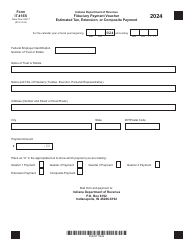

This version of the form is not currently in use and is provided for reference only. Download this version of

State Form 49410 (FT-ES)

for the current year.

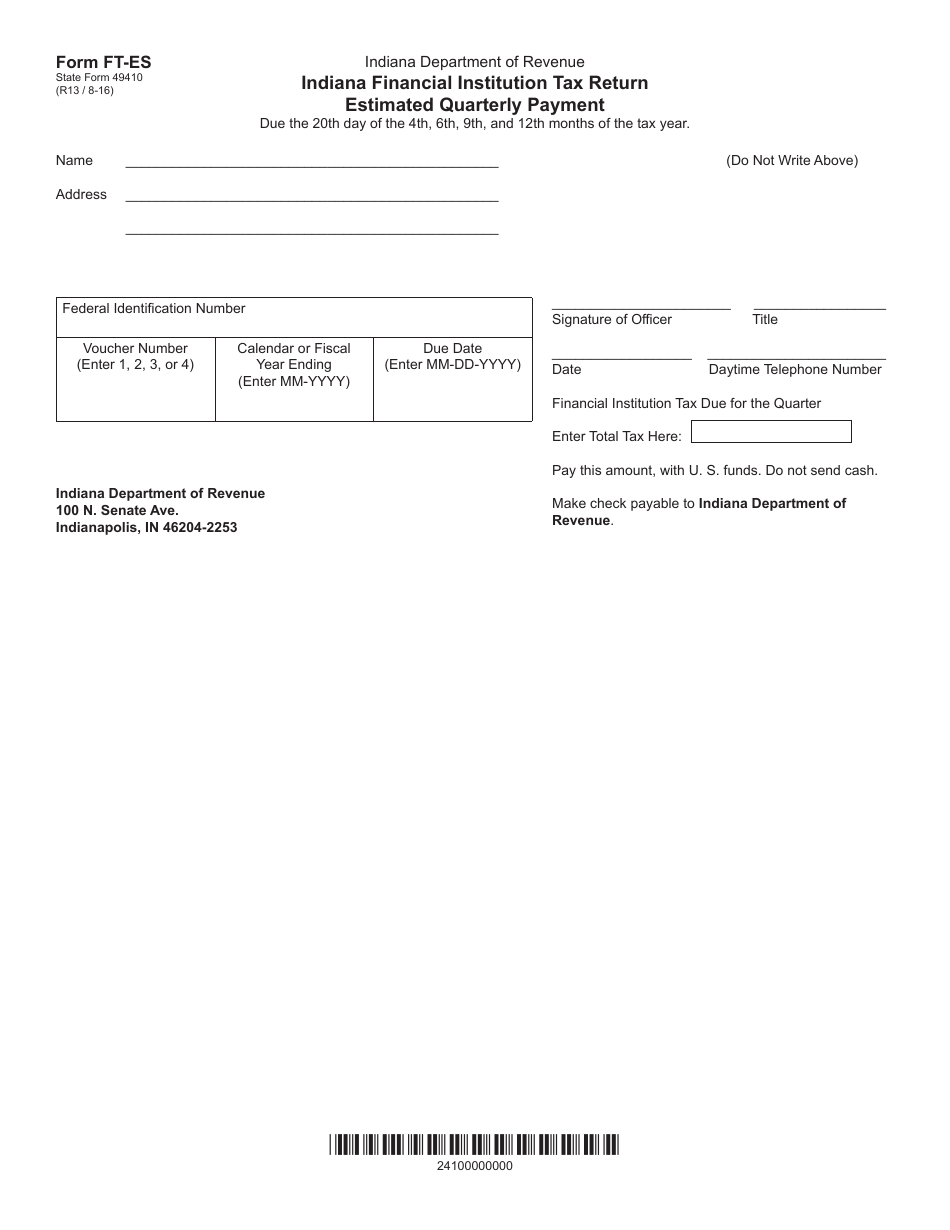

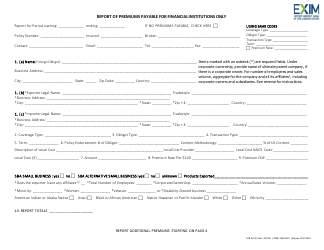

State Form 49410 (FT-ES) Indiana Financial Institution Tax Return Estimated Quarterly Payment - Indiana

What Is State Form 49410 (FT-ES)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 49410 (FT-ES)?

A: Form 49410 (FT-ES) is the Indiana Financial Institution Tax Return Estimated Quarterly Payment form.

Q: Who is required to file Form 49410 (FT-ES)?

A: Financial institutions in Indiana are required to file Form 49410 (FT-ES).

