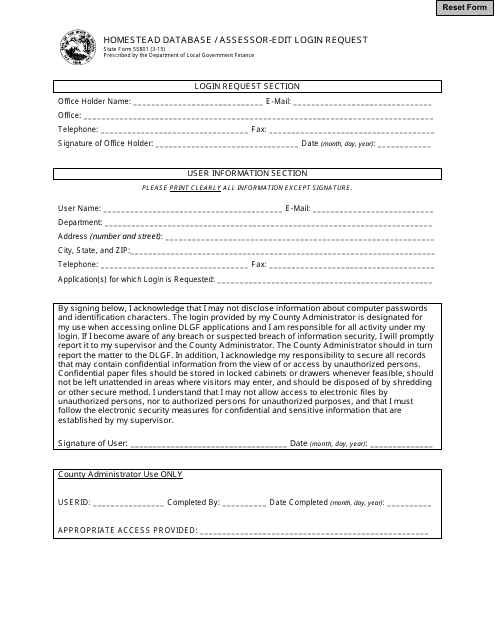

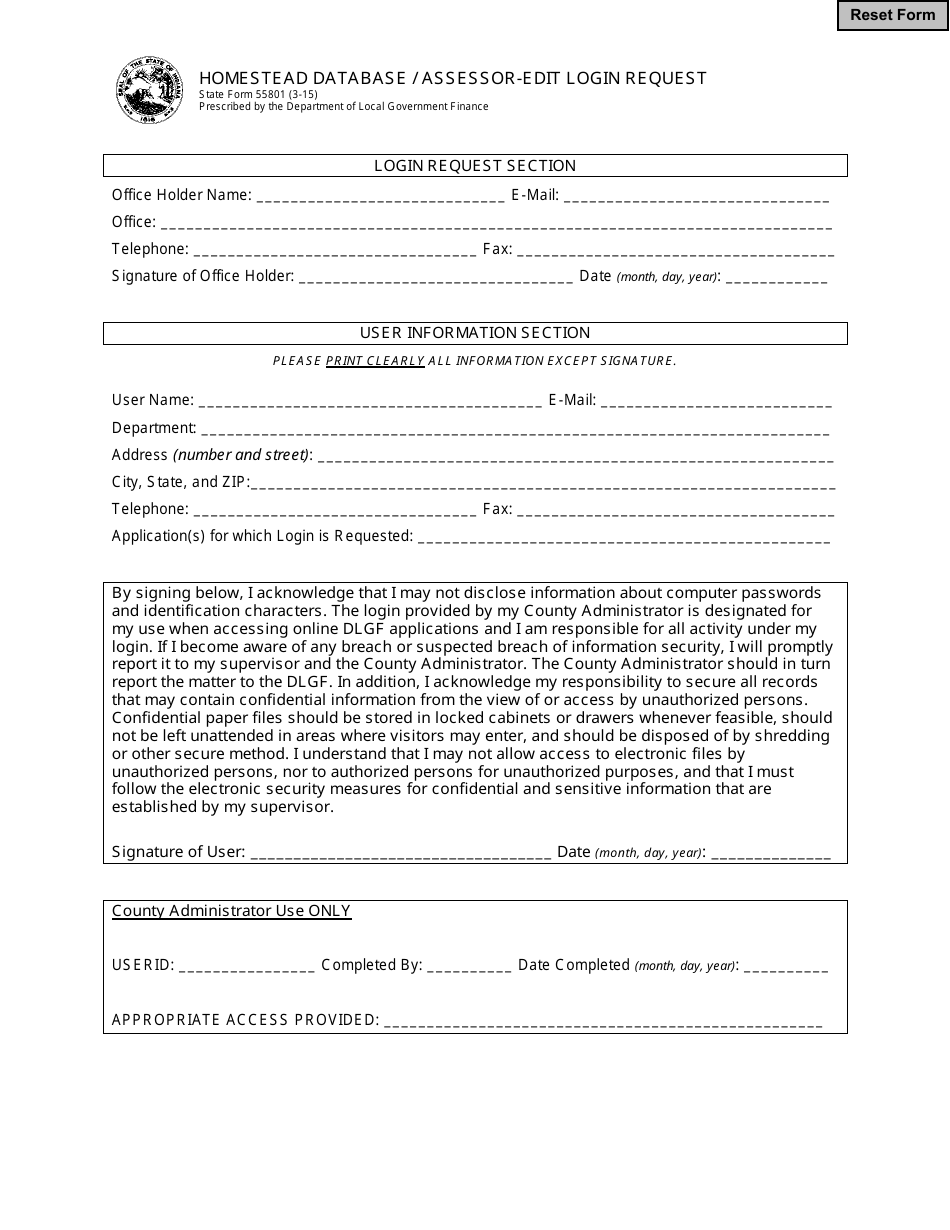

State Form 55801 Homestead Database / Assessor-Edit Login Request - Indiana

What Is State Form 55801?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 55801 Homestead Database?

A: Form 55801 is a document used in Indiana to apply for homestead exemption, which reduces property taxes for homeowners.

Q: What is the Homestead Database in Indiana?

A: The Homestead Database is a state-run system that collects and maintains information about homeowners who have applied for and received homestead exemptions.

Q: How do I request an Assessor-Edit Login for the Homestead Database in Indiana?

A: To request an Assessor-Edit Login for the Homestead Database, you will need to contact the appropriate authority in your local county assessor's office in Indiana.

Q: Who can use the Assessor-Edit Login for the Homestead Database in Indiana?

A: The Assessor-Edit Login is typically used by county assessor office staff to access and update information in the Homestead Database.

Q: What information can I edit with the Assessor-Edit Login for the Homestead Database in Indiana?

A: With the Assessor-Edit Login, you can edit information related to homestead exemptions, such as homeowner name, address, and eligibility status.

Q: Do I need to fill out form 55801 Homestead Database every year?

A: No, you generally do not need to fill out form 55801 every year. Once you have been approved for a homestead exemption, it usually remains in effect until there is a change in your eligibility status or property ownership.

Q: How does the Homestead Database affect my property taxes in Indiana?

A: The Homestead Database helps determine your eligibility for a homestead exemption, which can reduce the assessed value of your home and lower your property taxes.

Q: Are there any eligibility requirements for the homestead exemption in Indiana?

A: Yes, there are certain eligibility requirements for the homestead exemption in Indiana. These may include residency, property ownership, and primary residence criteria.

Q: How long does it take to process a homestead exemption application in Indiana?

A: The processing time for a homestead exemption application in Indiana can vary by county. It is best to contact your local county assessor's office for specific information on processing times.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55801 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.