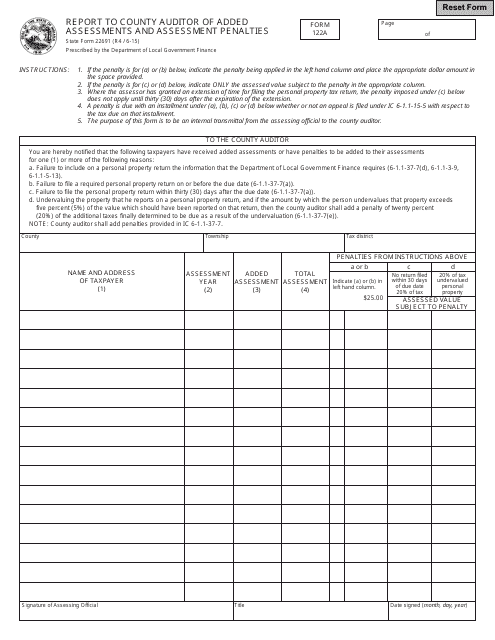

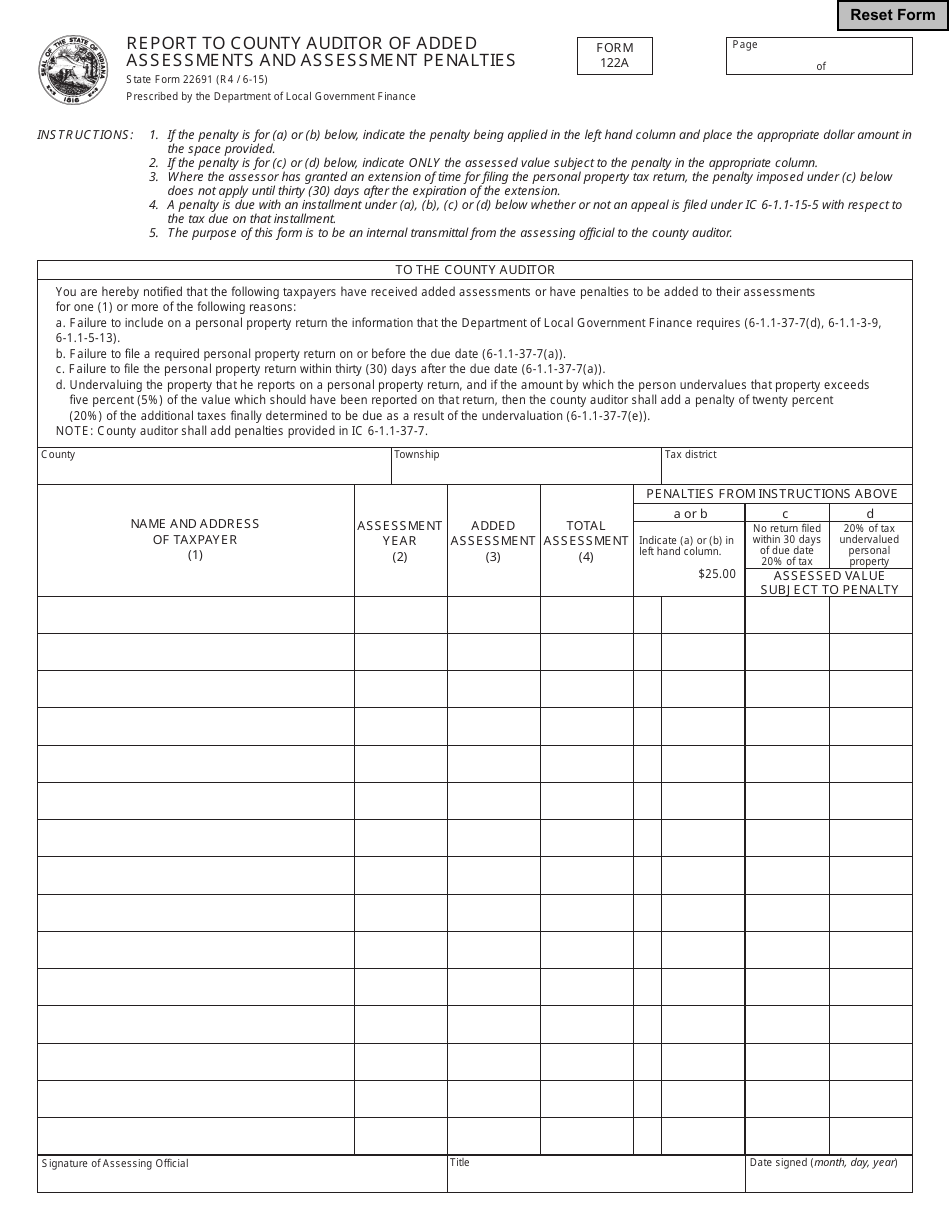

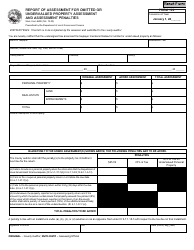

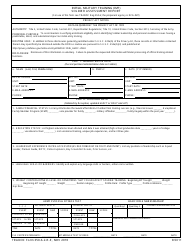

State Form 22691 (122A) Report to County Auditor of Added Assessments and Assessment Penalties - Indiana

What Is State Form 22691 (122A)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 22691?

A: State Form 22691 is a report filed with the County Auditor of Indiana.

Q: What is the purpose of State Form 22691?

A: The purpose of State Form 22691 is to report added assessments and assessment penalties to the County Auditor.

Q: Who needs to file State Form 22691?

A: Anyone who has incurred added assessments or assessment penalties in Indiana needs to file State Form 22691.

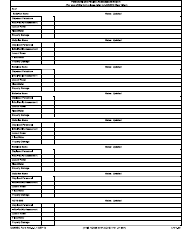

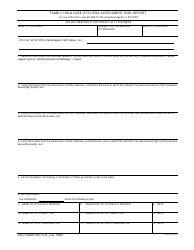

Q: What information is required on State Form 22691?

A: State Form 22691 requires information about the added assessments and assessment penalties, including the property details and the reasons for the assessments.

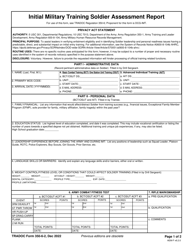

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 22691 (122A) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.