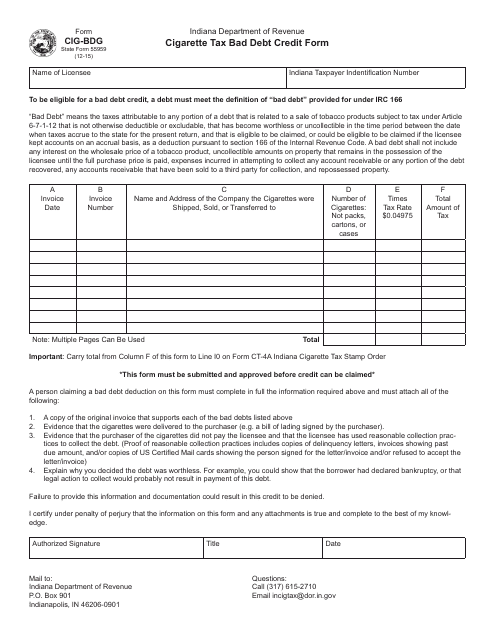

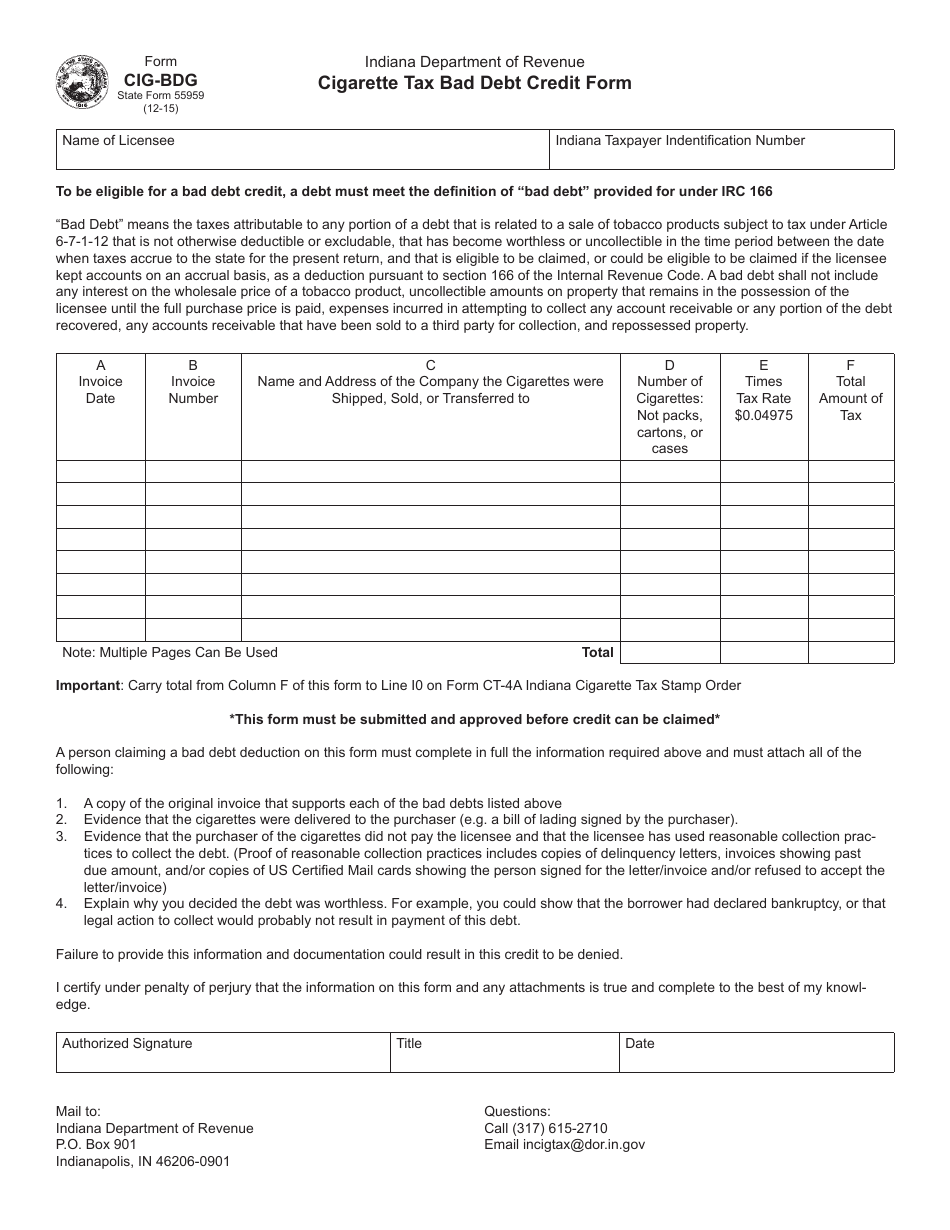

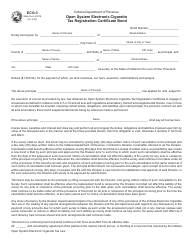

Form CIG-BDG (State Form 55959) Cigarette Tax Bad Debt Credit Form - Indiana

What Is Form CIG-BDG (State Form 55959)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG-BDG?

A: Form CIG-BDG is the Cigarette Tax Bad Debt Credit Form.

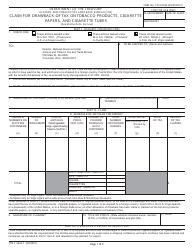

Q: What is the purpose of Form CIG-BDG?

A: The purpose of Form CIG-BDG is to claim a credit for bad debts related to cigarette taxes in Indiana.

Q: Who can use Form CIG-BDG?

A: Those who have incurred bad debts related to cigarette taxes in Indiana can use Form CIG-BDG.

Q: What information is required on Form CIG-BDG?

A: Form CIG-BDG requires information such as the taxpayer's name, address, and identification number, as well as details about the bad debts incurred.

Q: When is Form CIG-BDG due?

A: Form CIG-BDG is due on the same date as the Indiana cigarette tax return, which is generally the last day of the month following the end of the reporting period.

Q: Is there a fee for filing Form CIG-BDG?

A: No, there is no fee for filing Form CIG-BDG.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG-BDG (State Form 55959) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.