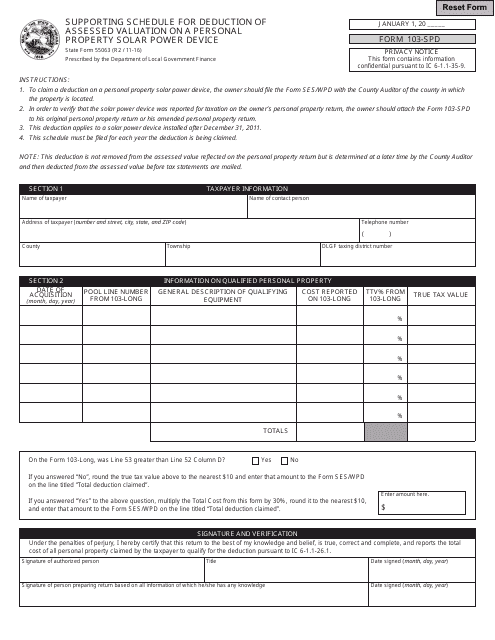

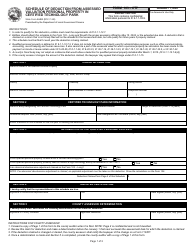

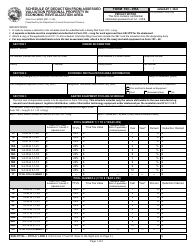

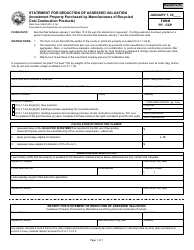

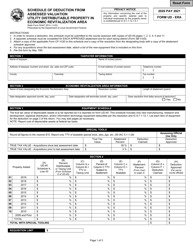

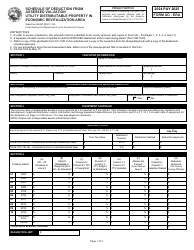

State Form 55063 (103-SPD) Supporting Schedule for Deduction of Assessed Valuation on a Personal Property Solar Power Device - Indiana

What Is State Form 55063 (103-SPD)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55063?

A: State Form 55063 is a supporting schedule for the deduction of assessed valuation on a personal property solar power device in Indiana.

Q: What is the purpose of State Form 55063?

A: The purpose of State Form 55063 is to provide a supporting schedule for claiming a deduction on the assessed valuation of a personal property solar power device in Indiana.

Q: Who needs to fill out State Form 55063?

A: Anyone in Indiana who wants to claim a deduction on the assessed valuation of a personal property solar power device needs to fill out State Form 55063.

Q: What information is required on State Form 55063?

A: State Form 55063 requires information such as the taxpayer's name, address, county of residence, personal property solar power device details, and assessed valuation.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55063 (103-SPD) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.