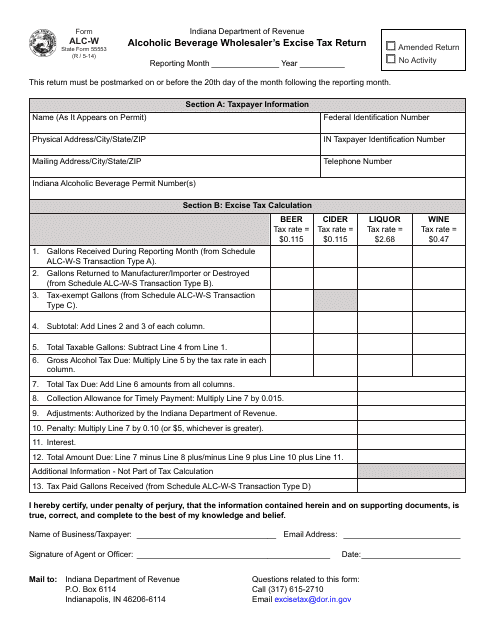

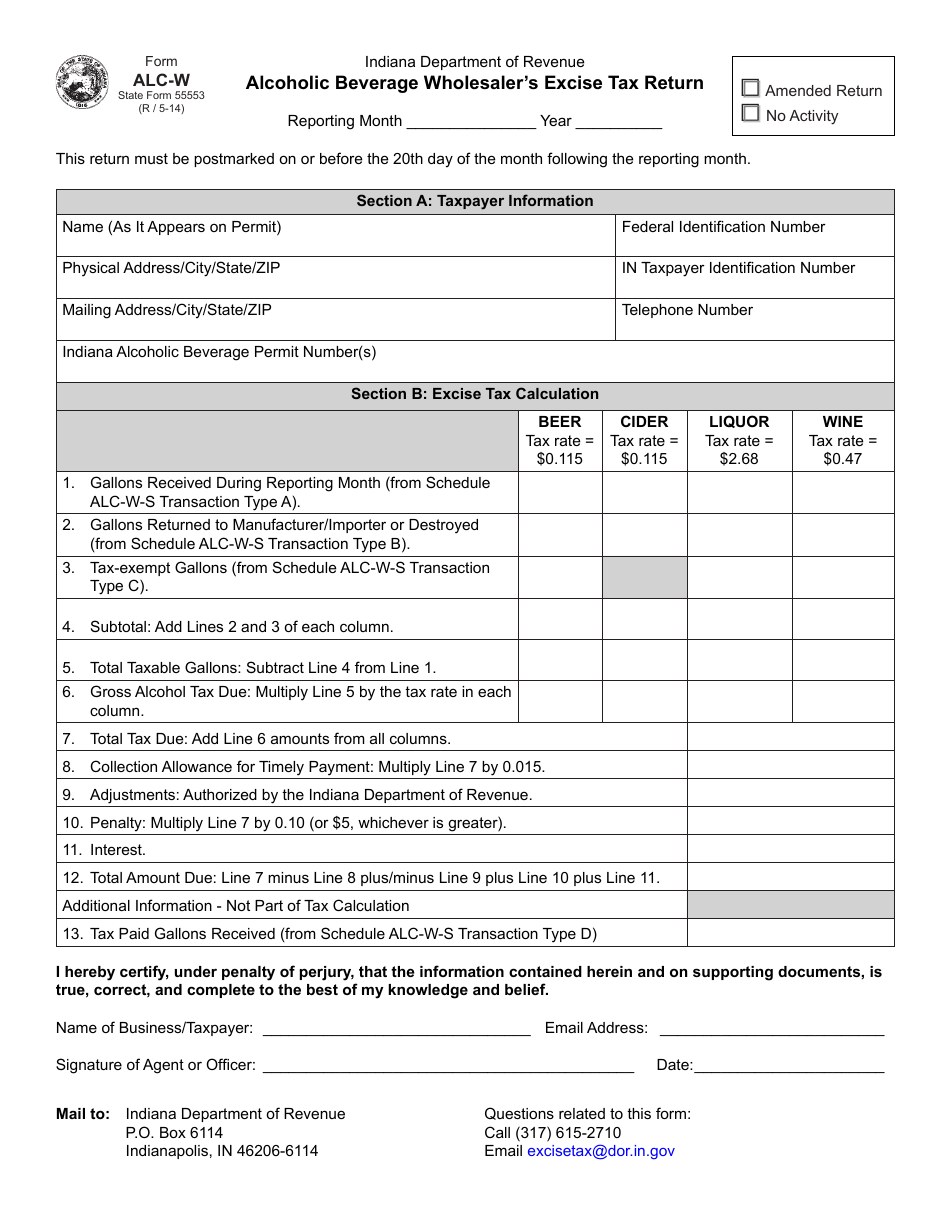

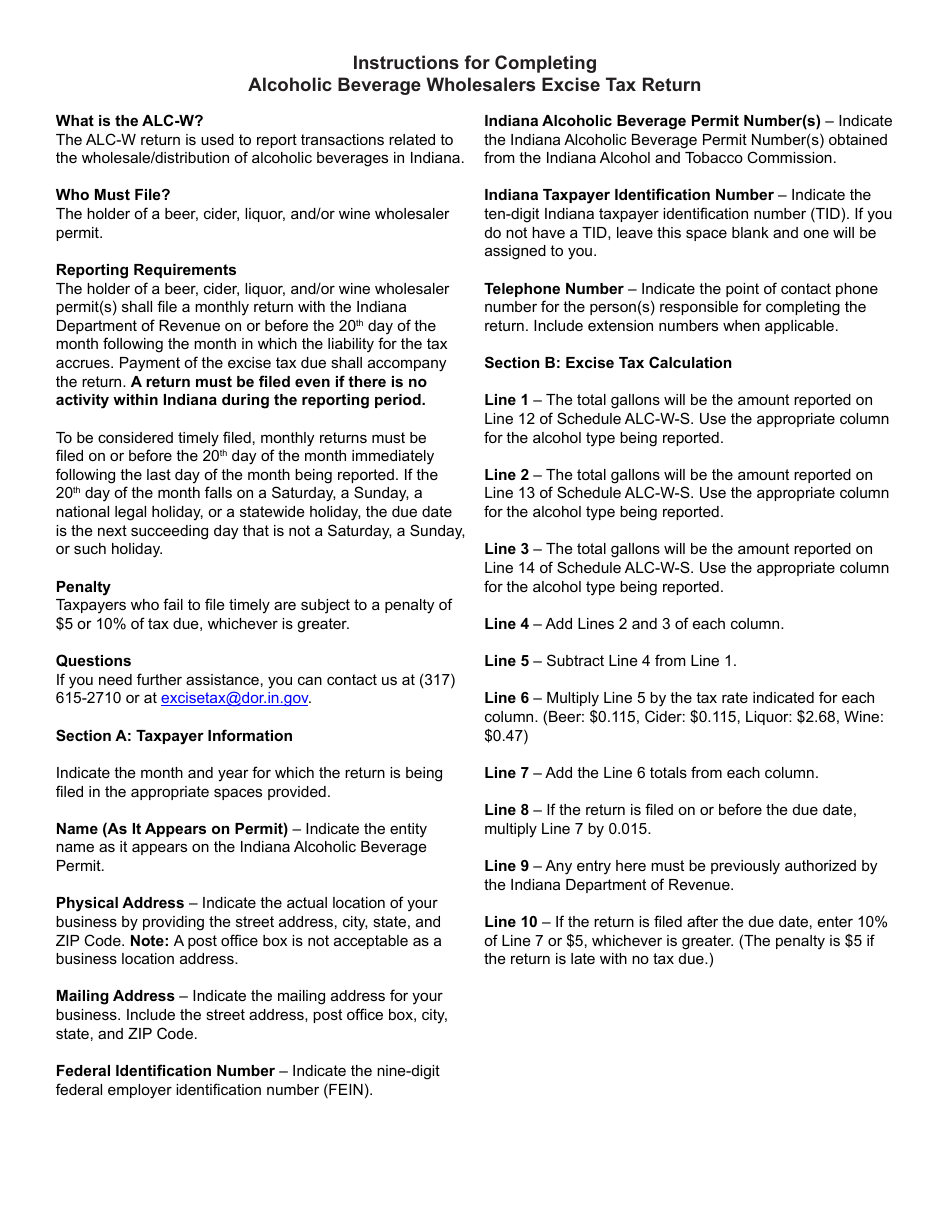

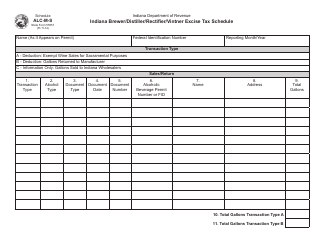

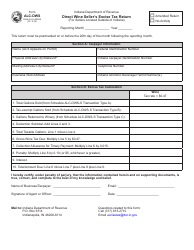

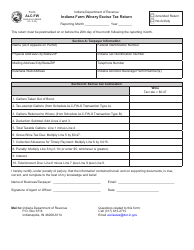

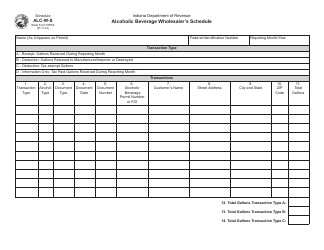

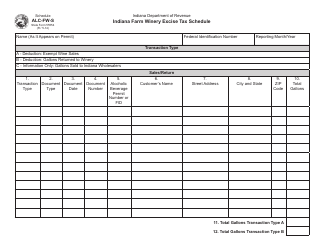

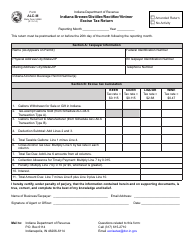

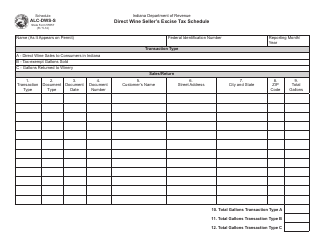

Form ALC-W (State Form 55553) Alcoholic Beverage Wholesaler's Excise Tax Return - Indiana

What Is Form ALC-W (State Form 55553)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ALC-W?

