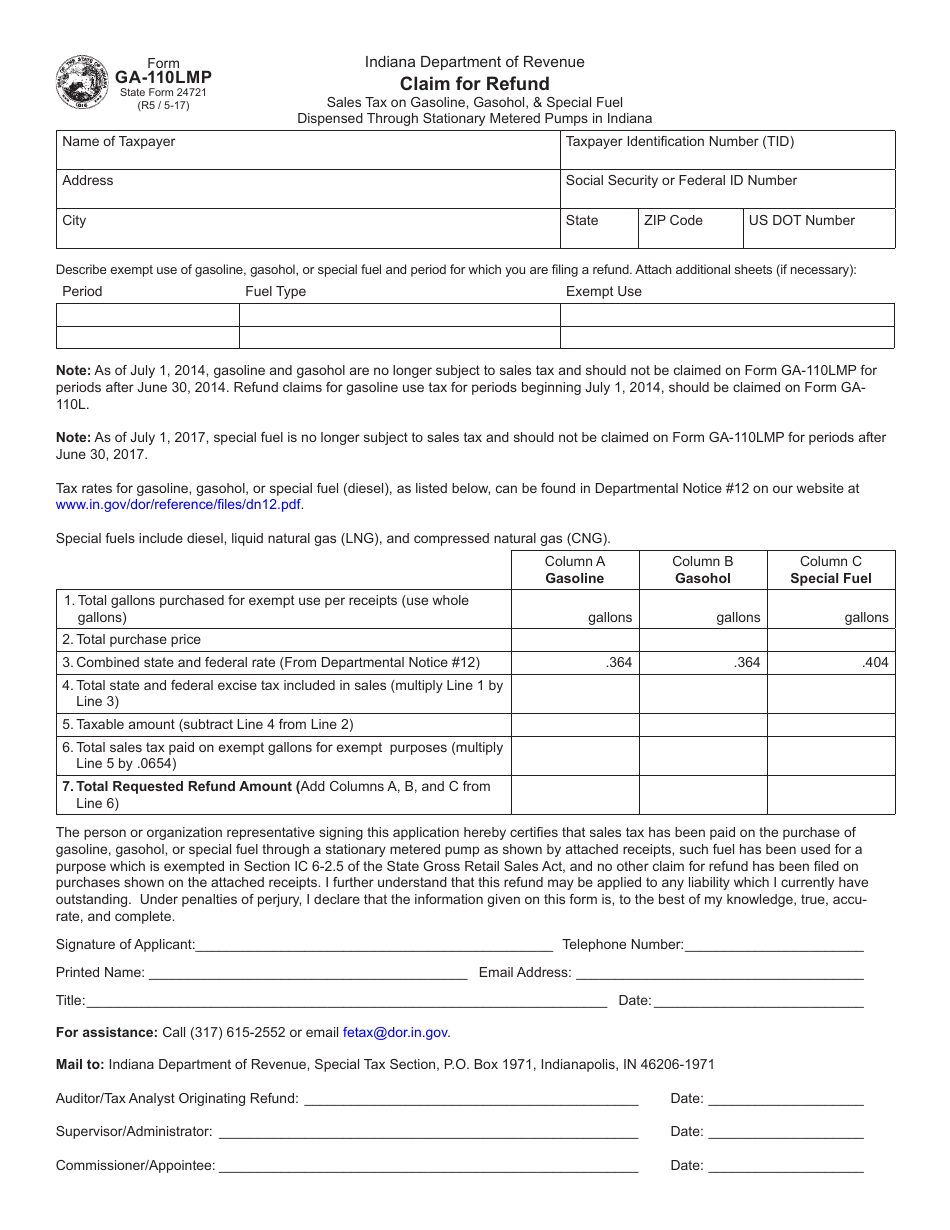

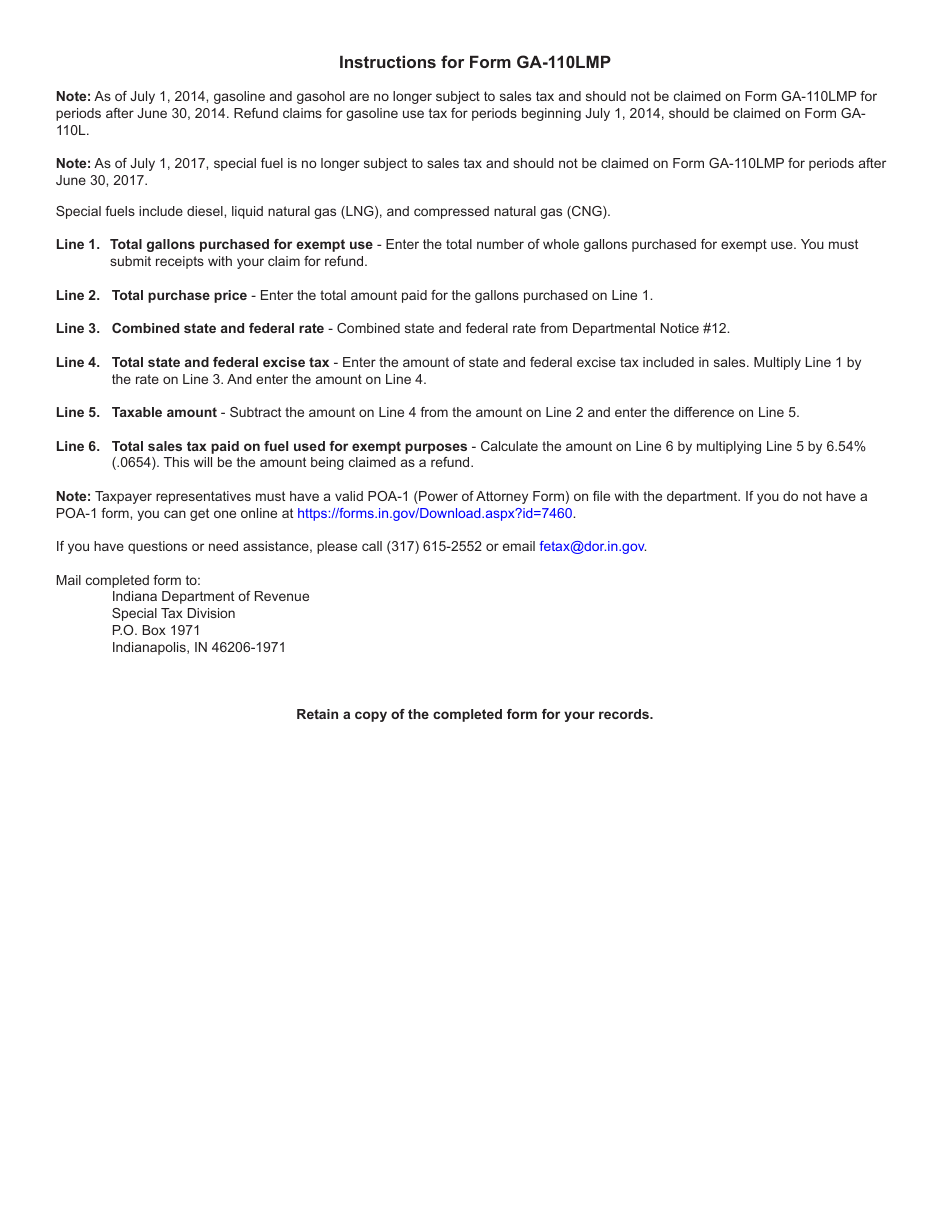

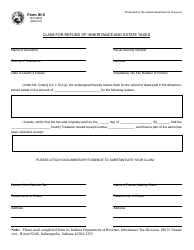

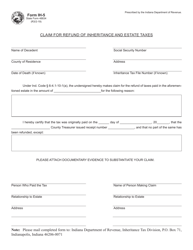

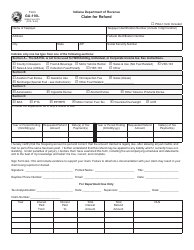

State Form 24721 (GA-110LMP) Claim for Refund - Sales Tax on Gasoline, Gasohol, & Special Fuel Dispensed Through Stationary Metered Pumps in Indiana - Indiana

What Is State Form 24721 (GA-110LMP)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of State Form 24721?

A: State Form 24721 is a claim for refund specifically for sales tax on gasoline, gasohol, and special fuel dispensed through stationary metered pumps in Indiana.

Q: Who can use State Form 24721?

A: This form can be used by individuals, businesses, or entities who have paid sales tax on gasoline, gasohol, or special fuel dispensed through stationary metered pumps in Indiana and wish to claim a refund.

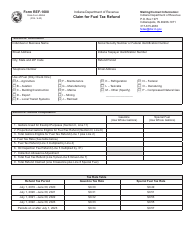

Q: What types of fuel are eligible for a refund using this form?

A: The eligible fuels include gasoline, gasohol, and special fuel that are dispensed through stationary metered pumps in Indiana.

Q: What is the deadline for filing a refund claim using this form?

A: The deadline for filing a refund claim using State Form 24721 is generally two years from the date of purchase.

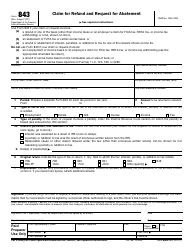

Q: What information is required to complete this form?

A: To complete State Form 24721, you will need to provide details such as your name, address, purchase information, and the amount of sales tax paid on the eligible fuel.

Q: How long does it take to receive a refund?

A: The processing time for refund claims can vary, but it typically takes several weeks to receive a refund.

Q: What should I do if I have questions about State Form 24721?

A: If you have questions or need further assistance with State Form 24721, you can contact the Indiana Department of Revenue for guidance.

Form Details:

- Released on May 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 24721 (GA-110LMP) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.