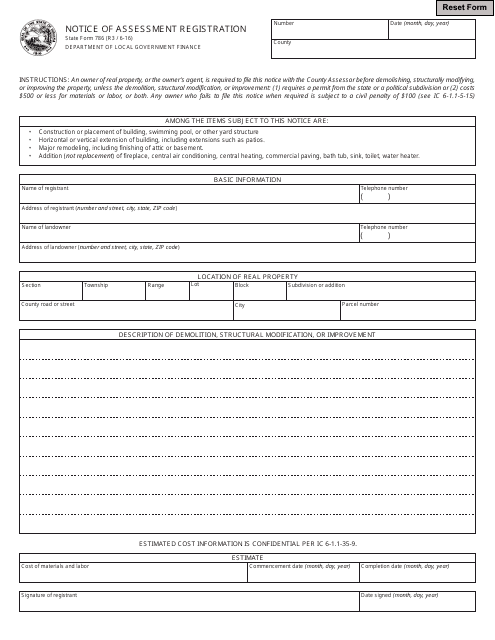

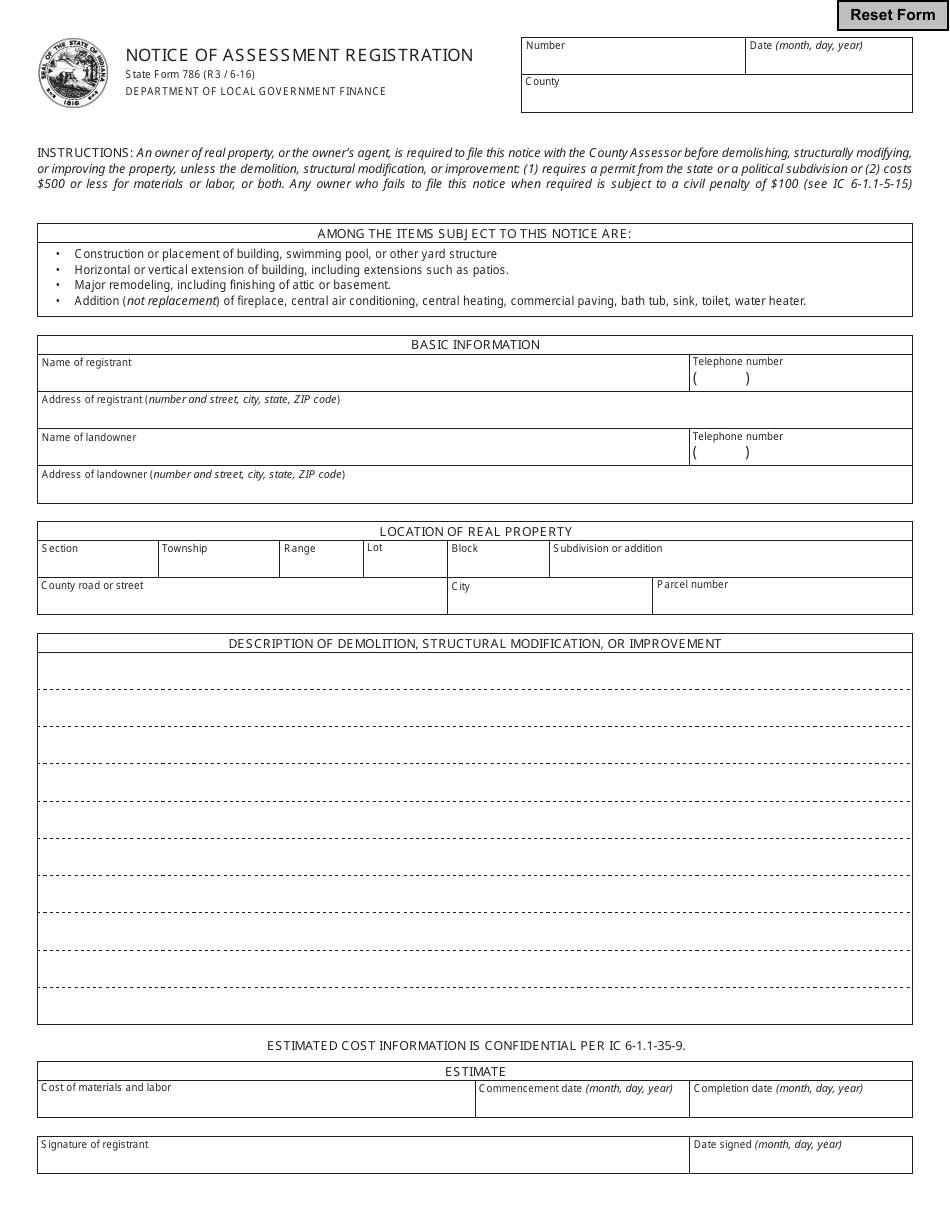

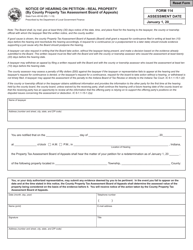

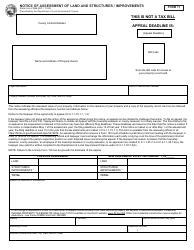

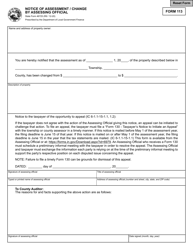

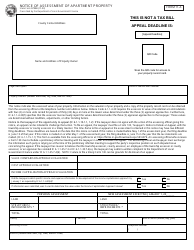

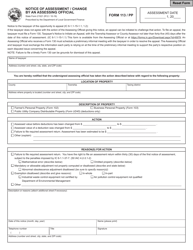

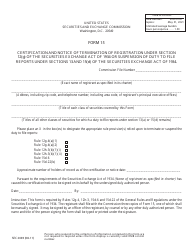

State Form 786 Notice of Assessment Registration - Indiana

What Is State Form 786?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

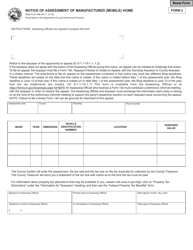

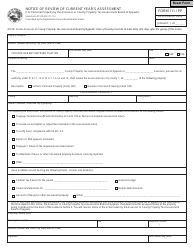

Q: What is Form 786 Notice of Assessment Registration in Indiana used for?

A: Form 786 Notice of Assessment Registration in Indiana is used to register the assessed value of a property for taxation purposes.

Q: Who needs to file Form 786 Notice of Assessment Registration in Indiana?

A: Property owners in Indiana who have received an assessment notice and disagree with the assessed value of their property need to file Form 786.

Q: When is Form 786 Notice of Assessment Registration in Indiana due?

A: Form 786 Notice of Assessment Registration in Indiana is typically due 45 days after the notice of assessment is received.

Q: Is there a fee for filing Form 786 Notice of Assessment Registration in Indiana?

A: No, there is no fee for filing Form 786 Notice of Assessment Registration in Indiana.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 786 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.