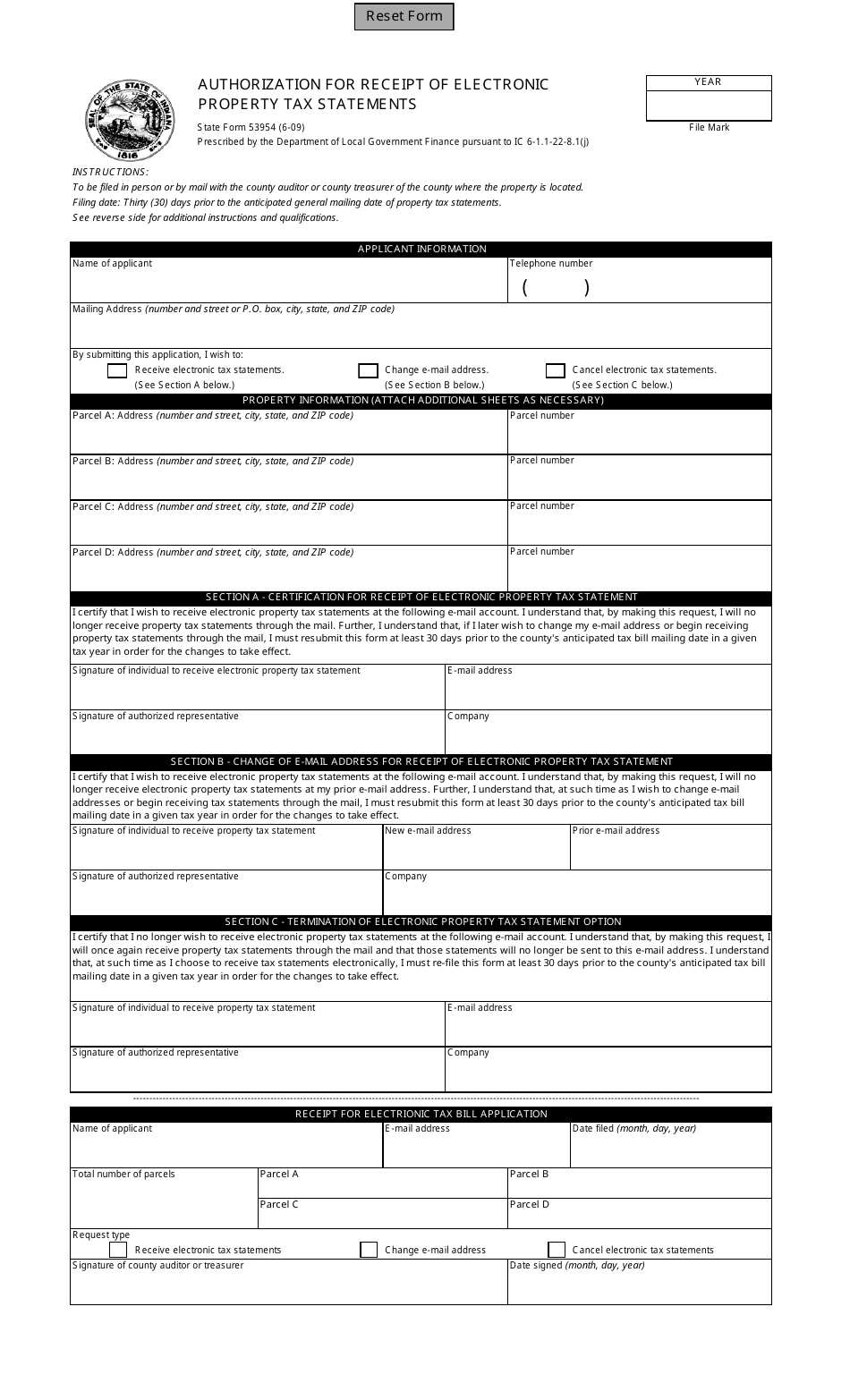

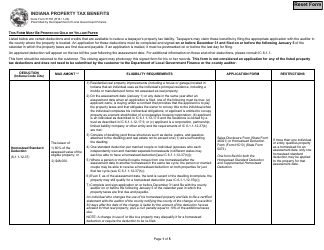

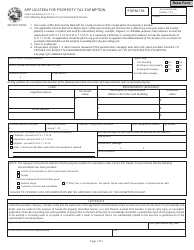

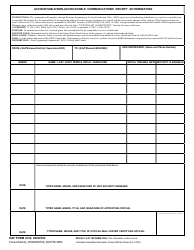

State Form 53954 Authorization for Receipt of Electronic Property Tax Statements - Indiana

What Is State Form 53954?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 53954?