Q: What is the purpose of Form 49410 (FT-ES)?

A: The purpose of Form 49410 (FT-ES) is to report and make estimated quarterly payments for the Indiana Financial Institution Tax.

Q: How often is Form 49410 (FT-ES) filed?

A: Form 49410 (FT-ES) is filed quarterly.

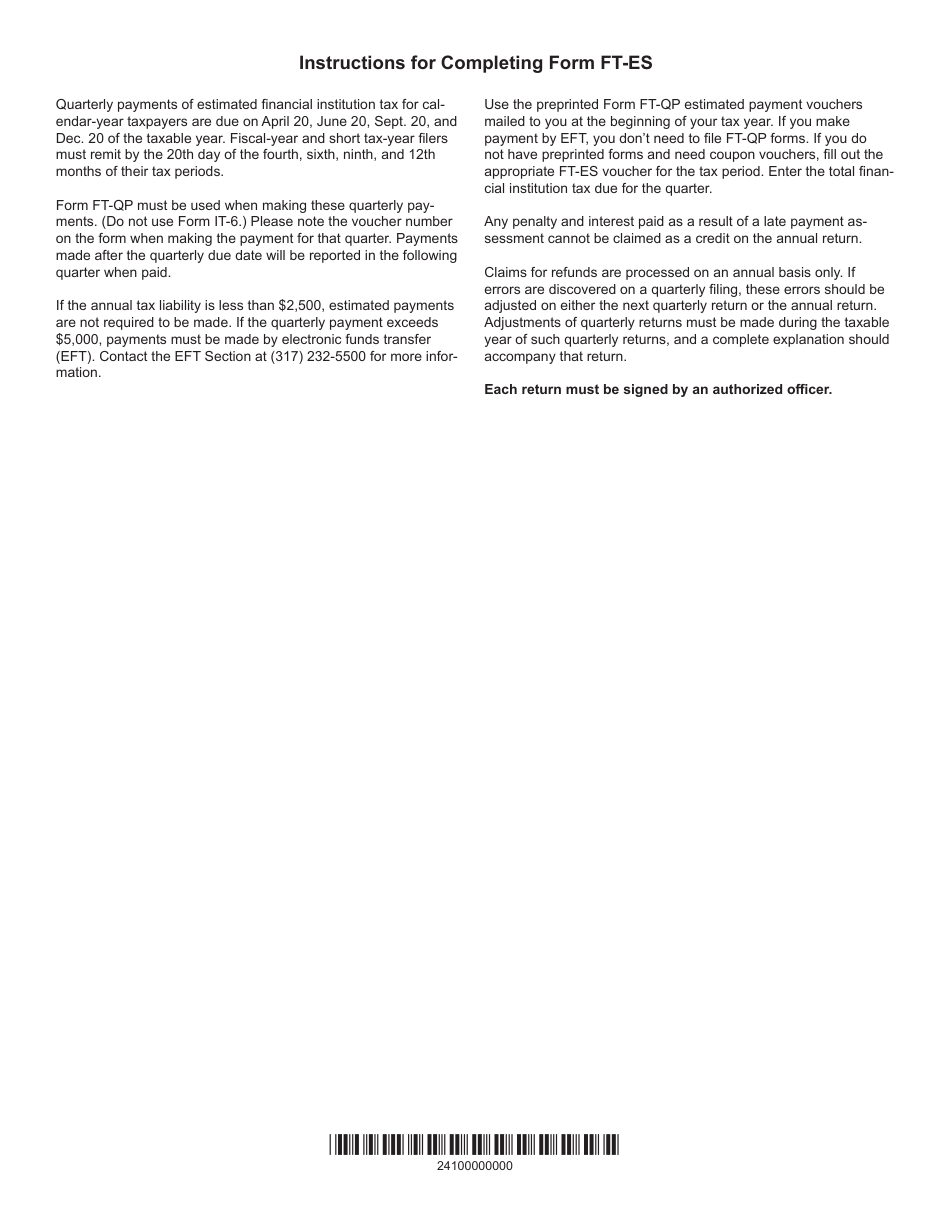

Q: What information is required on Form 49410 (FT-ES)?

A: Form 49410 (FT-ES) requires financial institutions to provide information about their estimated quarterly tax liability.

Q: What are the consequences of not filing Form 49410 (FT-ES)?

A: Failure to file Form 49410 (FT-ES) may result in penalties and interest charges.

Q: Is there a deadline for filing Form 49410 (FT-ES)?

A: Yes, Form 49410 (FT-ES) must be filed by the quarterly due dates specified by the Indiana Department of Revenue.

Q: Are there any exceptions to filing Form 49410 (FT-ES)?

A: Certain financial institutions may be exempt from filing Form 49410 (FT-ES). It is recommended to consult the Indiana Department of Revenue for specific exemptions.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 49410 (FT-ES) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.