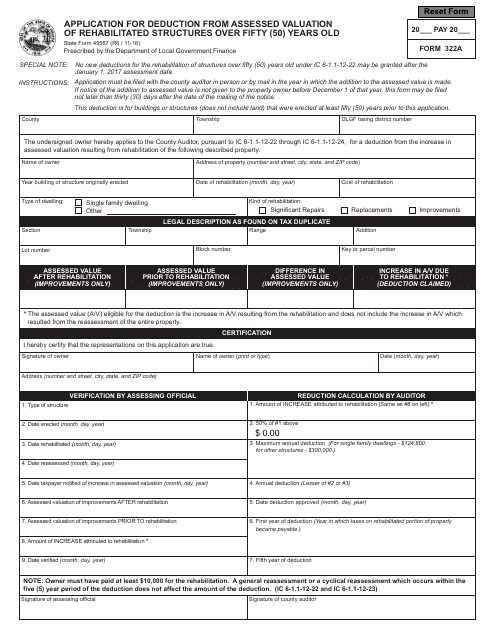

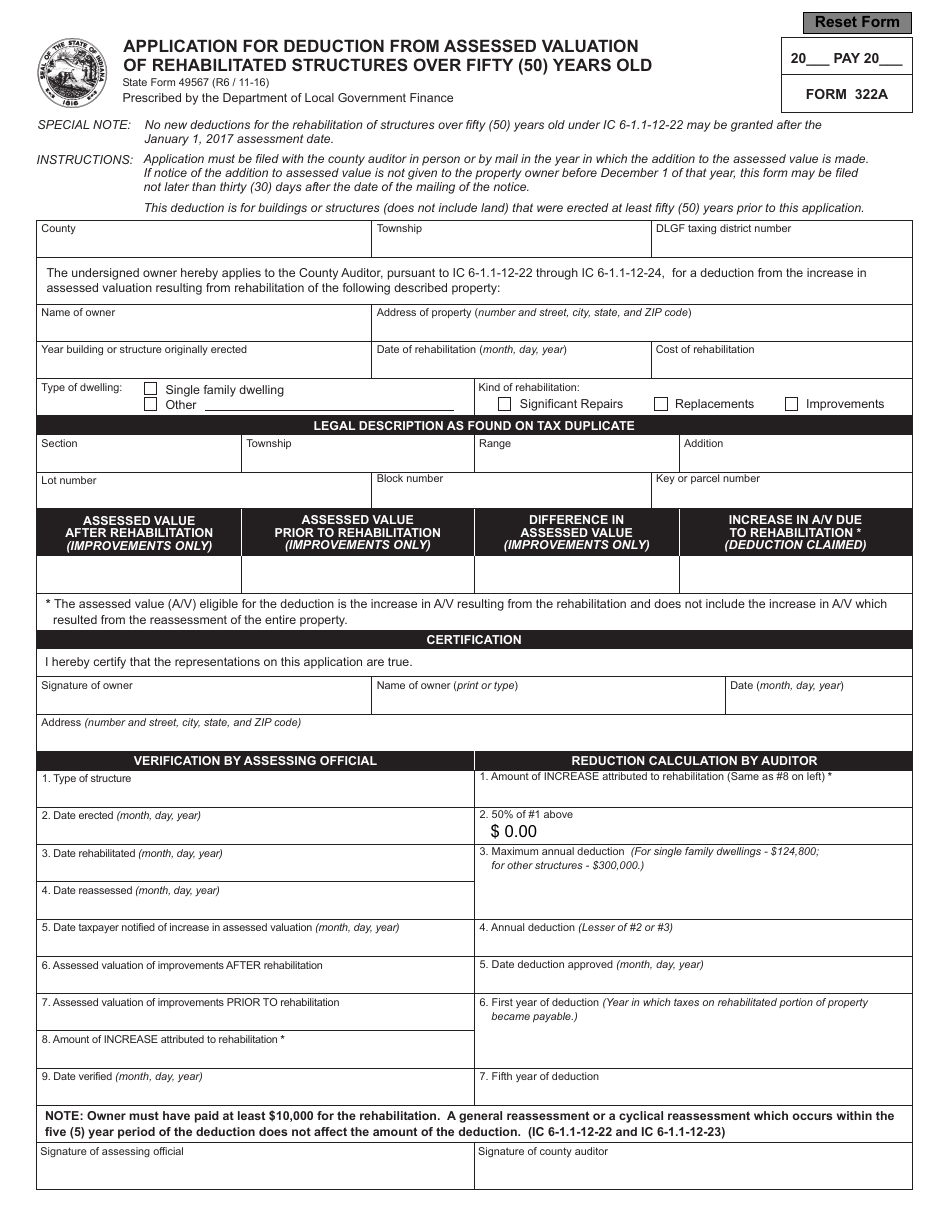

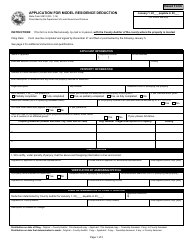

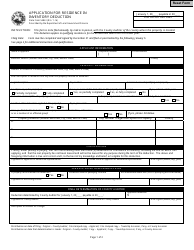

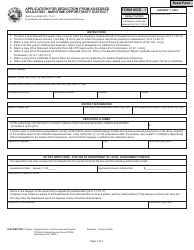

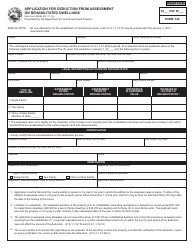

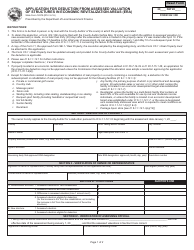

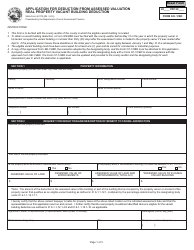

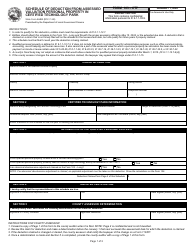

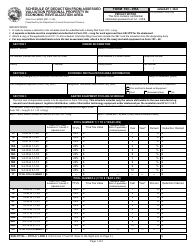

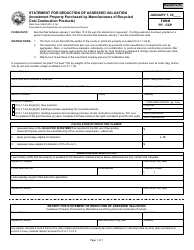

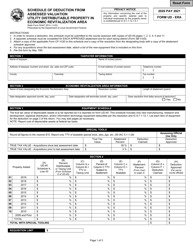

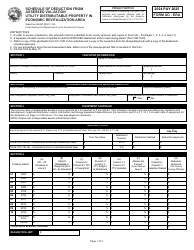

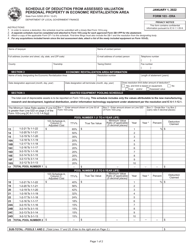

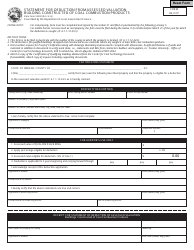

Form 322A (State Form 49567) Application for Deduction From Assessed Valuation of Rehabilitated Structures Over 50 Year Old - Indiana

What Is Form 322A (State Form 49567)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

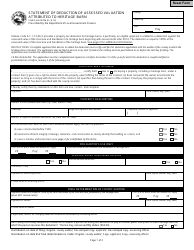

Q: What is Form 322A?

A: Form 322A is an application used in Indiana for a deduction from the assessed valuation of rehabilitated structures over 50 years old.

Q: What is the purpose of Form 322A?

A: The purpose of Form 322A is to request a deduction from the assessed valuation of rehabilitated structures that are over 50 years old.

Q: How do I obtain Form 322A?

