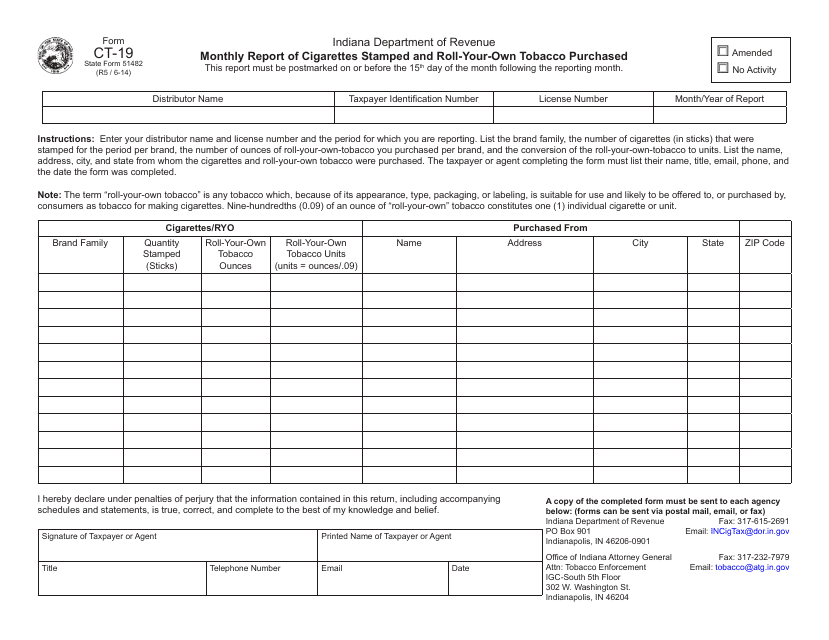

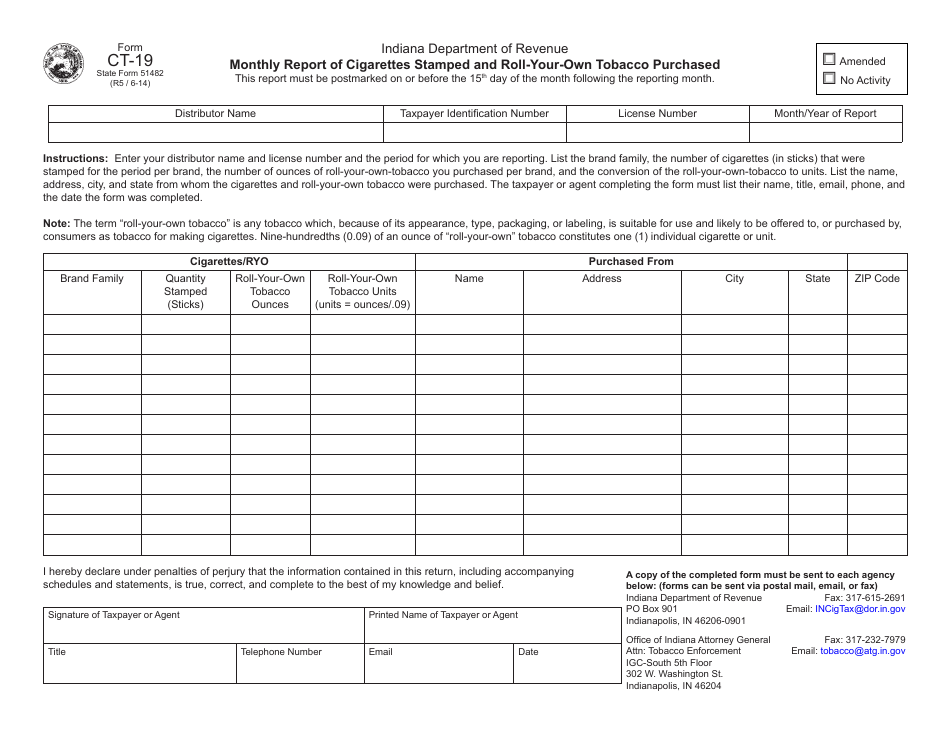

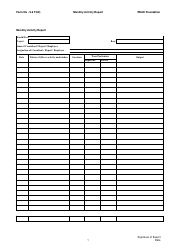

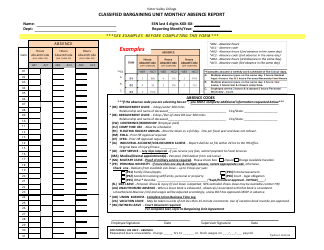

Form CT-19 (State Form 51482) Monthly Report of Cigarettes Stamped and Roll-Your-Own Tobacco Purchased - Indiana

What Is Form CT-19 (State Form 51482)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-19?

A: Form CT-19 is the Monthly Report of Cigarettes Stamped and Roll-Your-Own Tobacco Purchased.

Q: What is the purpose of Form CT-19?

A: The purpose of Form CT-19 is to report the quantity of cigarettes stamped and roll-your-own tobacco purchased in Indiana.

Q: Who needs to file Form CT-19?

A: Any business or individual who purchases cigarettes stamped and roll-your-own tobacco in Indiana needs to file Form CT-19.

Q: When is Form CT-19 due?

A: Form CT-19 is due on the 10th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form CT-19?

A: Yes, failure to file Form CT-19 or filing a false or incomplete form may result in penalties and interest.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-19 (State Form 51482) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.