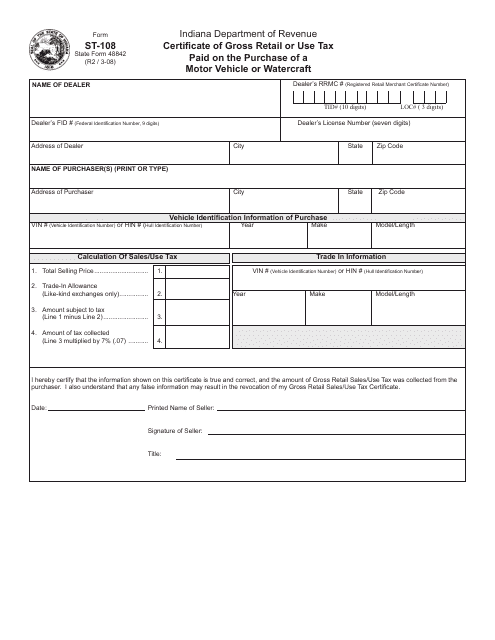

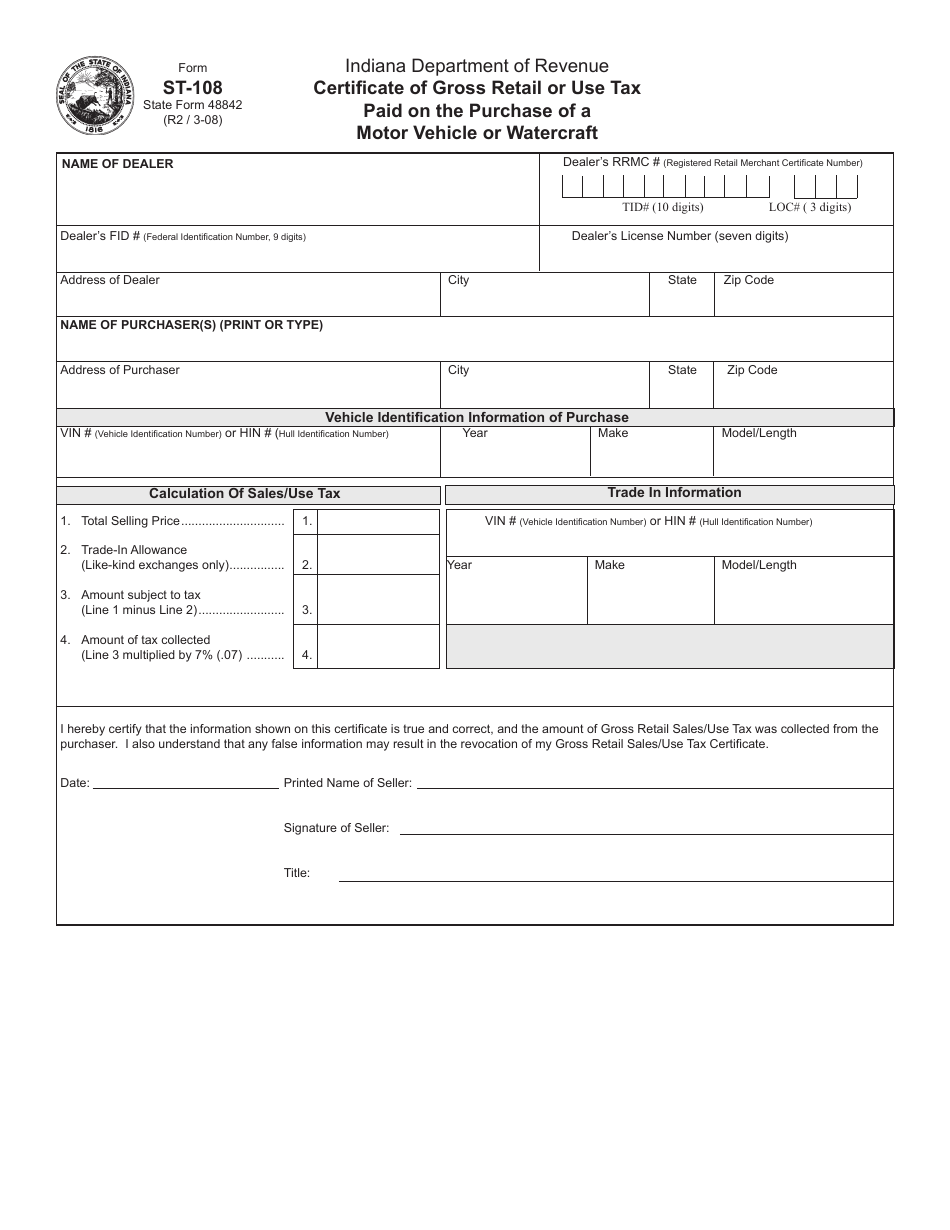

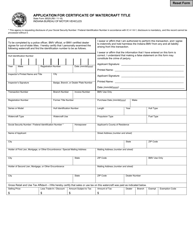

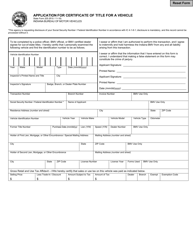

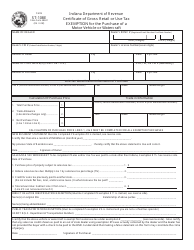

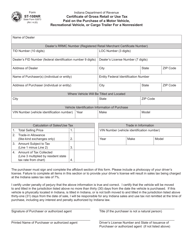

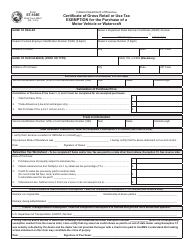

State Form 48842 (ST-108) Certificate of Gross Retail or Use Tax Paid on the Purchase of a Motor Vehicle or Watercraft - Indiana

What Is Form ST-108?

