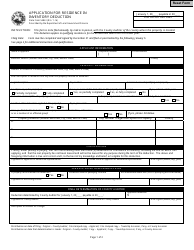

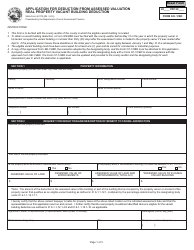

State Form 53812 Application for Model Residence Deduction - Indiana

What Is State Form 53812?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

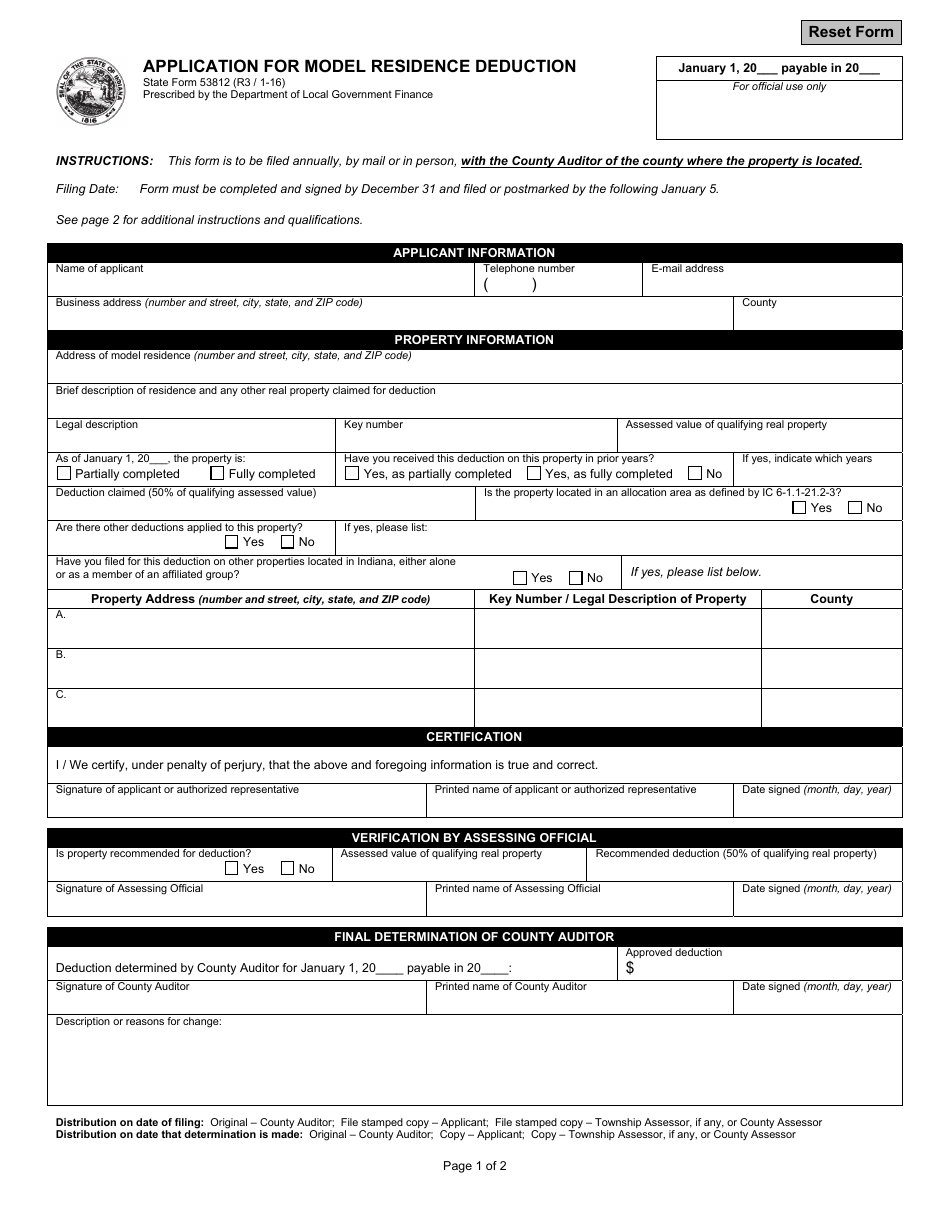

Q: What is Form 53812?

A: Form 53812 is the application for the Model Residence Deduction in Indiana.