A: State Form 53954 is the Authorization for Receipt of Electronic Property Tax Statements form in Indiana.

Q: What does State Form 53954 authorize?

A: State Form 53954 authorizes the receipt of electronic property tax statements in Indiana.

Q: Can I receive electronic property tax statements in Indiana?

A: Yes, by completing State Form 53954 and submitting it to the appropriate authorities.

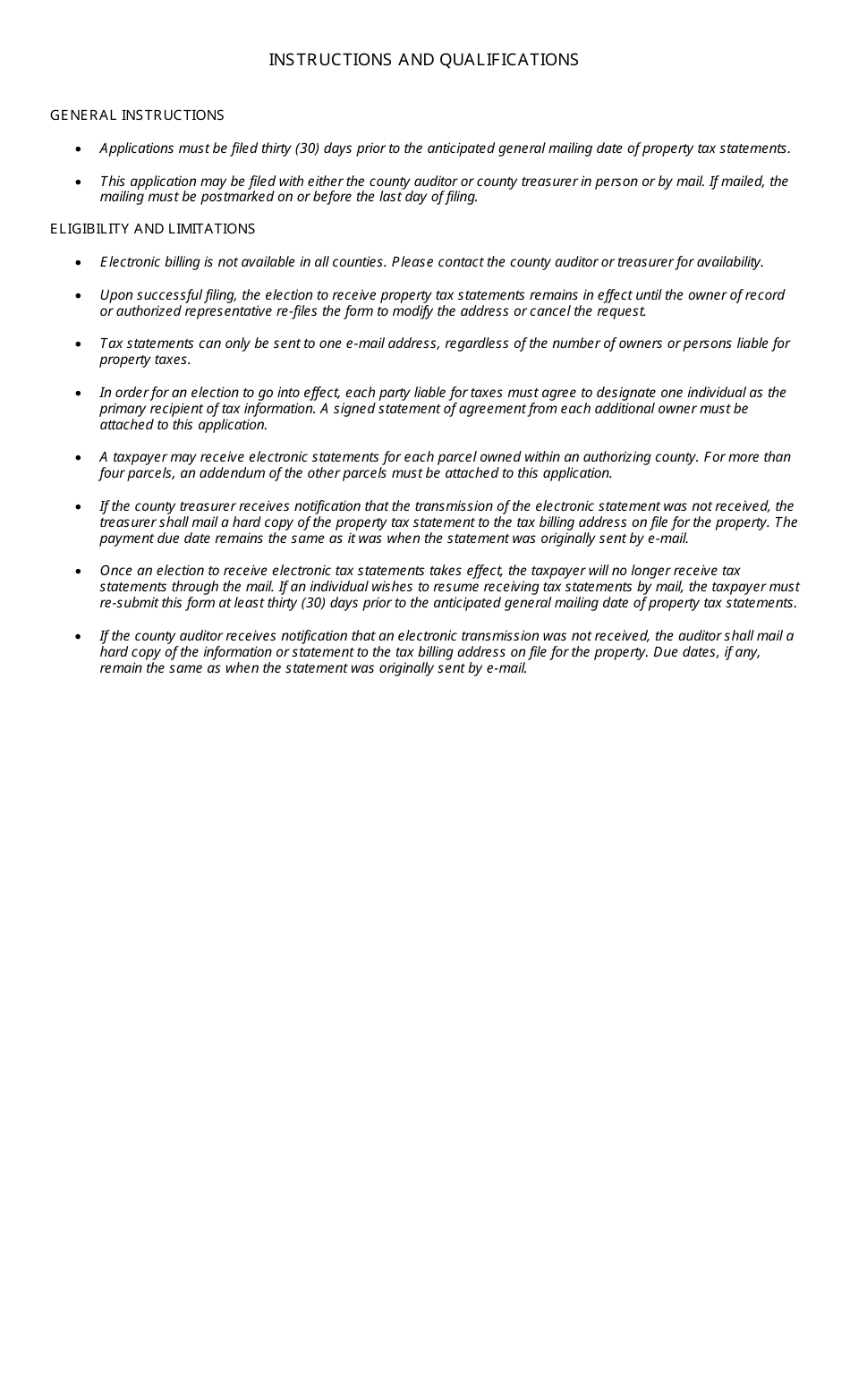

Q: Is there a deadline for submitting State Form 53954?

A: The deadline for submitting State Form 53954 varies and is typically mentioned in the instructions for the form.

Q: Can I opt out of receiving electronic property tax statements after submitting State Form 53954?

A: Yes, you can opt out of receiving electronic property tax statements by submitting a written request to the appropriate authorities.

Form Details:

- Released on June 1, 2009;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53954 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.