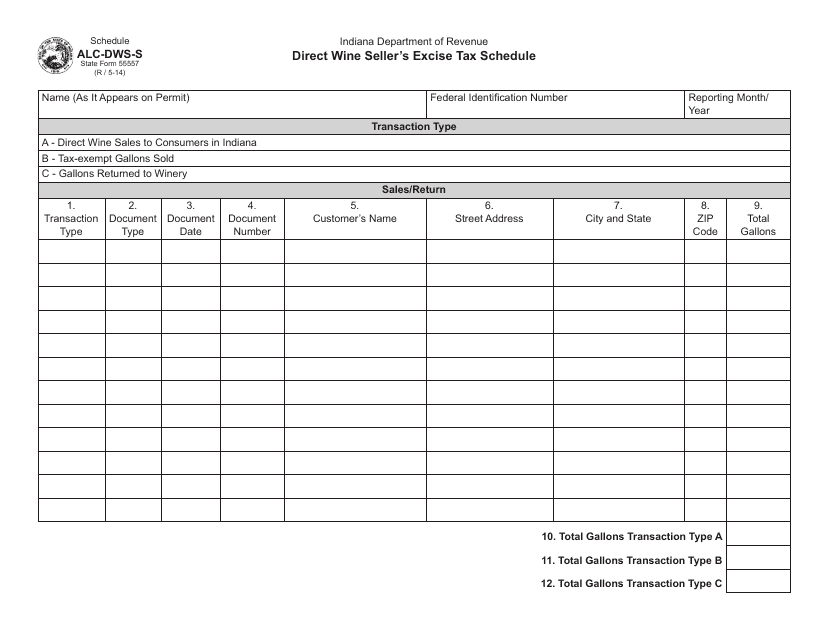

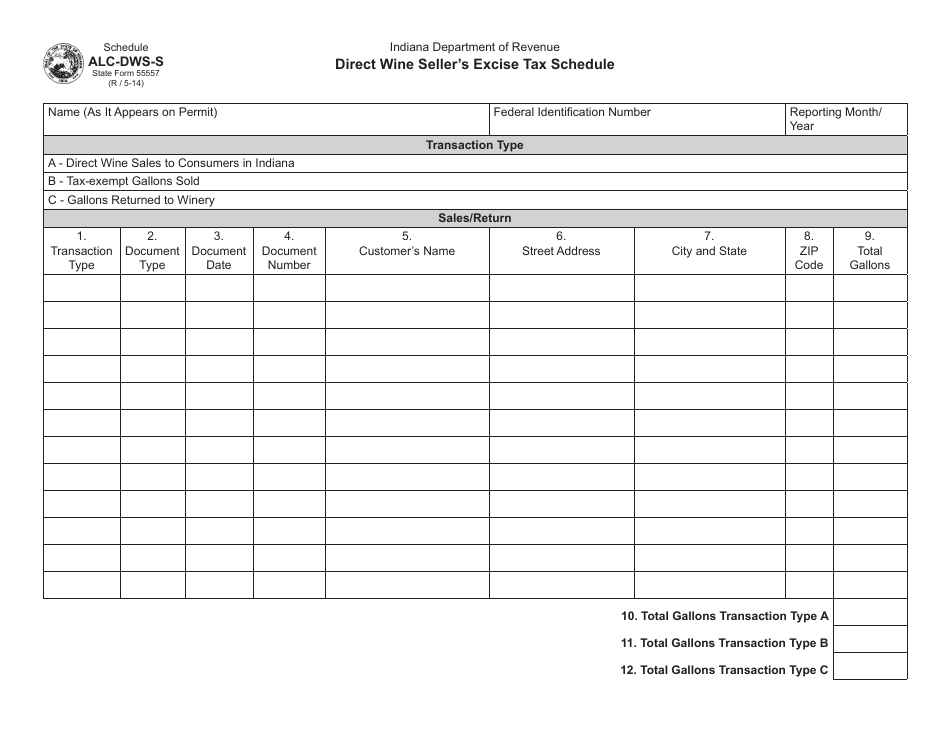

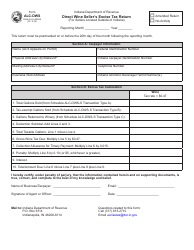

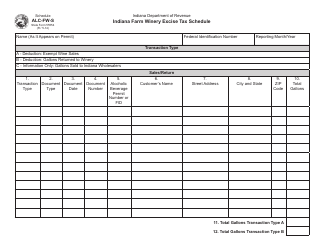

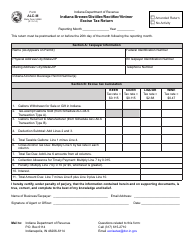

State Form 55557 Schedule ALC-DWS-S Direct Wine Seller's Excise Tax Schedule - Indiana

What Is State Form 55557 Schedule ALC-DWS-S?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55557 Schedule ALC-DWS-S?

A: Form 55557 Schedule ALC-DWS-S is the Direct Wine Seller's Excise Tax Schedule for Indiana.

