This version of the form is not currently in use and is provided for reference only. Download this version of

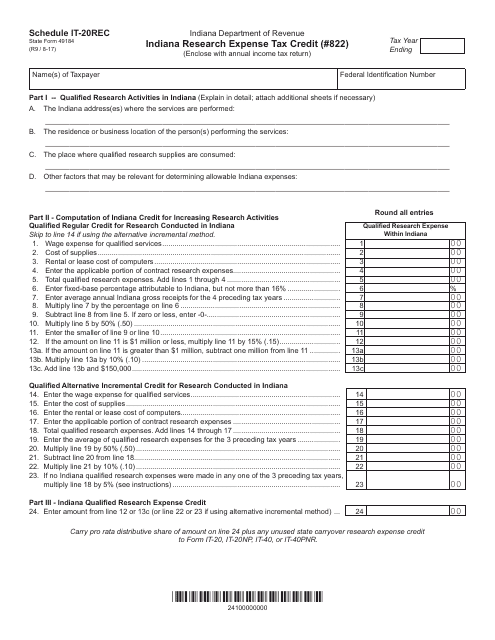

State Form 49184 Schedule IT-20REC

for the current year.

State Form 49184 Schedule IT-20REC Indiana Research Expense Tax Credit (#822) - Indiana

What Is State Form 49184 Schedule IT-20REC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