A: You can obtain Form 322A in Indiana by contacting the appropriate government office responsible for property assessments.

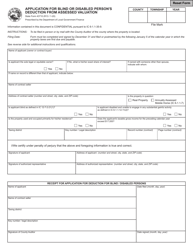

Q: Who is eligible to use Form 322A?

A: Property owners in Indiana who have rehabilitated structures that are over 50 years old may be eligible to use Form 322A for a deduction.

Q: What is the deduction for?

A: The deduction is for a reduction in the assessed valuation of rehabilitated structures, resulting in potential property tax savings.

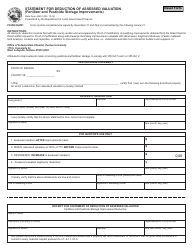

Q: Are there any requirements to qualify for the deduction?

A: Yes, there are specific requirements that must be met, such as the structure being 50 years or older and meeting certain rehabilitation criteria.

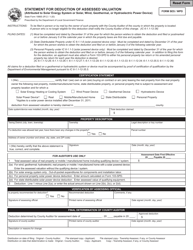

Q: Are there any deadlines for submitting Form 322A?

A: Yes, there are specific deadlines for submitting Form 322A, which vary depending on the assessment date of the property.

Q: Can I apply for the deduction every year?

A: Yes, you can apply for the deduction every year as long as you meet the eligibility requirements and submit the application within the specified deadlines.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 322A (State Form 49567) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.