This version of the form is not currently in use and is provided for reference only. Download this version of

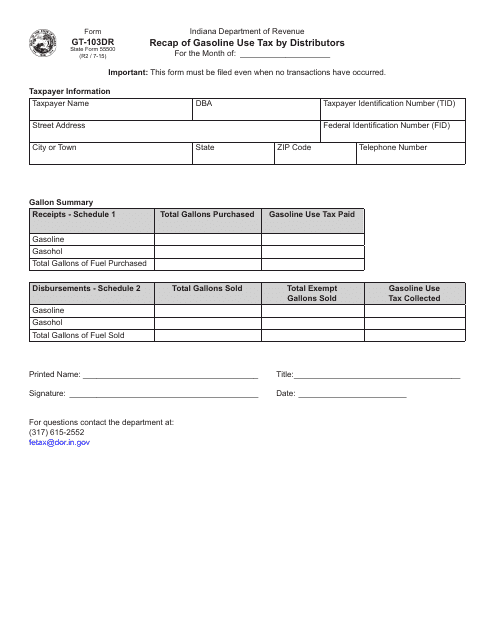

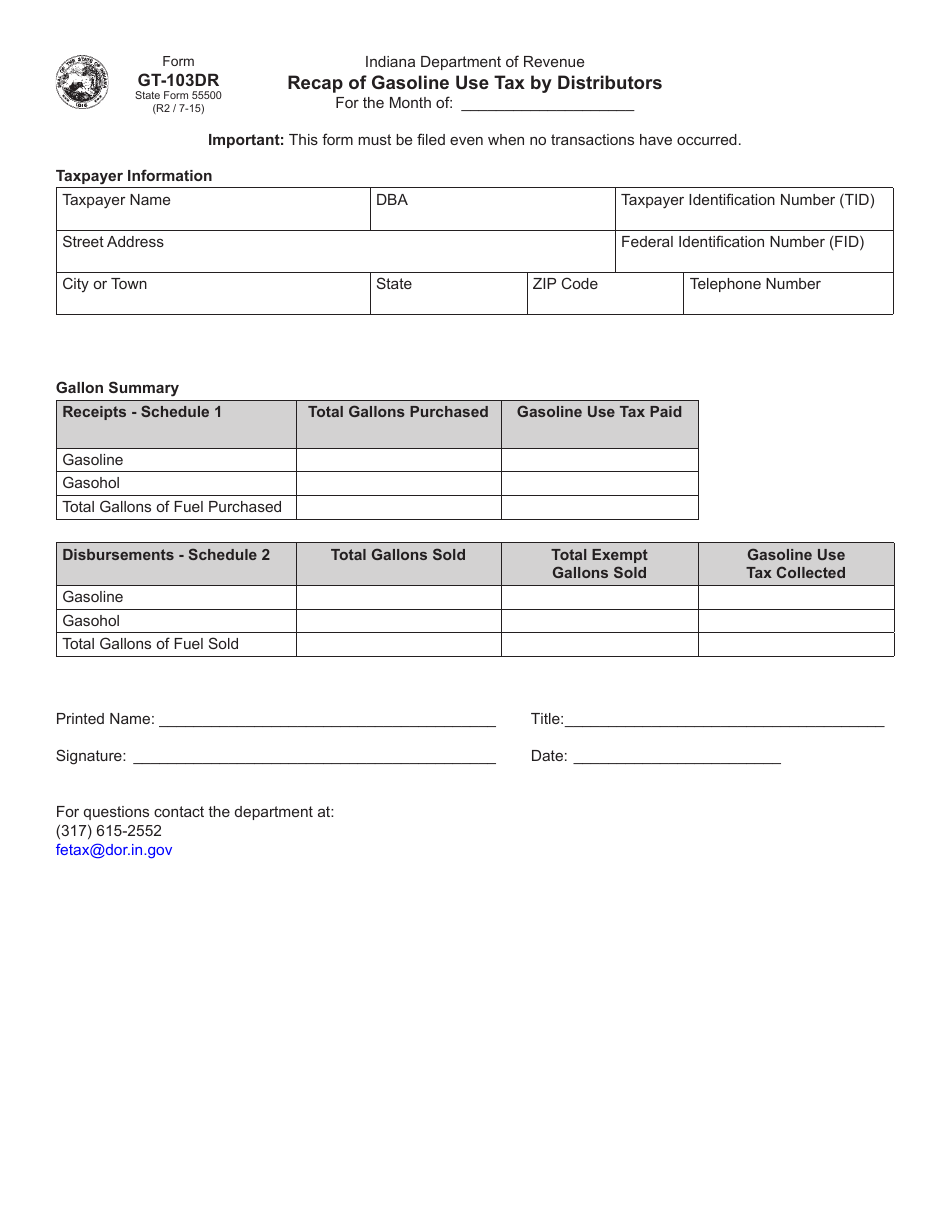

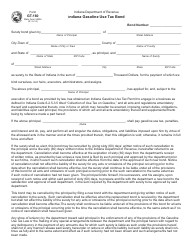

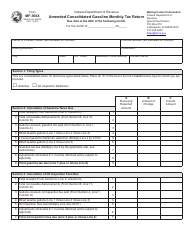

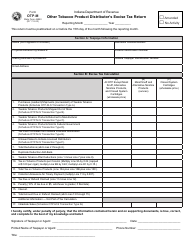

Form GT-103DR (State Form 55500)

for the current year.

Form GT-103DR (State Form 55500) Monthly Recap of Gasoline Use Tax by Distributors - Indiana

What Is Form GT-103DR (State Form 55500)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

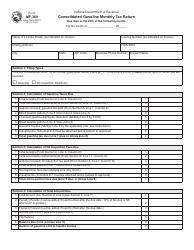

Q: What is Form GT-103DR?

A: Form GT-103DR is a monthly recap form used to report gasoline use tax by distributors in Indiana.

Q: What is the purpose of Form GT-103DR?

A: The purpose of Form GT-103DR is to track and report gasoline use tax by distributors in Indiana.

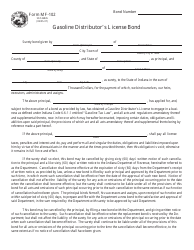

Q: Who needs to file Form GT-103DR?

A: Distributors of gasoline in Indiana need to file Form GT-103DR to report gasoline use tax.

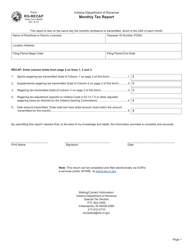

Q: Is Form GT-103DR for monthly reporting?

A: Yes, Form GT-103DR is used for monthly reporting of gasoline use tax.

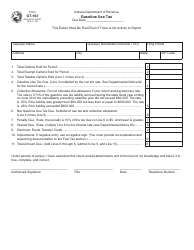

Q: What other information is required on Form GT-103DR?

A: In addition to reporting gasoline use tax, Form GT-103DR also requires information such as total gallons received, total gallons sold, and any tax credits or refunds.

Q: When is the deadline for filing Form GT-103DR?

A: The deadline for filing Form GT-103DR is typically the last day of the month following the reporting period.

Q: Are there any penalties for late filing of Form GT-103DR?

A: Yes, late filing of Form GT-103DR may result in penalties, including fines and interest charges.

Q: Can I file Form GT-103DR electronically?

A: Yes, the Indiana Department of Revenue offers electronic filing options for Form GT-103DR.

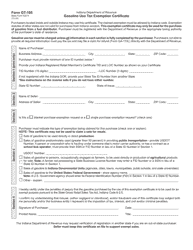

Q: Are there any exemptions or deductions available on Form GT-103DR?

A: Yes, there may be exemptions or deductions available for certain types of gasoline use. Consult the instructions for Form GT-103DR for more information.

Form Details:

- Released on July 1, 2015;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GT-103DR (State Form 55500) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.