Form ST-108, Certificate of Gross Retail or Motor Vehicle or Watercraft , is a formal document Indiana vehicle dealers must file to the authorities to confirm the state sales and use tax was paid during the transaction that involves a vehicle or vessel. This statement gives the dealer a right to collect the tax from the individual or company that bought a car or watercraft - otherwise, the tax will be paid directly to the Bureau of Motor Vehicles (BMV). Once the deal is complete, the dealer must obtain identification information from the new owner of the item and then present this statement to the local BMV office.

Alternate Name:

- State Form 48842.

This form was released by the Indiana Department of Revenue on March 1, 2008 , with all previous editions obsolete. A fillable ST-108 Form is available for download below.

Form ST-108 instructions are as follows:

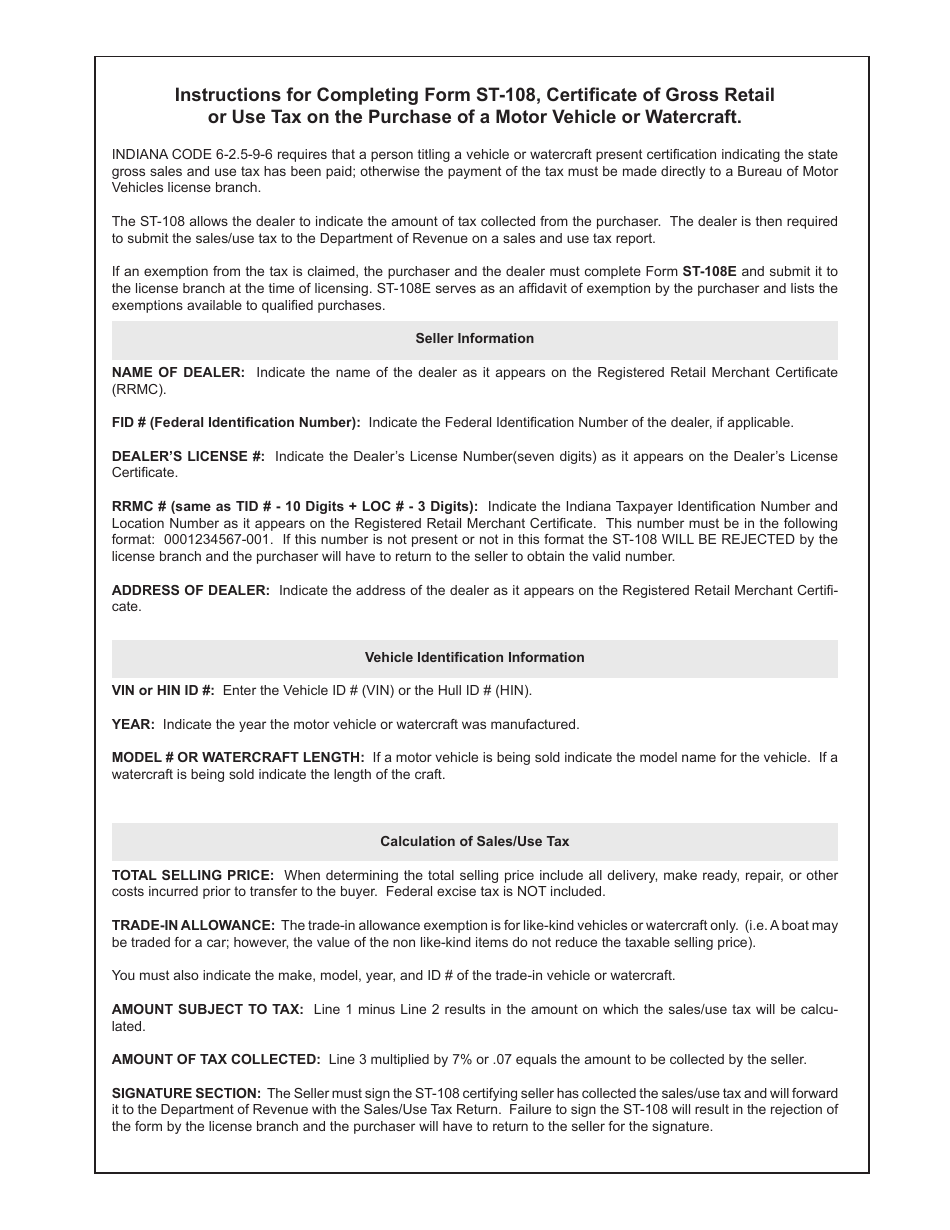

- Indicate the name of the dealer . Write down the number of the dealer's retail merchant certificate, the federal identification number, and the license number - you can find it in the license certificate. Add the dealer's full address as well.

- State the name and address of the buyer .

- Describe the vehicle - record its identification number, year of manufacture, make, model, and length.

- Calculate the sales/use tax - enter the item price, trade-in allowance if applicable, amount of money subject to tax (subtract the allowance from the total selling price), and the amount of tax collected by the dealer (multiply the latest result by 7%).

- If the vehicle was traded, describe the item it was traded for - write down the car or boat's main characteristics. Note that you can trade like-kind vehicles and watercraft and their value will not reduce the selling price that must be taxed.

- Confirm the information in the form is true and accurate and you have collected the proper amount of tax. Indicate your name and title, sign, and date the certificate.