A: Form ALC-W is the Alcoholic Beverage Wholesaler's Excise Tax Return in Indiana.

Q: Who needs to file Form ALC-W?

A: Alcoholic beverage wholesalers in Indiana need to file Form ALC-W.

Q: What is the purpose of Form ALC-W?

A: Form ALC-W is used to report and pay the excise tax on alcoholic beverages for wholesalers.

Q: When is Form ALC-W due?

A: Form ALC-W is due on the 15th day of the month following the reporting period.

Q: What information is required on Form ALC-W?

A: Form ALC-W requires information such as sales figures, tax calculations, and business details.

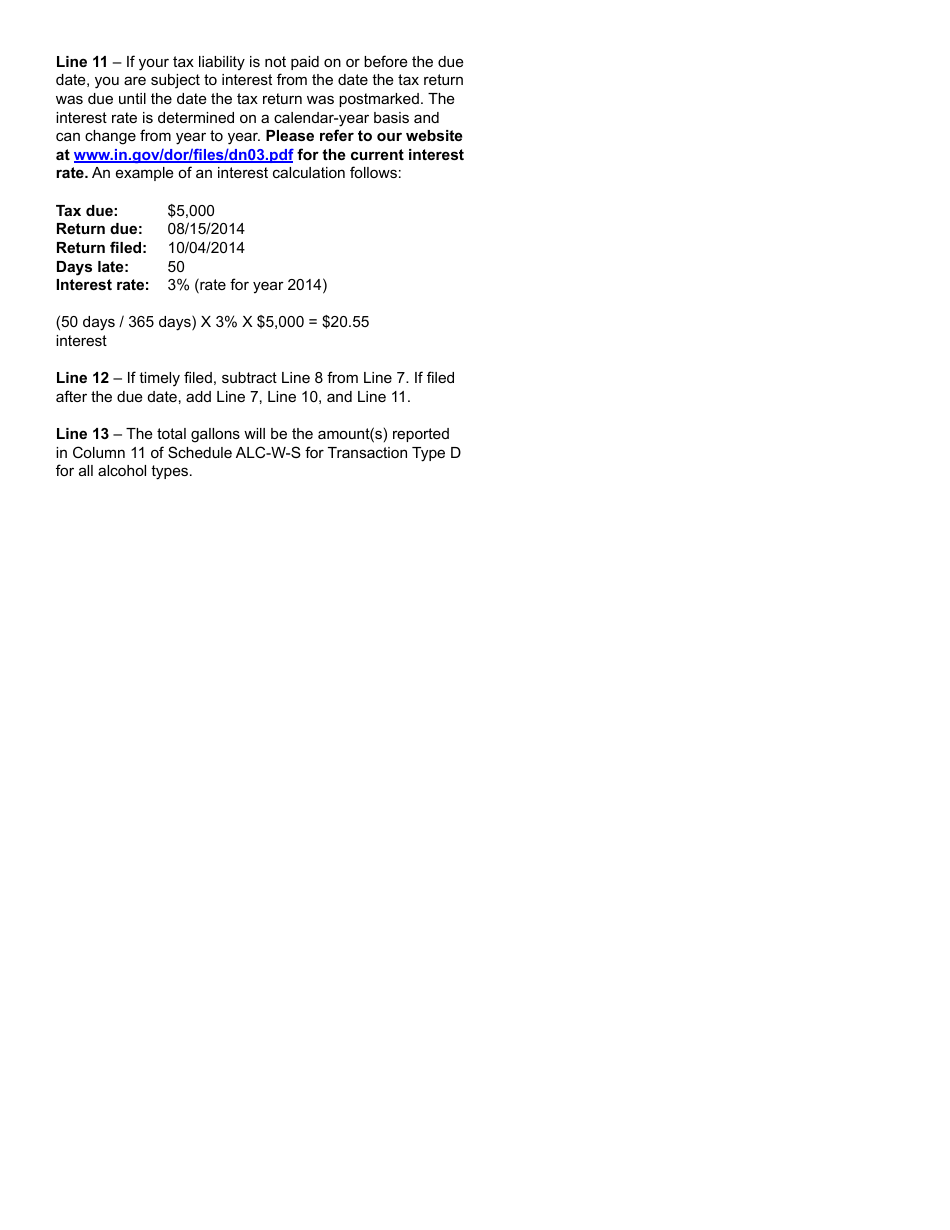

Q: Are there any penalties for late filing of Form ALC-W?

A: Yes, there are penalties for late filing of Form ALC-W. It's important to file on time to avoid penalties.

Q: How can I pay the excise tax on Form ALC-W?

A: You can pay the excise tax on Form ALC-W by check, money order, or electronically.

Form Details:

- Released on May 1, 2014;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ALC-W (State Form 55553) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.