Q: Who needs to file Form 55557 Schedule ALC-DWS-S?

A: Direct wine sellers in Indiana need to file Form 55557 Schedule ALC-DWS-S.

Q: What is the purpose of Form 55557 Schedule ALC-DWS-S?

A: The purpose of Form 55557 Schedule ALC-DWS-S is to report and pay the excise tax on direct wine sales in Indiana.

Q: Is Form 55557 Schedule ALC-DWS-S specific to Indiana?

A: Yes, Form 55557 Schedule ALC-DWS-S is specific to Indiana.

Q: When is Form 55557 Schedule ALC-DWS-S due?

A: Form 55557 Schedule ALC-DWS-S is due on the last day of the month following the end of the reporting period.

Q: What happens if I don't file Form 55557 Schedule ALC-DWS-S?

A: If you don't file Form 55557 Schedule ALC-DWS-S or fail to pay the excise tax, you may be subject to penalties and interest.

Q: Are there any exemptions or deductions available on Form 55557 Schedule ALC-DWS-S?

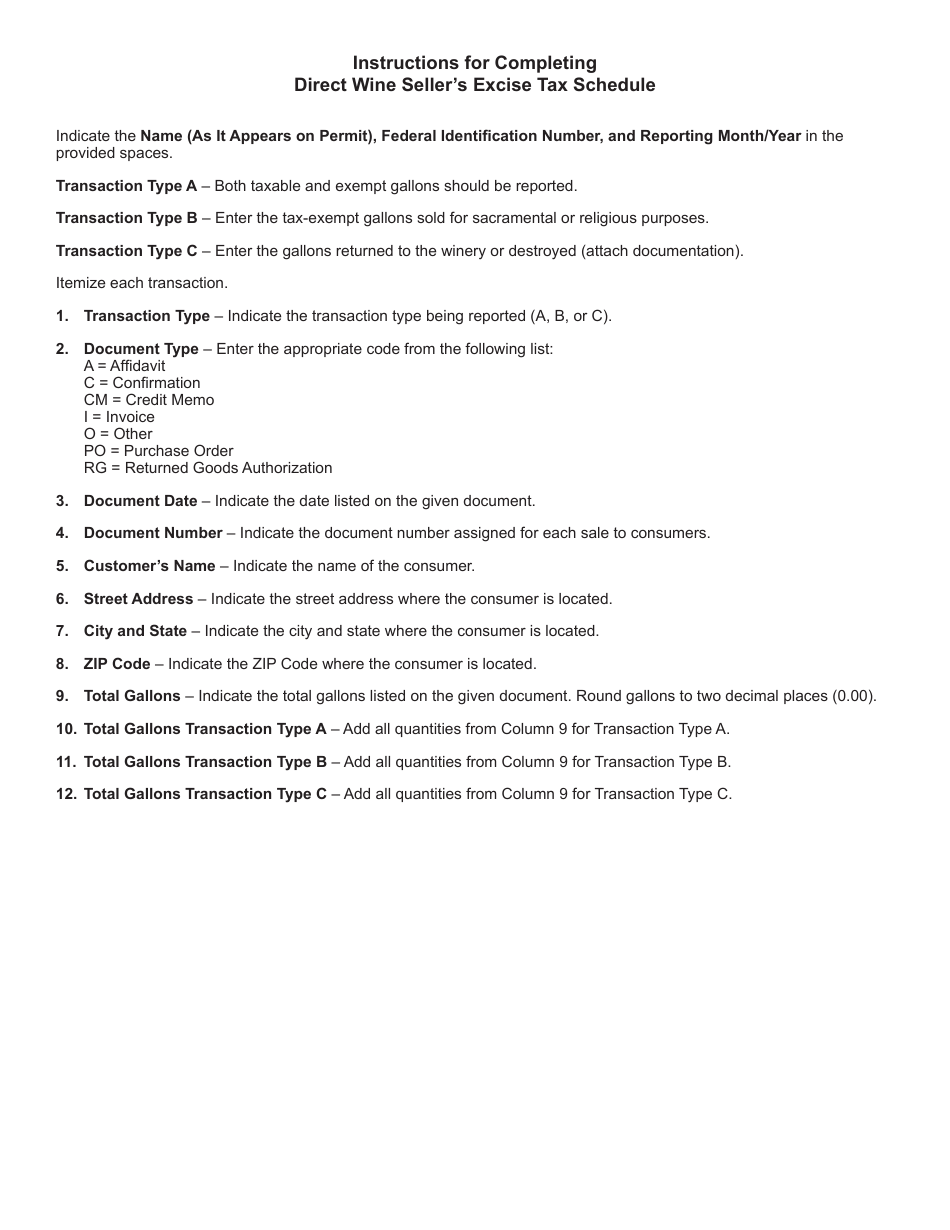

A: Specific exemptions or deductions may apply. Please refer to the instructions provided with the form or consult with the Indiana Department of Revenue for more information.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55557 Schedule ALC-DWS-S by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.