This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 53626 (134)

for the current year.

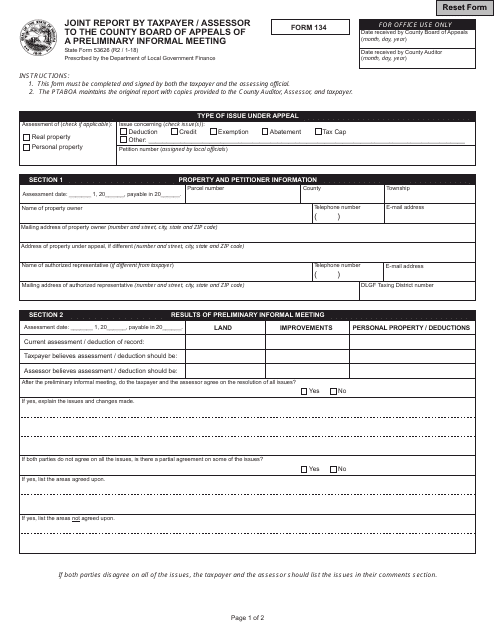

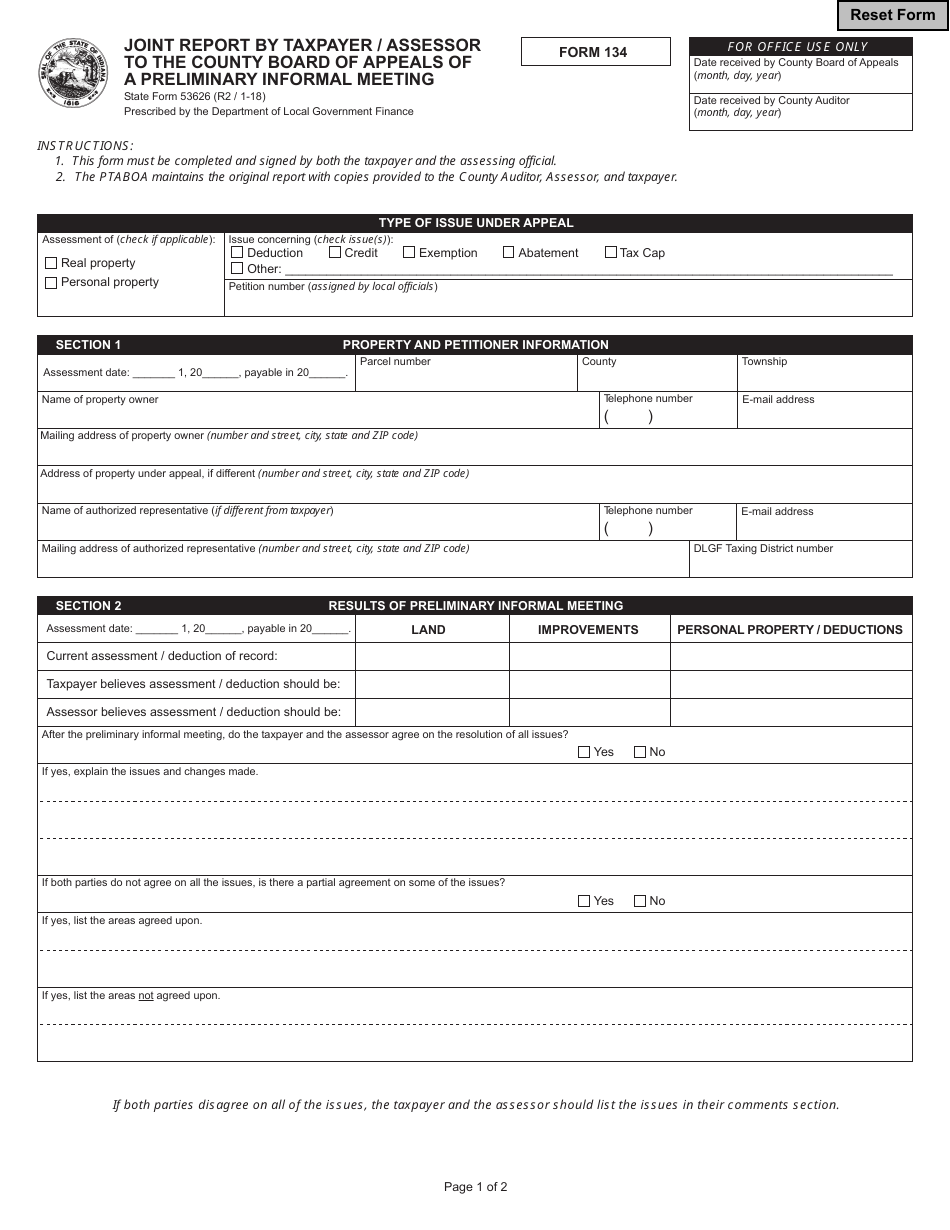

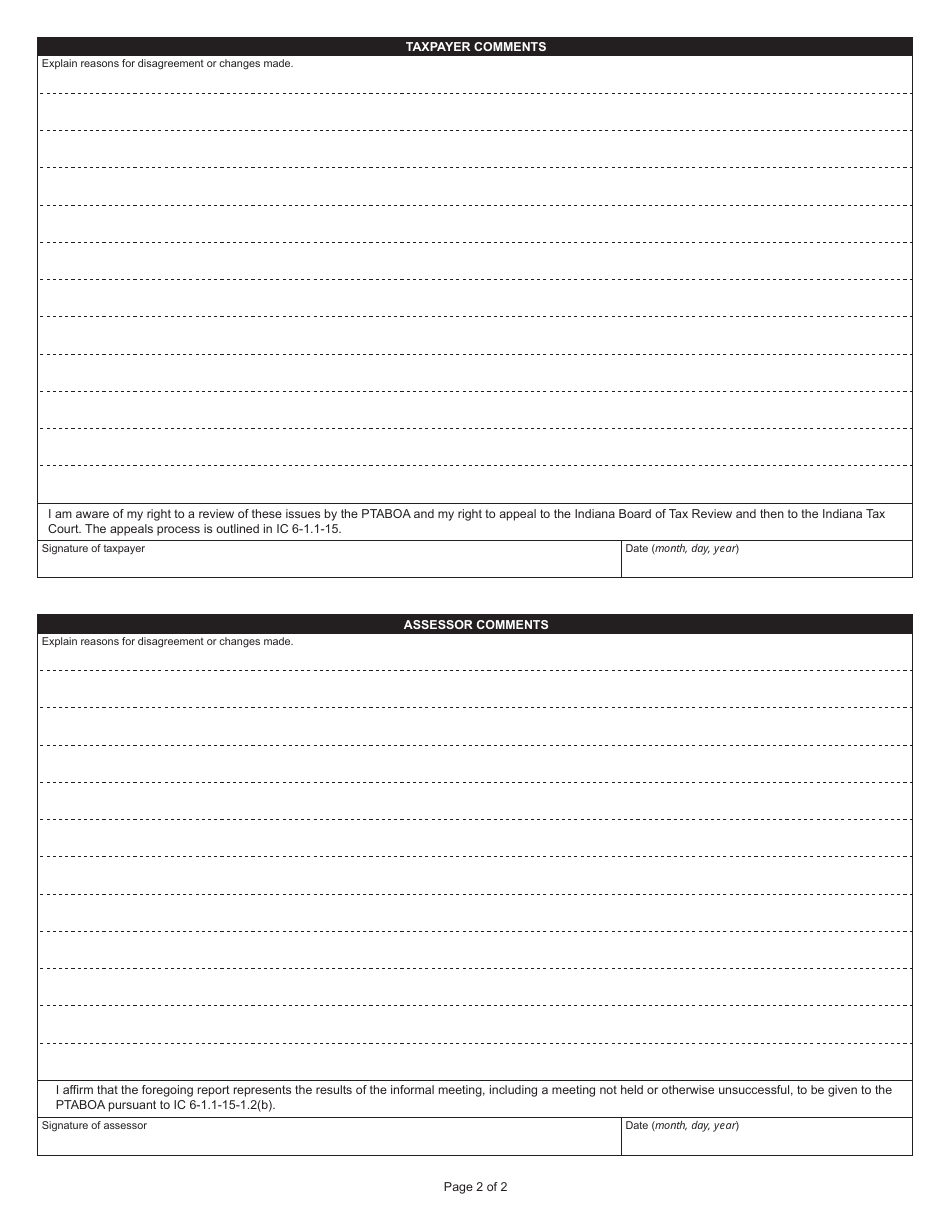

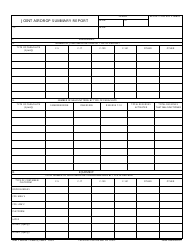

State Form 53626 (134) Joint Report by Taxpayer / Assessor to the County Board of Appeals of a Preliminary Informal Meeting - Indiana

What Is State Form 53626 (134)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 53626?

A: State Form 53626 is a joint report by taxpayer/assessor to the County Board of Appeals of a preliminary informal meeting in Indiana.

Q: What is the purpose of State Form 53626?

A: The purpose of State Form 53626 is to provide a joint report from the taxpayer and assessor regarding a preliminary informal meeting to the County Board of Appeals.

Q: Who needs to fill out State Form 53626?

A: Both the taxpayer and assessor need to fill out State Form 53626.

Q: What information is required in State Form 53626?

A: State Form 53626 requires information about the taxpayer, assessor, and details of the preliminary informal meeting.

Q: Is there a deadline to submit State Form 53626?

A: The deadline to submit State Form 53626 is typically specified by the County Board of Appeals. It is important to adhere to the specified deadline.

Q: Are there any fees associated with State Form 53626?

A: There are no fees associated with State Form 53626.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 53626 (134) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.