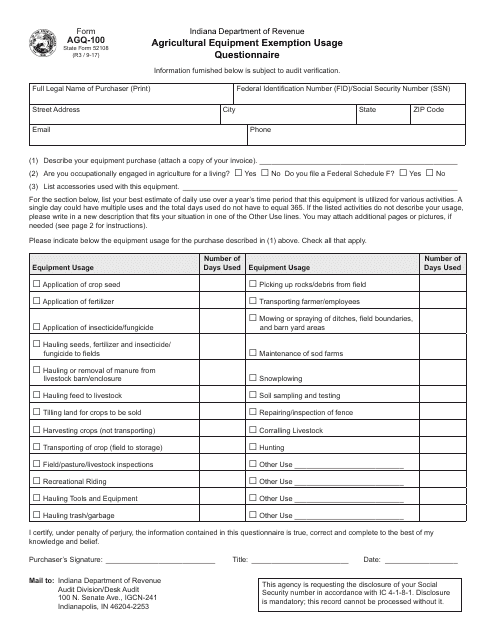

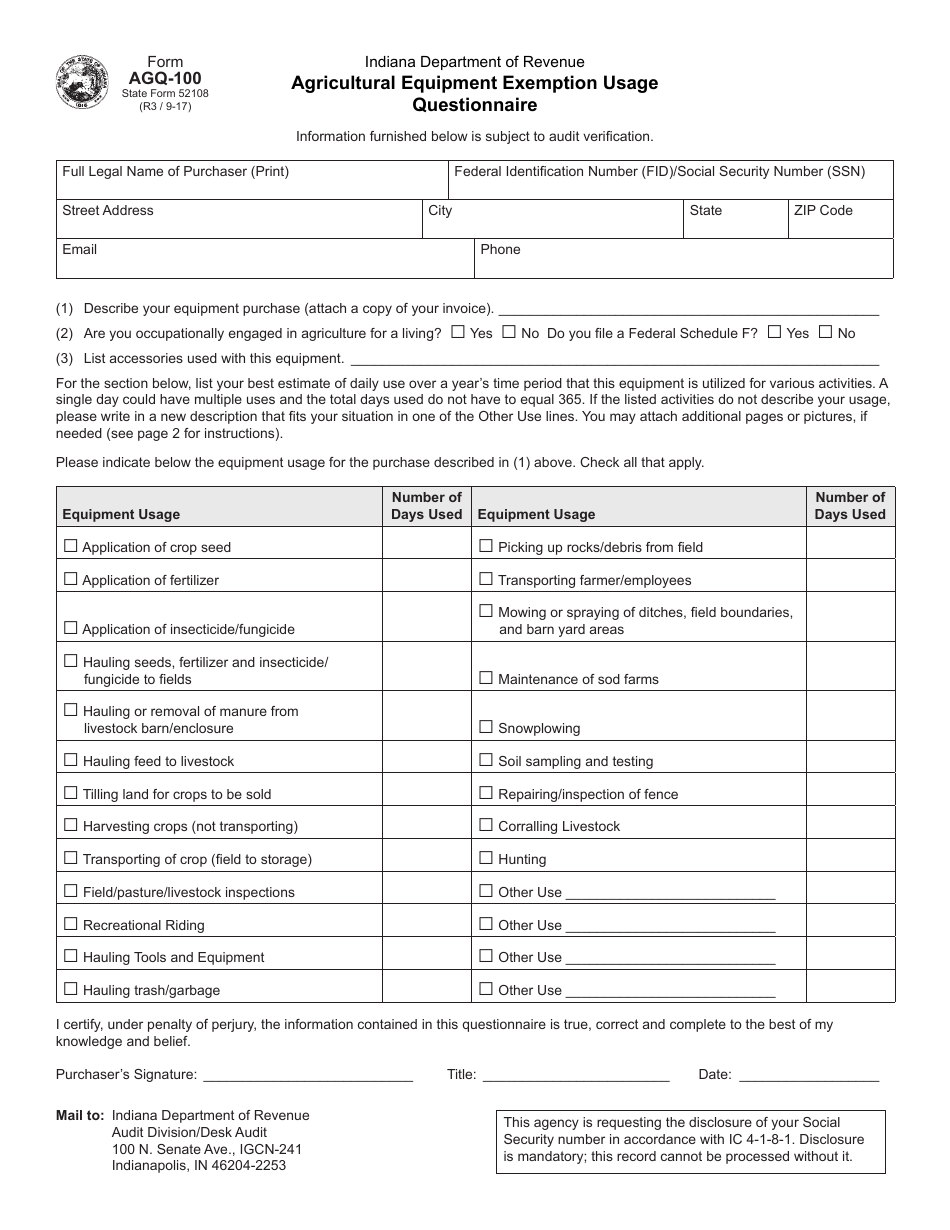

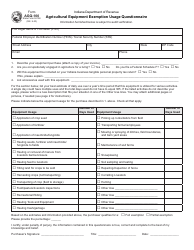

State Form 52108 (AGQ-100) Agricultural Equipment Exemption Usage Questionnaire - Indiana

What Is State Form 52108 (AGQ-100)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 52108 (AGQ-100)?

