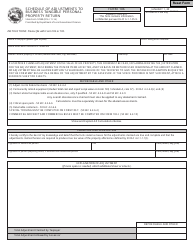

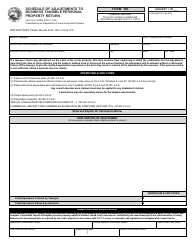

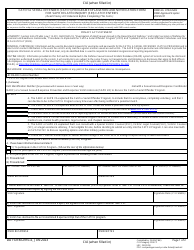

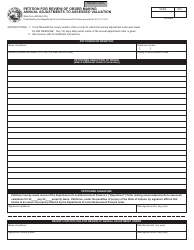

State Form 56032 Schedule E-1 Explanation of Adjustments - Indiana

What Is State Form 56032 Schedule E-1?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 56032 Schedule E-1?

A: State Form 56032 Schedule E-1 is a form used in Indiana to explain adjustments made on individual tax returns.

Q: Who is required to file State Form 56032 Schedule E-1?

A: Individuals who need to make adjustments on their Indiana tax returns may be required to file State Form 56032 Schedule E-1.

Q: What adjustments can be explained on State Form 56032 Schedule E-1?

A: State Form 56032 Schedule E-1 can be used to explain various adjustments, such as deductions, credits, and other modifications to the individual's tax liability.

Q: Do I need to include State Form 56032 Schedule E-1 with my tax return?

A: If you have made adjustments on your Indiana tax return, it is usually recommended to include State Form 56032 Schedule E-1 to provide an explanation for those adjustments.

Q: Can I e-file State Form 56032 Schedule E-1?

A: Yes, you can e-file State Form 56032 Schedule E-1 along with your Indiana tax return if you are filing electronically.

Q: Is State Form 56032 Schedule E-1 specific to Indiana?

A: Yes, State Form 56032 Schedule E-1 is specific to Indiana and is not used for other states.

Q: What should I do if I have further questions about State Form 56032 Schedule E-1?

A: If you have further questions about State Form 56032 Schedule E-1, you can contact the Indiana Department of Revenue or seek assistance from a tax professional.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56032 Schedule E-1 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.