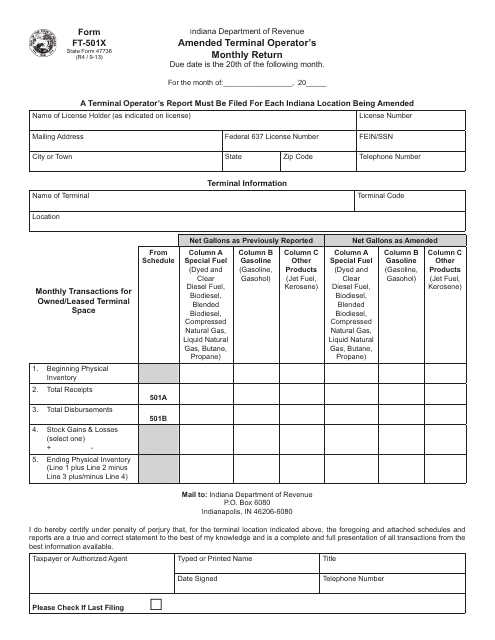

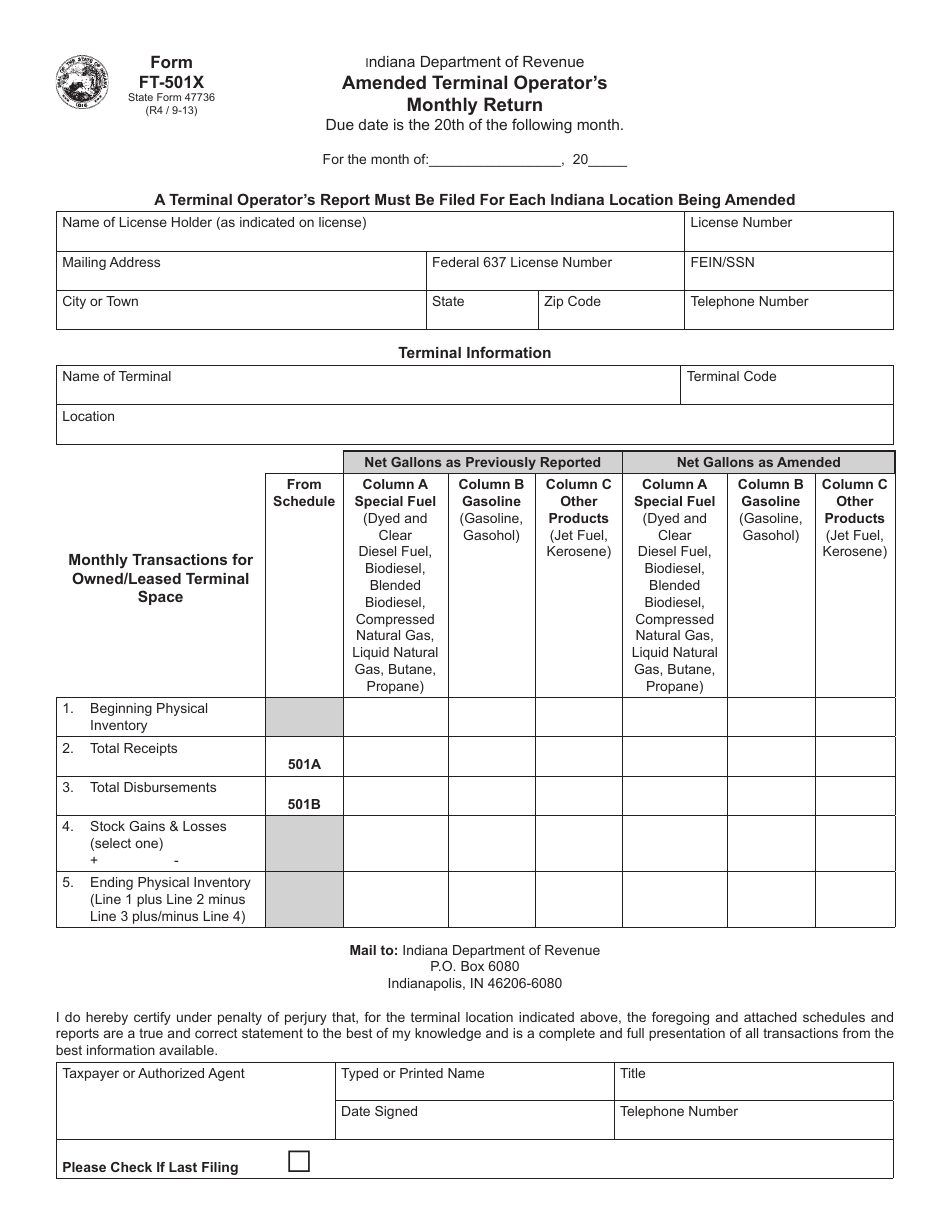

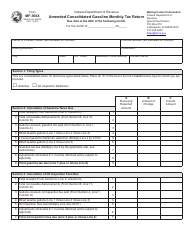

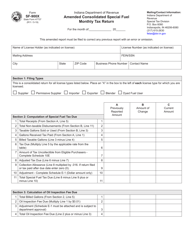

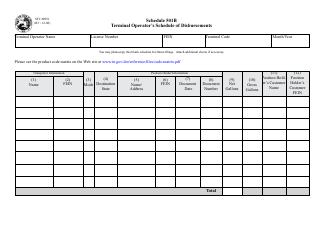

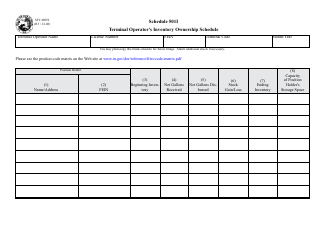

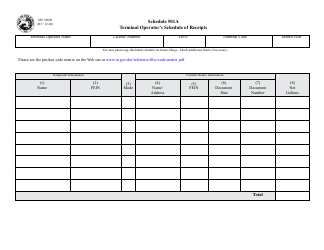

Form FT-501X (State Form 47736) Amended Terminal Operators Monthly Return - Indiana

What Is Form FT-501X (State Form 47736)?

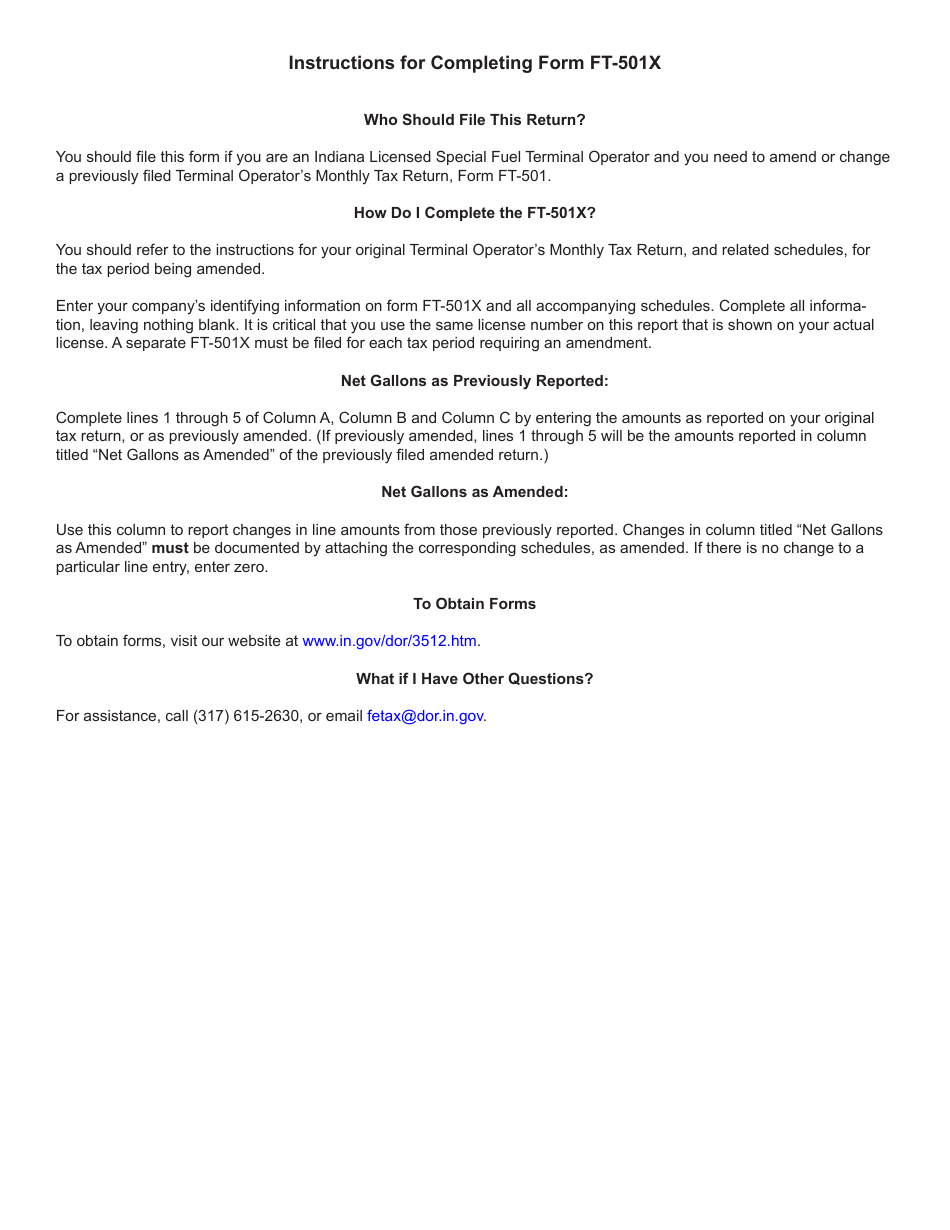

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FT-501X?

A: Form FT-501X is the Amended Terminal OperatorsMonthly Return.

Q: What is the purpose of Form FT-501X?

A: The purpose of Form FT-501X is to amend the Terminal Operators Monthly Return in Indiana.

Q: Who needs to file Form FT-501X?

A: Terminal operators in Indiana who need to make amendments to their monthly return.

Q: What is the State Form number for Form FT-501X?

A: The State Form number for Form FT-501X is 47736.

Q: What information is required on Form FT-501X?

A: Form FT-501X requires the terminal operator to provide details of the amended monthly return.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FT-501X (State Form 47736) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.