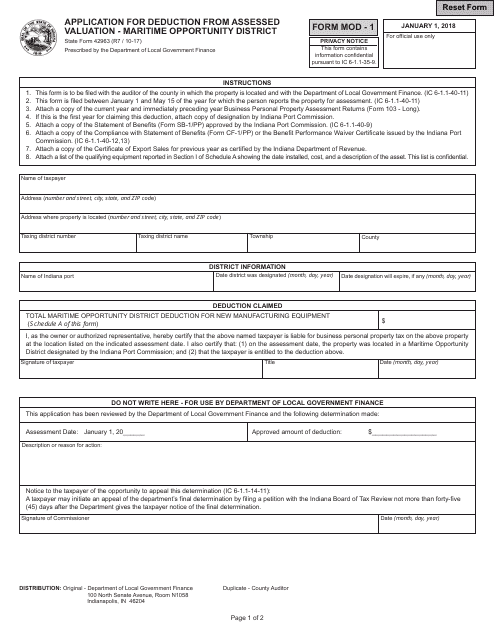

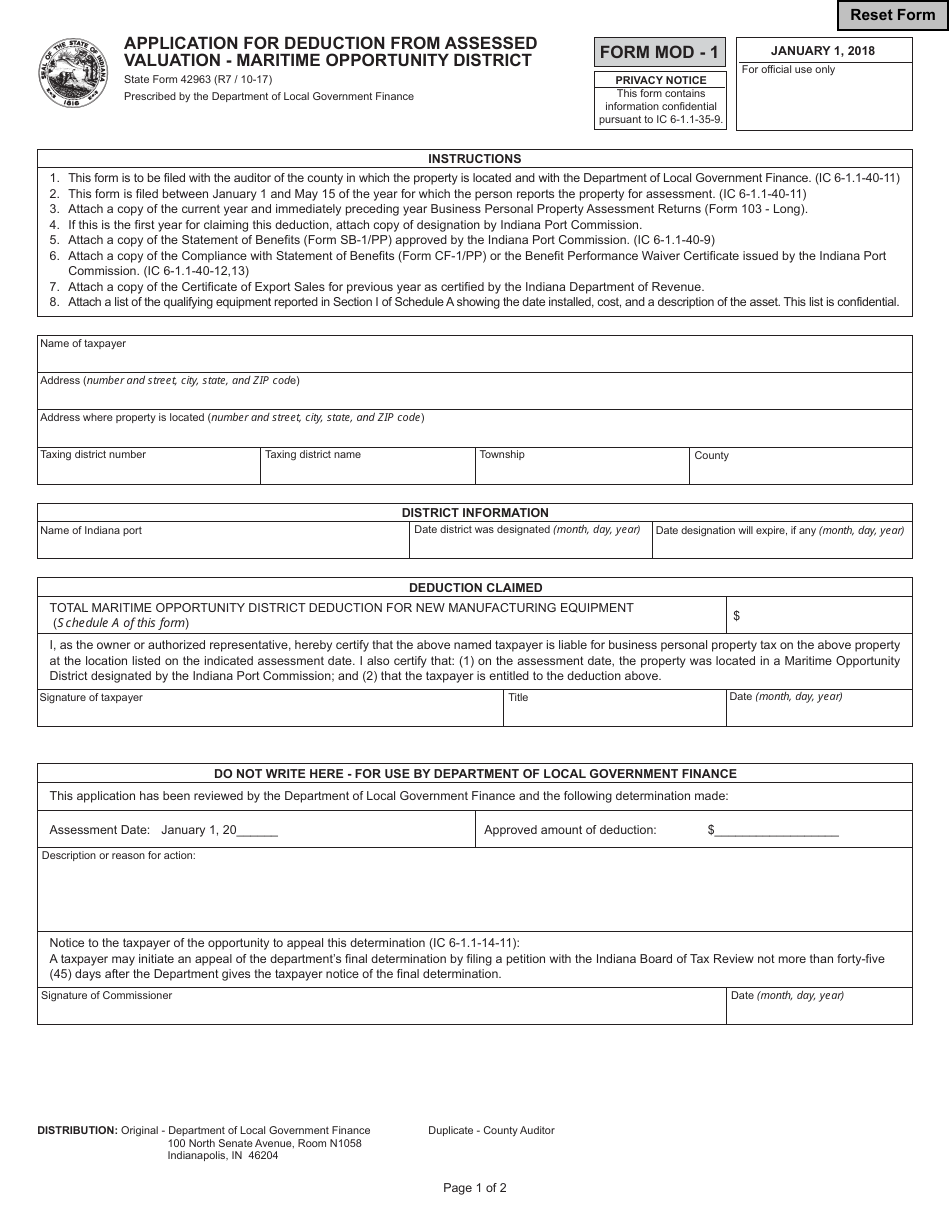

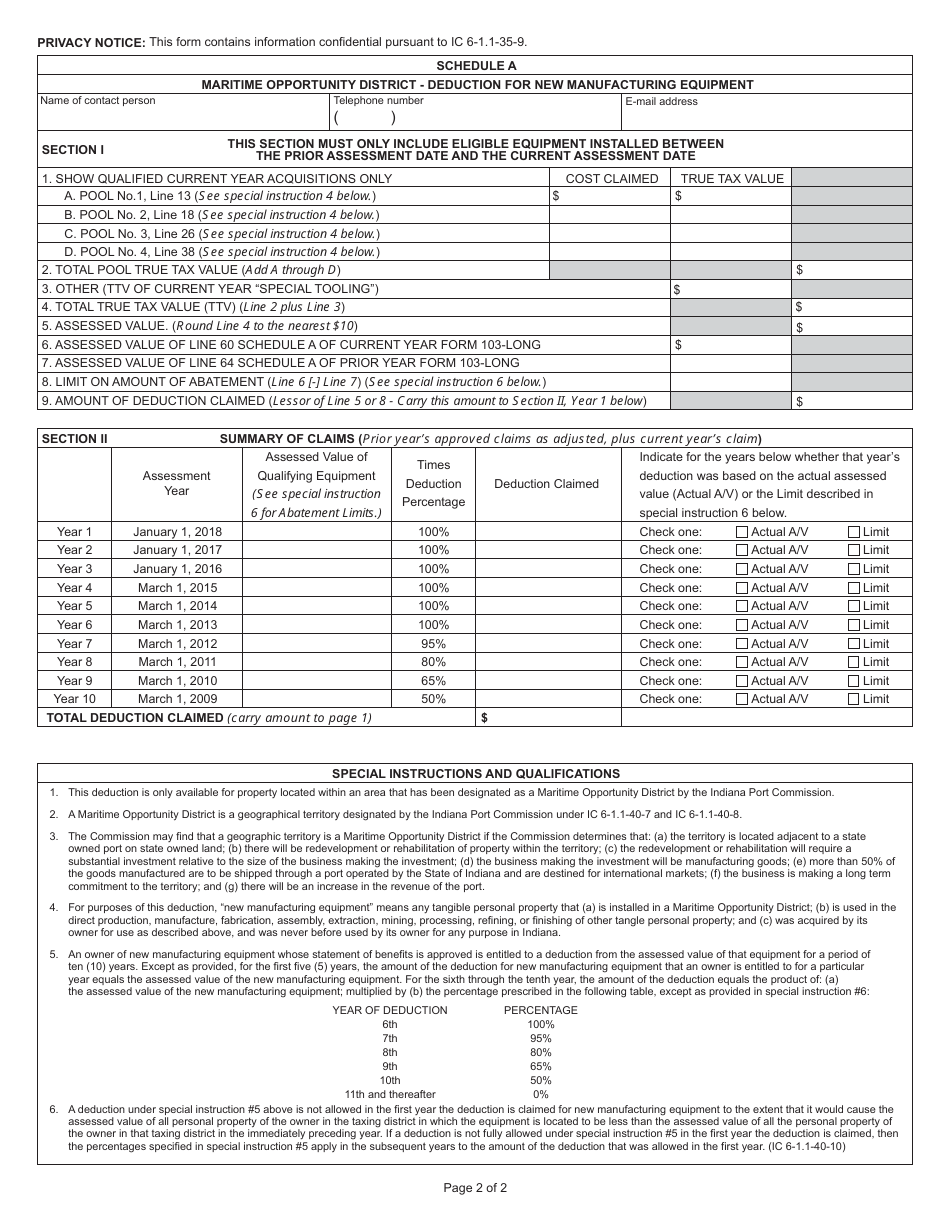

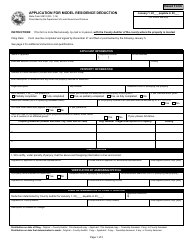

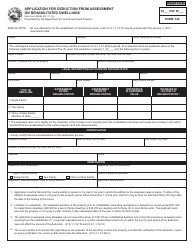

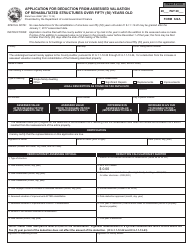

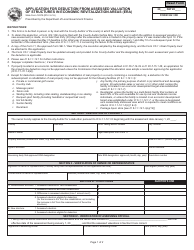

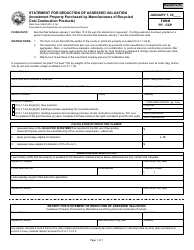

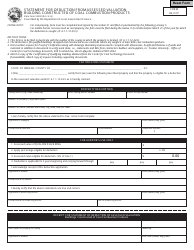

State Form 42963 (MOD-1) Application for Deduction From Assessed Valuation - Maritime Opportunity District - Indiana

What Is State Form 42963 (MOD-1)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 42963 (MOD-1)?

A: Form 42963 (MOD-1) is an application for deduction from assessed valuation for the Maritime Opportunity District in Indiana.

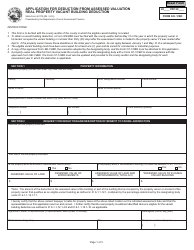

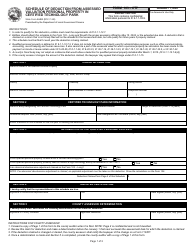

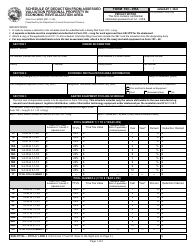

Q: What is the purpose of Form 42963 (MOD-1)?

