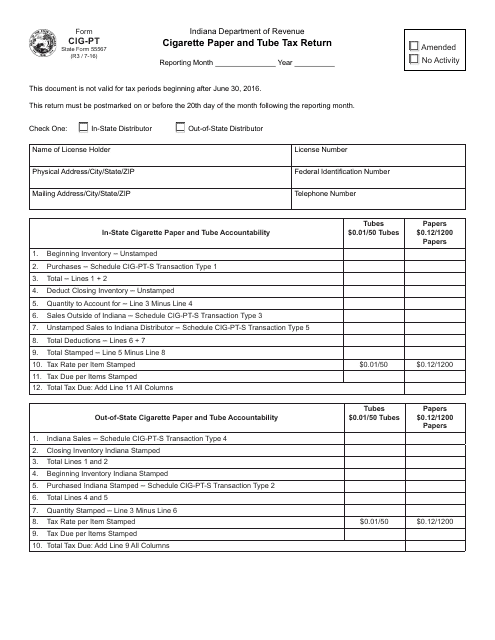

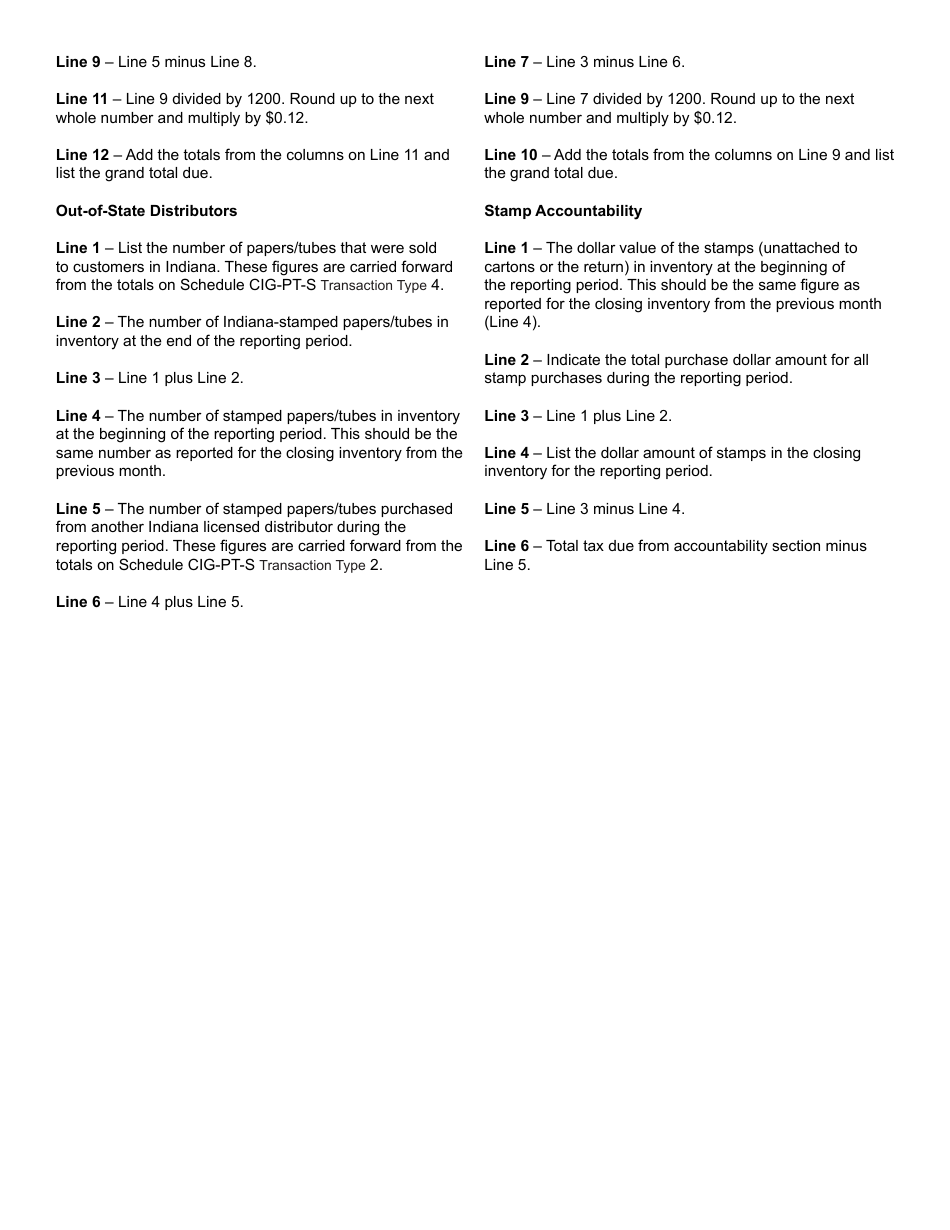

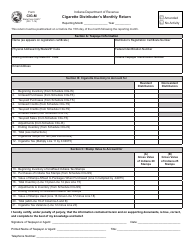

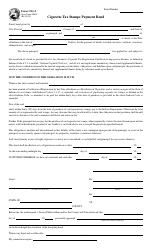

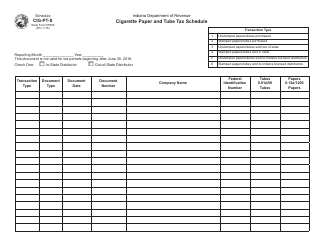

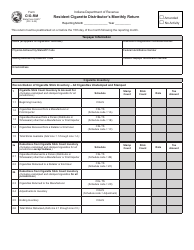

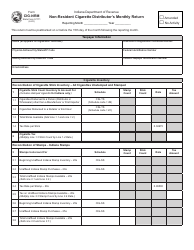

