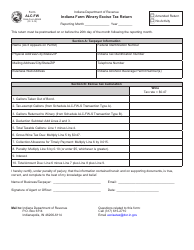

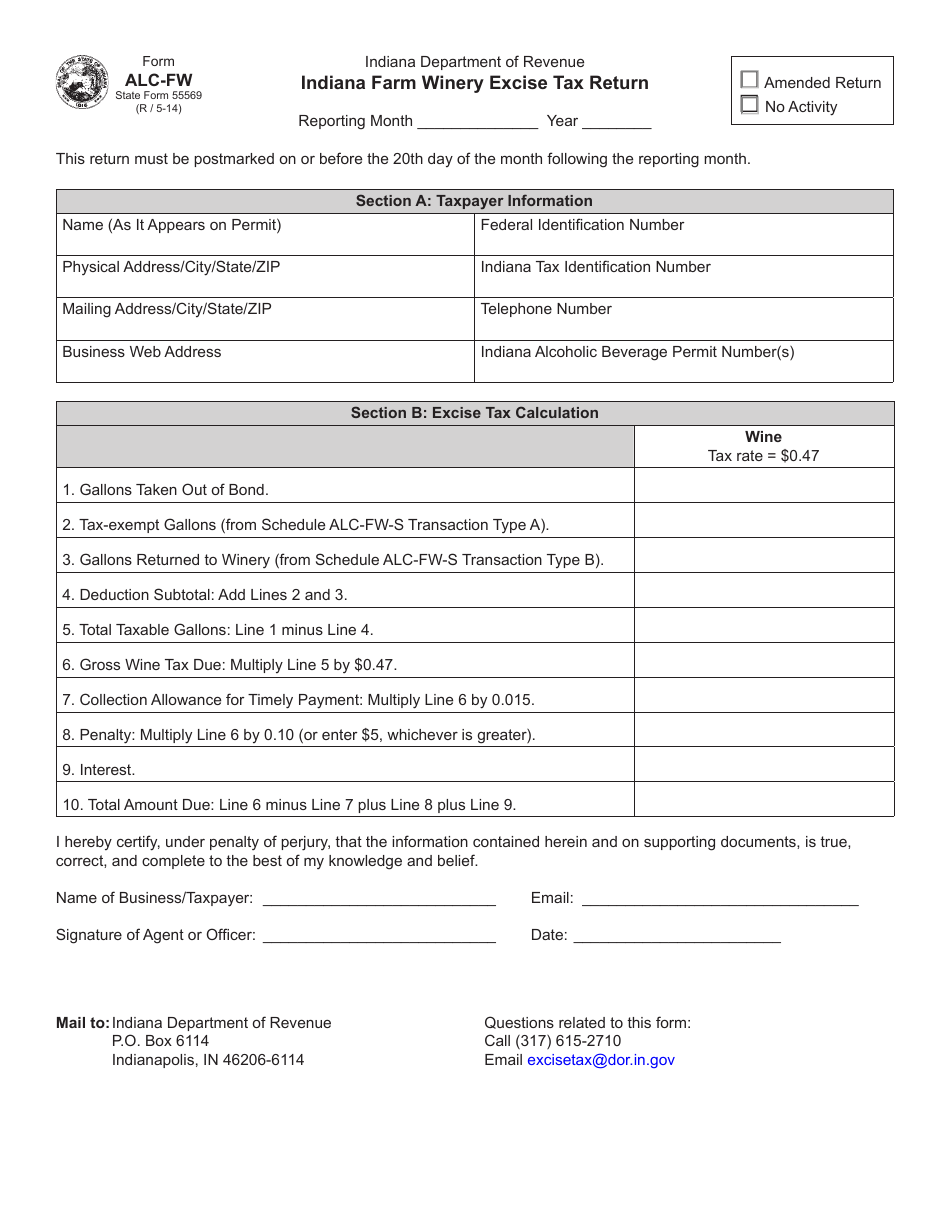

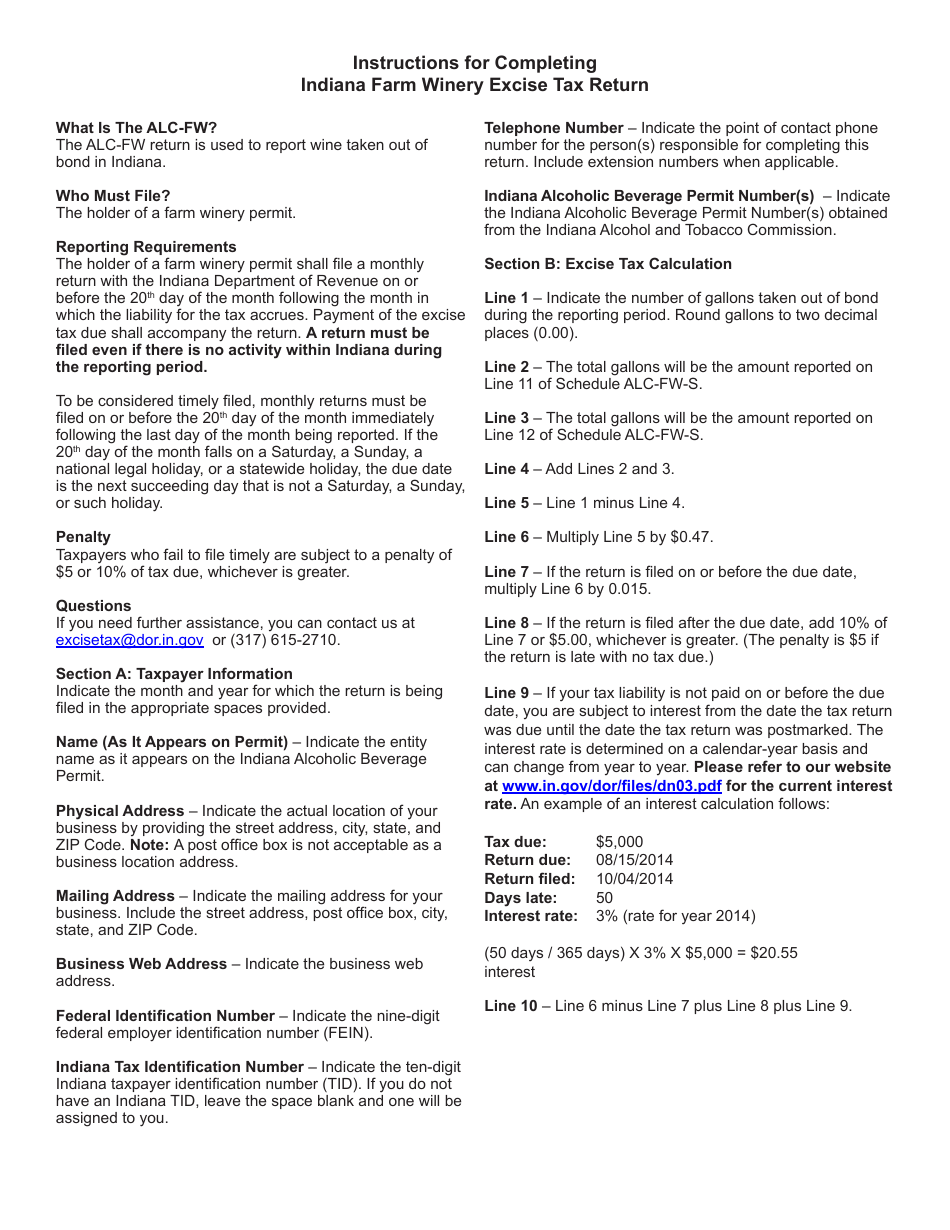

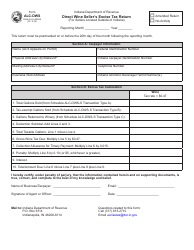

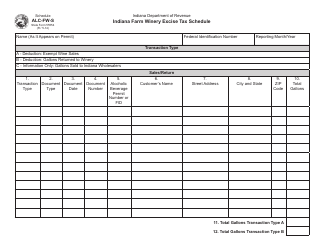

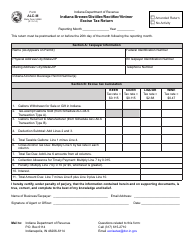

Form ALC-FW (State Form 55569) Indiana Farm Winery Excise Tax Return - Indiana

What Is Form ALC-FW (State Form 55569)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ALC-FW?

A: Form ALC-FW is the Indiana Farm Winery Excise Tax Return.

Q: What is the purpose of Form ALC-FW?

A: The purpose of Form ALC-FW is to report and pay the excise tax for Indiana farm wineries.

Q: What is the Indiana Farm Winery Excise Tax?

A: The Indiana Farm Winery Excise Tax is a tax on the wholesale price of wine produced and sold by farm wineries in Indiana.

Q: Who needs to file Form ALC-FW?

A: Farm wineries in Indiana need to file Form ALC-FW.

Q: How often do I need to file Form ALC-FW?

A: Form ALC-FW needs to be filed quarterly.

Q: What information do I need to complete Form ALC-FW?

A: You will need information about wine sold, production quantities, and other details about your farm winery operations.

Q: What are the penalties for not filing Form ALC-FW?

A: Penalties for not filing Form ALC-FW include late filing penalties and possible legal consequences.

Q: When is the deadline for filing Form ALC-FW?

A: The deadline for filing Form ALC-FW is the last day of the month following the end of the quarter.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC-FW (State Form 55569) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.