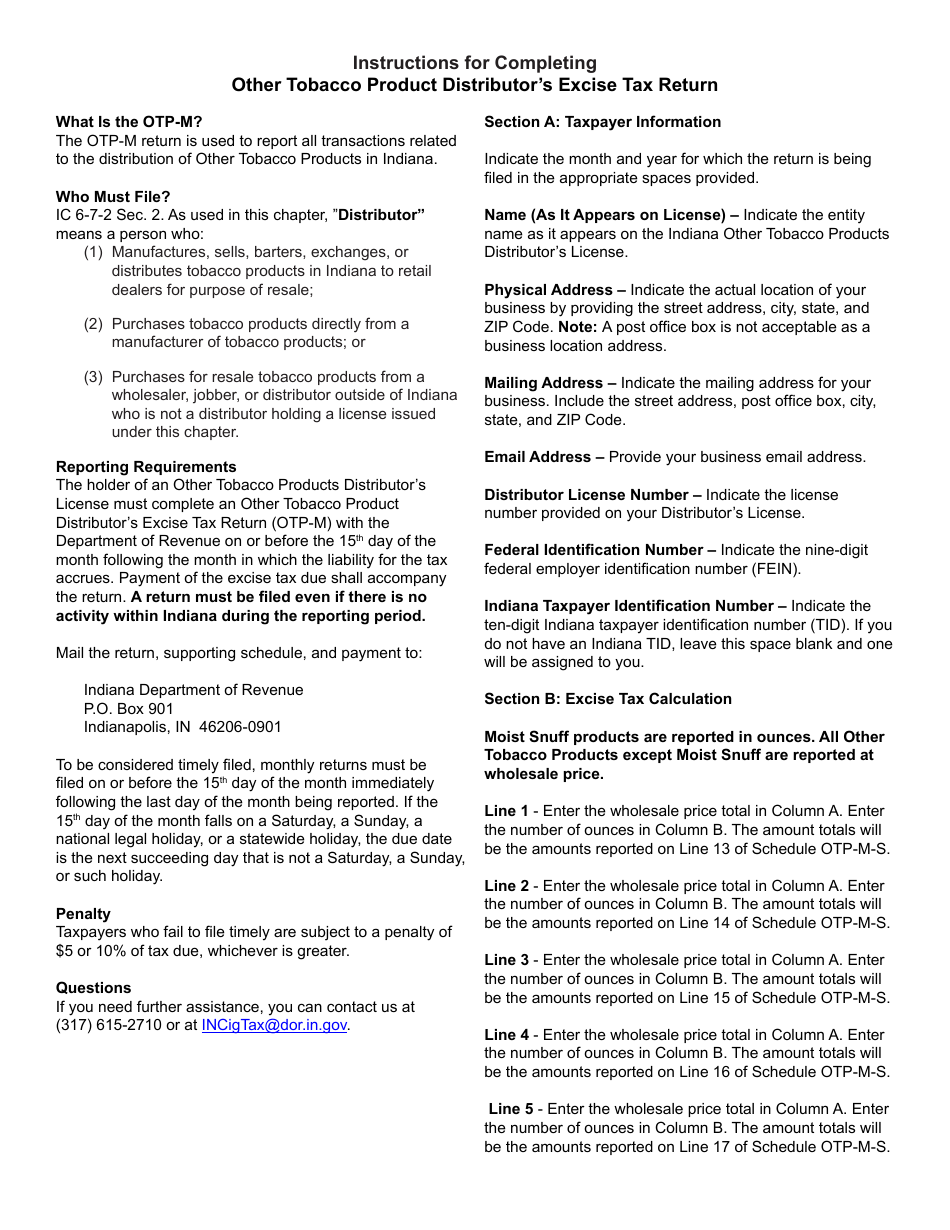

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OTP-M?

A: Form OTP-M is the Other Tobacco Product Distributor's Excise Tax Return for Indiana.

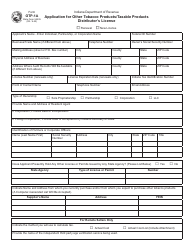

Q: Who is required to file Form OTP-M?

A: Other Tobacco Product Distributors in Indiana are required to file Form OTP-M.

Q: What is the purpose of Form OTP-M?

A: The purpose of Form OTP-M is to report and pay the excise tax on other tobacco products distributed in Indiana.

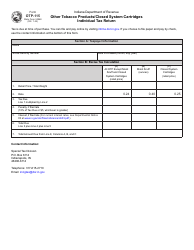

Q: What information is required on Form OTP-M?

A: Form OTP-M requires information such as total sales of other tobacco products, credits, and tax due.

Q: When is Form OTP-M due?

A: Form OTP-M is due on a monthly basis, on or before the 20th day of the month following the reporting period.

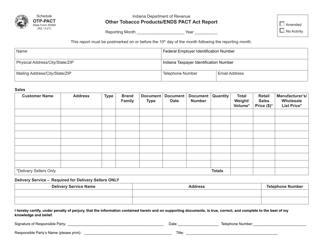

Q: Is there a penalty for late filing of Form OTP-M?

A: Yes, there may be penalties for late filing of Form OTP-M, including a 10% penalty on the tax due.

Q: Are there any exemptions or credits available on Form OTP-M?

A: Yes, there are certain exemptions and credits available on Form OTP-M. Please refer to the instructions for more information.

Q: Can Form OTP-M be filed electronically?

A: Yes, Form OTP-M can be filed electronically using the INtax system.

Q: Who can I contact for assistance with Form OTP-M?

A: You can contact the Indiana Department of Revenue for assistance with Form OTP-M.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OTP-M (State Form 46853) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.