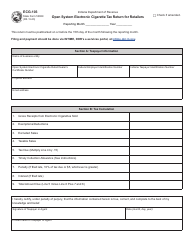

Form CIG-PT (State Form 55567) Cigarette Paper and Tube Tax Return - Indiana

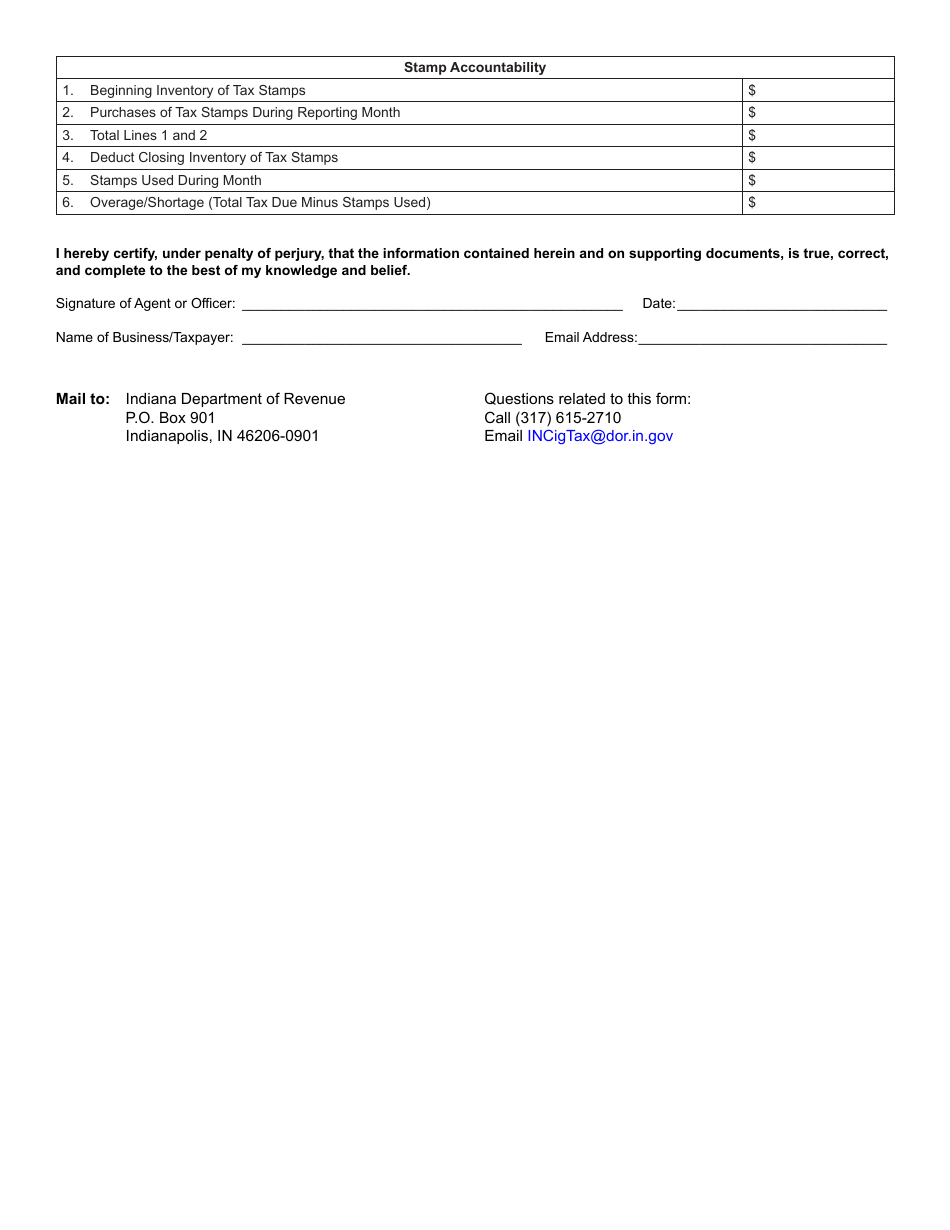

What Is Form CIG-PT (State Form 55567)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG-PT?

