This version of the form is not currently in use and is provided for reference only. Download this version of

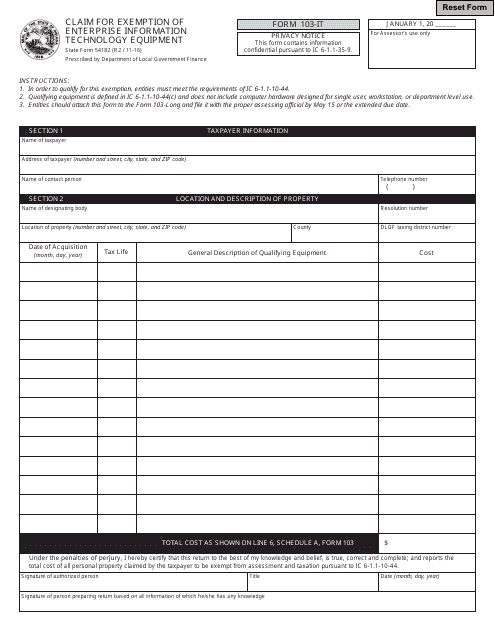

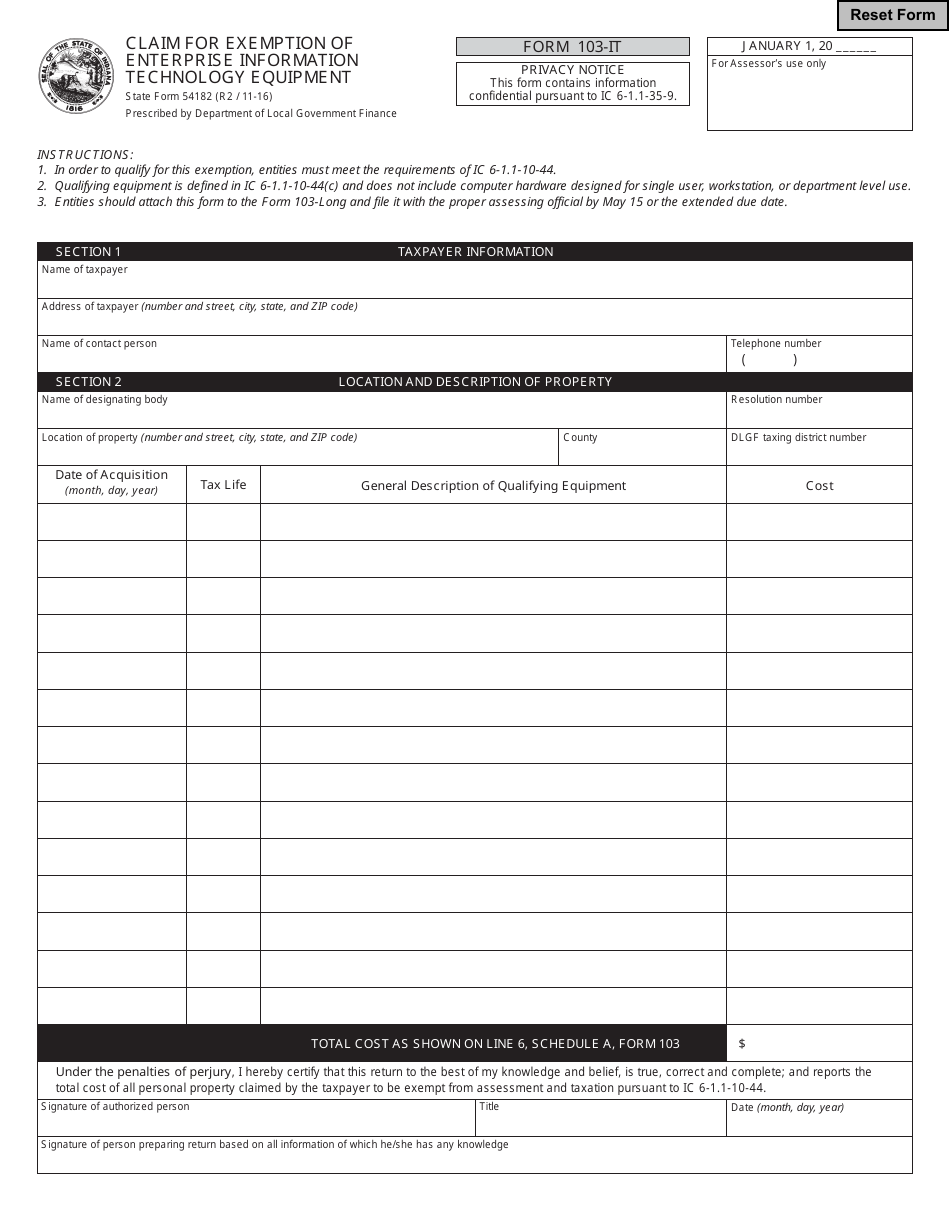

State Form 54182 (103-IT)

for the current year.

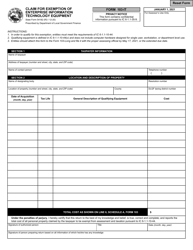

State Form 54182 (103-IT) Claim for Exemption of Enterprise Information Technology Equipment - Indiana

What Is State Form 54182 (103-IT)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 54182?

A: State Form 54182 is a form used to claim exemption of enterprise information technology equipment in Indiana.

Q: What is the purpose of State Form 54182?

A: The purpose of State Form 54182 is to request exemption from taxes on enterprise information technology equipment in Indiana.

Q: What is enterprise information technology equipment?

A: Enterprise information technology equipment refers to computer hardware, software, and peripherals used for business purposes.

Q: Who is eligible to claim exemption using State Form 54182?

A: Businesses and organizations in Indiana that use enterprise information technology equipment for business purposes are eligible to claim exemption.

Q: What information do I need to provide on State Form 54182?

A: You will need to provide details about your business or organization, the specific enterprise information technology equipment being claimed, and the justification for the exemption.

Q: Are there any deadlines or limitations for filing State Form 54182?

A: The form should be filed in a timely manner, generally before the due date for filing taxes in Indiana. Other limitations or deadlines may apply, so it is recommended to consult the instructions or contact the Indiana Department of Revenue for specific information.

Form Details:

- Released on November 1, 2016;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54182 (103-IT) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.