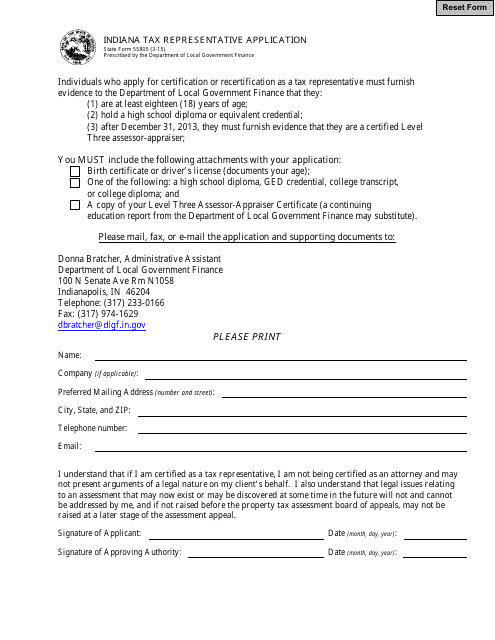

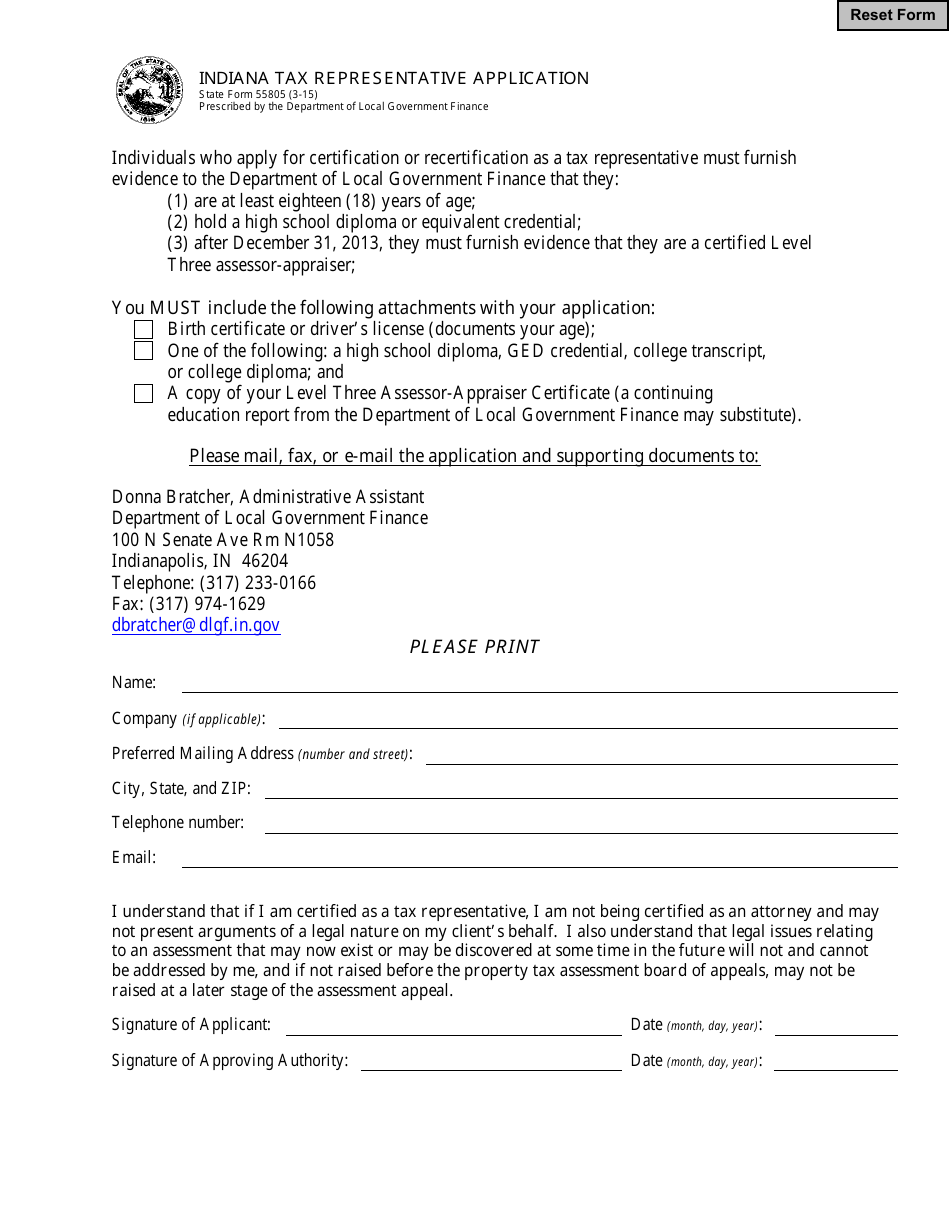

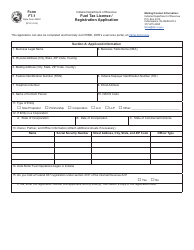

State Form 55805 Indiana Tax Representative Application - Indiana

What Is State Form 55805?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55805?

A: Form 55805 is the Indiana Tax Representative Application.

Q: What is the purpose of Form 55805?

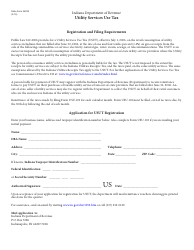

A: The purpose of Form 55805 is to apply to become a tax representative in Indiana.

Q: Who can use Form 55805?

A: Tax professionals who want to represent taxpayers in Indiana can use Form 55805.

Q: Are there any fees associated with filing Form 55805?

A: No, there are no fees associated with filing Form 55805.

Q: What information is required on Form 55805?

A: Form 55805 requires information about the tax professional and their qualifications, as well as contact details.

Q: How long does it take to process Form 55805?

A: The processing time for Form 55805 can vary, but it typically takes a few weeks to process.

Q: Can I check the status of my Form 55805 application?

A: Yes, you can check the status of your Form 55805 application by contacting the Indiana Department of Revenue.

Q: What should I do if there are changes to my information after filing Form 55805?

A: If there are changes to your information after filing Form 55805, you should notify the Indiana Department of Revenue.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55805 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.