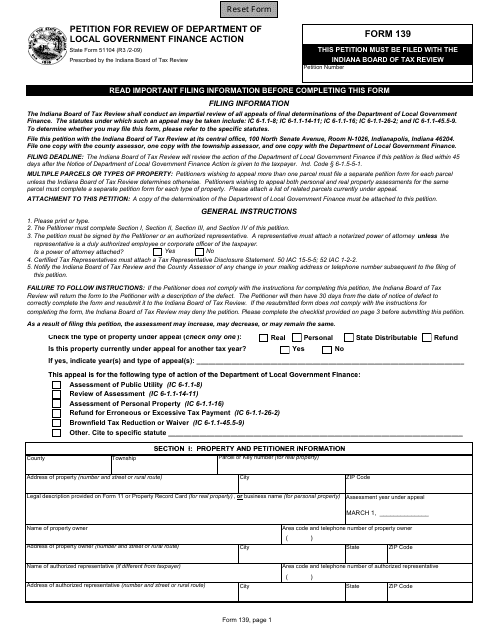

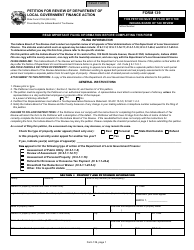

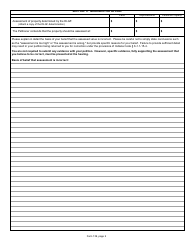

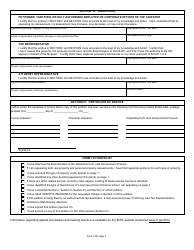

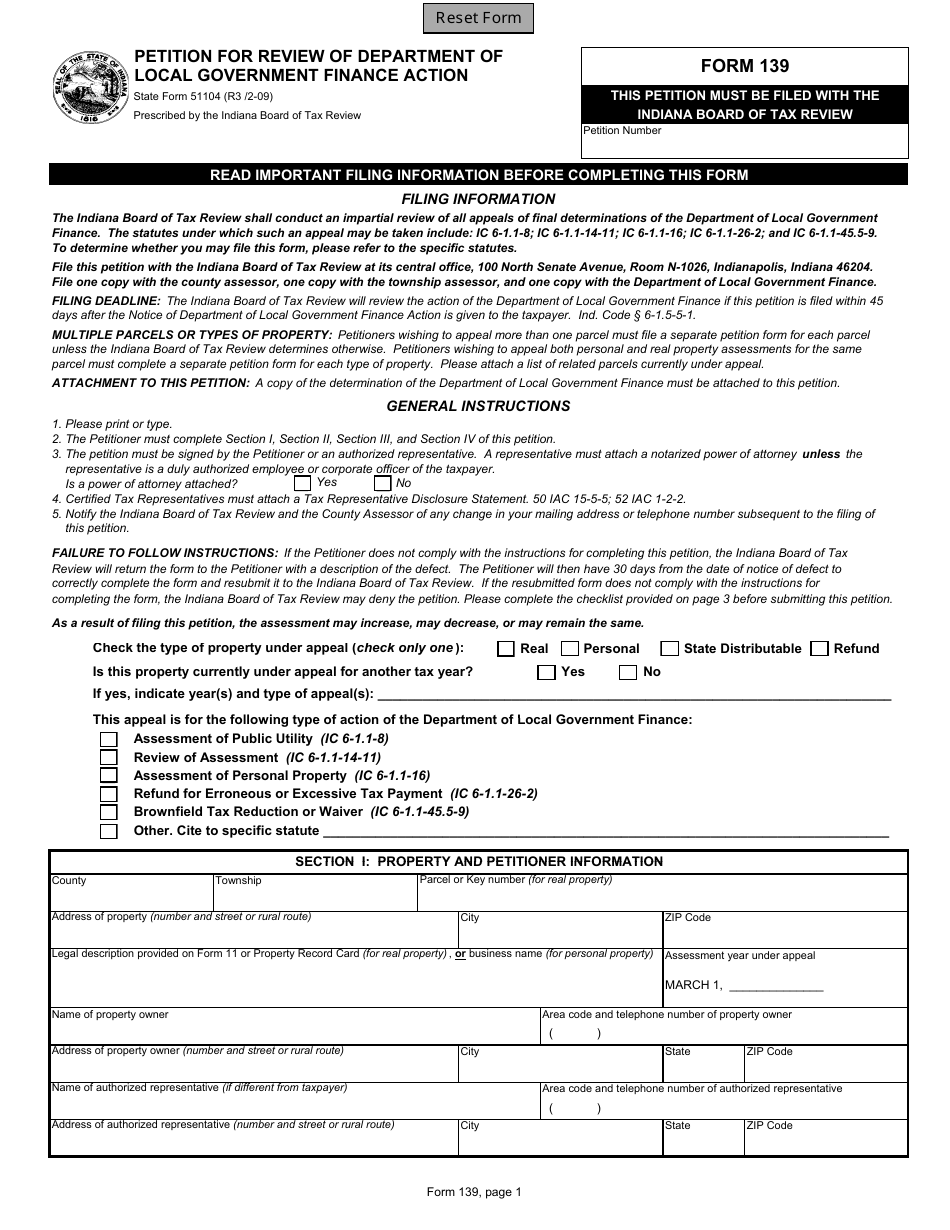

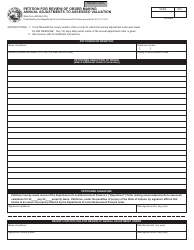

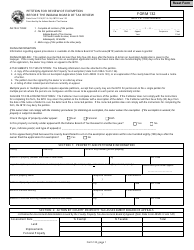

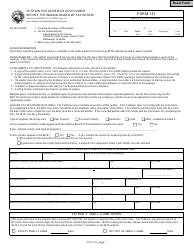

State Form 51104 (139) Petition for Review of Department of Local Government Finance Action - Indiana

What Is State Form 51104 (139)?

This is a legal form that was released by the Indiana Board of Tax Review - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51104 (139)?

A: State Form 51104 (139) is a Petition for Review of Department of Local Government Finance Action in Indiana.

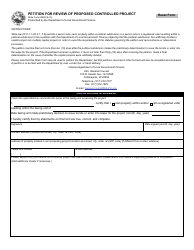

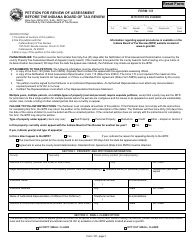

Q: Who can file State Form 51104 (139)?

A: Any individual or organization who is aggrieved by a decision or action of the Department of Local Government Finance in Indiana can file State Form 51104 (139).

Q: What is the purpose of filing State Form 51104 (139)?

A: The purpose of filing State Form 51104 (139) is to seek a review of a decision or action taken by the Department of Local Government Finance in Indiana.

Q: What information is required to complete State Form 51104 (139)?

