This version of the form is not currently in use and is provided for reference only. Download this version of

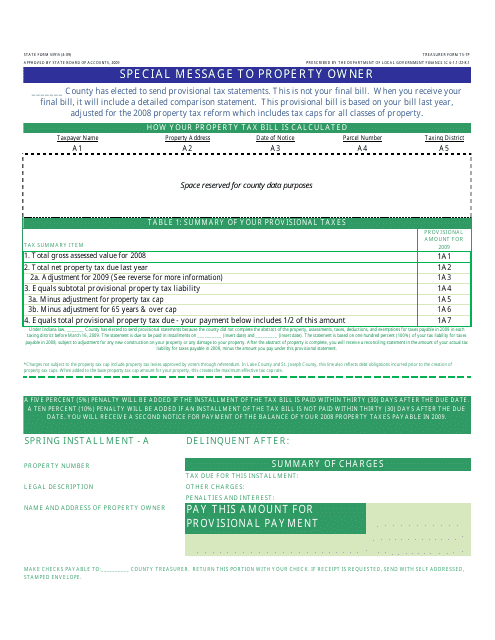

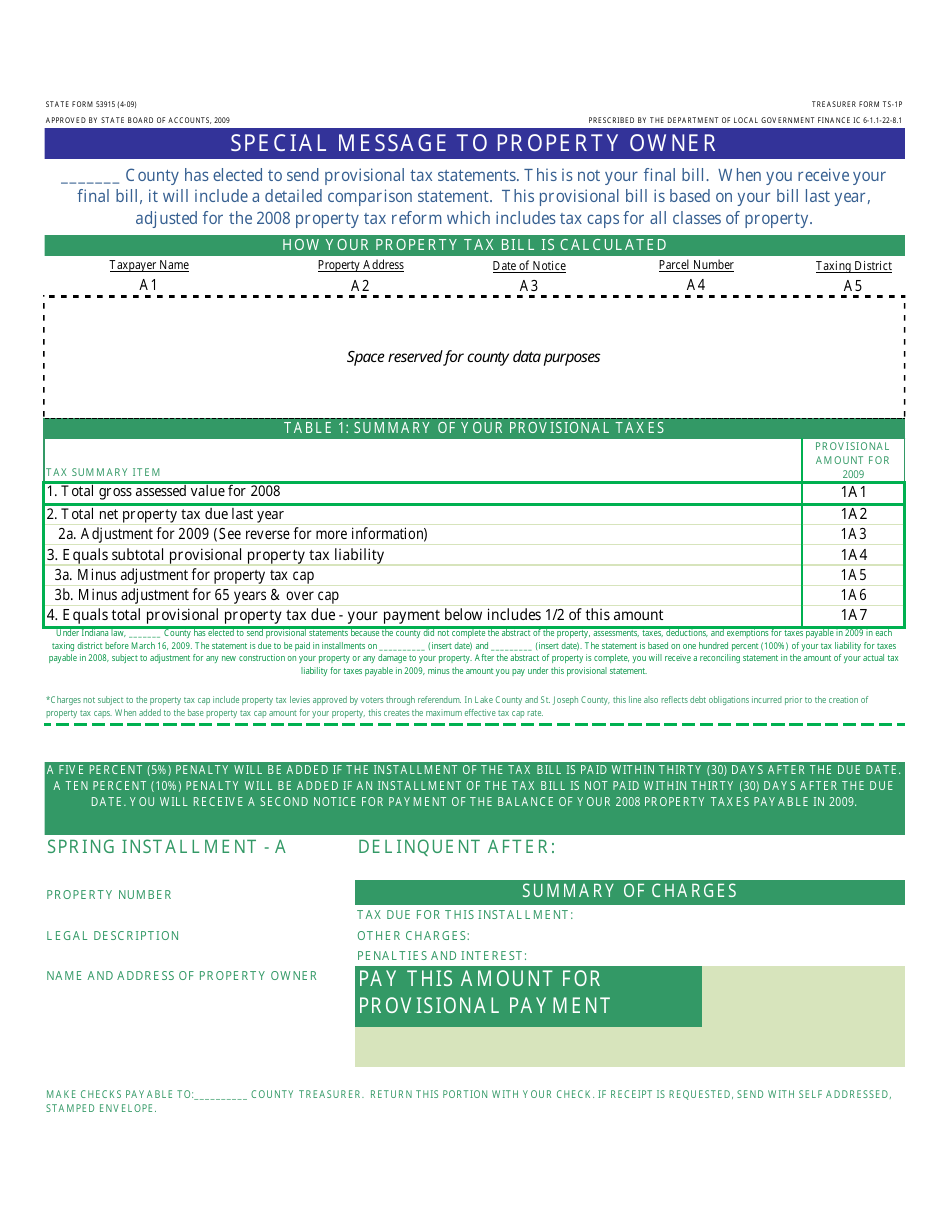

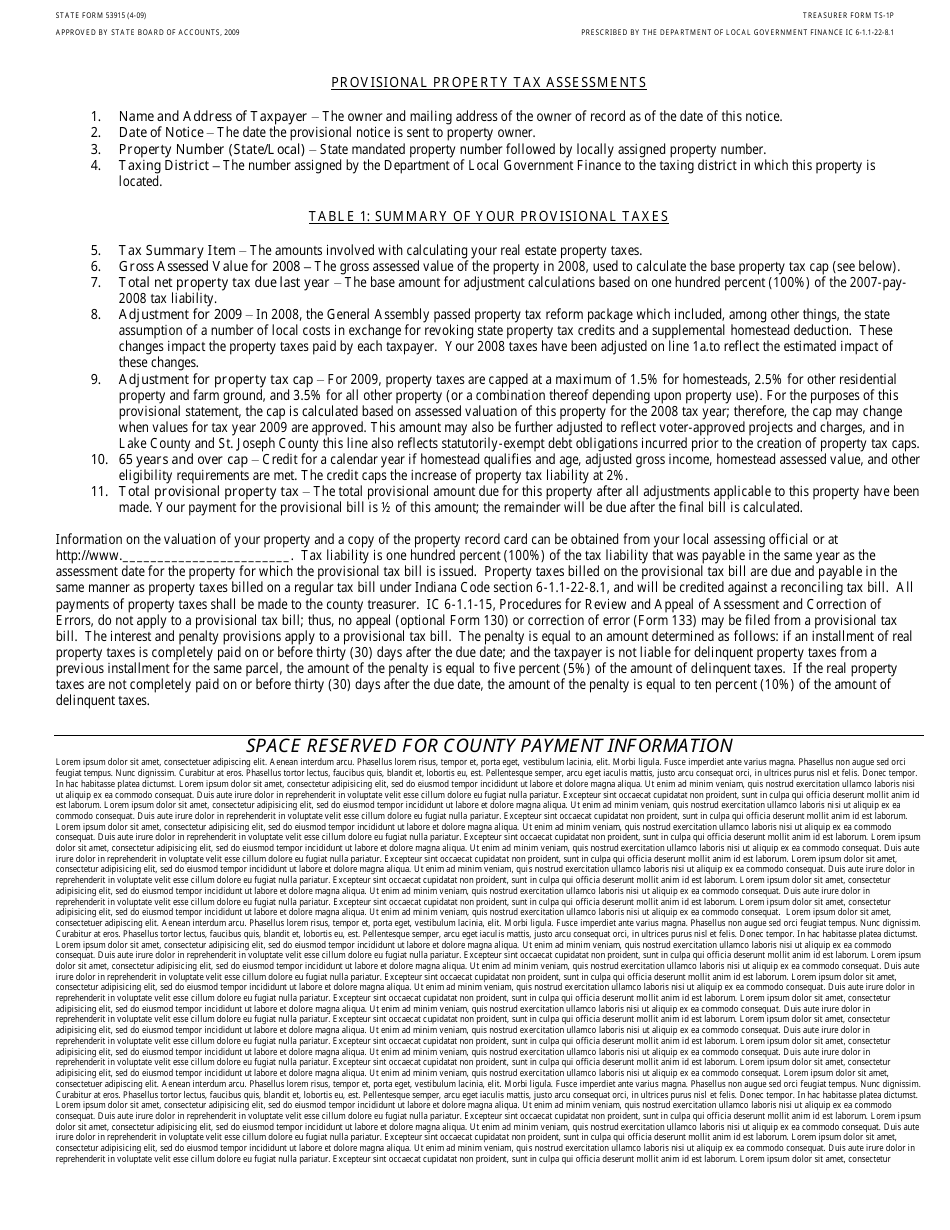

Form TS-1P (State Form 53915)

for the current year.

Form TS-1P (State Form 53915) Tax Statement - Indiana

What Is Form TS-1P (State Form 53915)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TS-1P?

A: Form TS-1P is the Tax Statement for Indiana.

Q: Who needs to file Form TS-1P?

A: Individuals who are residents of Indiana and have income from sources within Indiana need to file Form TS-1P.

Q: What information is included in Form TS-1P?

A: Form TS-1P includes information about your income, deductions, and credits for the tax year.

Q: When is the deadline to file Form TS-1P?

A: The deadline to file Form TS-1P is usually April 15th of each year.

Q: Are there any penalties for late filing of Form TS-1P?

A: Yes, there may be penalties for late filing of Form TS-1P. It is advised to file your taxes on time to avoid any penalties.

Q: How do I submit Form TS-1P?

A: Form TS-1P can be submitted electronically or by mail, depending on your preference.

Q: Can I file Form TS-1P jointly with my spouse?

A: Yes, you can file Form TS-1P jointly with your spouse if you are married.

Q: Do I need to include any supporting documents with Form TS-1P?

A: Yes, you may need to include supporting documents such as W-2 forms and receipts for deductions.

Q: How long should I keep a copy of Form TS-1P?

A: It is recommended to keep a copy of Form TS-1P and any supporting documents for at least 3 years.

Form Details:

- Released on April 1, 2009;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form TS-1P (State Form 53915) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.