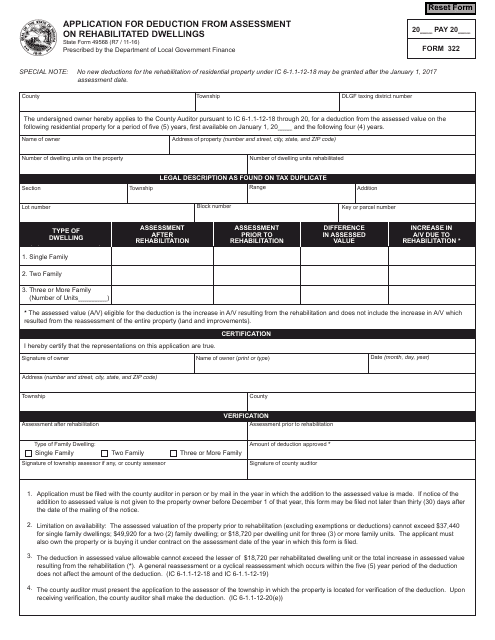

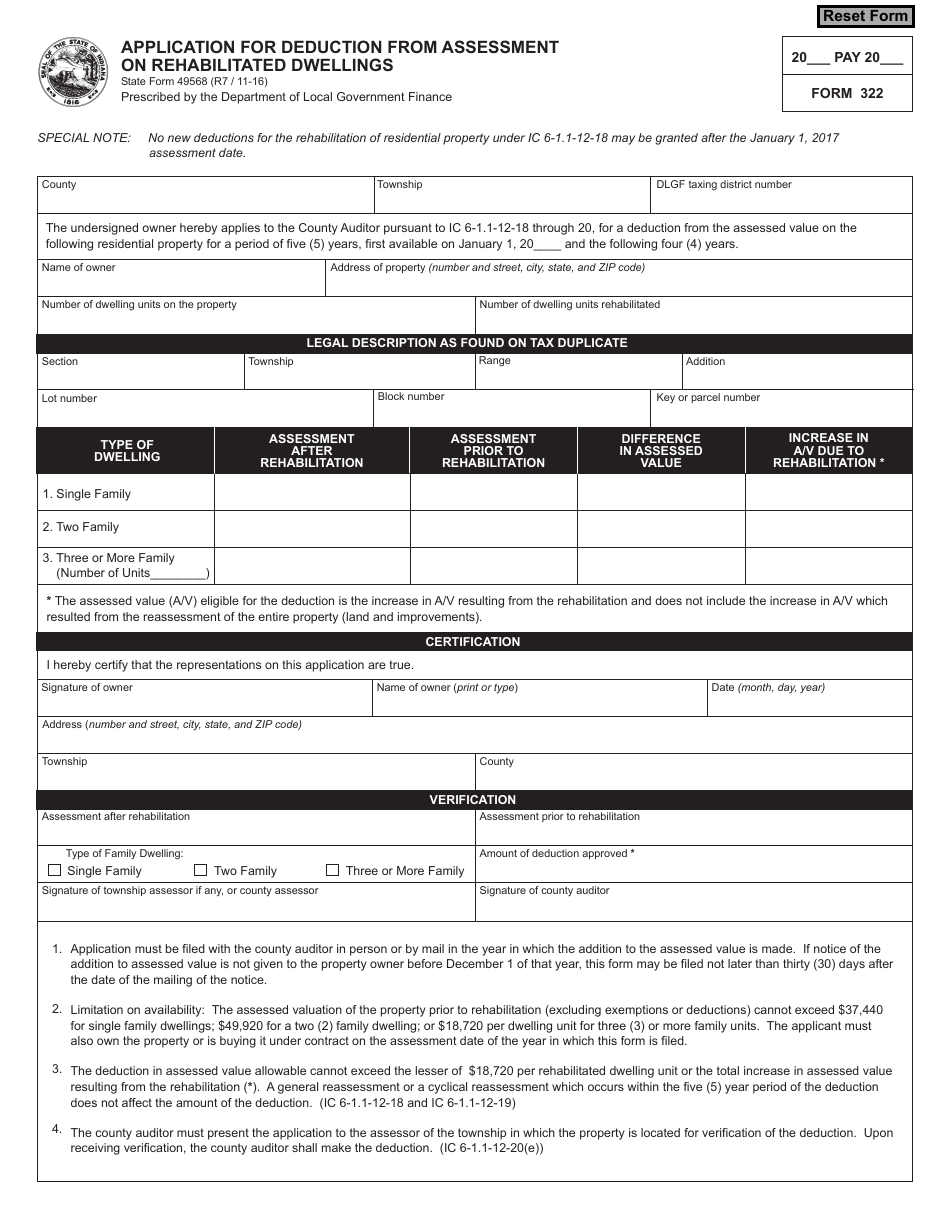

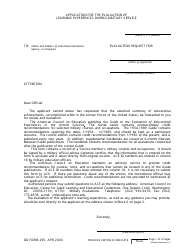

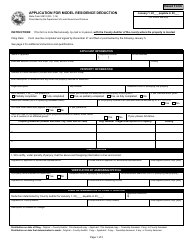

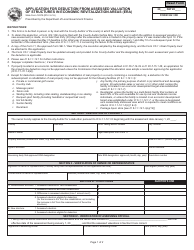

Form 322 (State Form 49568) Application for Deduction From Assessment on Rehabilitated Dwellings - Indiana

What Is Form 322 (State Form 49568)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 322?

A: Form 322 is the Application for Deduction From Assessment on Rehabilitated Dwellings in Indiana.

Q: What is the purpose of Form 322?

A: The purpose of Form 322 is to apply for a deduction from assessment on rehabilitated dwellings in Indiana.

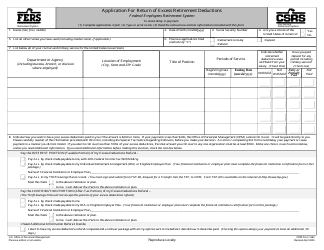

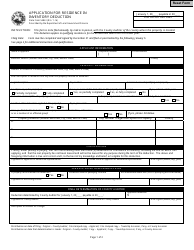

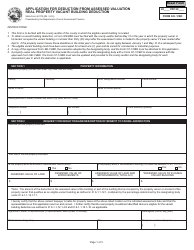

Q: What information is required on Form 322?

A: Form 322 requires information about the property owner, property address, rehabilitation details, and financing information.

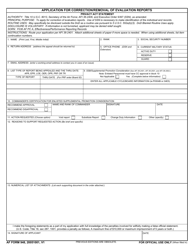

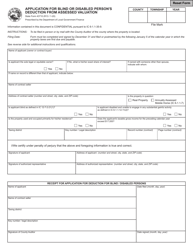

Q: Is there a deadline to submit Form 322?

A: Yes, Form 322 must be submitted to the county auditor by January 5th of the year in which the deduction is claimed.

Q: What are the eligibility requirements for the deduction?

A: To be eligible for the deduction, the dwelling must have been rehabilitated and the assessed value of the property must have increased by at least 25% due to the rehabilitation.

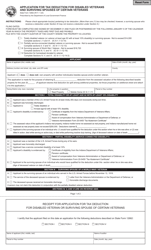

Q: How long does the deduction last?

A: The deduction lasts for a period of 10 years. After that, the property reverts to its full assessed value.

Q: Is there a fee to apply for the deduction?

A: There is no fee to apply for the deduction.

Q: Can I apply for the deduction if I am a renter?

A: No, the deduction is only available to property owners.

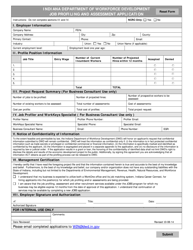

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 322 (State Form 49568) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.