A: Form CIG-PT is the Cigarette Paper and Tube Tax Return.

Q: What is the purpose of Form CIG-PT?

A: The purpose of Form CIG-PT is to report and pay the cigarette paper and tube tax in Indiana.

Q: Who needs to file Form CIG-PT?

A: Anyone engaged in the sale or distribution of cigarette papers or tubes in Indiana needs to file Form CIG-PT.

Q: How often do you need to file Form CIG-PT?

A: Form CIG-PT needs to be filed on a monthly basis.

Q: What information do I need to include on Form CIG-PT?

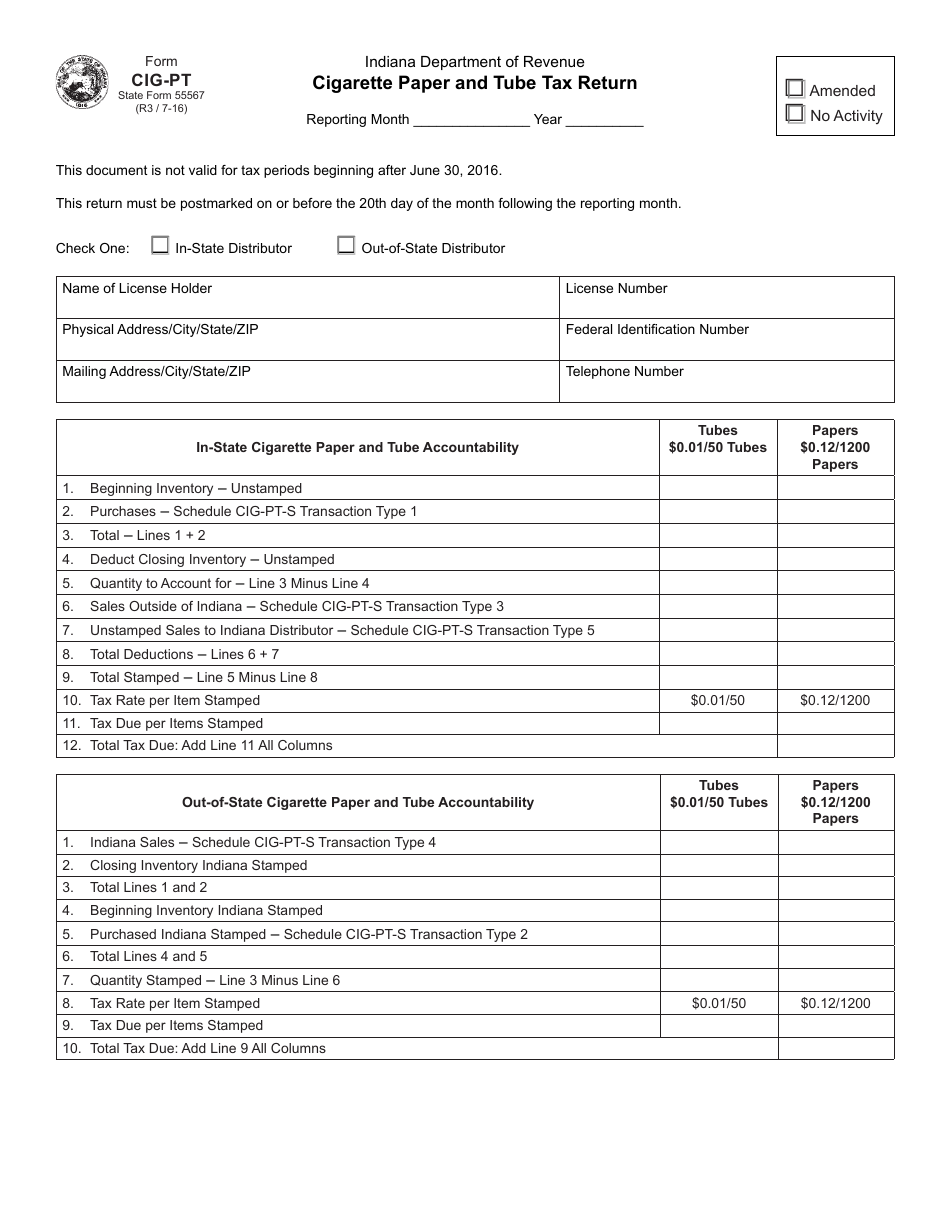

A: You need to include information about the quantity of cigarette papers or tubes sold, the tax due, and any other required details.

Q: When is the deadline to file Form CIG-PT?

A: Form CIG-PT must be filed and the tax paid by the 20th day of the month following the reporting period.

Q: What happens if I don't file Form CIG-PT?

A: Failure to file Form CIG-PT or pay the tax on time may result in penalties and interest charges.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG-PT (State Form 55567) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.