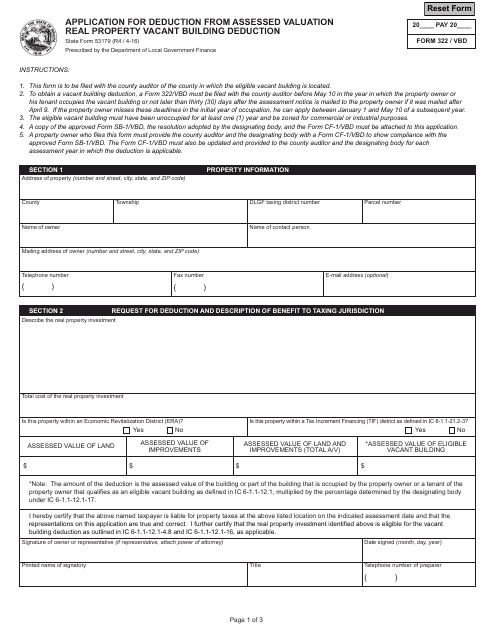

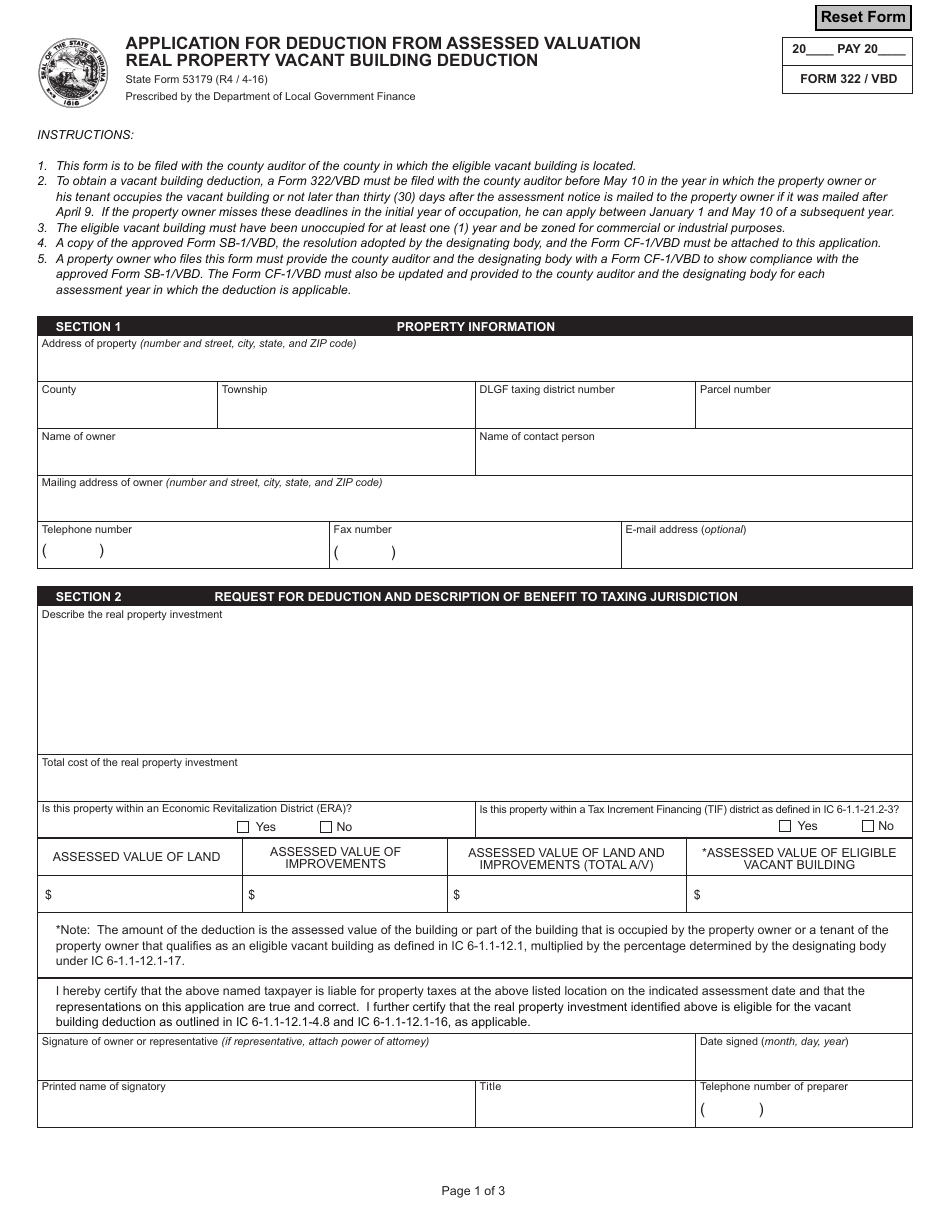

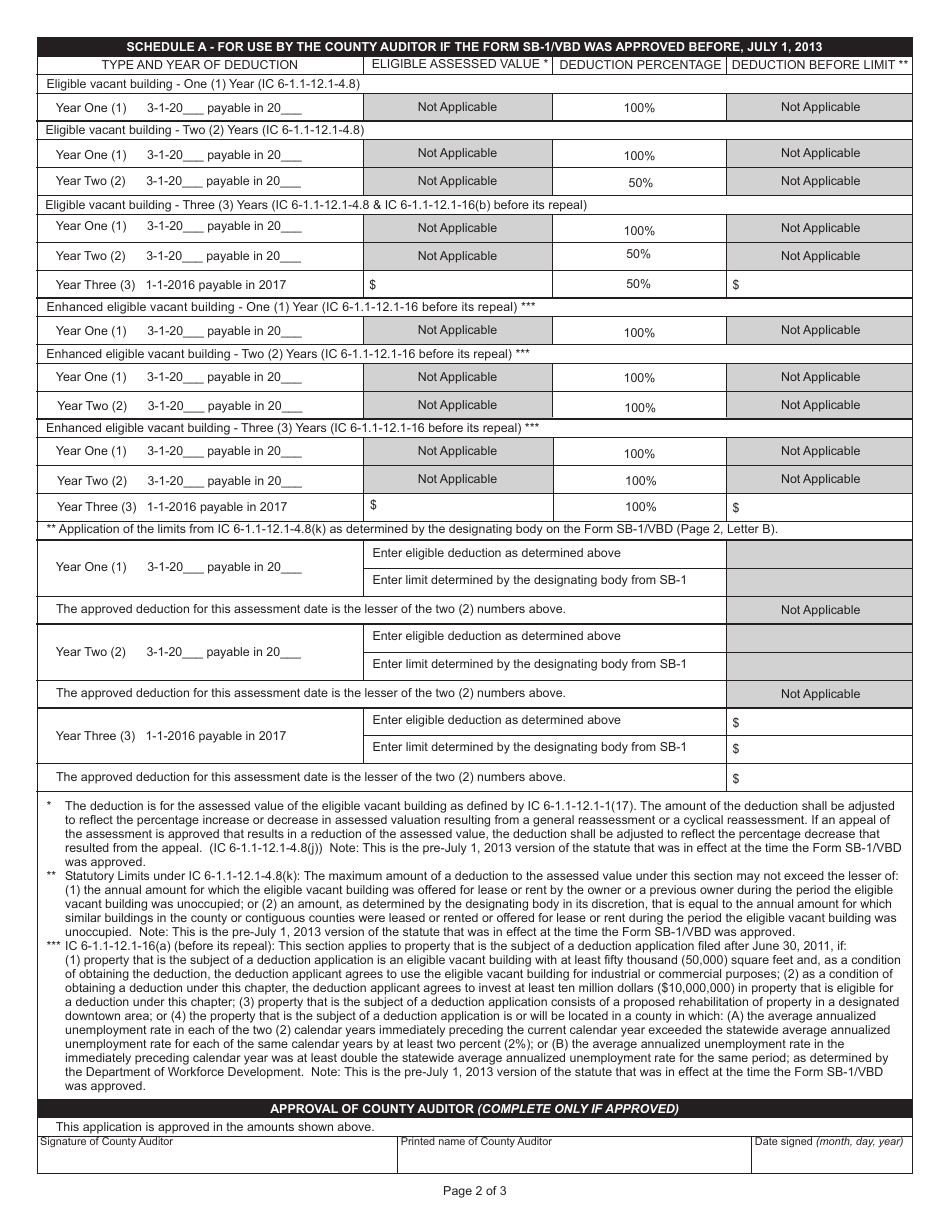

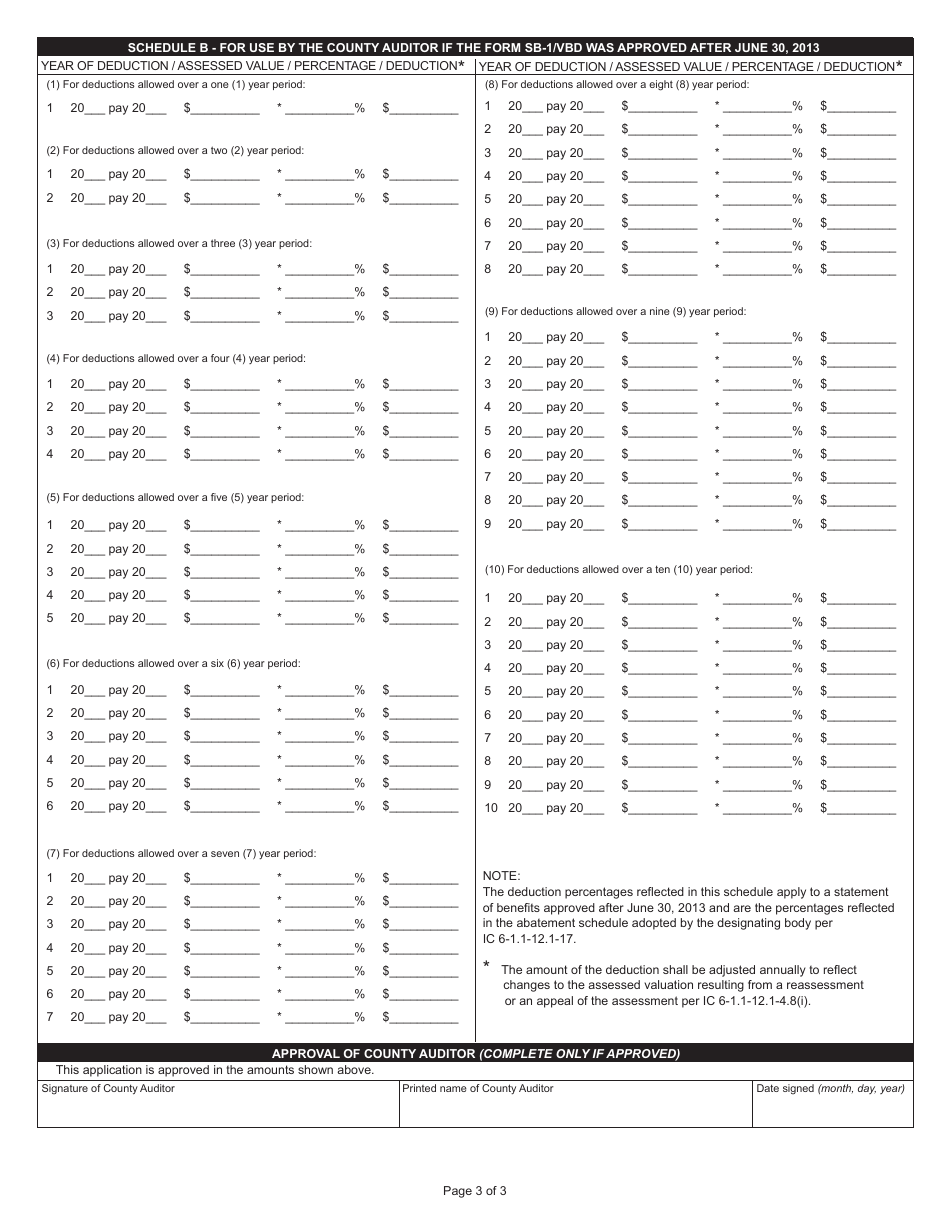

Form 322 / VBD (State Form 53179) Application for Deduction From Assessed Valuation - Real Property Vacant Building Deduction - Indiana

What Is Form 322/VBD (State Form 53179)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 322/VBD?

A: Form 322/VBD is an application form used in Indiana for the Vacant Building Deduction on real property.

Q: What is the purpose of Form 322/VBD?

A: The purpose of Form 322/VBD is to apply for a deduction from the assessed valuation of a vacant building in Indiana.

Q: Who should use Form 322/VBD?

A: Form 322/VBD should be used by property owners in Indiana who have a vacant building and want to apply for a deduction from their assessed valuation.

Q: What information is required on Form 322/VBD?

A: Form 322/VBD requires information such as the owner's name and contact information, the property address and description, and details about the vacancy and plans for reoccupation.

Q: When should Form 322/VBD be filed?

A: Form 322/VBD should be filed annually with the local assessor's office by May 10th of each year.

Q: What is the deadline for submitting Form 322/VBD?

A: The deadline for submitting Form 322/VBD is May 10th of each year in Indiana.

Q: Is there a fee for filing Form 322/VBD?

A: There is typically no fee for filing Form 322/VBD, but it is recommended to check with your local assessor's office to confirm.

Q: What is the benefit of the Vacant Building Deduction?

A: The Vacant Building Deduction can reduce the assessed valuation of a vacant building, resulting in potential savings on property taxes.

Q: Are there any eligibility requirements for the Vacant Building Deduction?

A: Yes, there are eligibility requirements for the Vacant Building Deduction, including a minimum vacancy period and compliance with local ordinances.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 322/VBD (State Form 53179) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.