This version of the form is not currently in use and is provided for reference only. Download this version of

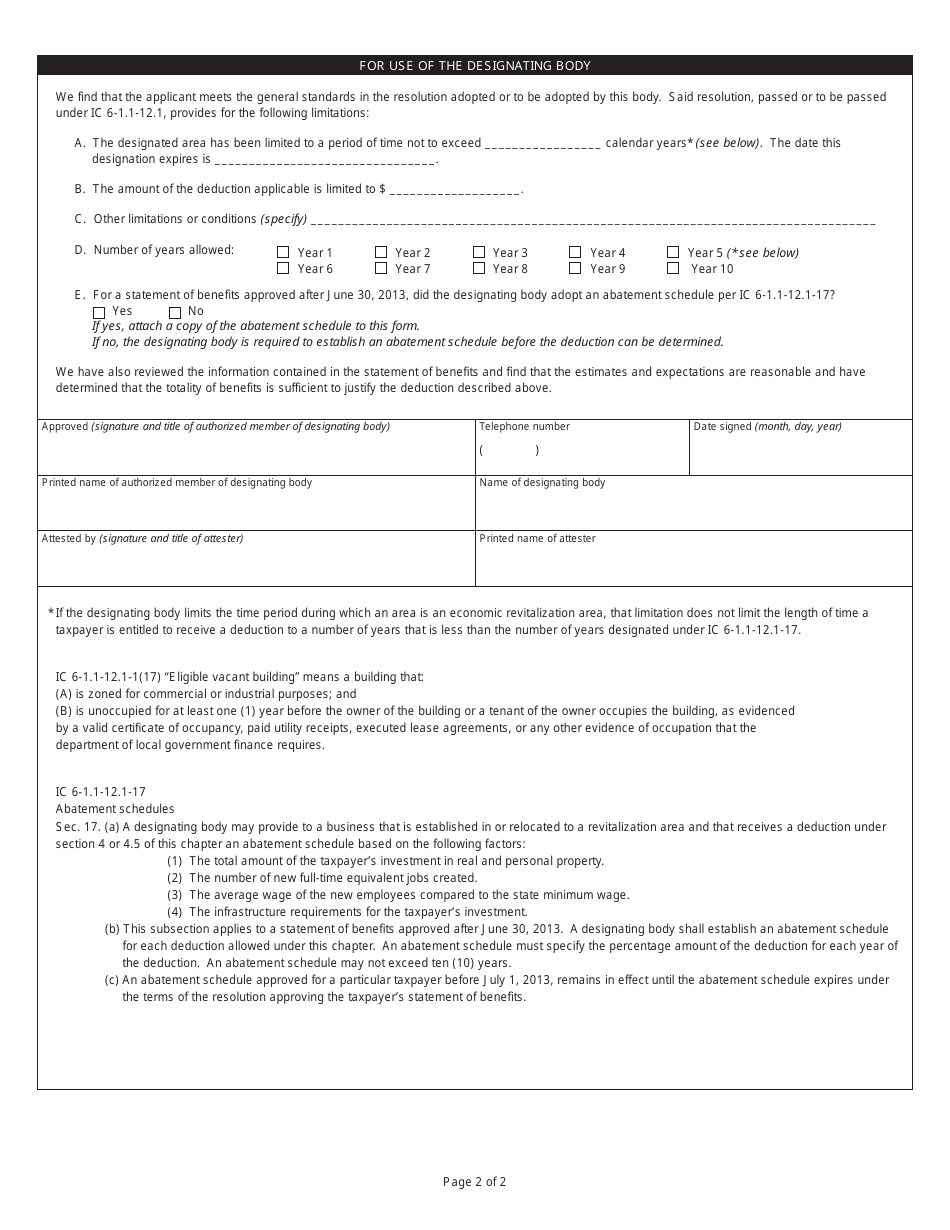

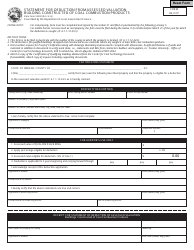

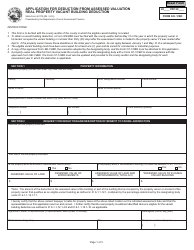

State Form 55182 (SB-1/VBD)

for the current year.

