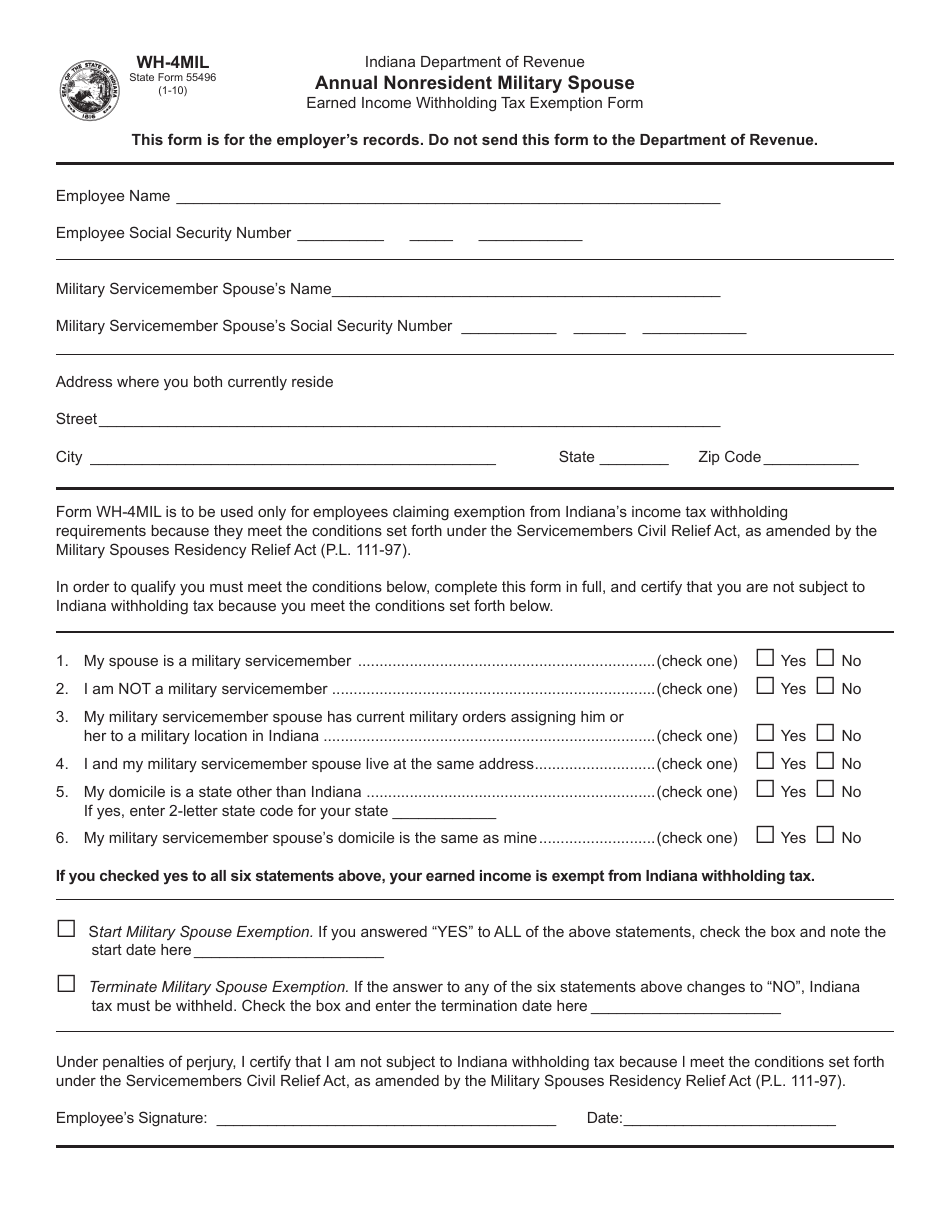

State Form 55496 (WH-4MIL) Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form - Indiana

What Is State Form 55496 (WH-4MIL)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55496 (WH-4MIL)?

A: Form 55496 (WH-4MIL) is the Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form in Indiana.

