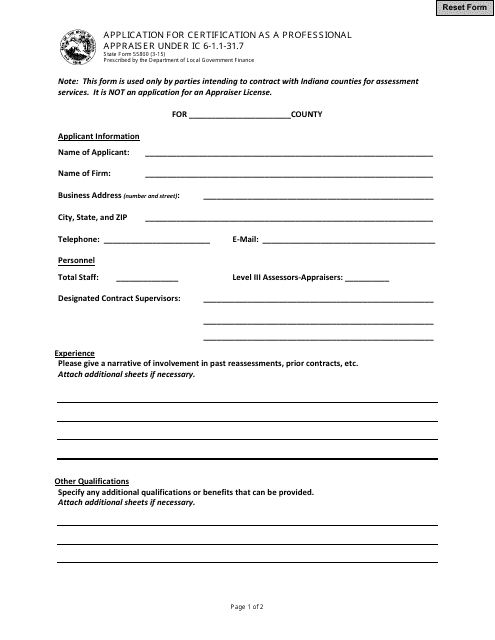

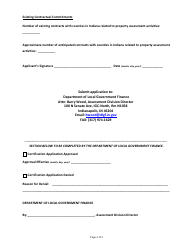

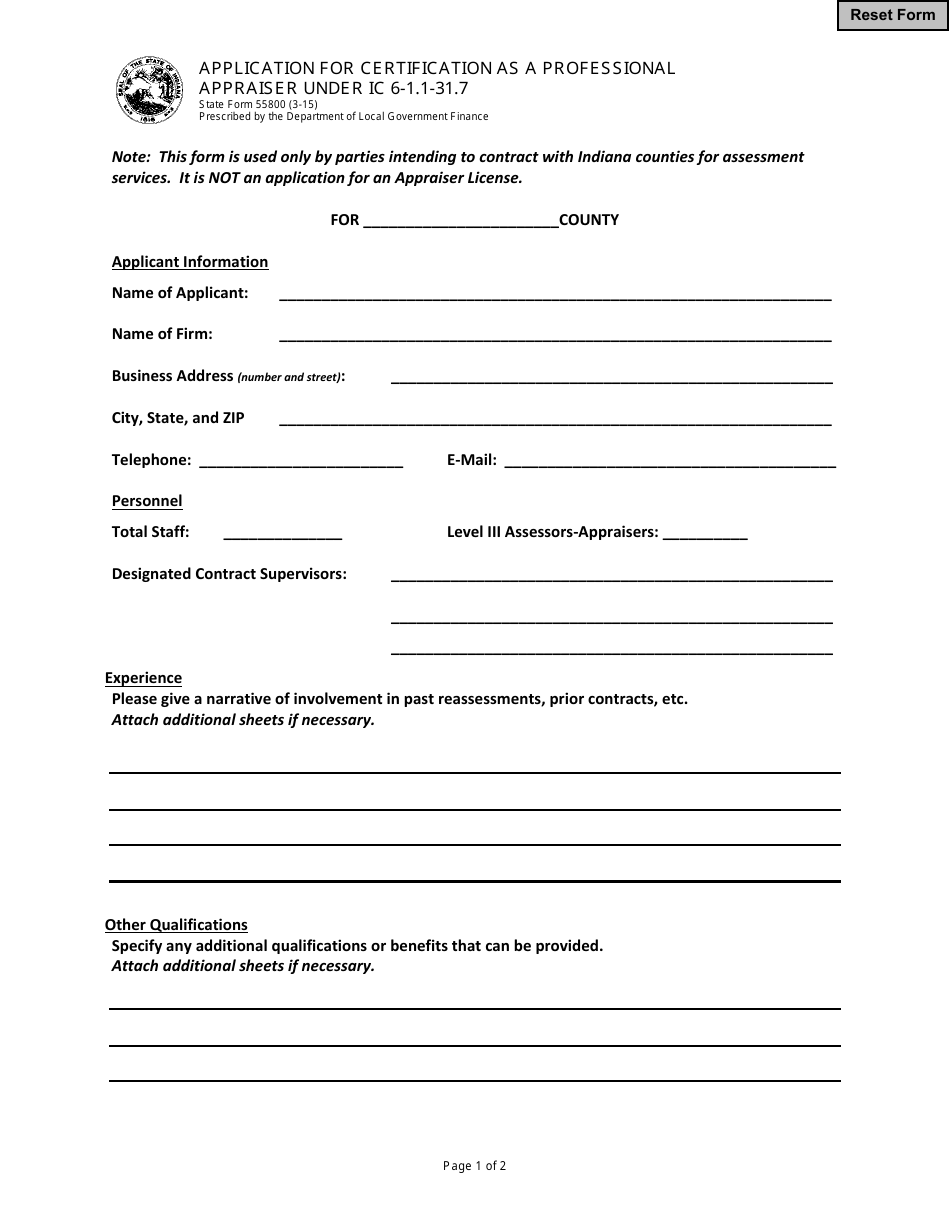

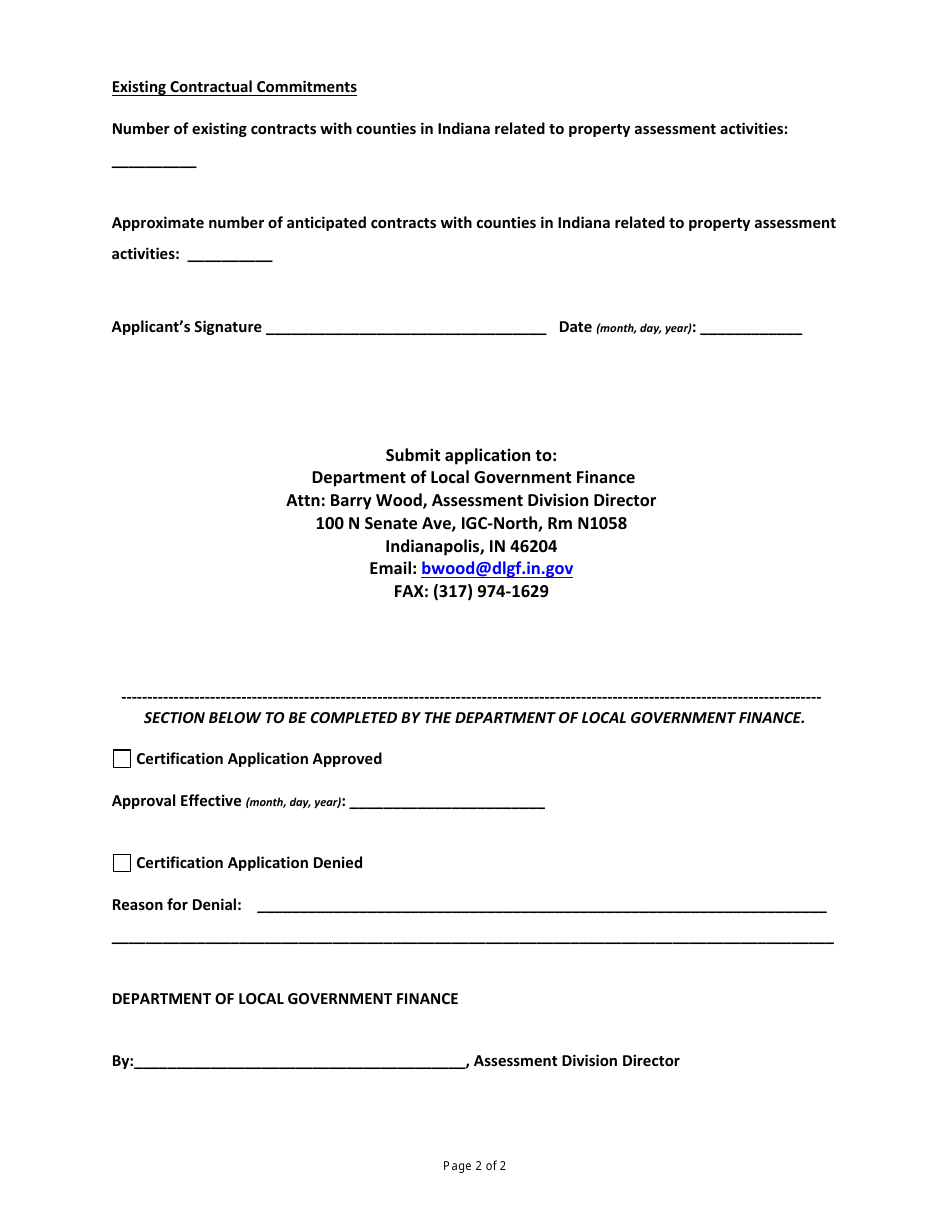

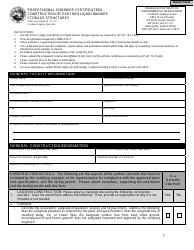

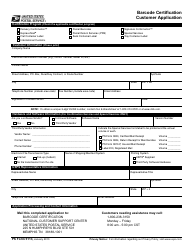

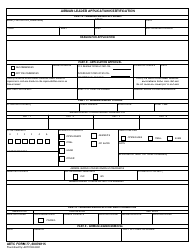

State Form 55800 Application for Certification as a Professional Appraiser Under Ic 6-1.1-31.7 - Indiana

What Is State Form 55800?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55800?

A: Form 55800 is an application for certification as a professional appraiser under Ic 6-1.1-31.7 in Indiana.

Q: What is the purpose of Form 55800?

A: The purpose of Form 55800 is to apply for certification as a professional appraiser in Indiana.

Q: What is Ic 6-1.1-31.7?

A: Ic 6-1.1-31.7 is a section of the Indiana Code that pertains to the certification of professional appraisers.

Q: Who can apply for certification as a professional appraiser?

A: Anyone who meets the qualifications outlined in Ic 6-1.1-31.7 can apply for certification as a professional appraiser.

Q: What qualifications are required to apply for certification as a professional appraiser?

A: The specific qualifications required can be found in Ic 6-1.1-31.7. It may include education, experience, and other criteria.

Q: What is the Indiana Department of Local Government Finance?

A: The Indiana Department of Local Government Finance is the department responsible for administering property tax laws and regulations in Indiana.

Q: Are there any fees associated with the application?

A: Details about any fees associated with the application can be found on the application form or by contacting the Indiana Department of Local Government Finance.

Q: How long does it take to process the application?

A: The processing time for the application may vary. For specific information, it is best to contact the Indiana Department of Local Government Finance.

Q: What happens after the application is approved?

A: Once the application is approved, you will receive certification as a professional appraiser in Indiana.

Form Details:

- Released on March 1, 2015;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55800 by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.