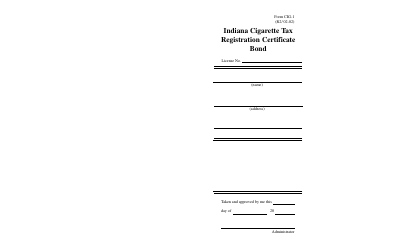

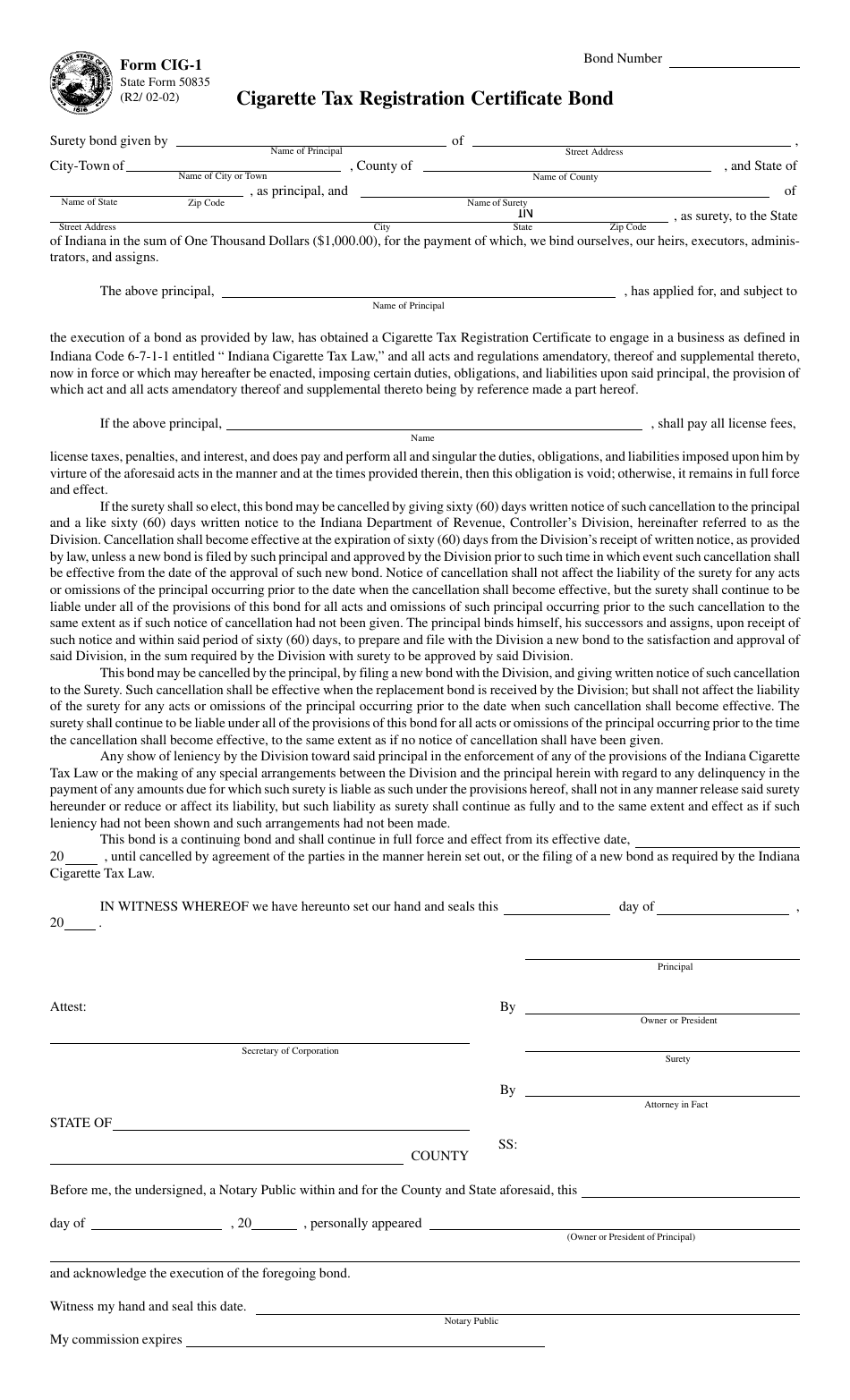

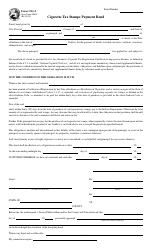

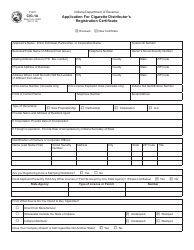

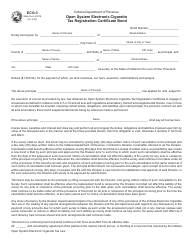

Form CIG-1 (State Form 50835) Cigarette Tax Registration Certificate Bond - Indiana

What Is Form CIG-1 (State Form 50835)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CIG-1?

A: Form CIG-1 is the Cigarette Tax Registration Certificate Bond for Indiana.

Q: What is the purpose of Form CIG-1?

A: The purpose of Form CIG-1 is to register for a cigarette tax certificate bond in Indiana.

Q: How do I obtain Form CIG-1?

A: You can obtain Form CIG-1 by contacting the appropriate agency or department in Indiana that handles cigarette tax registration.

Q: What information is required on Form CIG-1?

A: Form CIG-1 requires information such as the name and address of the applicant, the type of business, and the amount of bond.

Q: Are there any fees associated with Form CIG-1?

A: Yes, there may be fees associated with Form CIG-1. You will need to contact the relevant agency or department to inquire about the specific fees.

Q: Is Form CIG-1 specific to Indiana?

A: Yes, Form CIG-1 is specific to Indiana. It is used to register for a cigarette tax certificate bond in the state of Indiana.

Q: What is the purpose of a cigarette tax registration certificate bond?

A: A cigarette tax registration certificate bond is a guarantee that the cigarette taxes will be paid by the business. It helps ensure compliance with state tax laws.

Q: Who needs to file Form CIG-1?

A: Businesses that sell or distribute cigarettes in Indiana need to file Form CIG-1 to register for a cigarette tax certificate bond.

Q: Are there any penalties for not filing Form CIG-1?

A: Yes, there may be penalties for not filing Form CIG-1. It is important to comply with the cigarette tax registration requirements to avoid potential penalties.

Form Details:

- Released on February 1, 2002;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CIG-1 (State Form 50835) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.