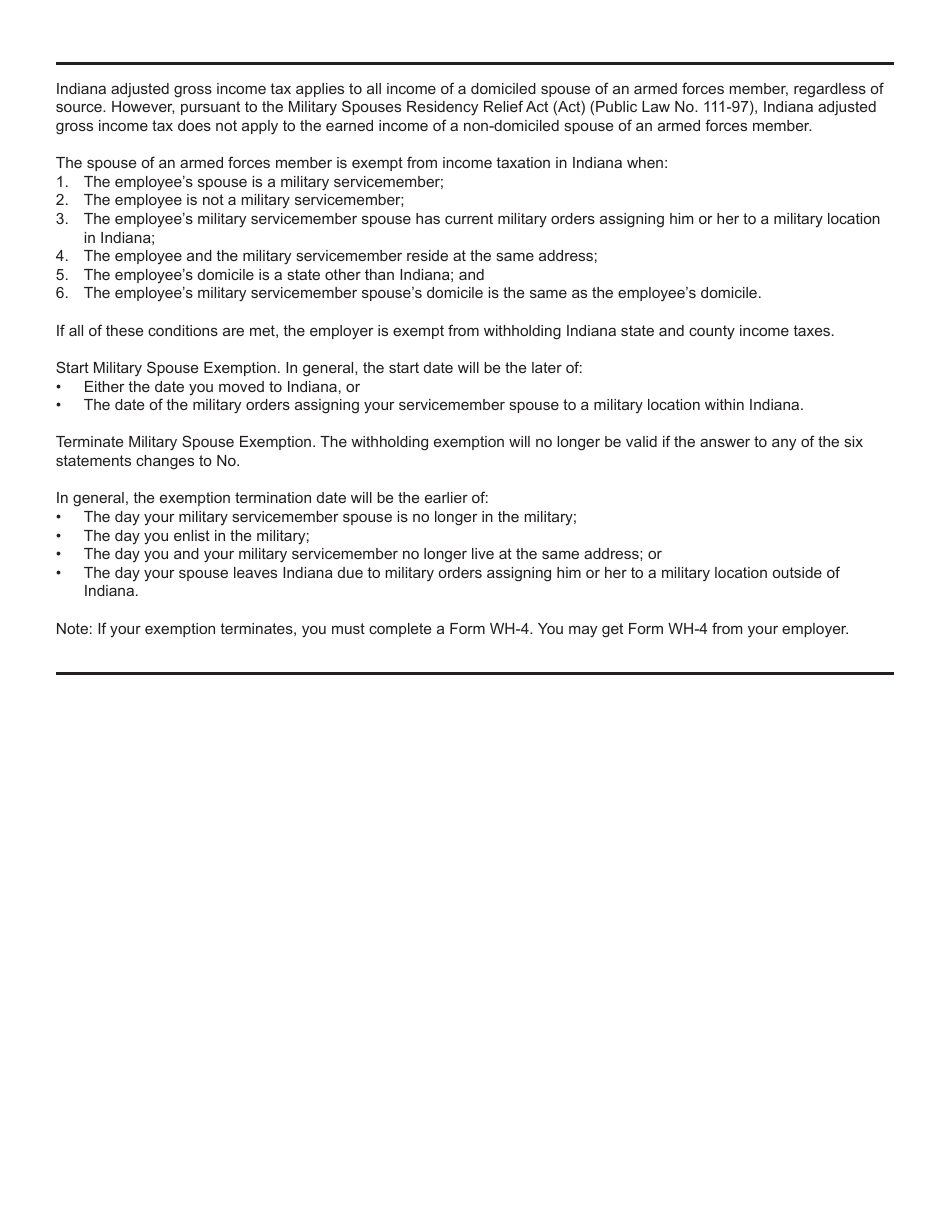

Q: Who should use Form 55496 (WH-4MIL)?

A: Form 55496 (WH-4MIL) should be used by nonresident military spouses in Indiana who want to claim an exemption from withholding taxes on earned income.

Q: What is the purpose of Form 55496 (WH-4MIL)?

A: The purpose of Form 55496 (WH-4MIL) is to allow nonresident military spouses in Indiana to request an exemption from withholding taxes on their earned income.

Q: When should I file Form 55496 (WH-4MIL)?

A: Form 55496 (WH-4MIL) should be filed annually, preferably at the beginning of the tax year or as soon as you become a nonresident military spouse in Indiana.

Q: Is there a deadline for filing Form 55496 (WH-4MIL)?

A: Yes, Form 55496 (WH-4MIL) should be filed by April 15th of the tax year or within 60 days of your arrival in Indiana, whichever is later.

Q: What happens if I don't file Form 55496 (WH-4MIL)?

A: If you don't file Form 55496 (WH-4MIL), your employer will withhold taxes from your earned income as required by law.

Q: Can I claim an exemption for my spouse and dependents on Form 55496 (WH-4MIL)?

A: No, Form 55496 (WH-4MIL) only allows nonresident military spouses to claim an exemption for themselves.

Q: What supporting documentation do I need to attach to Form 55496 (WH-4MIL)?

A: You need to attach a copy of your military spouse's Leave and Earnings Statement (LES) or a statement from your spouse's commanding officer to support your claim for exemption.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55496 (WH-4MIL) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.