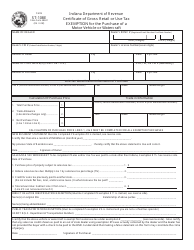

This version of the form is not currently in use and is provided for reference only. Download this version of

Form AVF-105 (State Form 55314)

for the current year.

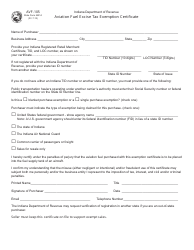

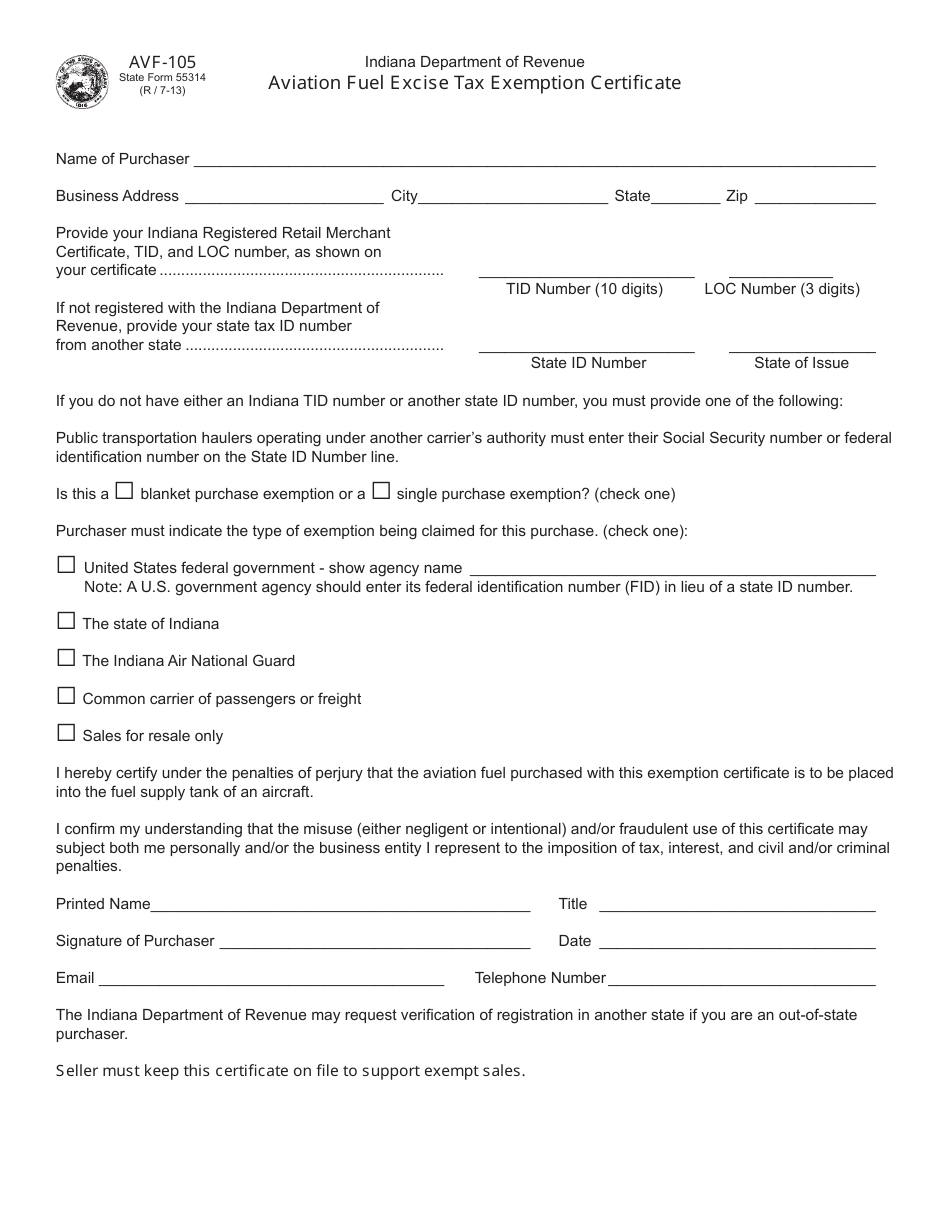

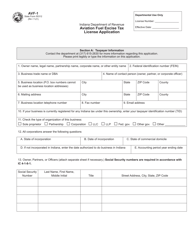

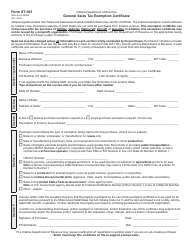

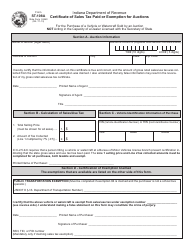

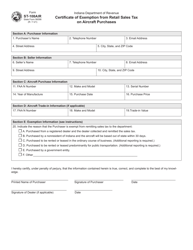

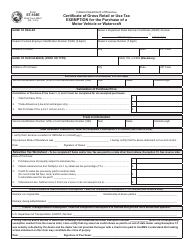

Form AVF-105 (State Form 55314) Aviation Fuel Excise Tax Exemption Certificate - Indiana

What Is Form AVF-105 (State Form 55314)?