A: Form 42963 (MOD-1) is used to apply for a deduction from assessed valuation for properties located in the Maritime Opportunity District in Indiana.

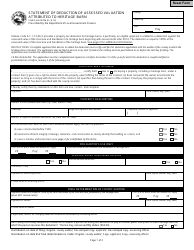

Q: What is a Maritime Opportunity District?

A: A Maritime Opportunity District is a designated area in Indiana where certain properties may be eligible for a deduction from assessed valuation.

Q: Who can use Form 42963 (MOD-1)?

A: Property owners located within the Maritime Opportunity District in Indiana can use Form 42963 (MOD-1) to apply for a deduction from assessed valuation.

Q: Is there a deadline to submit Form 42963 (MOD-1)?

A: The specific deadline for submitting Form 42963 (MOD-1) may vary and should be verified with the relevant government agency in Indiana.

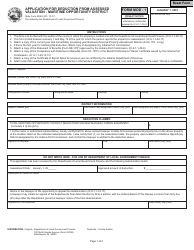

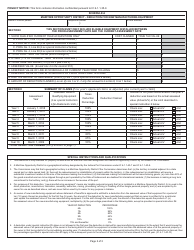

Q: What documentation is required with Form 42963 (MOD-1)?

A: The documentation required with Form 42963 (MOD-1) may vary and should be specified by the relevant government agency in Indiana.

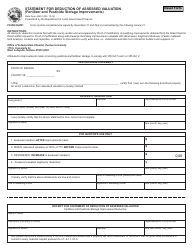

Q: Can I claim a deduction from assessed valuation for properties outside the Maritime Opportunity District?

A: No, Form 42963 (MOD-1) is specifically for properties located within the Maritime Opportunity District in Indiana.

Q: What are the benefits of a deduction from assessed valuation?

A: A deduction from assessed valuation can result in lower property taxes for eligible properties in the Maritime Opportunity District.

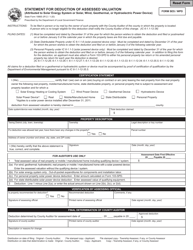

Q: Who should I contact for more information about Form 42963 (MOD-1)?

A: For more information about Form 42963 (MOD-1), you should contact the appropriate government agency in Indiana responsible for property assessments.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 42963 (MOD-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.