This version of the form is not currently in use and is provided for reference only. Download this version of

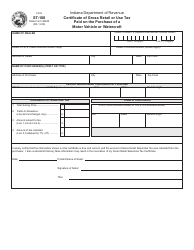

State Form 52873 (ST-108NR)

for the current year.

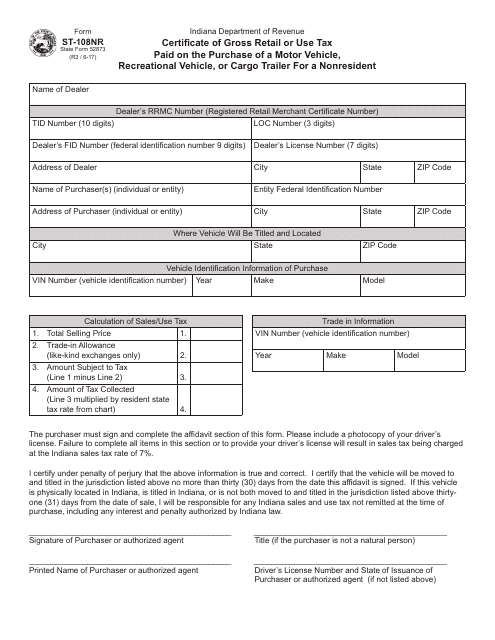

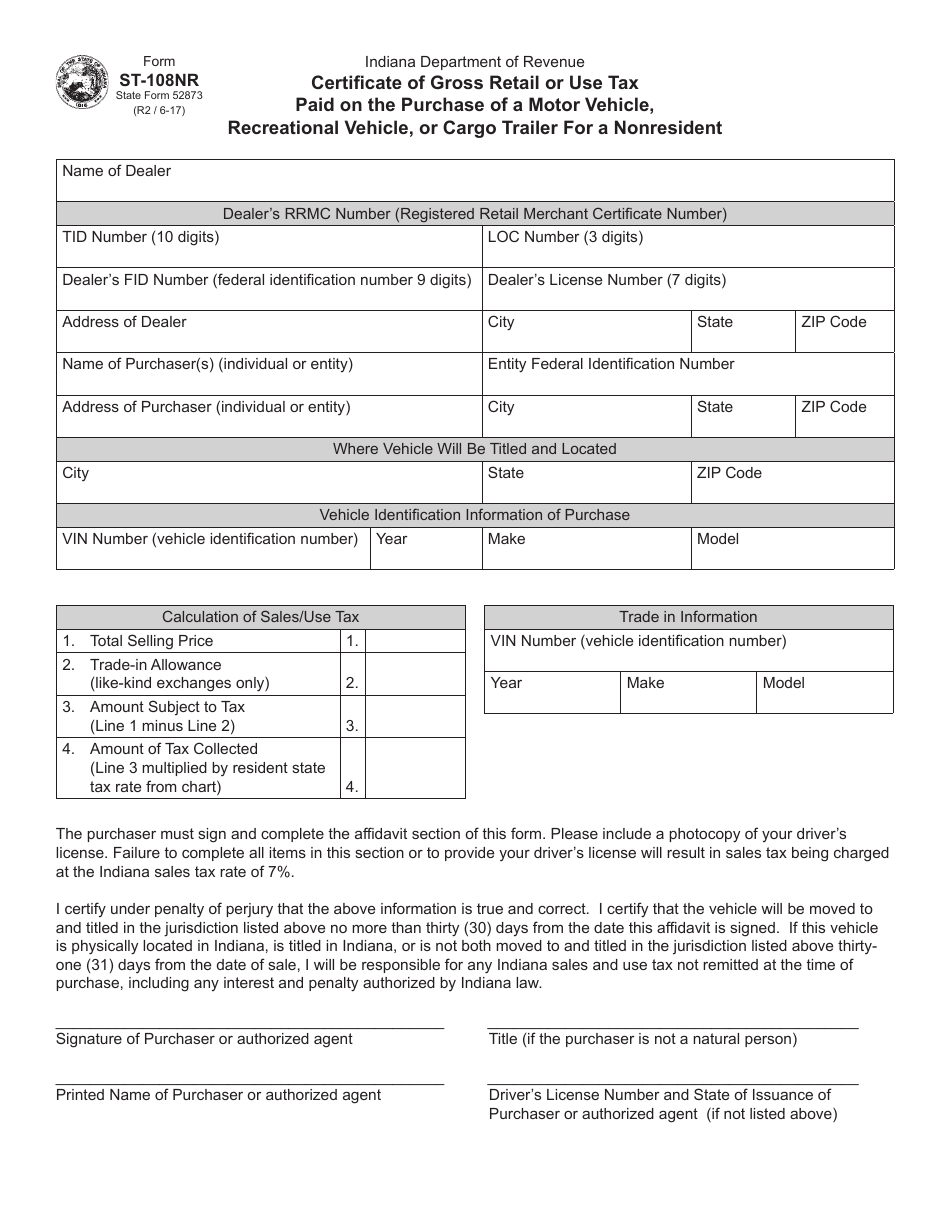

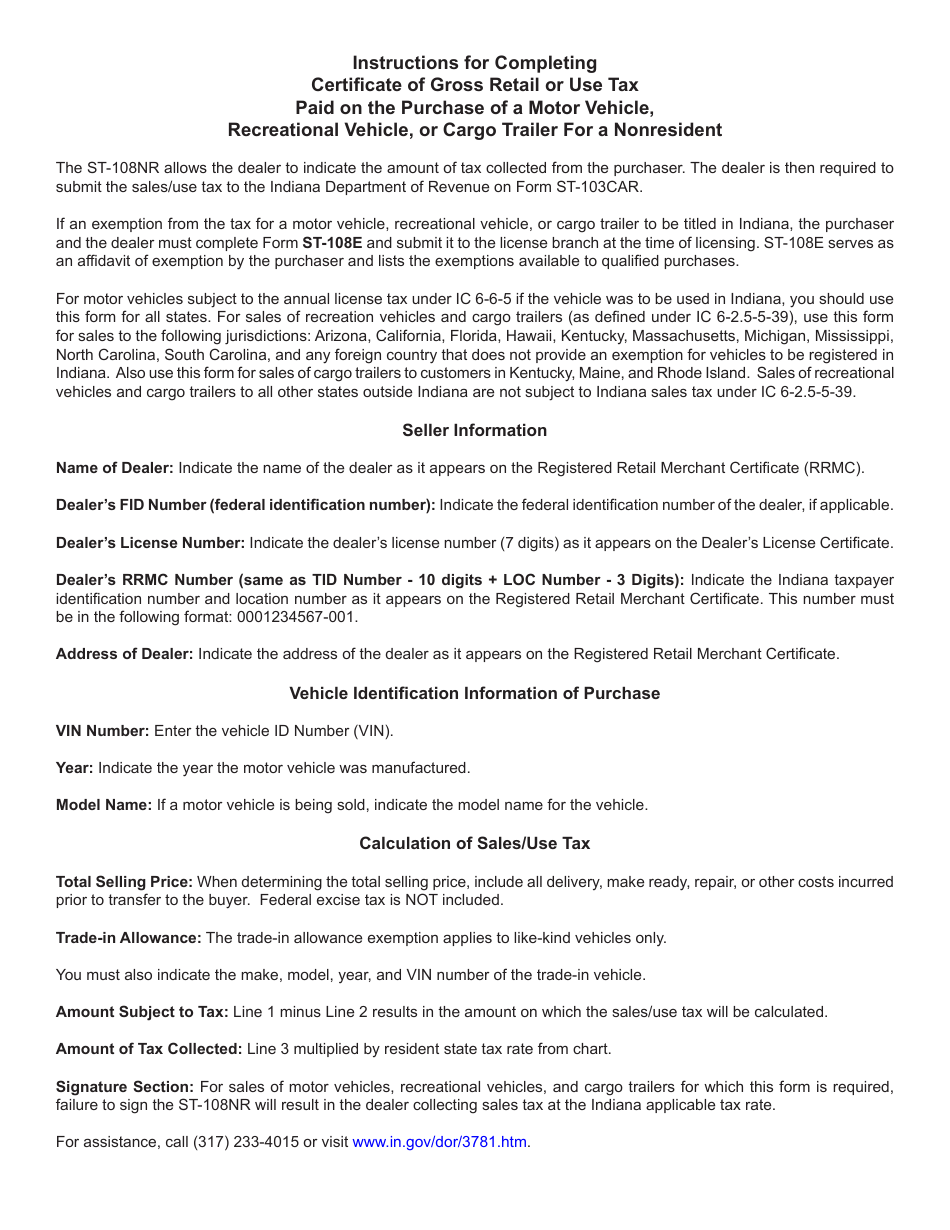

State Form 52873 (ST-108NR) Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor Vehicle, Recreational Vehicle, or Cargo Trailer for a Nonresident - Indiana

What Is State Form 52873 (ST-108NR)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52873 (ST-108NR)?

A: State Form 52873 (ST-108NR) is a certificate of gross retail or use tax paid on the purchase of a motor vehicle, recreational vehicle, or cargo trailer for a nonresident in Indiana.

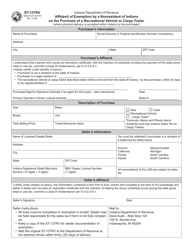

Q: Who needs to fill out State Form 52873 (ST-108NR)?

A: Nonresidents who have purchased a motor vehicle, recreational vehicle, or cargo trailer in Indiana and have paid gross retail or use tax on the purchase need to fill out State Form 52873 (ST-108NR).

Q: What is the purpose of State Form 52873 (ST-108NR)?

A: The purpose of State Form 52873 (ST-108NR) is to provide proof of the gross retail or use tax payment on a motor vehicle, recreational vehicle, or cargo trailer purchased by a nonresident in Indiana.

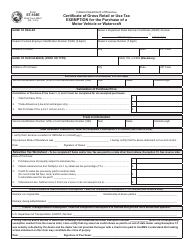

Q: What information do I need to fill out State Form 52873 (ST-108NR)?

A: You will need information such as your name, address, vehicle details, purchase price, and proof of gross retail or use tax payment to fill out State Form 52873 (ST-108NR).

Q: Do I need to submit any additional documents with State Form 52873 (ST-108NR)?

A: Yes, you will need to submit copies of documentation showing proof of your gross retail or use tax payment on the motor vehicle, recreational vehicle, or cargo trailer.

Q: Is there a deadline to submit State Form 52873 (ST-108NR)?

A: Yes, State Form 52873 (ST-108NR) should be submitted within 31 days of the purchase date of the motor vehicle, recreational vehicle, or cargo trailer.

Q: What happens after I submit State Form 52873 (ST-108NR)?

A: The Indiana Department of Revenue will review your form and supporting documents to verify the gross retail or use tax payment. They will then provide you with a certificate acknowledging the payment.

Q: Can I claim a refund on the gross retail or use tax paid?

A: Nonresidents are generally not eligible for a refund on the gross retail or use tax paid on a motor vehicle, recreational vehicle, or cargo trailer purchased in Indiana.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52873 (ST-108NR) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.