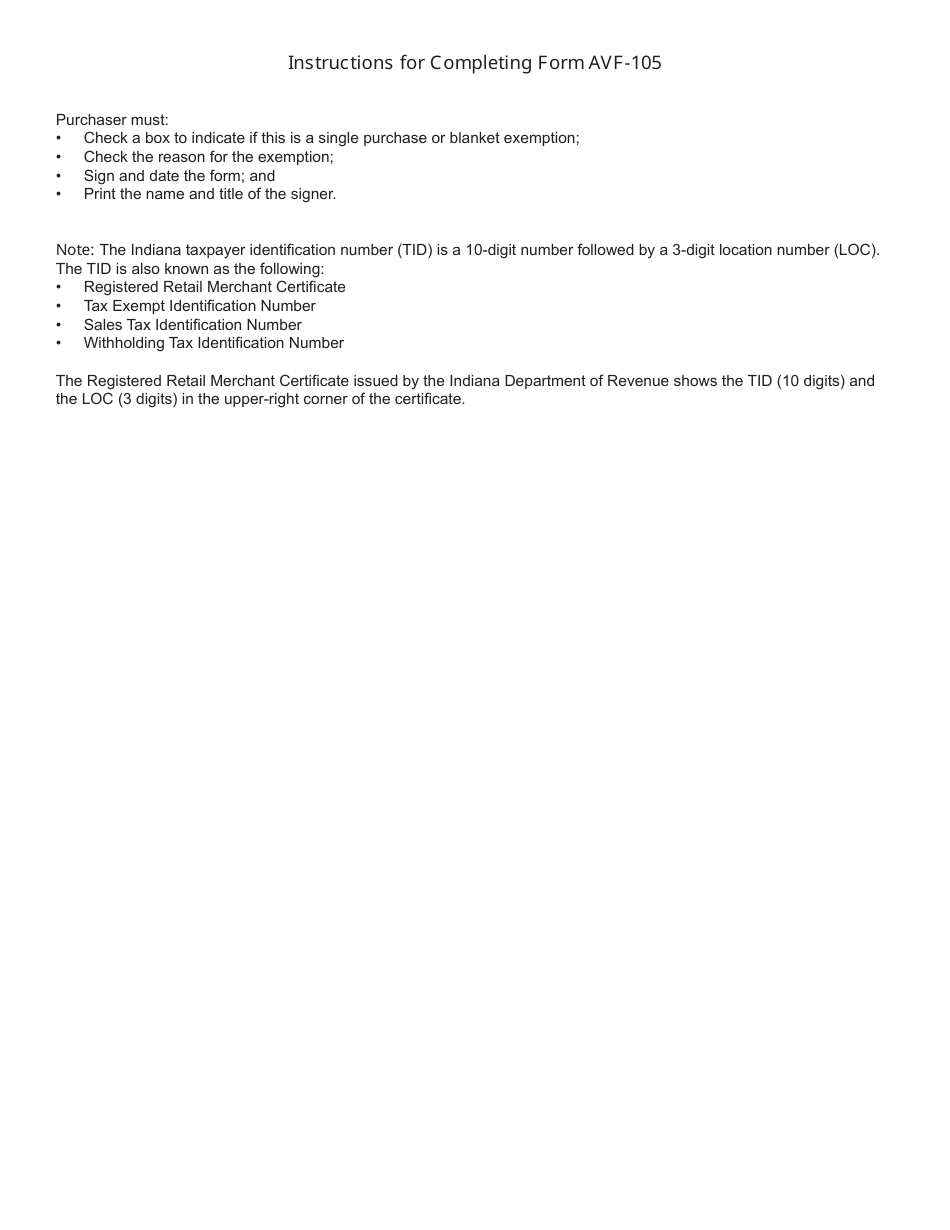

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AVF-105?

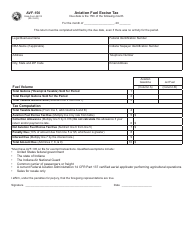

A: Form AVF-105 is the Aviation Fuel Excise Tax Exemption Certificate used in Indiana.

Q: What is the purpose of Form AVF-105?

A: The purpose of Form AVF-105 is to claim an exemption from aviation fuel excise tax in Indiana.

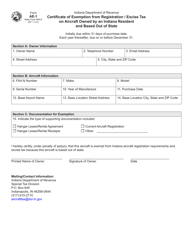

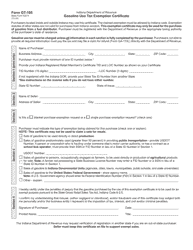

Q: Who should use Form AVF-105?

A: Any individual or business entity seeking an exemption from aviation fuel excise tax in Indiana should use Form AVF-105.

Q: Can Form AVF-105 be filed electronically?

A: No, Form AVF-105 cannot be filed electronically. It must be filed by mail or in person.

Q: Are there any fees associated with filing Form AVF-105?

A: There are no fees associated with filing Form AVF-105.

Q: What information is required on Form AVF-105?

A: Form AVF-105 requires information such as the taxpayer's name, address, aircraft registration number, and detailed fuel consumption information.

Q: When is Form AVF-105 due?

A: Form AVF-105 must be filed on a monthly basis and is due on the 20th day of the following month.

Q: Is there a penalty for not filing Form AVF-105?

A: Yes, failing to file Form AVF-105 or filing it late may result in penalties and interest charges.

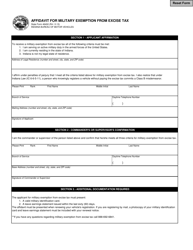

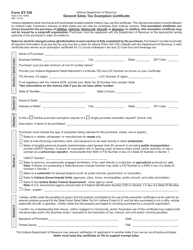

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AVF-105 (State Form 55314) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.