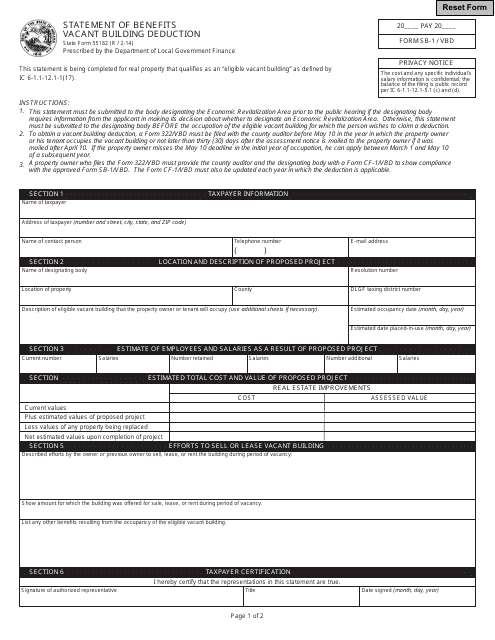

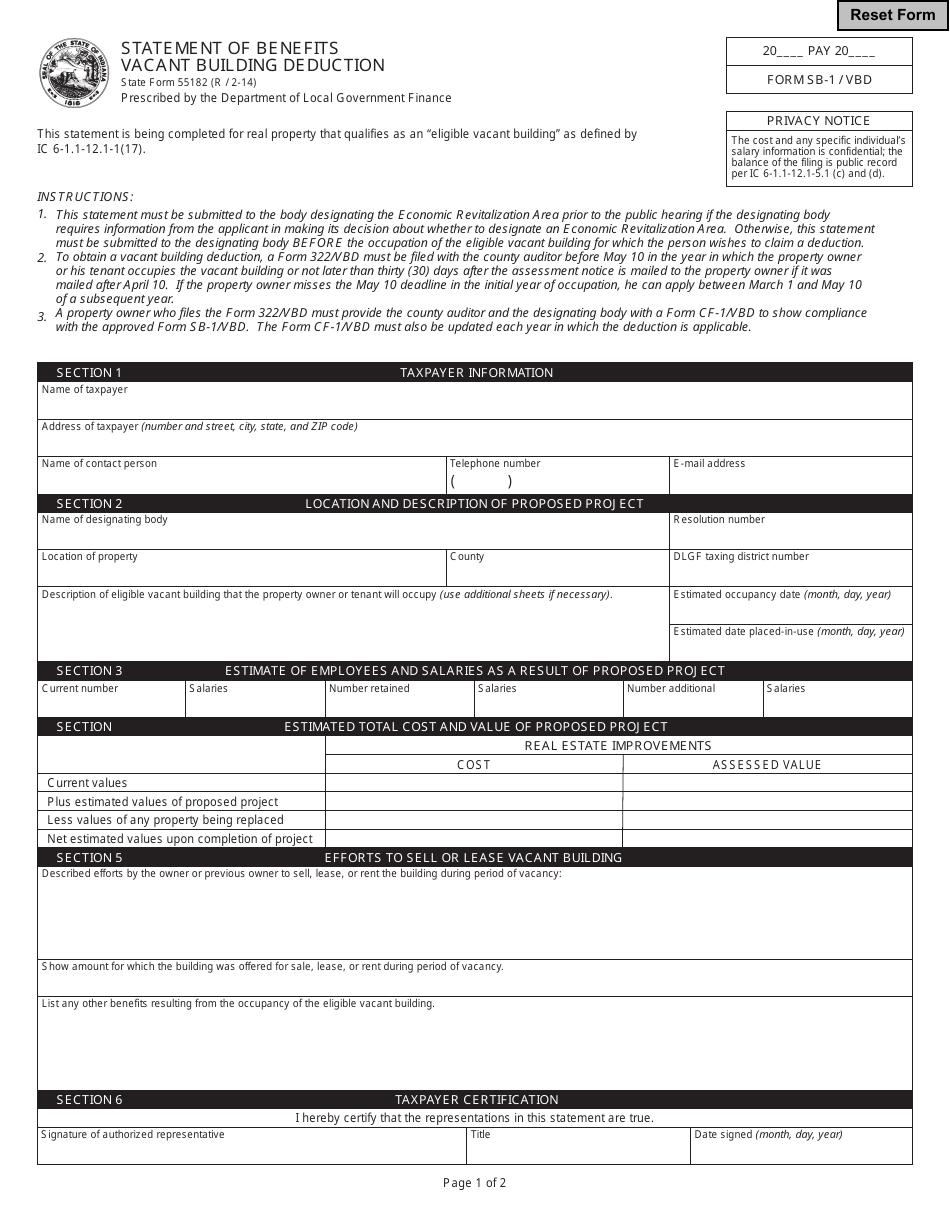

State Form 55182 (SB-1 / VBD) Statement of Benefits Vacant Building Deduction - Indiana

What Is State Form 55182 (SB-1/VBD)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55182?

A: State Form 55182 is the form used in Indiana for the Statement of Benefits Vacant Building Deduction (SB-1/VBD).

Q: What is the Vacant Building Deduction?

A: The Vacant Building Deduction is a benefit provided in Indiana that reduces the assessed value of a vacant building for property tax purposes.

Q: Who is eligible for the Vacant Building Deduction?

A: Vacant buildings that meet certain criteria, as outlined in the form, are eligible for the deduction.

Q: How does the Vacant Building Deduction work?

A: The assessed value of a vacant building eligible for the deduction is reduced, resulting in lower property taxes.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55182 (SB-1/VBD) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.