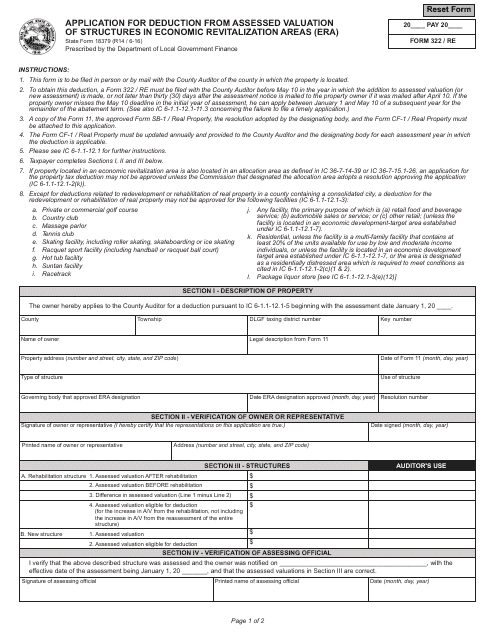

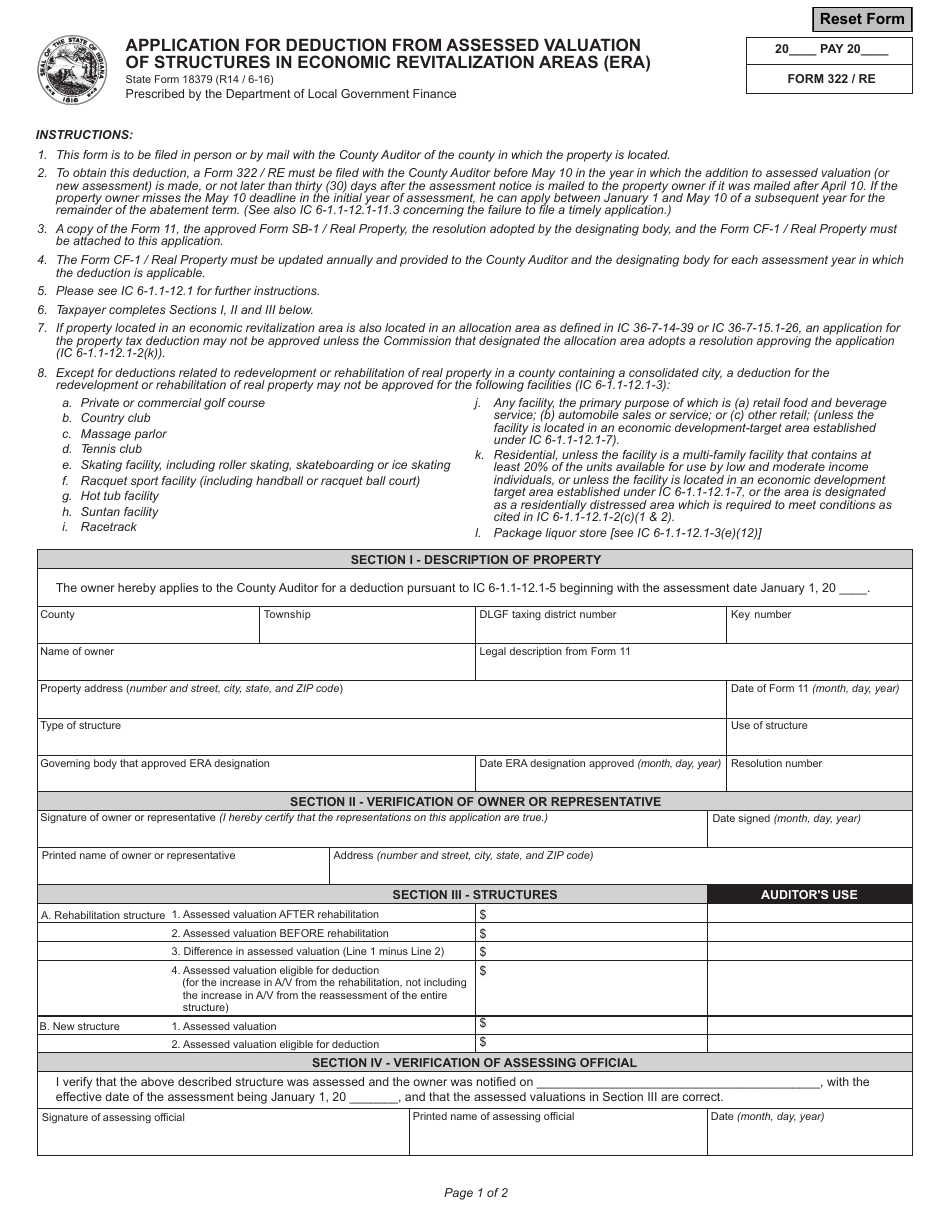

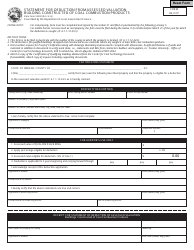

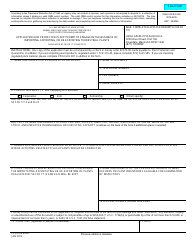

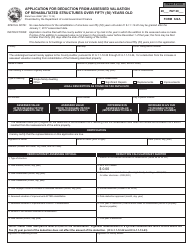

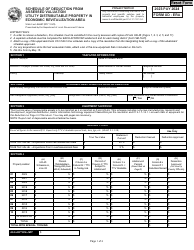

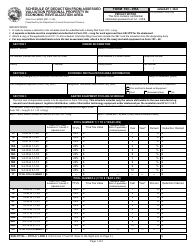

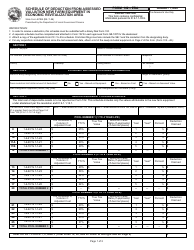

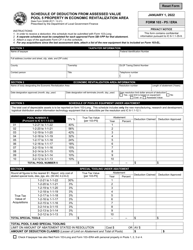

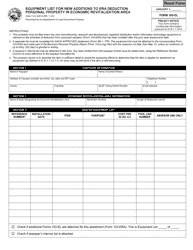

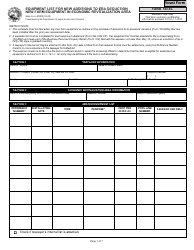

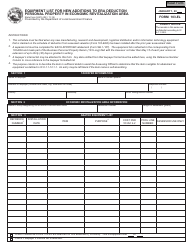

Form 322 / RE (State Form 18379) Application for Deduction From Assessed Valuation of Structures in Economic Revitalization Areas (Era) - Indiana

What Is Form 322/RE (State Form 18379)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 322/RE?

A: Form 322/RE is the Application for Deduction From Assessed Valuation of Structures in Economic Revitalization Areas (ERA) in Indiana.

Q: What is the purpose of Form 322/RE?

A: The purpose of Form 322/RE is to apply for a deduction from the assessed valuation of structures located in economic revitalization areas in Indiana.

Q: Who is eligible to apply for this deduction?

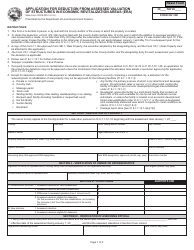

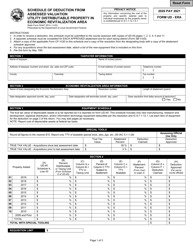

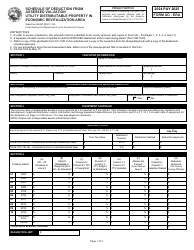

A: Property owners or tenants who have a qualifying structure in an economic revitalization area in Indiana are eligible to apply for this deduction.

Q: What are economic revitalization areas?

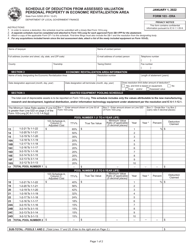

A: Economic revitalization areas are designated areas where economic development is encouraged through tax incentives and other benefits.

