This version of the form is not currently in use and is provided for reference only. Download this version of

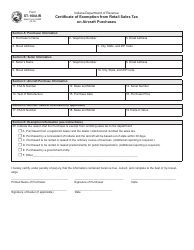

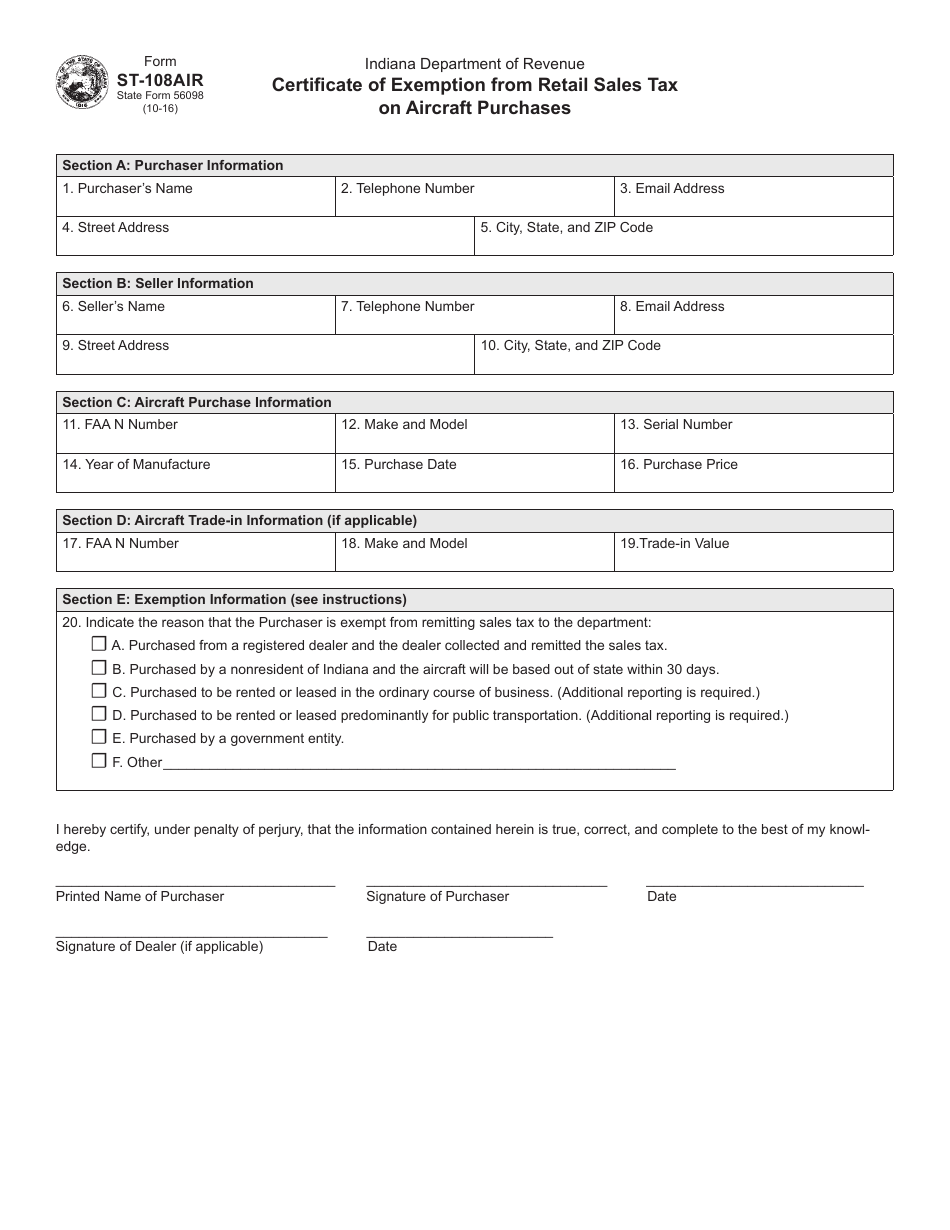

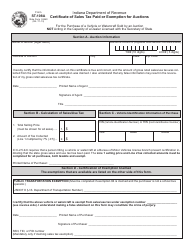

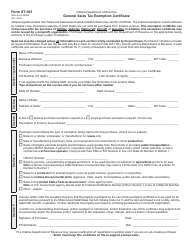

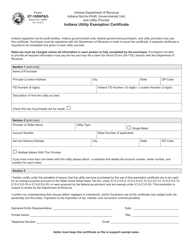

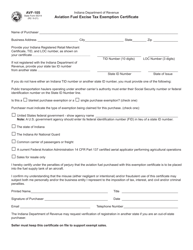

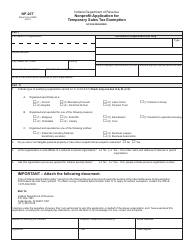

Form ST-108AIR (State Form 56098)

for the current year.

Form ST-108AIR (State Form 56098) Certificate of Exemption From Retail Sales Tax on Aircraft Purchases - Indiana

What Is Form ST-108AIR (State Form 56098)?

