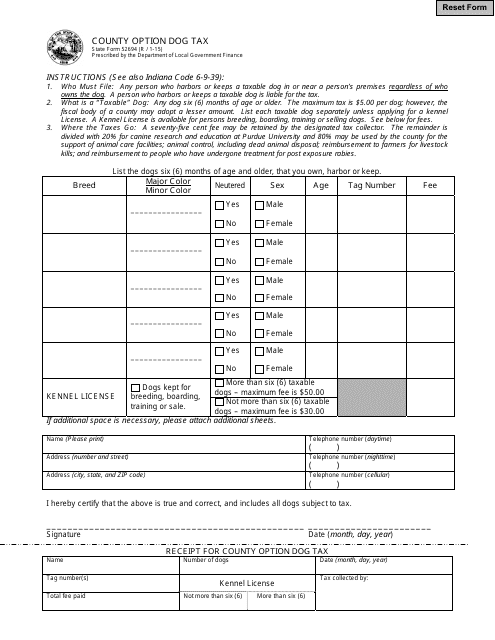

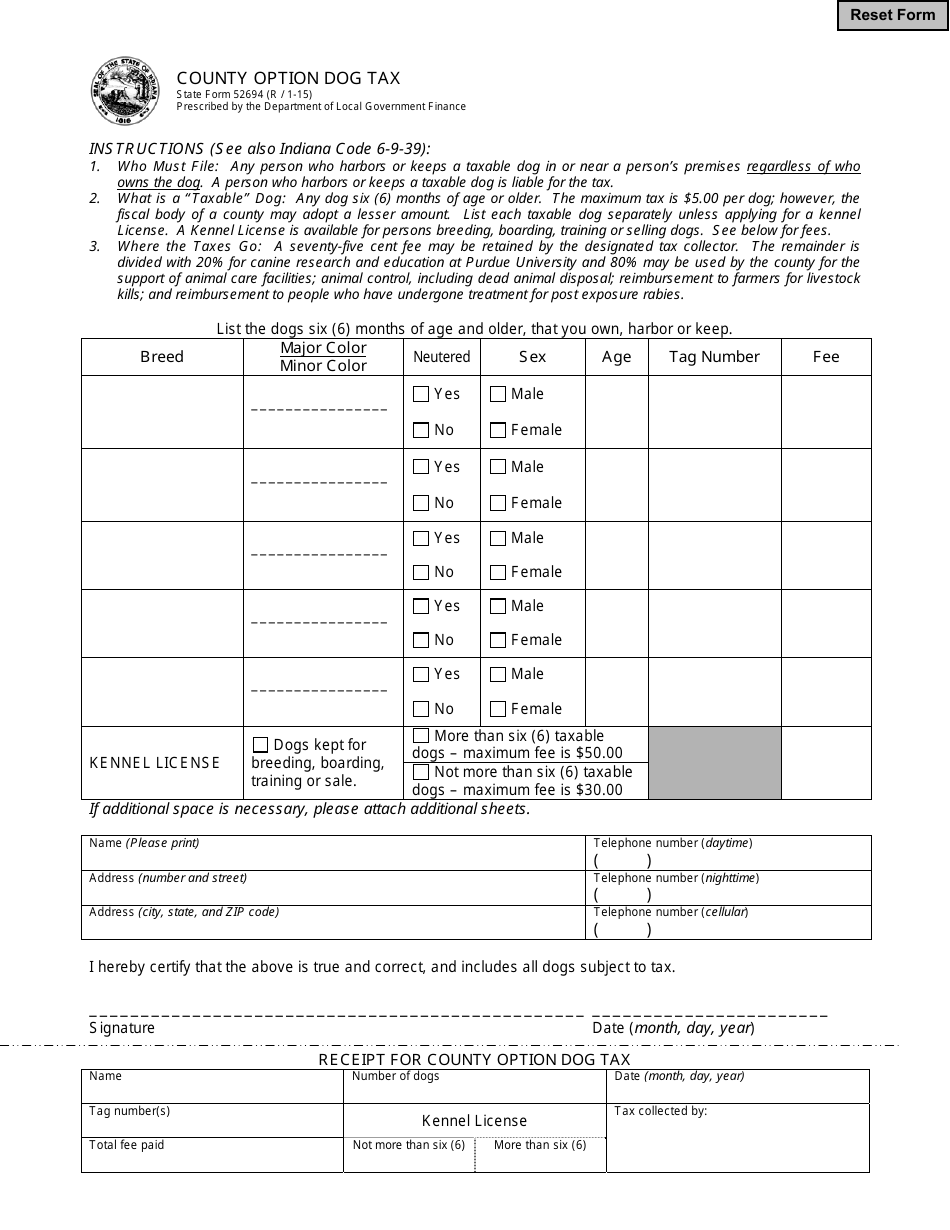

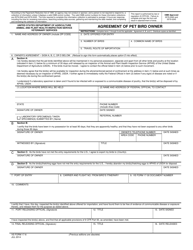

State Form 52694 County Option Dog Tax - Indiana

What Is State Form 52694?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 52694?

A: Form 52694 is a county option dog tax form in Indiana.

Q: What is the purpose of Form 52694?

A: The purpose of Form 52694 is to report and pay the county option dog tax.

Q: Who needs to file Form 52694?

A: Any dog owner in counties where the county option dog tax is applicable needs to file Form 52694.

Q: What is the county option dog tax?

A: The county option dog tax is a tax imposed on dog owners in certain counties in Indiana.

Q: How often does Form 52694 need to be filed?

A: Form 52694 needs to be filed annually.

Q: What information is needed to complete Form 52694?

A: You will need to provide information about your dog(s), including breed, age, and registration number.

Q: What happens if I don't file Form 52694?

A: Failure to file Form 52694 may result in penalties, including fines and legal action.

Q: Can I get a refund for the county option dog tax?

A: Refunds for the county option dog tax are generally not available, but you should check with your local county government office for specific rules and exceptions.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52694 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.