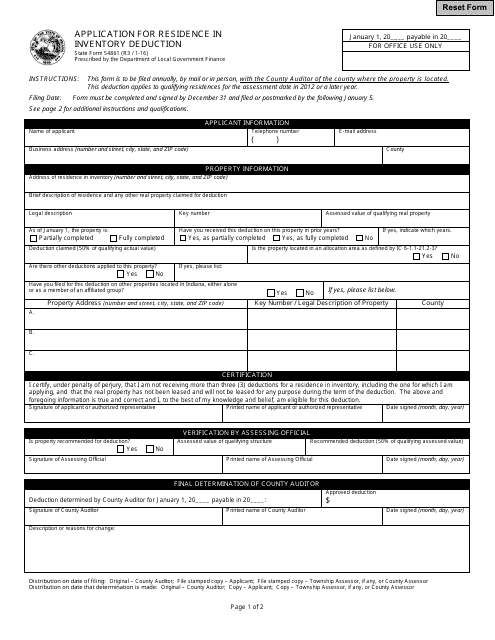

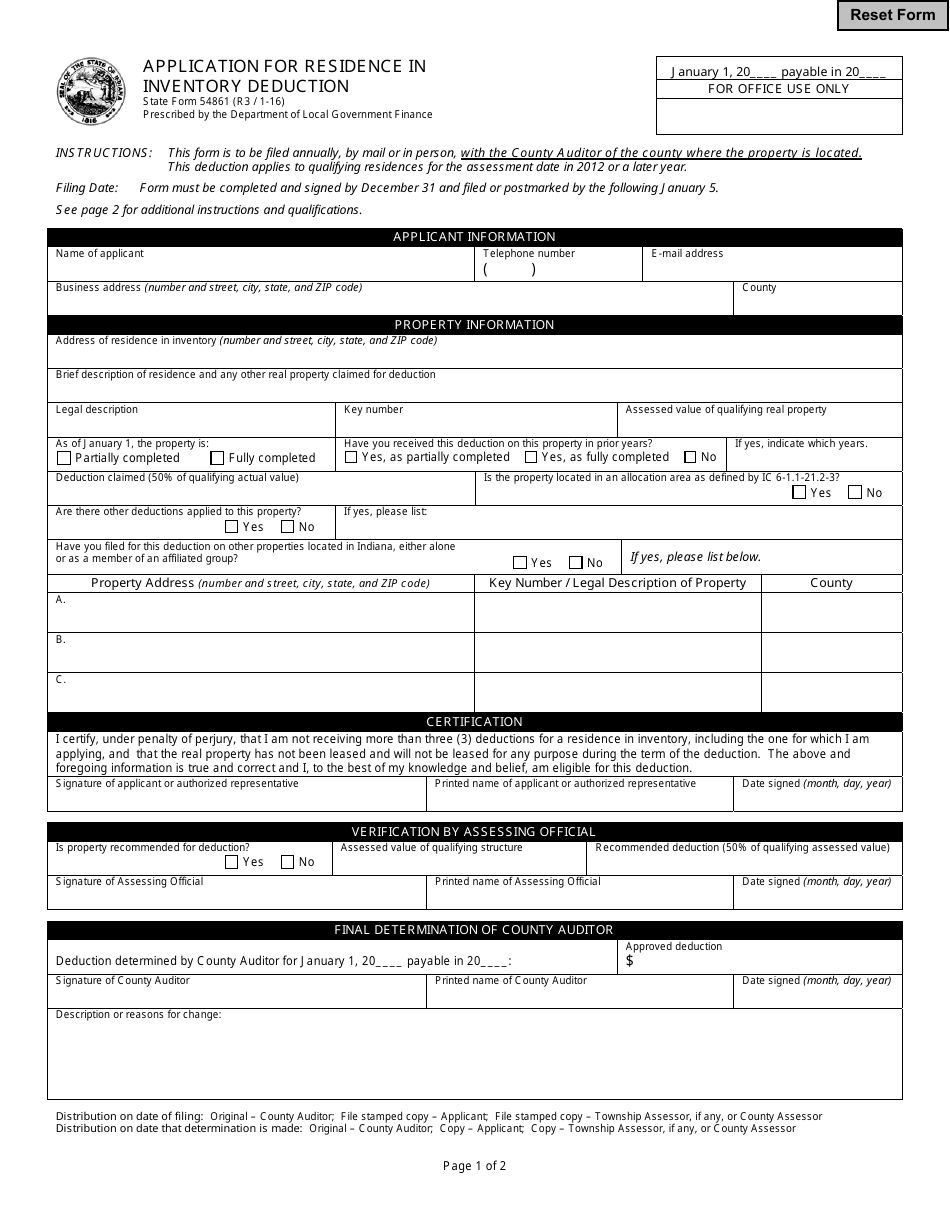

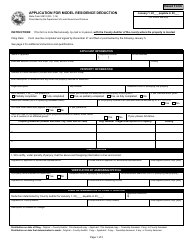

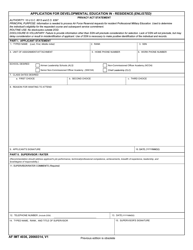

State Form 54861 Application for Residence in Inventory Deduction - Indiana

What Is State Form 54861?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 54861?

A: State Form 54861 is the Application for Residence in Inventory Deduction in Indiana.

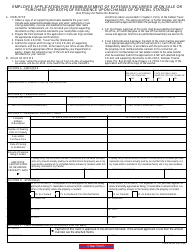

Q: Why do I need to fill out State Form 54861?

A: You need to fill out State Form 54861 if you want to apply for the Residence in Inventory Deduction in Indiana.

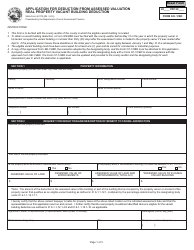

Q: What is the Residence in Inventory Deduction?

A: The Residence in Inventory Deduction is a tax benefit in Indiana that allows eligible residents to reduce the assessed value of their inventory held for sale or lease at a particular location.

Q: Who is eligible for the Residence in Inventory Deduction?

A: To be eligible for the Residence in Inventory Deduction, you must meet certain criteria set by the Indiana Department of Revenue. These criteria may include residing at the location, having ownership or control of the inventory, and using the location for business purposes.

Q: Are there any filing fees for State Form 54861?

A: No, there are no filing fees for State Form 54861.

Q: Do I need to include any supporting documents with State Form 54861?

A: Depending on your specific circumstances, you may need to include supporting documents such as proof of residency, ownership, or use of the location. The instructions on the form will provide guidance on any required documentation.

Q: What happens after I submit State Form 54861?

A: After you submit State Form 54861, the Indiana Department of Revenue will review your application and determine your eligibility for the Residence in Inventory Deduction. They will notify you of their decision or any additional steps that may be required.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54861 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.