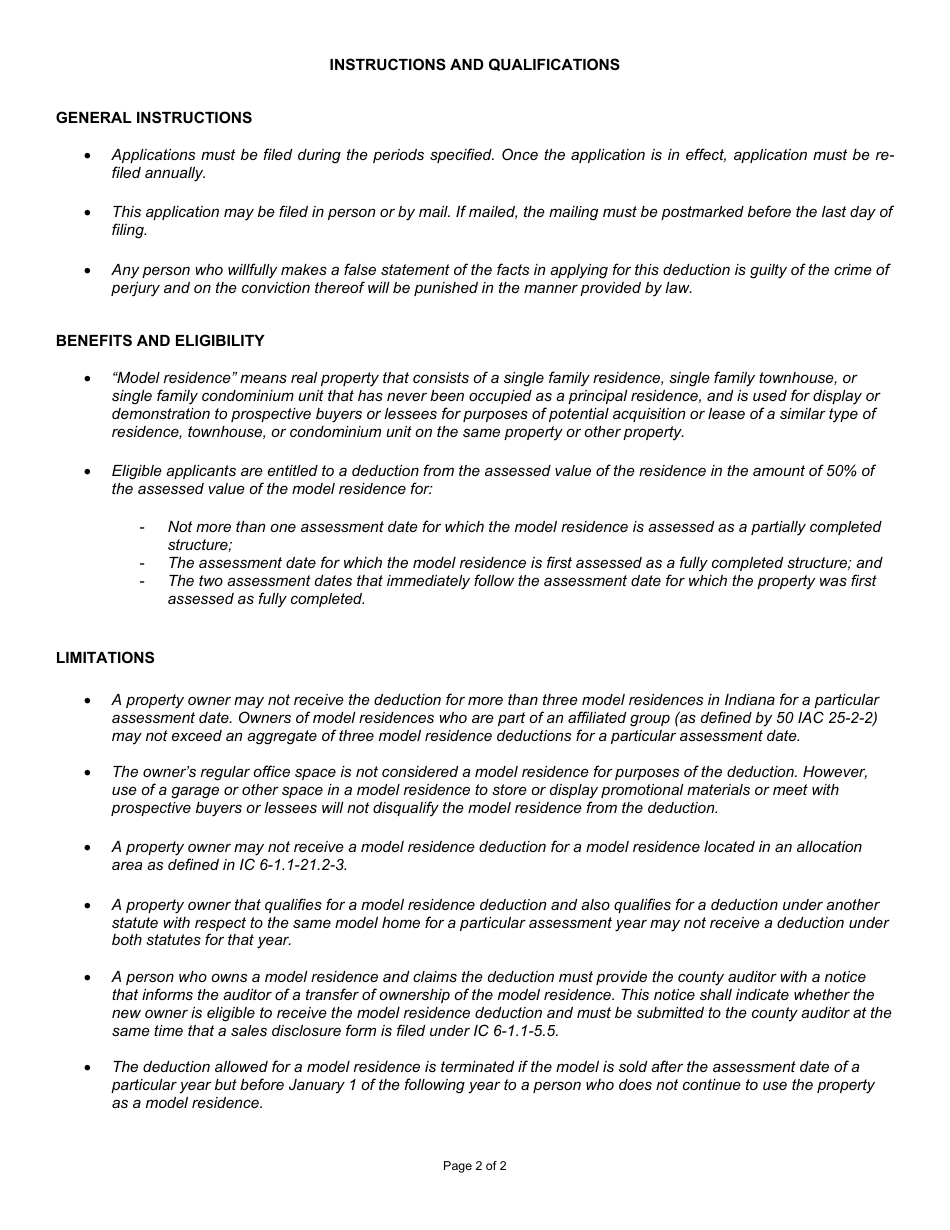

Q: What is the Model Residence Deduction?

A: The Model Residence Deduction in Indiana allows taxpayers to deduct a portion of the assessed value of their primary residence.

Q: Who is eligible for the Model Residence Deduction?

A: Homeowners in Indiana who use their residence as a model for displaying residential construction techniques and materials may be eligible for the deduction.

Q: How can I apply for the Model Residence Deduction?

A: You can apply for the Model Residence Deduction by completing and submitting Form 53812 to the relevant tax authority in Indiana.

Q: What documentation do I need to provide with my application?

A: You may need to provide documentation that demonstrates how your residence is used as a model, such as photographs or certificates.

Q: Is there a deadline for applying for the Model Residence Deduction?

A: The deadline for applying for the Model Residence Deduction may vary depending on the tax authority in Indiana. It is best to check with them for specific deadlines.

Q: What are the benefits of the Model Residence Deduction?

A: The Model Residence Deduction can potentially reduce the assessed value of your primary residence, which may lead to lower property taxes.

Q: Can I claim the Model Residence Deduction if I rent out part of my residence?

A: The Model Residence Deduction is typically only available to homeowners who use their primary residence as a model and not to those who rent out part of the property.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53812 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.