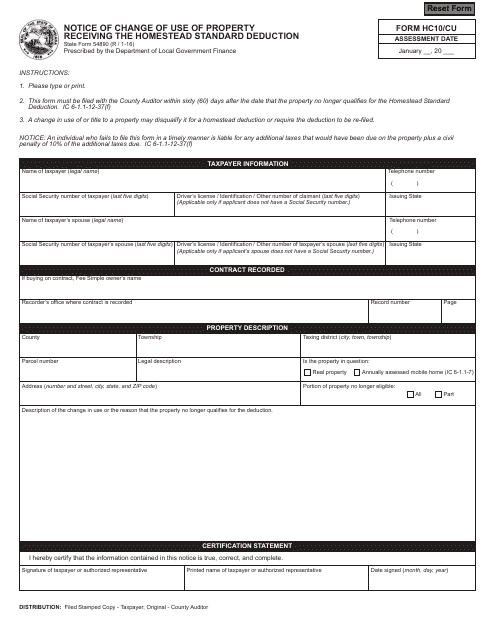

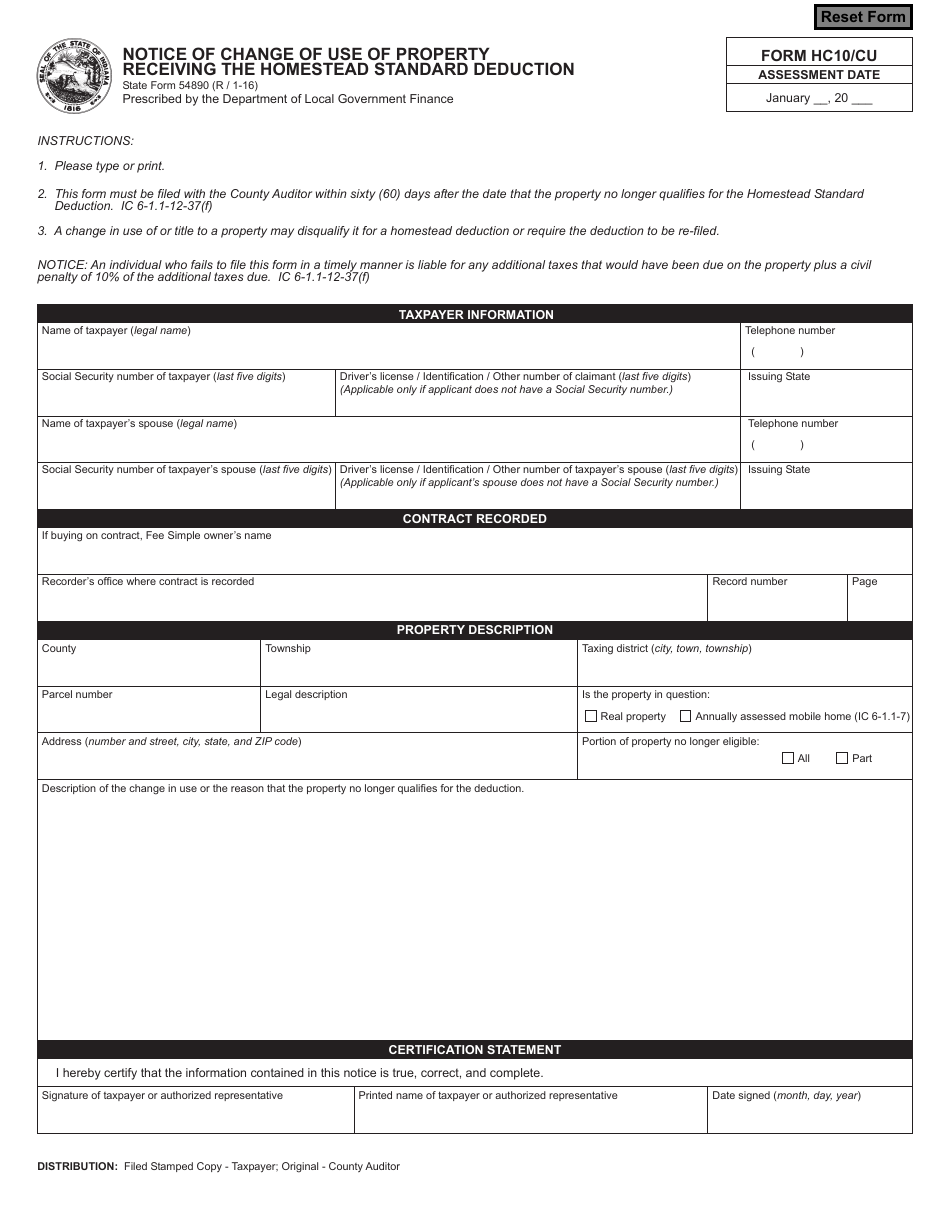

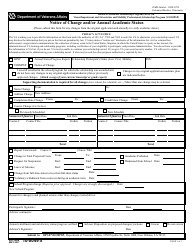

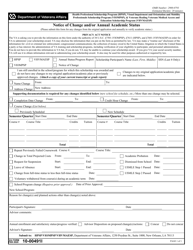

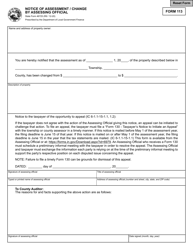

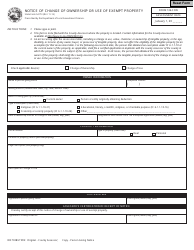

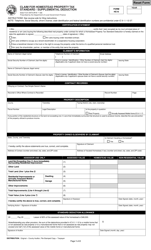

State Form 54890 Notice of Change of Use of Property Receiving the Homestead Standard Deduction - Indiana

What Is State Form 54890?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 54890?

A: Form 54890 is the Notice of Change of Use of Property Receiving the Homestead Standard Deduction in Indiana.

Q: What is the purpose of Form 54890?

A: The purpose of Form 54890 is to notify the county assessor of any changes in the use or ownership of a property that is receiving the Homestead Standard Deduction.

Q: Who is required to file Form 54890?

A: Property owners who are receiving the Homestead Standard Deduction in Indiana and have experienced changes in the use or ownership of their property are required to file Form 54890.

Q: When should Form 54890 be filed?

A: Form 54890 should be filed within 60 days of the change in use or ownership of the property.

Q: Is there a fee for filing Form 54890?

A: No, there is no fee for filing Form 54890.

Q: What happens if I fail to file Form 54890?

A: Failure to file Form 54890 may result in the loss of the Homestead Standard Deduction for the property.

Q: Is Form 54890 specific to Indiana?

A: Yes, Form 54890 is specific to the state of Indiana and its homestead tax laws.

Q: What other documents should be included when filing Form 54890?

A: You may be required to provide supporting documents such as a deed or other proof of ownership or use changes.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54890 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.