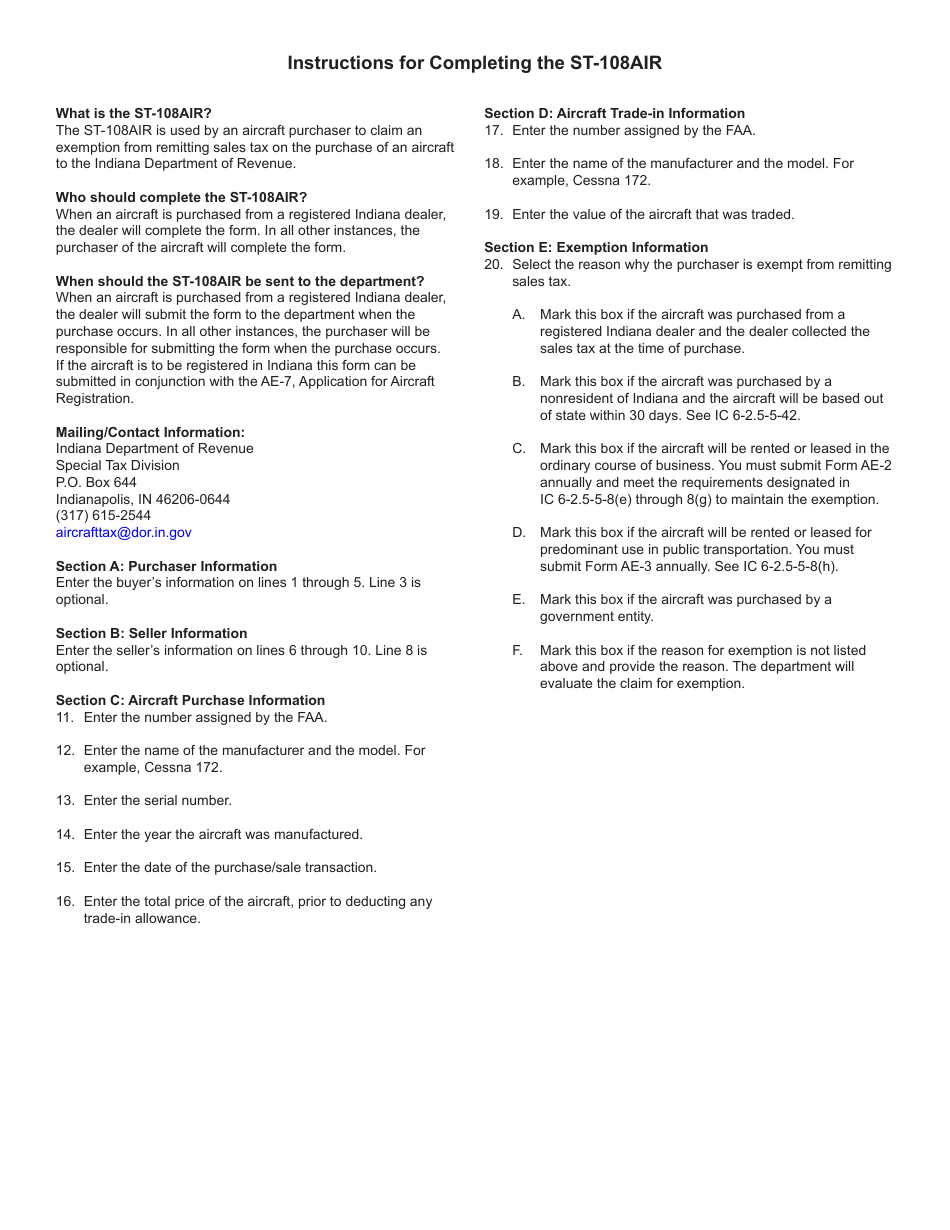

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-108AIR?

A: Form ST-108AIR is a Certificate of Exemption From Retail Sales Tax on Aircraft Purchases in Indiana.

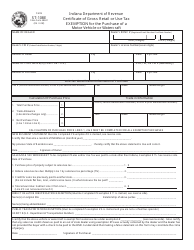

Q: When is Form ST-108AIR used?

A: Form ST-108AIR is used when purchasing an aircraft and claiming exemption from retail sales tax in Indiana.

Q: Who can use Form ST-108AIR?

A: Individuals or businesses purchasing an aircraft in Indiana and meeting certain criteria can use Form ST-108AIR.

Q: What is the purpose of Form ST-108AIR?

A: The purpose of Form ST-108AIR is to certify that the purchaser is eligible for exemption from retail sales tax on aircraft purchases in Indiana.

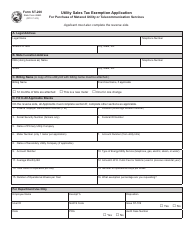

Q: What information is required on Form ST-108AIR?

A: Form ST-108AIR requires information such as the purchaser's name, address, aircraft details, and the reason for claiming exemption.

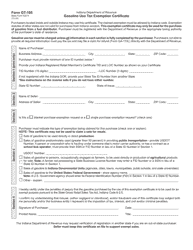

Q: Are there any fees associated with filing Form ST-108AIR?

A: No, there are no fees associated with filing Form ST-108AIR.

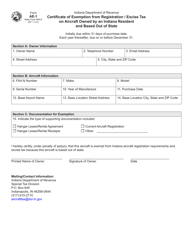

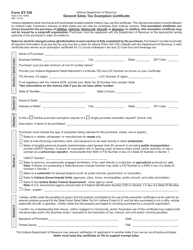

Q: When should Form ST-108AIR be filed?

A: Form ST-108AIR should be filed at the time of the aircraft purchase or within 30 days of the purchase.

Q: Can Form ST-108AIR be used for other types of purchases?

A: No, Form ST-108AIR is specifically for claiming exemption from retail sales tax on aircraft purchases in Indiana.

Q: What happens after submitting Form ST-108AIR?

A: After submitting Form ST-108AIR, the Indiana Department of Revenue will review the form and determine if the purchaser is eligible for exemption.

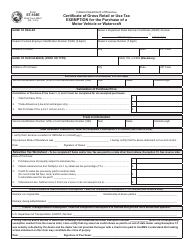

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-108AIR (State Form 56098) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.