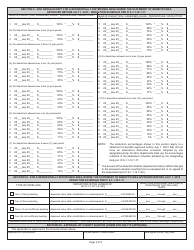

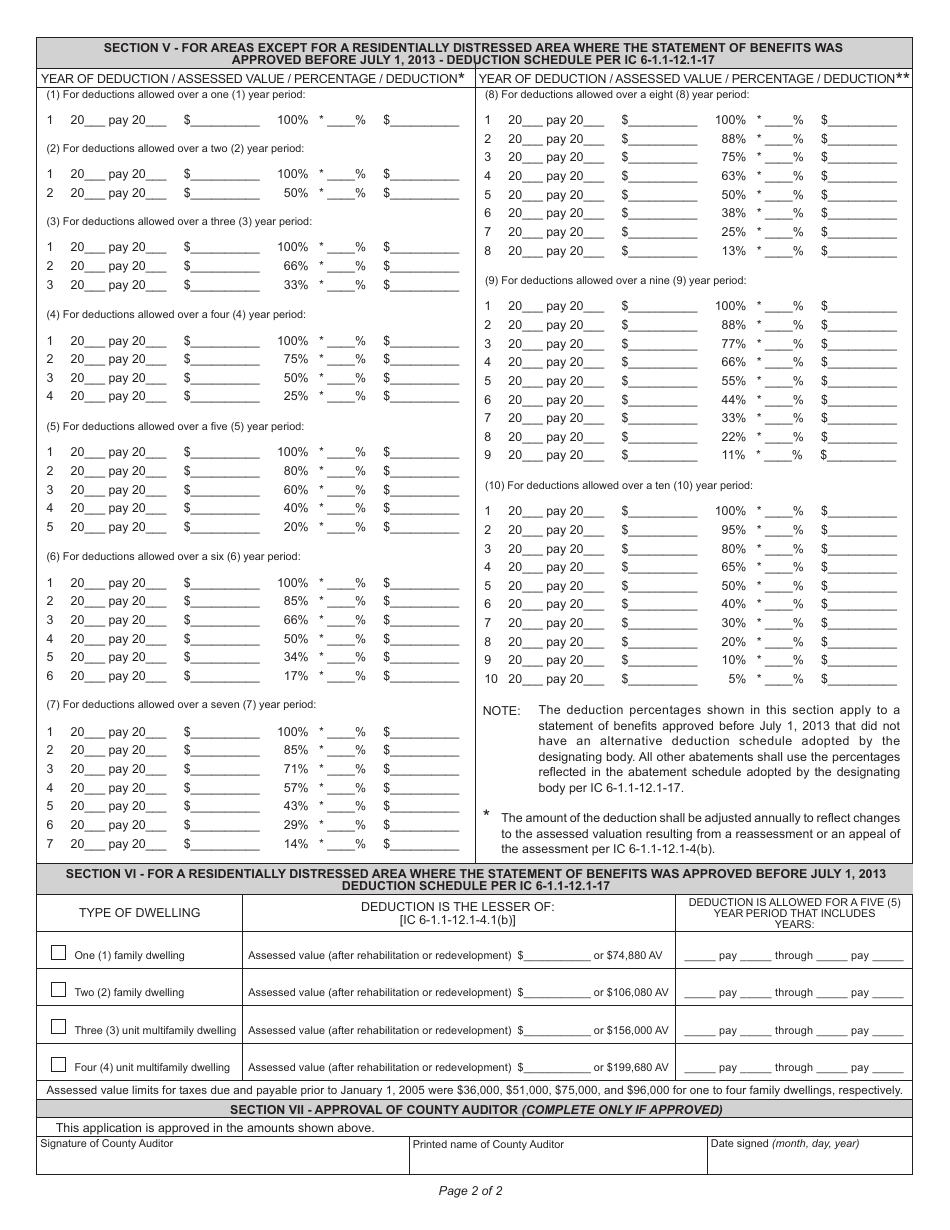

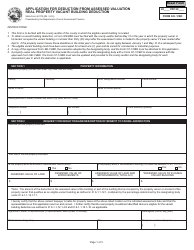

Q: What is the deduction amount for qualifying structures?

A: The deduction amount for qualifying structures is up to 100% of the assessed valuation in the first year, gradually decreasing over a period of 10 years.

Q: Are there any additional requirements or conditions?

A: Yes, there are additional requirements and conditions that must be met, such as compliance with local ordinances and agreements with the appropriate redevelopment commission.

Q: Is there a deadline for submitting the application?

A: Yes, the application must be submitted on or before May 10th of the assessment year.

Q: Can the deduction be transferred to a new owner?

A: Yes, the deduction can be transferred to a new owner if the property is sold or transferred.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 322/RE (State Form 18379) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.