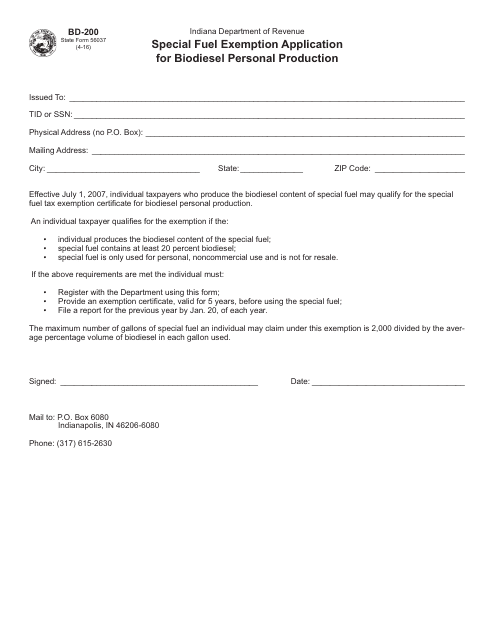

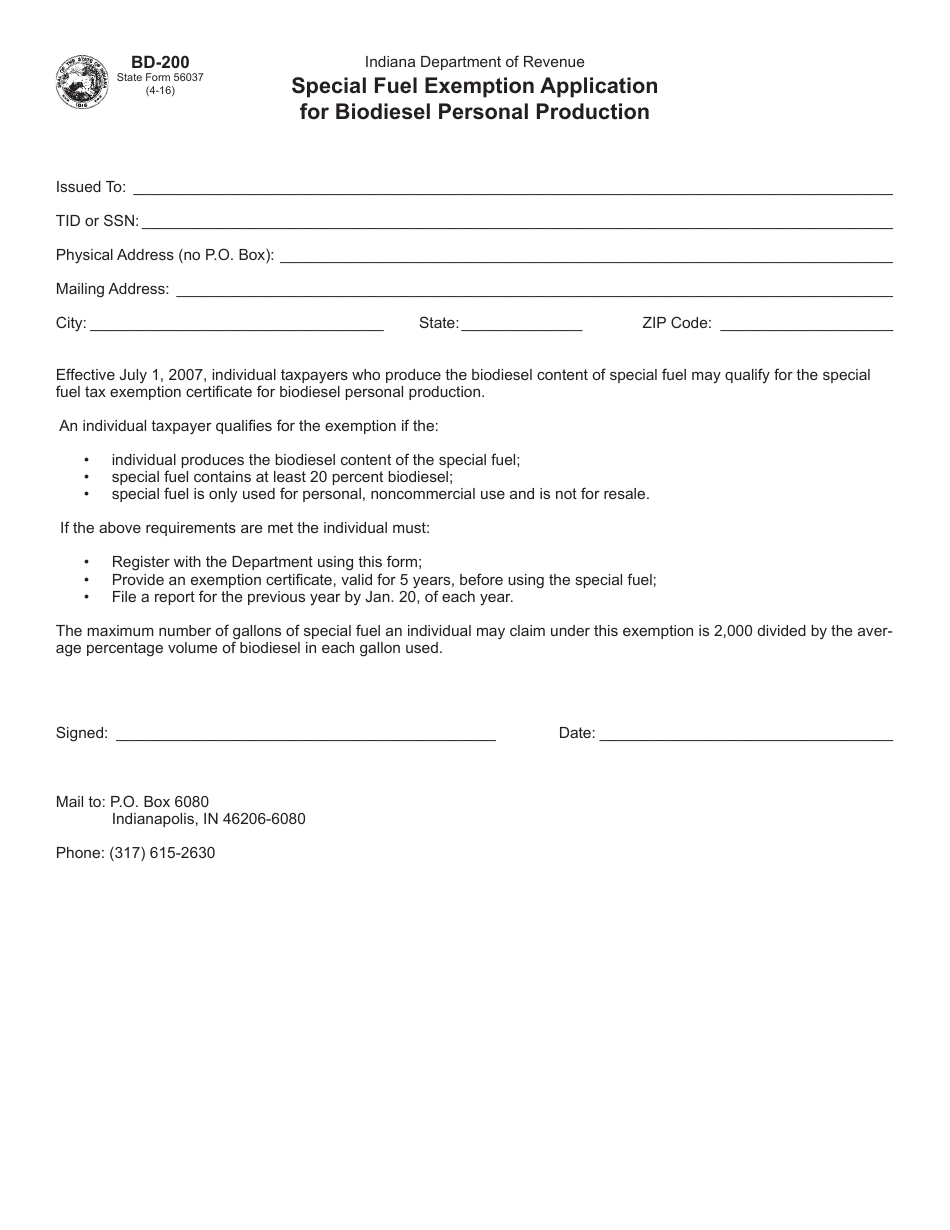

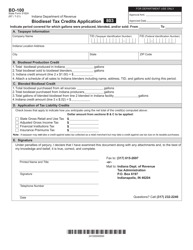

Form BD-200 (State Form 56037) Special Fuel Exemption Application for Biodiesel Personal Production - Indiana

What Is Form BD-200 (State Form 56037)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BD-200?

A: Form BD-200 is the Special Fuel Exemption Application for Biodiesel Personal Production in Indiana.

Q: What is the purpose of Form BD-200?

A: The purpose of Form BD-200 is to apply for an exemption from the special fuel tax for biodiesel fuel that is personally produced in Indiana.

Q: What is biodiesel?

A: Biodiesel is a renewable fuel made from vegetable oils, animal fats, or recycled cooking grease.

Q: Who can use Form BD-200?

A: Individuals who produce biodiesel fuel for personal use in Indiana can use Form BD-200.

Q: How do I apply for a special fuel exemption with Form BD-200?

A: To apply for a special fuel exemption, fill out Form BD-200 and submit it to the Indiana Department of Revenue.

Q: Are there any fees to submit Form BD-200?

A: No, there are no fees to submit Form BD-200.

Q: Can I use Form BD-200 if I produce biodiesel fuel for commercial purposes?

A: No, Form BD-200 is only for individuals producing biodiesel fuel for personal use.

Q: Are there any deadlines to submit Form BD-200?

A: No specific deadlines are mentioned for submitting Form BD-200. Contact the Indiana Department of Revenue for more information.

Q: What happens after I submit Form BD-200?

A: After submitting Form BD-200, the Indiana Department of Revenue will review your application and notify you of the status of your special fuel exemption.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BD-200 (State Form 56037) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.