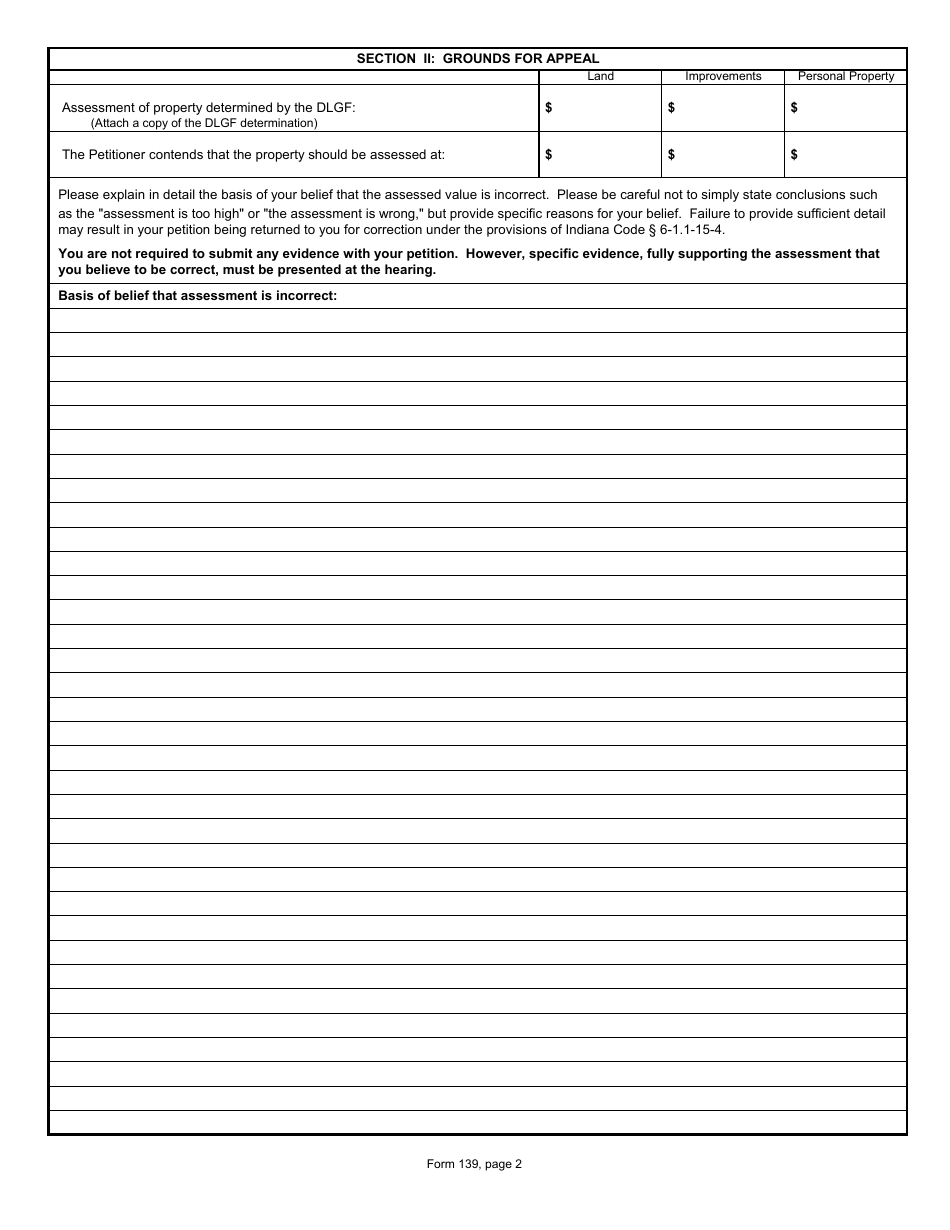

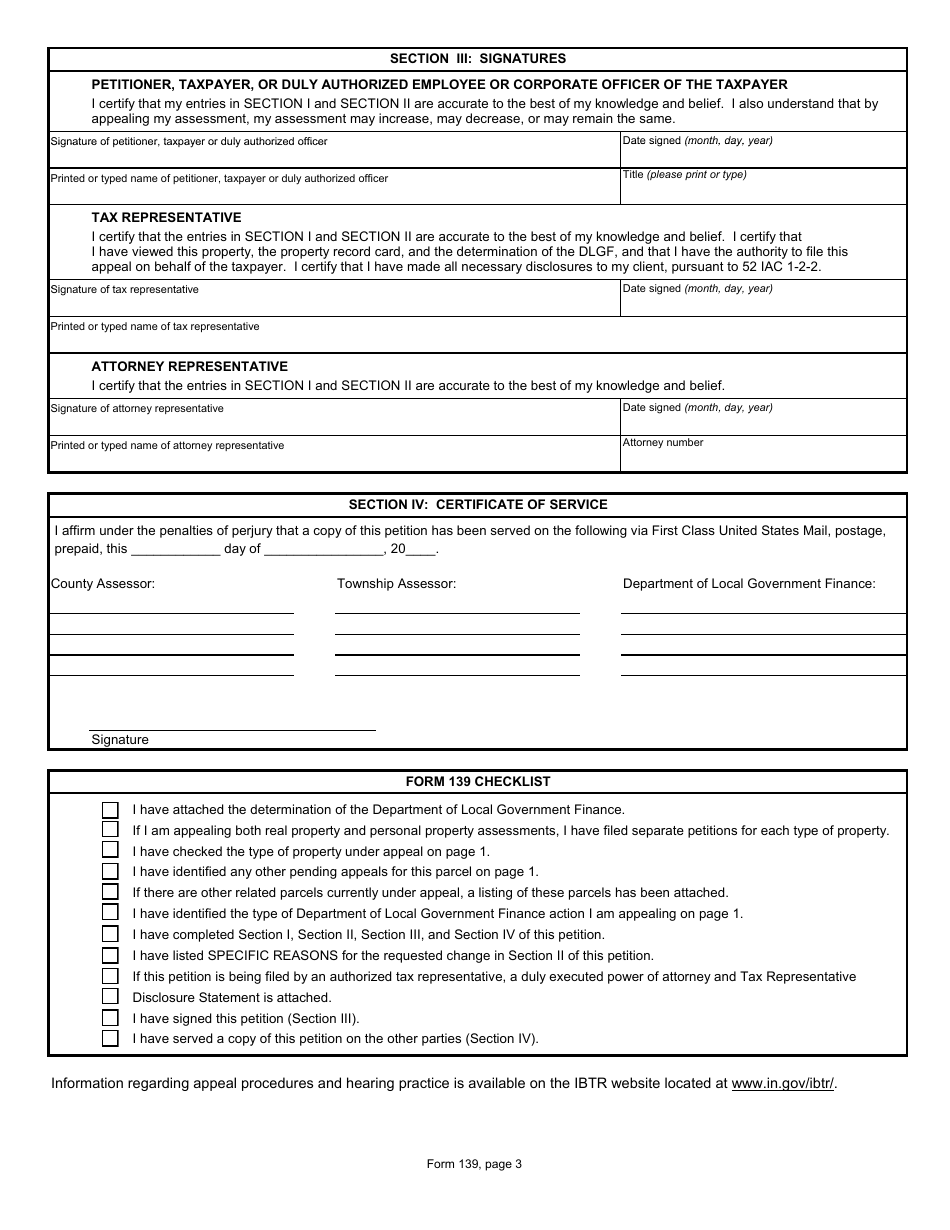

A: To complete State Form 51104 (139), you will need to provide information such as your name, contact information, a description of the decision or action being challenged, and any supporting documents or evidence.

Q: What is the deadline for filing State Form 51104 (139)?

A: The deadline for filing State Form 51104 (139) is typically 45 days from the date of the decision or action being challenged.

Q: Is there a fee for filing State Form 51104 (139)?

A: Yes, there is a filing fee associated with State Form 51104 (139), which must be paid at the time of filing.

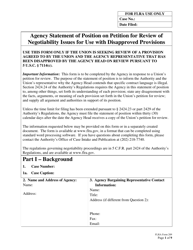

Q: What happens after filing State Form 51104 (139)?

A: After filing State Form 51104 (139), the Department of Local Government Finance will review the petition and may schedule a hearing to consider the matter.

Q: Can I appeal the decision made on my petition?

A: Yes, if you are not satisfied with the decision made on your petition, you may have the right to further appeal the decision.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Indiana Board of Tax Review;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51104 (139) by clicking the link below or browse more documents and templates provided by the Indiana Board of Tax Review.