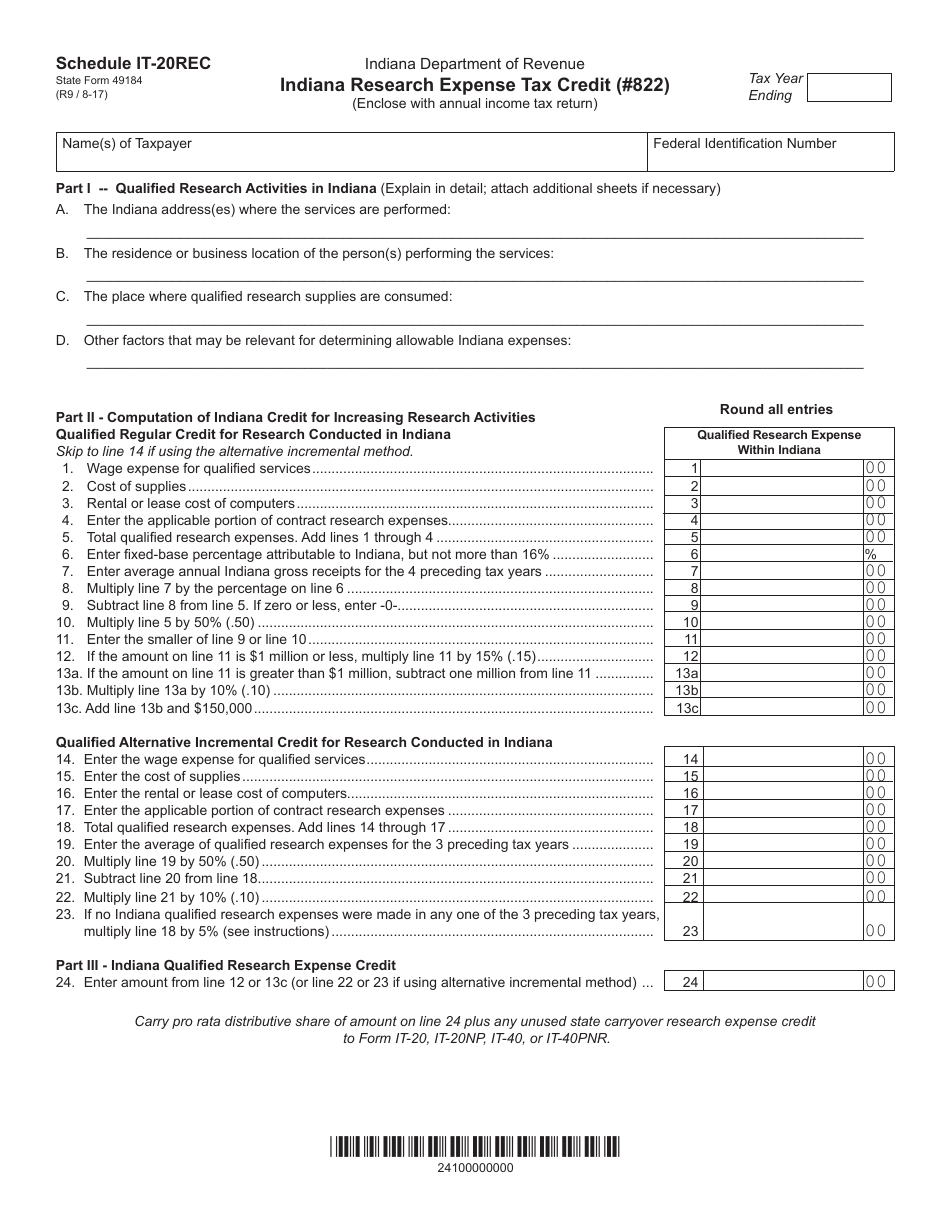

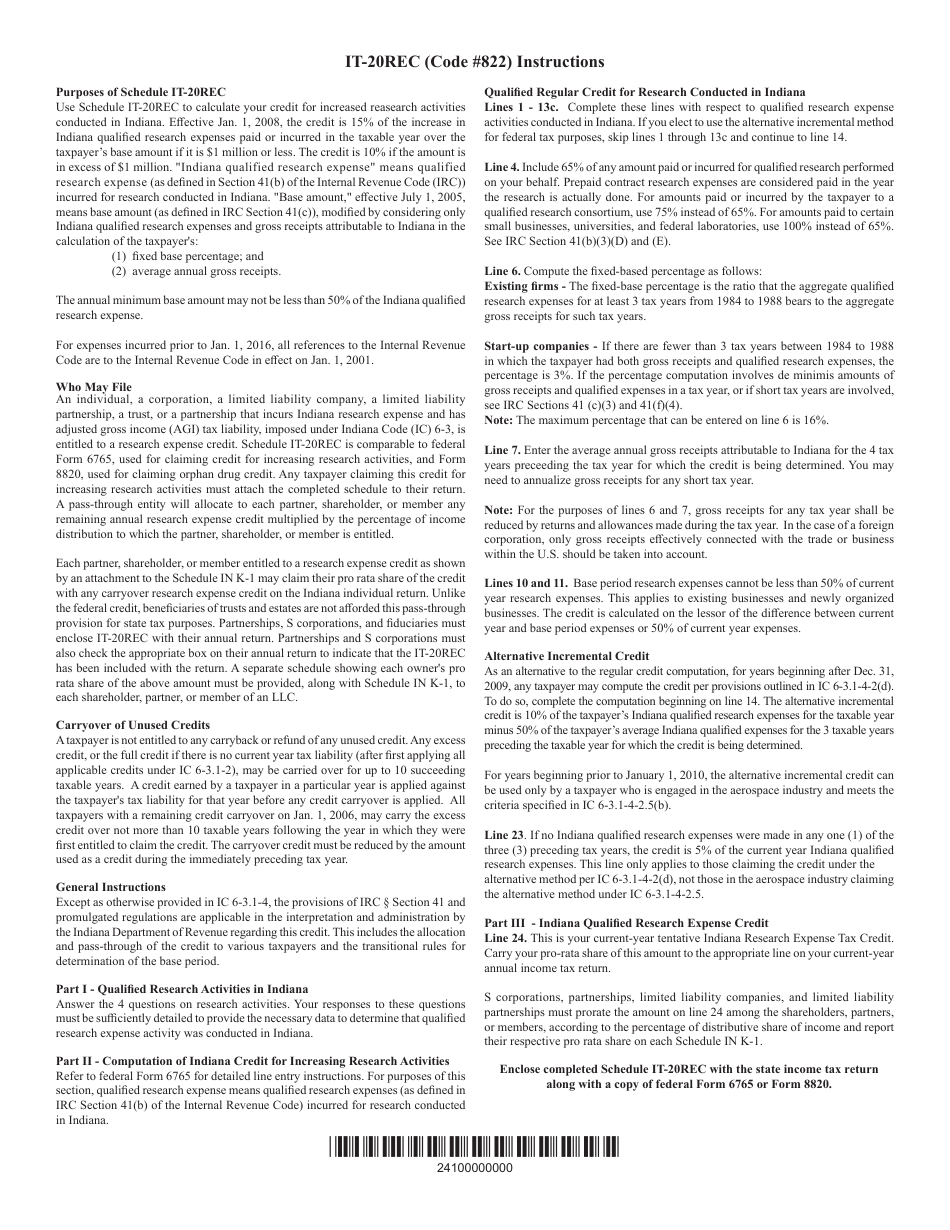

Q: What is Form 49184 Schedule IT-20REC?

A: Form 49184 Schedule IT-20REC is used to claim the Indiana Research Expense Tax Credit (#822) in Indiana.

Q: What is the Indiana Research Expense Tax Credit?

A: The Indiana Research Expense Tax Credit is a tax credit offered by the state of Indiana to encourage research and development activities by businesses.

Q: Who can claim the Indiana Research Expense Tax Credit?

A: Businesses that have qualified research expenses in Indiana can claim the Indiana Research Expense Tax Credit.

Q: What expenses qualify for the Indiana Research Expense Tax Credit?

A: Expenses related to qualified research activities, such as wages, supplies, and contract research expenses, may qualify for the Indiana Research Expense Tax Credit.

Q: How do I claim the Indiana Research Expense Tax Credit?

A: To claim the Indiana Research Expense Tax Credit, businesses must complete and file Form 49184 Schedule IT-20REC with their Indiana tax return.

Q: Is there a limit to the amount of the Indiana Research Expense Tax Credit?

A: Yes, there is a limit to the amount of the Indiana Research Expense Tax Credit that can be claimed. The maximum credit amount varies each year.

Q: Are there any deadlines for claiming the Indiana Research Expense Tax Credit?

A: Yes, businesses must file Form 49184 Schedule IT-20REC with their Indiana tax return by the due date of the return, which is typically April 15th.

Q: Is the Indiana Research Expense Tax Credit refundable?

A: No, the Indiana Research Expense Tax Credit is not refundable. It can only be used to offset the taxpayer's Indiana tax liability.

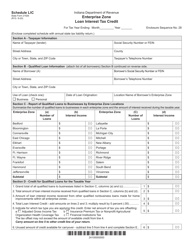

Q: Are there any other tax credits available in Indiana?

A: Yes, Indiana offers several other tax credits, such as the Indiana Small Business Tax Credit and the Indiana Enterprise Zone Investment Deduction.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of State Form 49184 Schedule IT-20REC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.