A: State Form 52108 (AGQ-100) is the Agricultural Equipment Exemption Usage Questionnaire used in Indiana.

Q: Who uses State Form 52108 (AGQ-100)?

A: This form is used by individuals or businesses in the agricultural industry in Indiana.

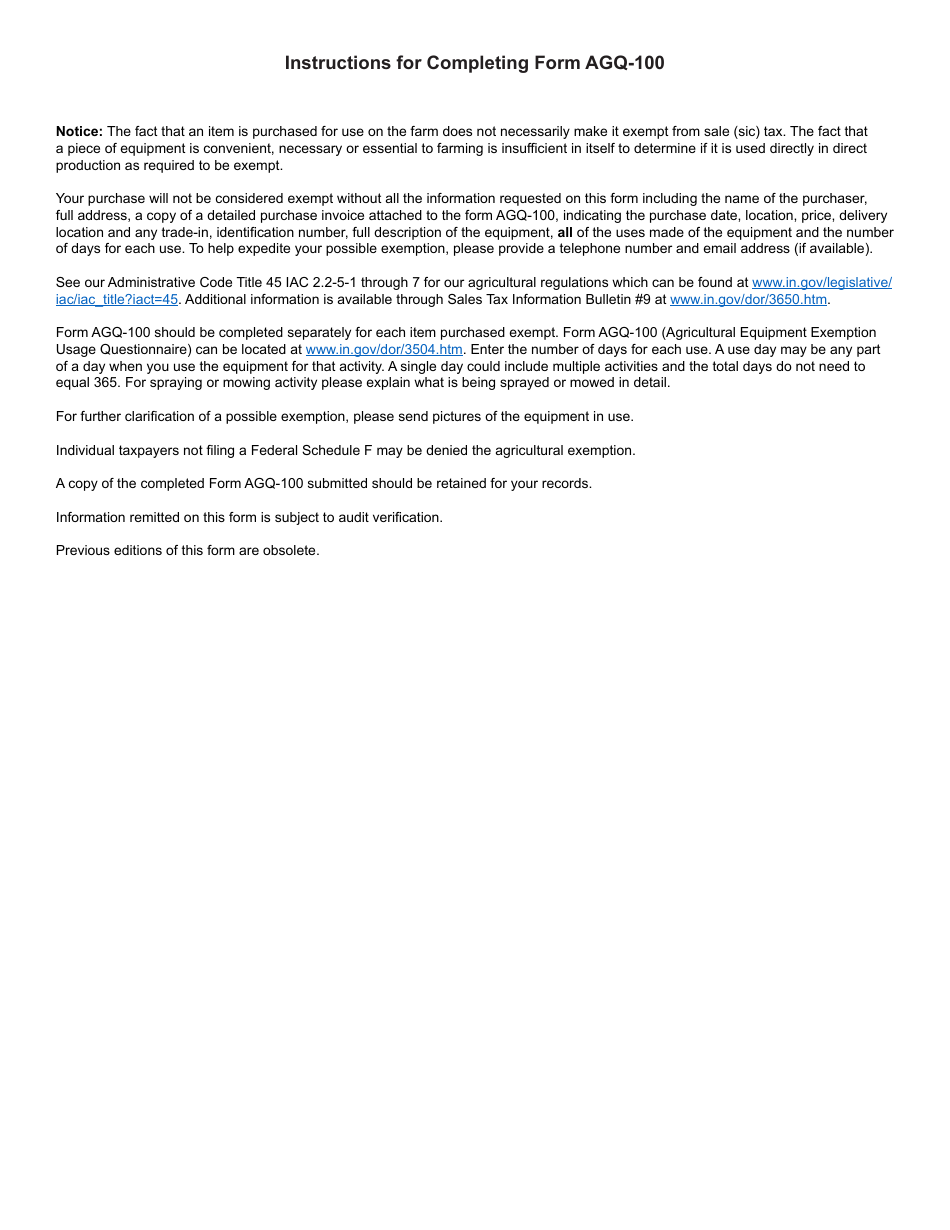

Q: What is the purpose of State Form 52108 (AGQ-100)?

A: The purpose of this form is to determine if agricultural equipment is being used for exempt purposes.

Q: Do I need to fill out State Form 52108 (AGQ-100) every year?

A: No, this form only needs to be filled out if you are claiming an agricultural equipment exemption or if requested by the Indiana Department of Revenue.

Q: What information do I need to provide on State Form 52108 (AGQ-100)?

A: You will need to provide details about the agricultural equipment, its usage, and any exemptions claimed.

Q: Can I claim an agricultural equipment exemption if I am not in the agricultural industry?

A: No, this exemption is specifically for individuals or businesses engaged in agricultural activities.

Q: What happens if I don't fill out State Form 52108 (AGQ-100) correctly?

A: Incorrect or incomplete information on this form may result in denial of the agricultural equipment exemption.

Q: Are there any fees associated with State Form 52108 (AGQ-100)?

A: There are no fees associated with submitting this form to claim an agricultural equipment exemption.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 52108 (AGQ-100) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.