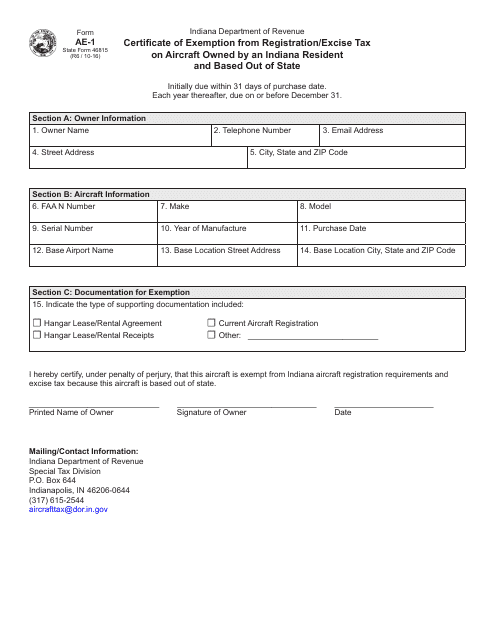

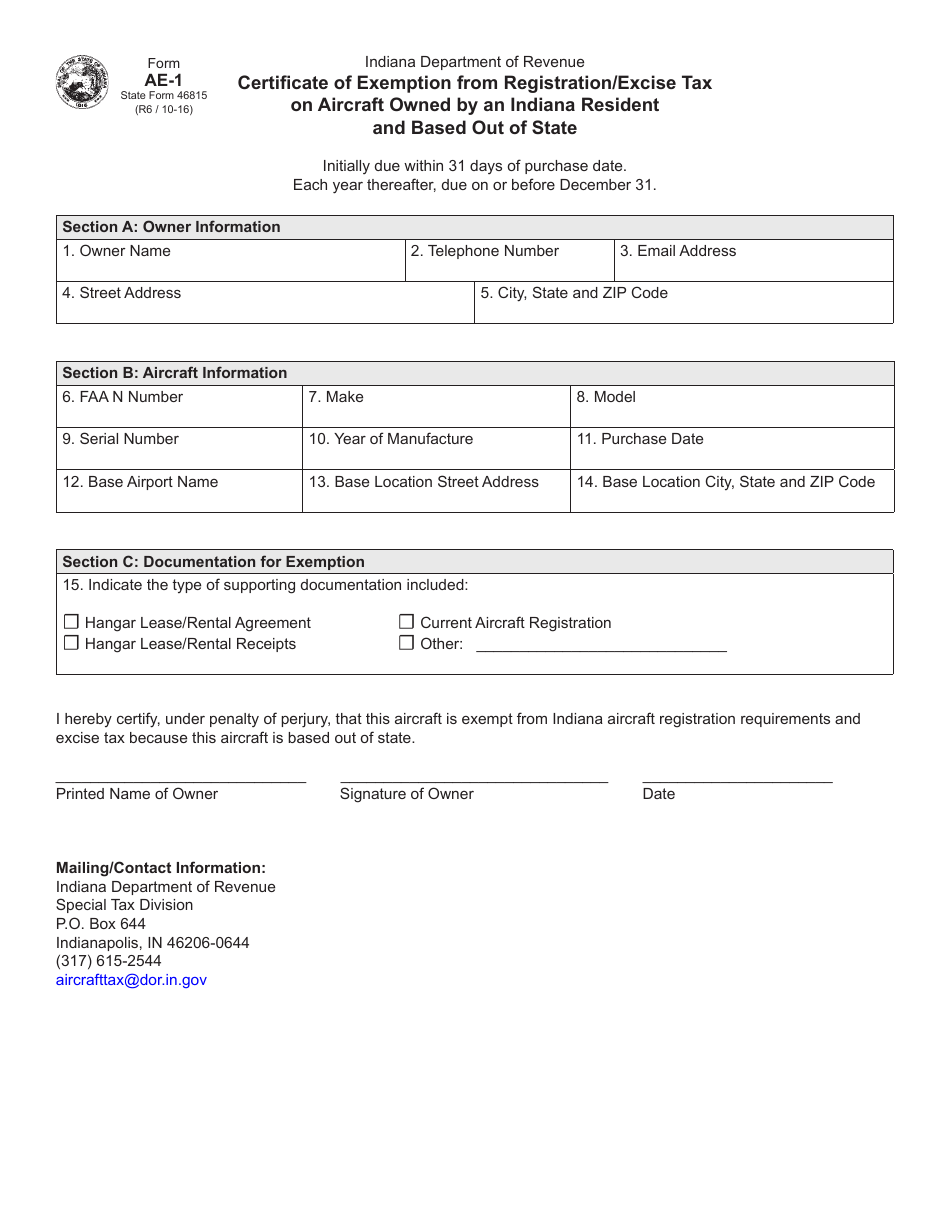

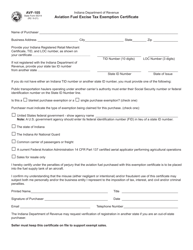

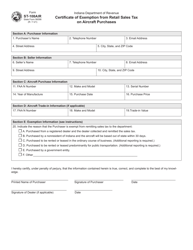

This version of the form is not currently in use and is provided for reference only. Download this version of

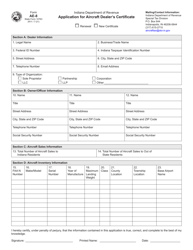

Form AE-1 (State Form 46815)

for the current year.

Form AE-1 (State Form 46815) Certificate of Exemption From Registration / Excise Tax on Aircraft Owned by an Indiana Resident and Based out of State - Indiana

What Is Form AE-1 (State Form 46815)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AE-1?

A: Form AE-1 is the Certificate of Exemption From Registration/Excise Tax on Aircraft Owned by an Indiana Resident and Based out of State in Indiana.

Q: Who is eligible to use Form AE-1?

A: Indiana residents who own an aircraft and base it out of state are eligible to use Form AE-1.

Q: What is the purpose of Form AE-1?

A: The purpose of Form AE-1 is to claim exemptions from registration and excise taxes on aircraft owned by Indiana residents that are not based in Indiana.

Q: Do I need to pay any fees for filing Form AE-1?

A: There are no filing fees associated with Form AE-1.

Q: Are there any deadlines for filing Form AE-1?

A: There are no specific deadlines for filing Form AE-1, but it is recommended to submit the form as soon as possible after acquiring the aircraft.

Q: What are the consequences of not filing Form AE-1?

A: Failure to file Form AE-1 may result in the assessment of registration and excise taxes on the aircraft.

Q: Can I use Form AE-1 for an aircraft that is based in Indiana?

A: No, Form AE-1 is specifically for aircraft owned by Indiana residents that are based out of state.

Q: Is Form AE-1 applicable to all types of aircraft?

A: Yes, Form AE-1 is applicable to all types of aircraft owned by Indiana residents and based out of state.

Form Details:

- Released on October 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AE-1 (State Form 46815) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.