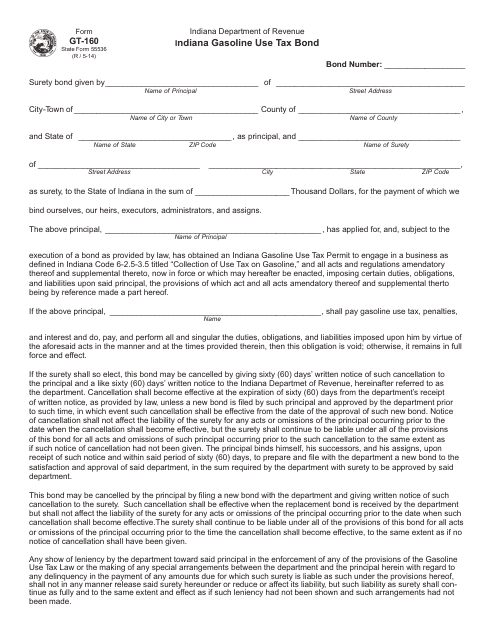

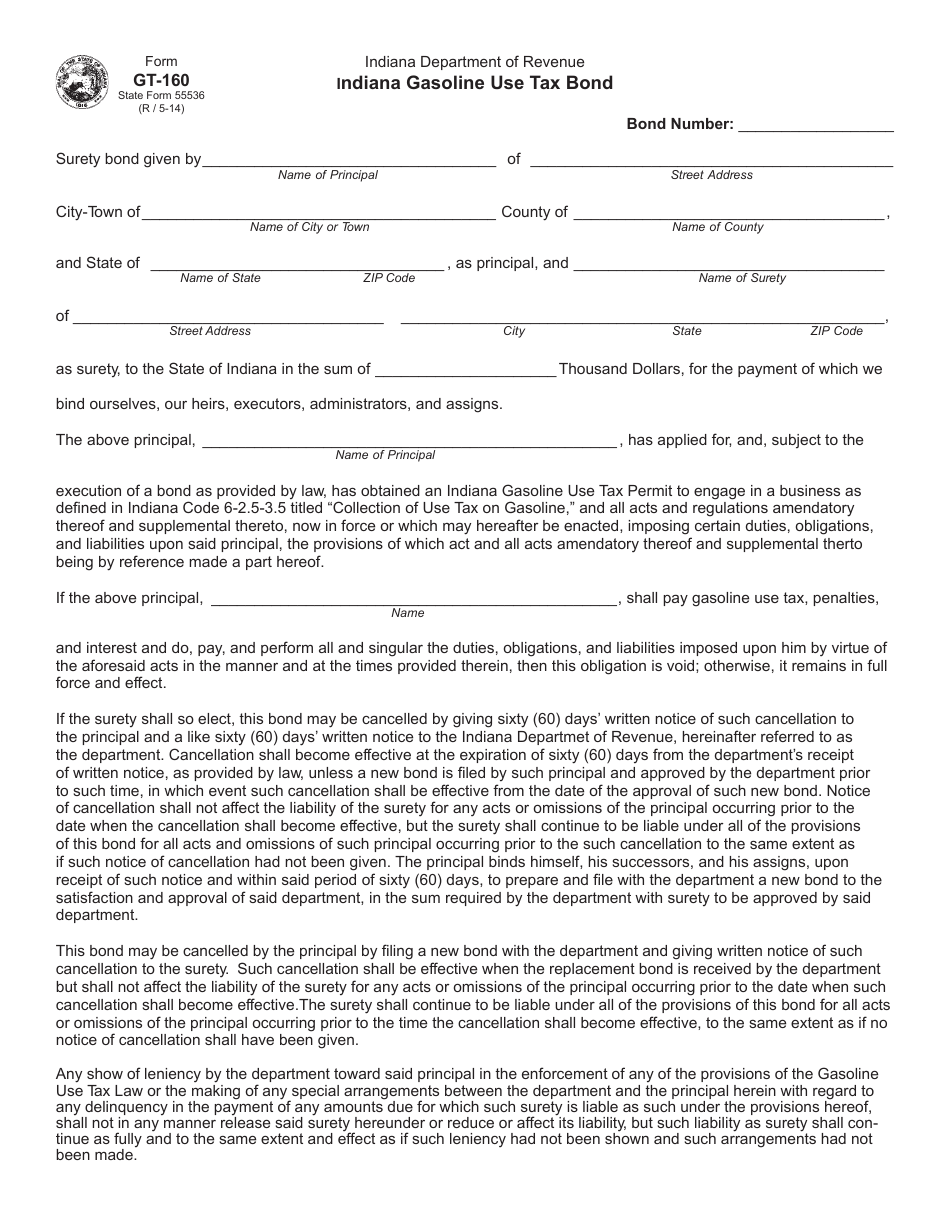

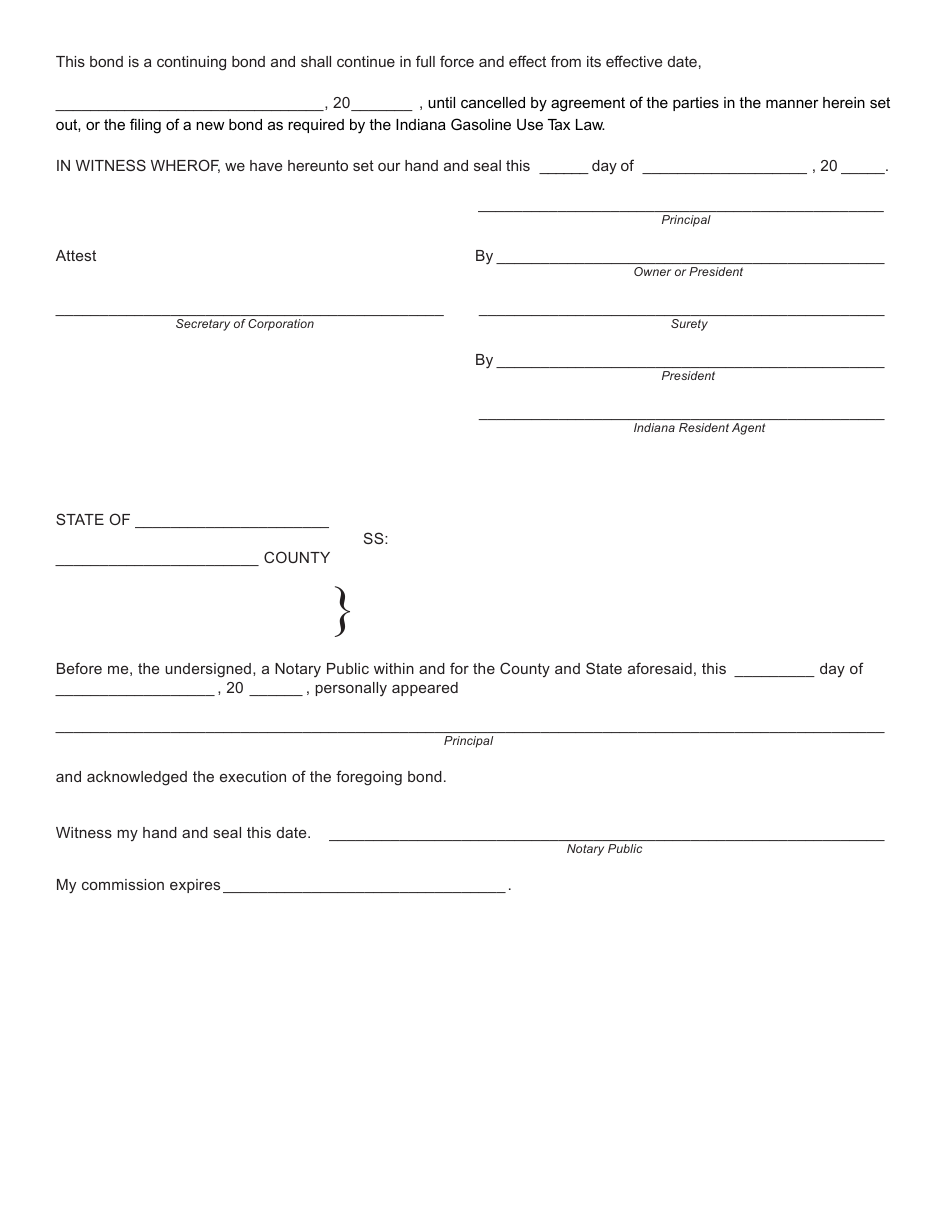

Form GT-160 (State Form 55536) Indiana Gasoline Use Tax Bond - Indiana

What Is Form GT-160 (State Form 55536)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GT-160?

A: Form GT-160 is a State Form 55536, which is the Indiana Gasoline Use Tax Bond.

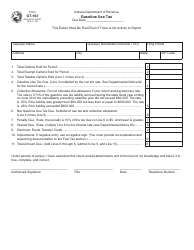

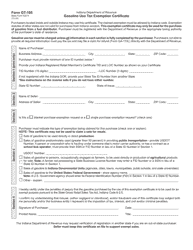

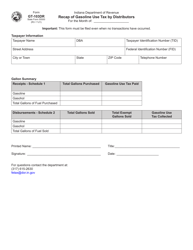

Q: Who is required to file Form GT-160?

A: Any business or individual who is engaged in selling gasoline in the state of Indiana is required to file Form GT-160.

Q: What is the purpose of Form GT-160?

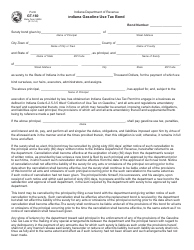

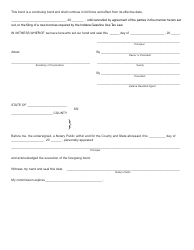

A: The purpose of Form GT-160 is to provide a surety bond to the State of Indiana for the payment of any gasoline use tax owed.

Q: Are there any fees associated with Form GT-160?

A: Yes, there may be fees associated with filing Form GT-160. Please refer to the instructions on the form or contact the Indiana Department of Revenue for more information.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GT-160 (State Form 55536) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.