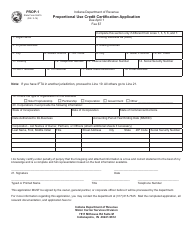

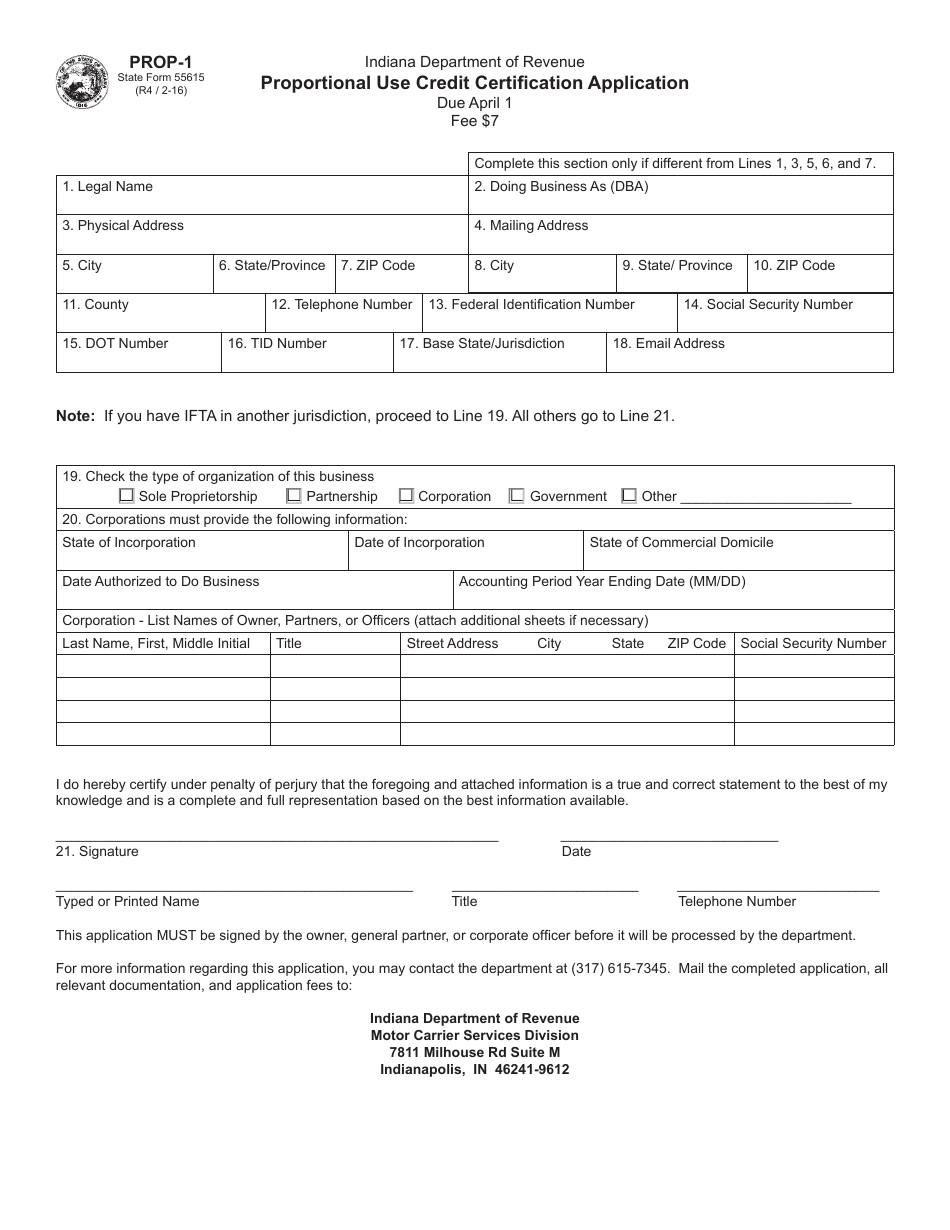

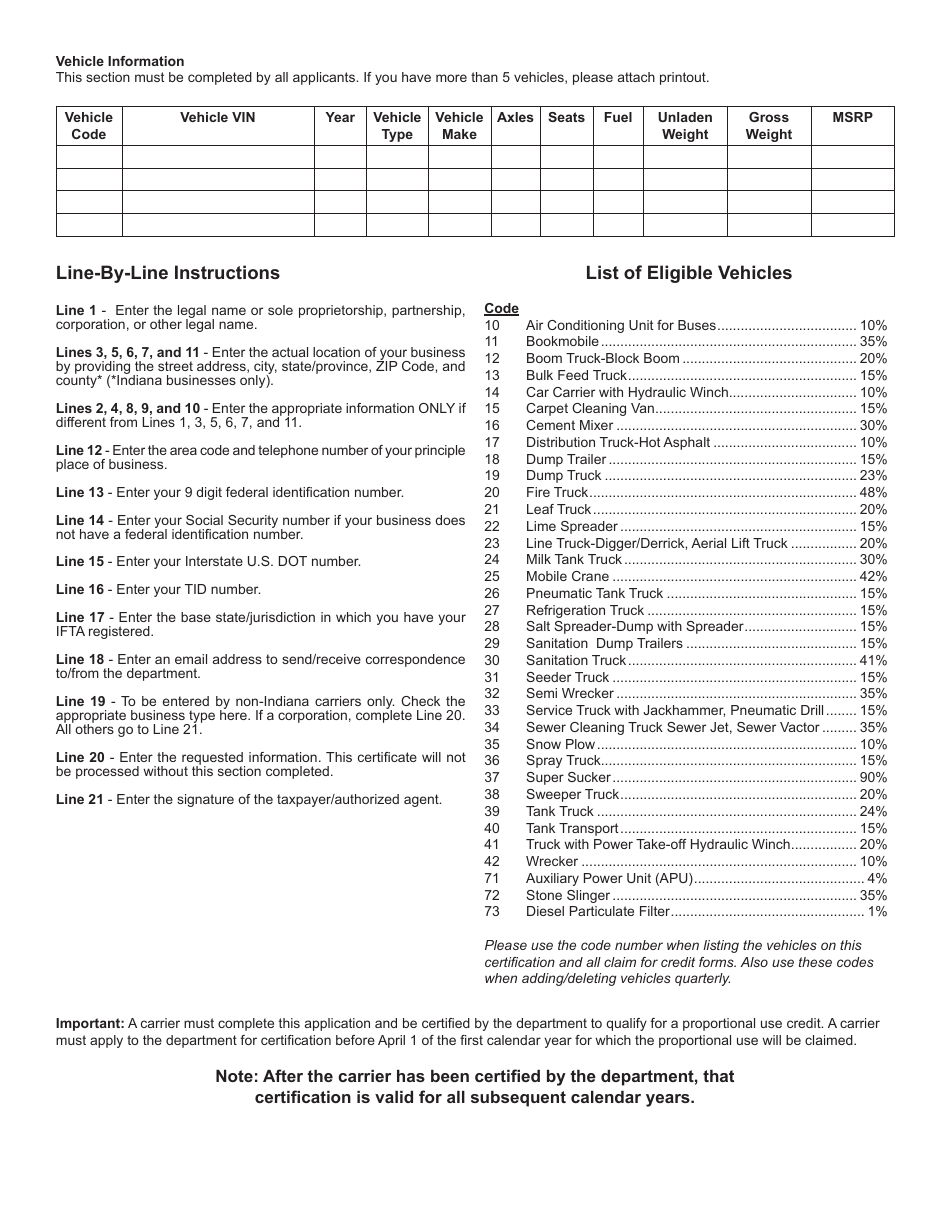

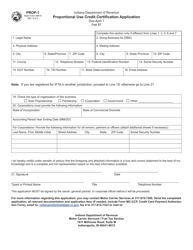

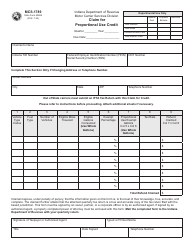

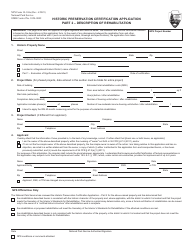

State Form 55615 (PROP-1) Proportional Use Credit Certification Application - Indiana

What Is State Form 55615 (PROP-1)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 55615 (PROP-1)?

A: Form 55615 (PROP-1) is the Proportional Use Credit Certification Application in Indiana.

Q: What is the purpose of Form 55615 (PROP-1)?

A: The purpose of Form 55615 (PROP-1) is to apply for the Proportional Use Credit Certification in Indiana.

Q: Who needs to fill out Form 55615 (PROP-1)?

A: Anyone who wants to apply for the Proportional Use Credit Certification in Indiana needs to fill out Form 55615 (PROP-1).

Q: Are there any fees associated with Form 55615 (PROP-1)?

A: There are no fees associated with Form 55615 (PROP-1).

Q: What is the Proportional Use Credit Certification?

A: The Proportional Use Credit Certification is a tax credit in Indiana that allows taxpayers to reduce their tax liability based on the proportion of property used in certain activities.

Q: What are the eligibility requirements for the Proportional Use Credit Certification?

A: To be eligible for the Proportional Use Credit Certification, the property must be used in certain activities specified by Indiana law.

Q: How long does it take to process Form 55615 (PROP-1)?

A: The processing time for Form 55615 (PROP-1) varies, but it typically takes a few weeks to process.

Q: Can I apply for the Proportional Use Credit Certification retroactively?

A: No, you cannot apply for the Proportional Use Credit Certification retroactively. The certification must be obtained prior to the use of the property.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55615 (PROP-1) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.