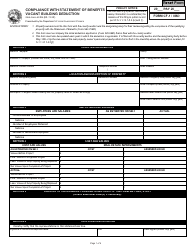

This version of the form is not currently in use and is provided for reference only. Download this version of

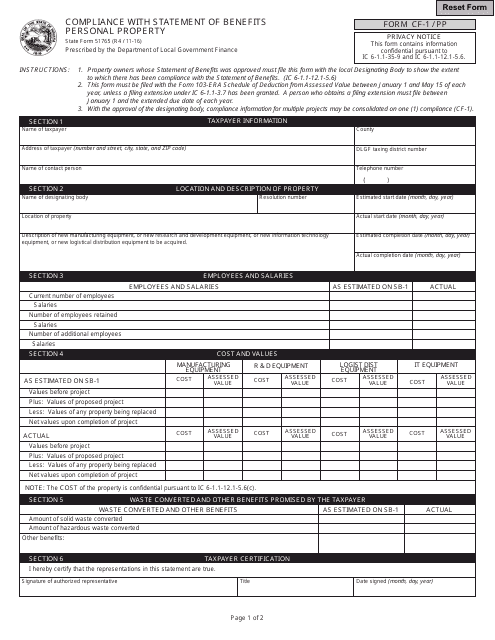

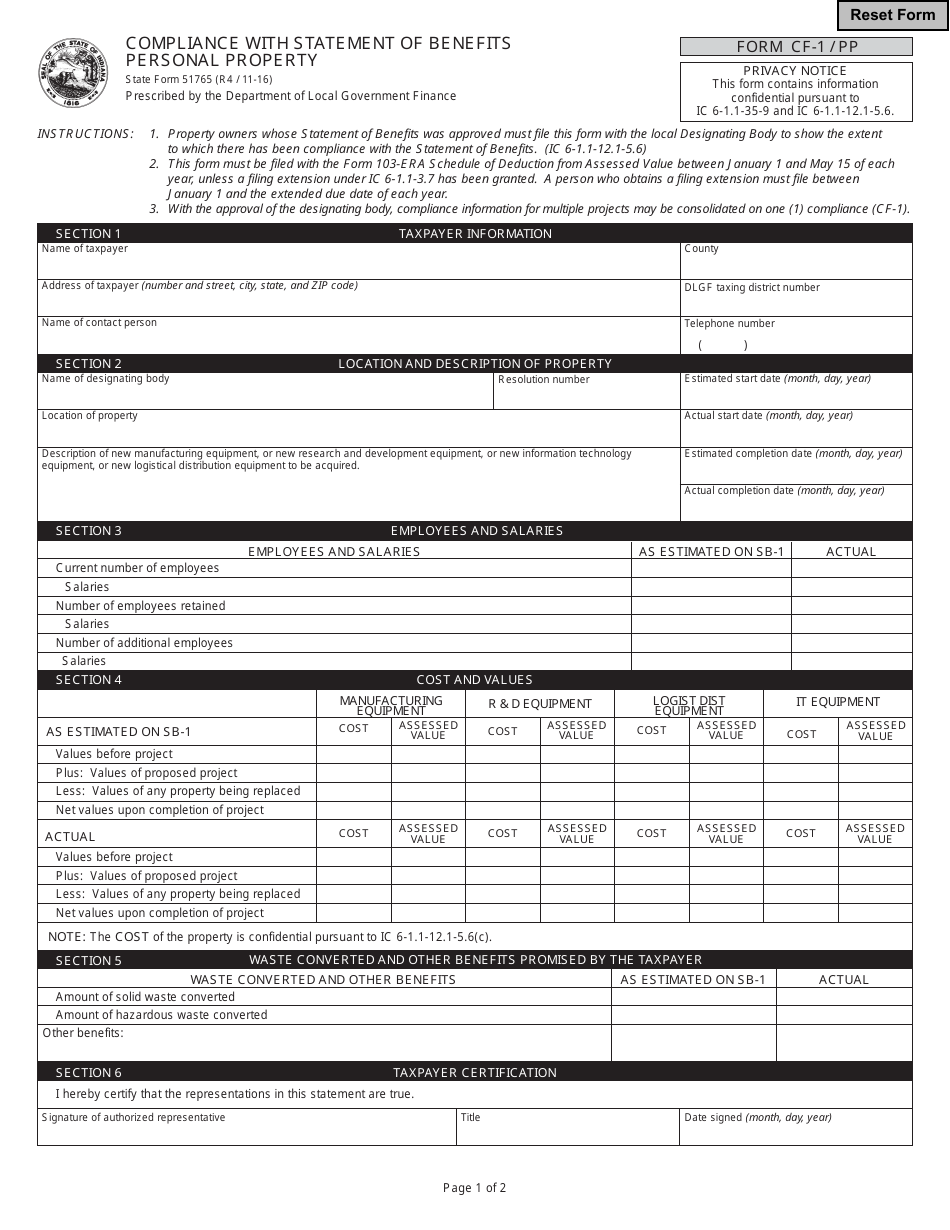

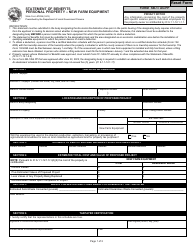

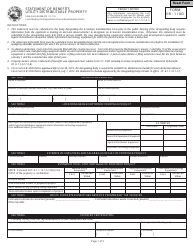

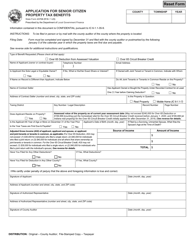

State Form 51765 (CF-1/PP)

for the current year.

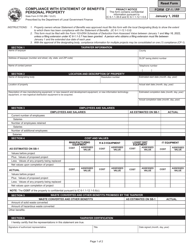

State Form 51765 (CF-1 / PP) Compliance With Statement of Benefits Personal Property - Indiana

What Is State Form 51765 (CF-1/PP)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51765?

A: State Form 51765 is a compliance form related to personal property in Indiana.

Q: What is CF-1/PP?

A: CF-1/PP is the code/name of the form State Form 51765.

Q: What does the form State Form 51765 comply with?

A: The form complies with the Statement of Benefits for Personal Property in Indiana.

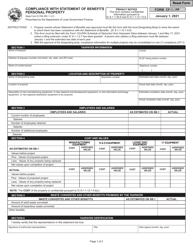

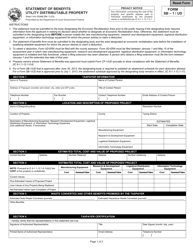

Q: What is meant by personal property in this context?

A: Personal property refers to possessions that are movable, such as vehicles, machinery, equipment, and other tangible assets.

Q: Why is compliance with the Statement of Benefits necessary?

A: Compliance ensures that the personal property is accurately reported and assessed for taxation purposes.

Q: Who needs to complete State Form 51765?

A: Anyone who owns taxable personal property in Indiana may be required to complete this form.

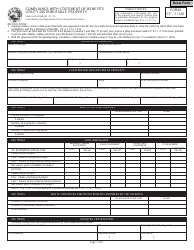

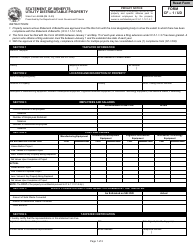

Q: Is there a deadline for filing State Form 51765?

A: It is best to check with the local assessor's office for the specific deadline, as it may vary depending on the county.

Q: What happens if I don't comply with the Statement of Benefits?

A: Failure to comply may result in penalties or fines, and may also affect the accuracy of property assessments and tax calculations.

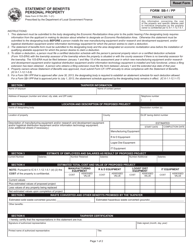

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51765 (CF-1/PP) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.