This version of the form is not currently in use and is provided for reference only. Download this version of

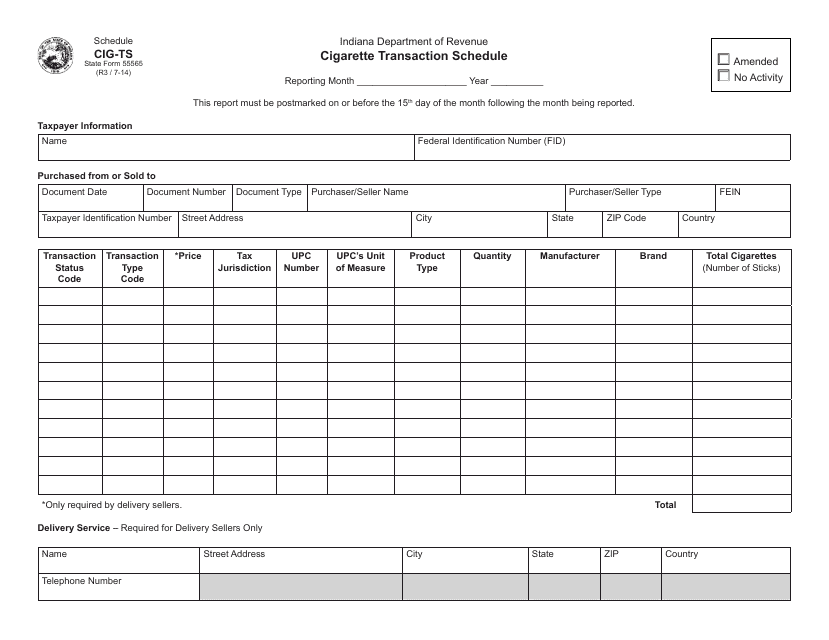

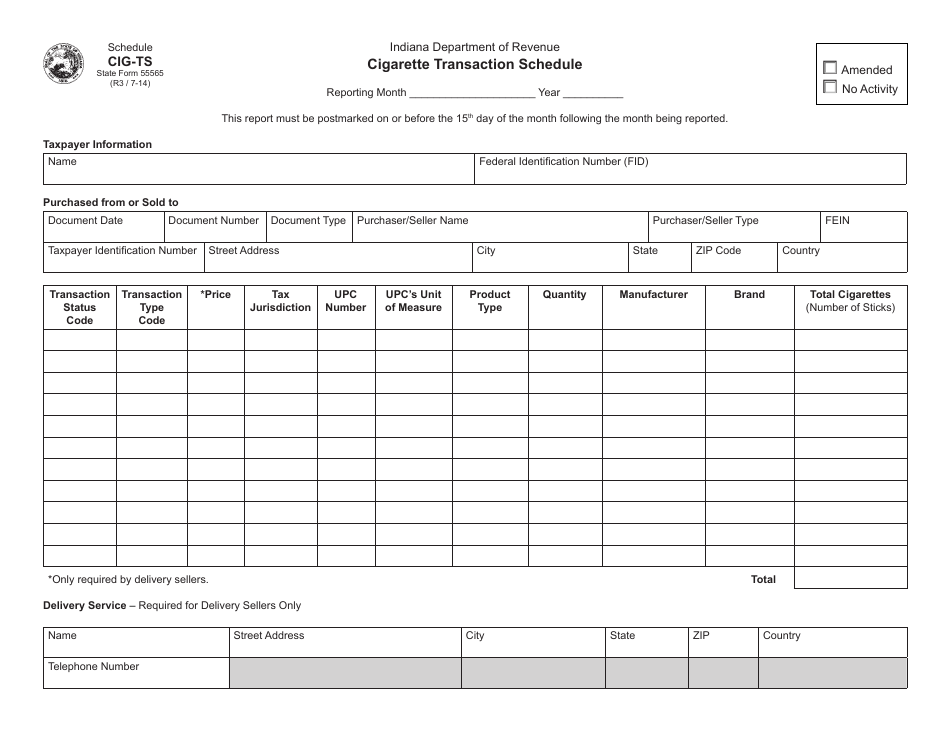

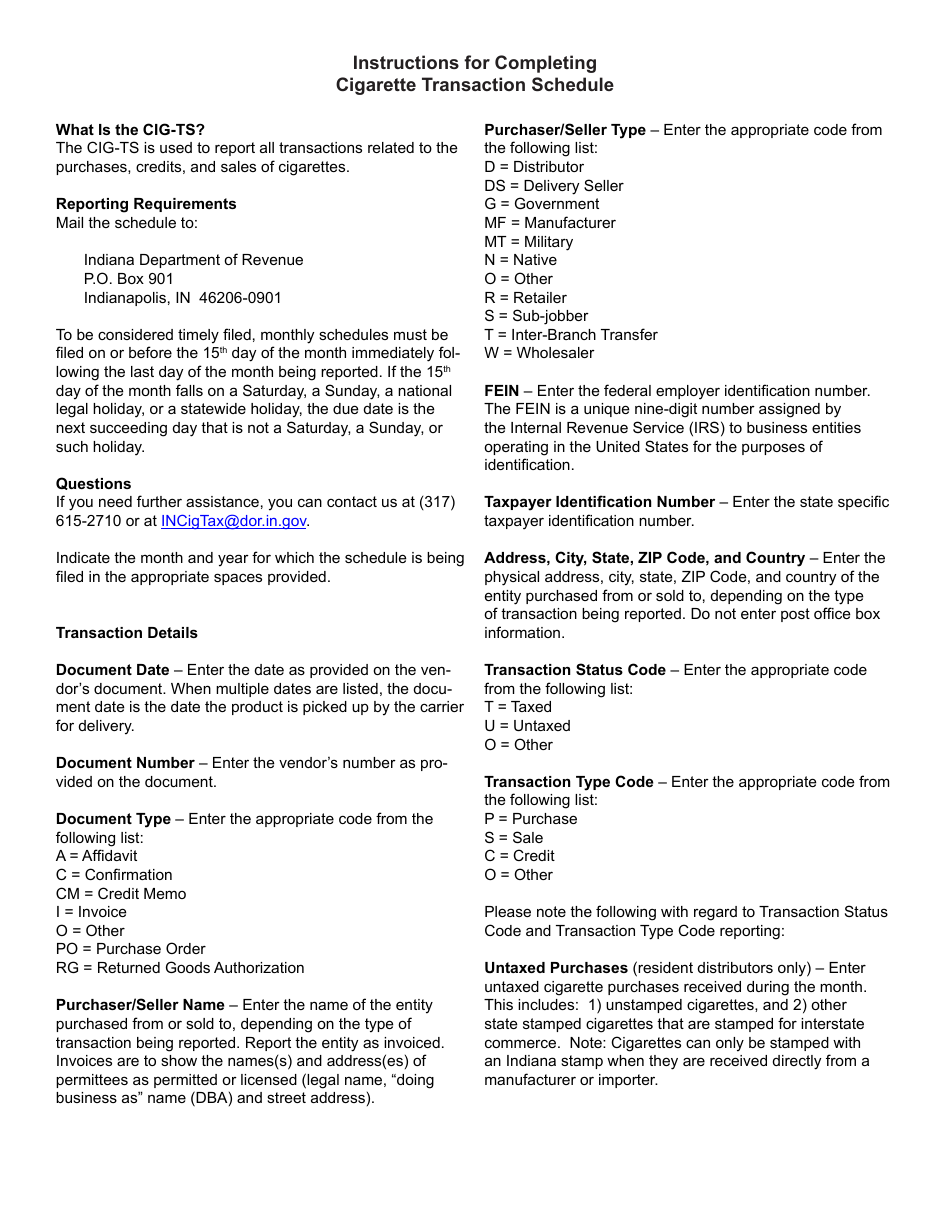

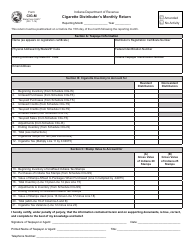

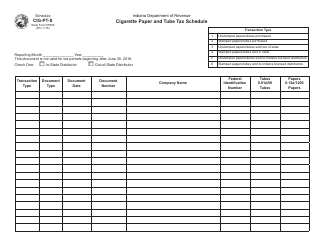

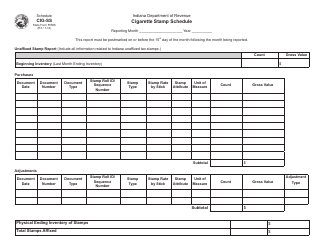

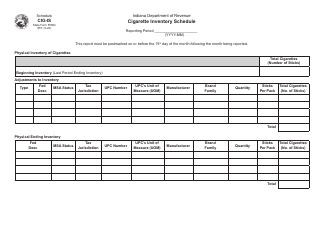

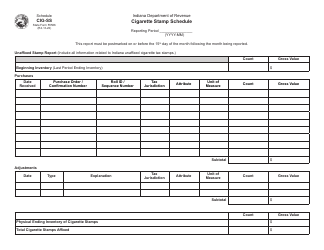

State Form 55565 Schedule CIG-TS

for the current year.

State Form 55565 Schedule CIG-TS Cigarette Transaction Schedule - Indiana

What Is State Form 55565 Schedule CIG-TS?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

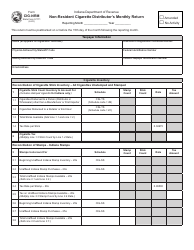

Q: What is Form 55565 Schedule CIG-TS?

A: Form 55565 Schedule CIG-TS is the Cigarette Transaction Schedule in Indiana.

Q: What is the purpose of Form 55565 Schedule CIG-TS?

A: The purpose of Form 55565 Schedule CIG-TS is to report cigarette purchases and sales for tax purposes.

Q: Who is required to file Form 55565 Schedule CIG-TS?

A: Cigarette wholesalers and retailers in Indiana are required to file Form 55565 Schedule CIG-TS.

Q: When is Form 55565 Schedule CIG-TS due?

A: Form 55565 Schedule CIG-TS is due on a monthly basis, by the 15th day of the following month.

Q: Are there any penalties for not filing Form 55565 Schedule CIG-TS?

A: Yes, failure to file Form 55565 Schedule CIG-TS or submitting false information may result in penalties or other legal consequences.

Q: Is Form 55565 Schedule CIG-TS required for personal use of cigarettes?

A: No, Form 55565 Schedule CIG-TS is not required for personal use of cigarettes. It is only for businesses involved in cigarette sales.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55565 Schedule CIG-TS by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.